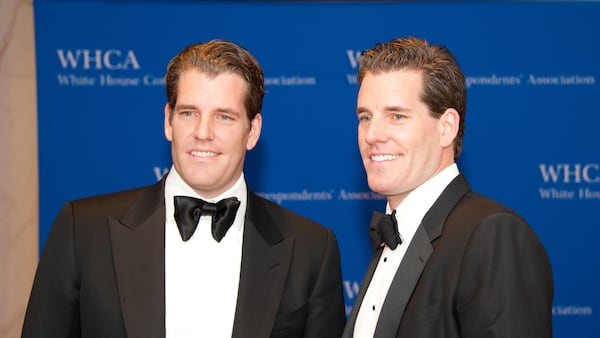

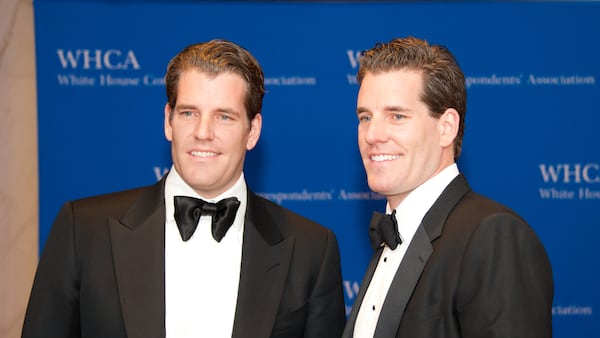

- Winklevoss twins’ exchange raises $425m at $3.3bn valuation.

- Deal was 20x oversubscribed, despite capped proceeds.

Gemini Space Station is blasting off.

The US crypto exchange led by brothers Cameron and Tyler Winklevoss priced its long-awaited initial public offering on Thursday at $28 a share, above the marketed range of $24 to $26. The sale raised $425 million and valued the company at over $3 billion, Reuters reported.

Gemini will begin to trade on the Nasdaq, a New York City stock exchange, on Friday under the ticker GEMI.

The listing drew investor demand, with bankers halting new orders after bids topped 20 times the available shares, insiders told Reuters.

In a rare move, Gemini capped the proceeds at $425 million, with any further price increase instead reducing the number of shares sold.

Nasdaq committed to a $50 million private placement alongside the Gemini deal, underscoring confidence in the exchange’s prospects. Goldman Sachs and Citigroup led the underwriting.

The red-hot demand from Wall Street highlights how record crypto prices and a friendlier regulatory climate have transformed digital asset firms into mainstays of US public markets.

Stablecoin issuer Figure Technology raised $787.5 million in a blockbuster debut on Wednesday, while Peter Thiel-backed institutional exchange Bullish and stablecoin bluechip Circle both upsized their offerings earlier this year.

Coinbase, the biggest public crypto exchange in the US, went debuted on the Nasdaq in 2021.

The Winklevoss twins founded Gemini in 2014, one of the first crypto exchanges to pursue a compliance-first strategy.

The company has been buoyed by the Trump administration’s pro-crypto stance, which has lifted exchange-traded fund inflows and emboldened corporate treasuries to adopt Bitcoin and Ethereum.

Gemini has also benefited from regulatory relief. In April it moved closer to resolving a lawsuit with the Securities and Exchange Commission over its defunct crypto lending programme, with a status update due September 15.

Crypto market movers

- Bitcoin is up 0.8% over the past 24 hours to trade at $115,017.

- Ethereum is up 2.1% over the past 24 hours trading at $4,514.

What we’re reading

- Saylor’s Strategy rebuffed as S&P 500 sets ‘higher bar’ for crypto firms — DL News

- Stripe’s Tempo blockchain ‘doomed to fail,’ says Libra co-creator— DL News

- Polygon Completes Hard Fork to Address Finality Issue — Unchained

- Was there a recession last year? — Milk Road

- Crypto companies raise $869m in one week— DL News

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.