- Galaxy reported a $241 million net loss in the fourth quarter of 2025.

- The losses were driven by unrealised losses on digital asset holdings.

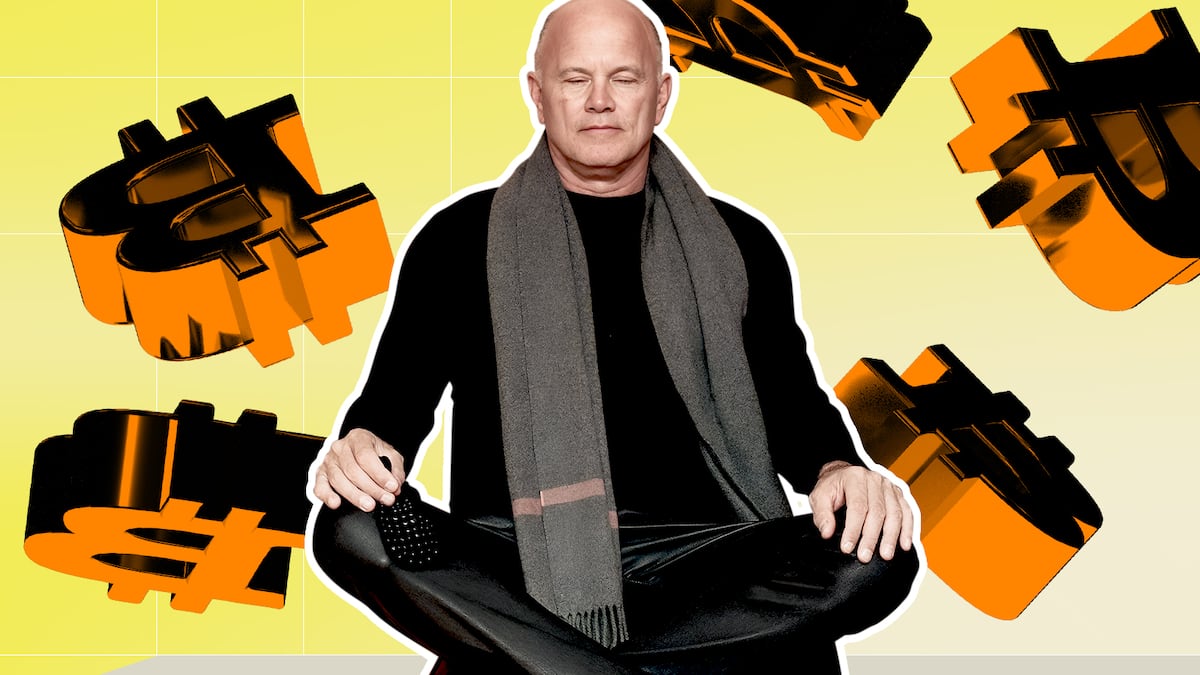

- CEO Mike Novogratz is hopeful that prices will turn around soon.

Galaxy Digital posted a near half-billion net loss for 2025 as falling crypto prices hammered the company’s digital asset holdings.

The New York-based firm reported a $241 million net loss for the fourth quarter alone, when Bitcoin fell nearly 25%. For the full year, Galaxy’s losses reached $482 million.

“If you had told me a year ago, with gold at the highs and NASDAQ at the highs, and a very friendly administration, that we would be lower, I’d have said no way,” CEO Mike Novogratz said on the company’s earnings call Tuesday.

Galaxy’s results highlight the brutal reality facing crypto-focused companies. Despite the acceleration of institutional adoption and improving regulatory clarity, short-term price volatility can still overwhelm fundamentals.

Take the company’s operating businesses. They thrived in 2025, generating record trading volumes and $505 million in adjusted gross profit. But those gains were wiped out by the paper losses on the company’s own crypto holdings.

Turning tide

Novogratz remains cautiously optimistic that Bitcoin has found a bottom in the $70,000 to $100,000 range.

Today the top crypto trades at $73,000, down nearly 7% in the past 24 hours.

But that can change in the blink of an eye.

“Often when things feel worse, it’s time to be very focused,” said Novogratz. “Because when the tide turns, it turns quick.”

And the catalysts? Passage of the Clarity Act in the US and ongoing institutional adoption, according to Novogratz. Both, however, have been sluggish in the beginning of 2026.

“The broad story that brought people into Bitcoin as a store of value is intact,” Novogratz said. “Our debt is $40 trillion.”

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.