- Gemini lost $282 million in 2025 but still plans to go public.

- The exchange holds $2.1 billion in debt.

- It joins a wave of crypto firms tapping public markets this year.

US-based Gemini crypto exchange is striking while the iron is hot, filing for an initial public offering in a raging crypto bull market even as it racks up heavy losses.

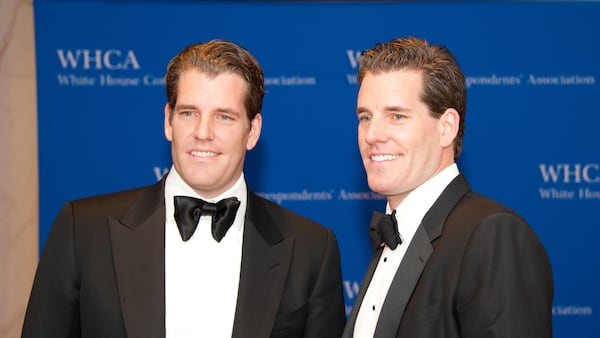

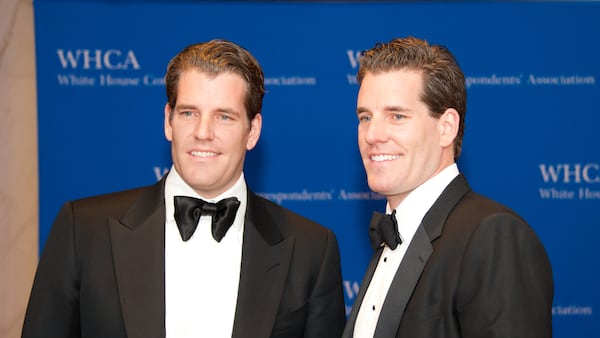

The Winklevoss-led company lost $282 million in the first half of 2025, according to its IPO filing made public Friday.

Gemini plans to list on Nasdaq under the ticker GEMI and said it may use the proceeds to repay debt. The firm reported $2.1 billion in liabilities as of June 30, including loans from Galaxy and NYDIG.

Despite the mounting losses, Gemini is betting that favourable market conditions and renewed investor interest in crypto stocks will help it land a successful debut.

The exchange generated just $68.6 million in revenue in the first six months of 2025, down from $74.3 million during the same period last year, while losses ballooned more than sixfold.

One of us

Gemini’s filing comes on the heels of Bullish’s blockbuster IPO, which raised $1.1 billion and saw shares surge 228% on the first day of trading, giving it a $10 billion valuation.

The Peter Thiel-backed exchange became the second publicly traded crypto exchange in the US, after Coinbase. Gemini will be the third once it lists.

Gemini’s filing adds to a wave of digital asset firms tapping public markets as investor appetite in all things crypto rebounds.

Stablecoin issuer Circle went public in June and quickly hit a $40 billion market cap, becoming the first publicly traded stablecoin firm in the US. It has since slipped to just over $37 billion.

Galaxy Digital, led by Mike Novogratz, also joined the Nasdaq this year to gain deeper access to US capital markets. Galaxy shares dipped in the days following its IPO but have since rebounded, gaining around 12% since then.

Crypto market movers

- Bitcoin has lost 1% in value over the past 24 hours and is trading at $117,710.

- Ethereum is down 4% in the same period to $4,460.

What we’re reading

- New York’s top lawyer said Ethereum is a security. A crypto lawyer is coming for her job — DL News

- Citigroup considers custody and payment services for stablecoins, crypto ETFs — Reuters

- DeFi Tokens Surge — But These Hidden Gems Could Shine Next — Unchained

- Why Ethena’s USDe got a 1,250% risk weighting in S&P Global’s Sky credit rating — DL News

Kyle Baird is DL News’ Weekend Editor. Got a tip? Email at kbaird@dlnews.com.