- The world’s largest asset manager applied for a spot Bitcoin ETF on Thursday.

- No application has been successful for a spot-based product to date.

- Market watchers wonder if BlackRock may be able to succeed where others failed.

BlackRock’s shock announcement that it wants to offer clients a Bitcoin exchange-traded fund in the US sets up the world’s largest asset manager for a battle that few have won.

BlackRock, with about $9 trillion in assets under management, applied for a Bitcoin ETF yesterday.

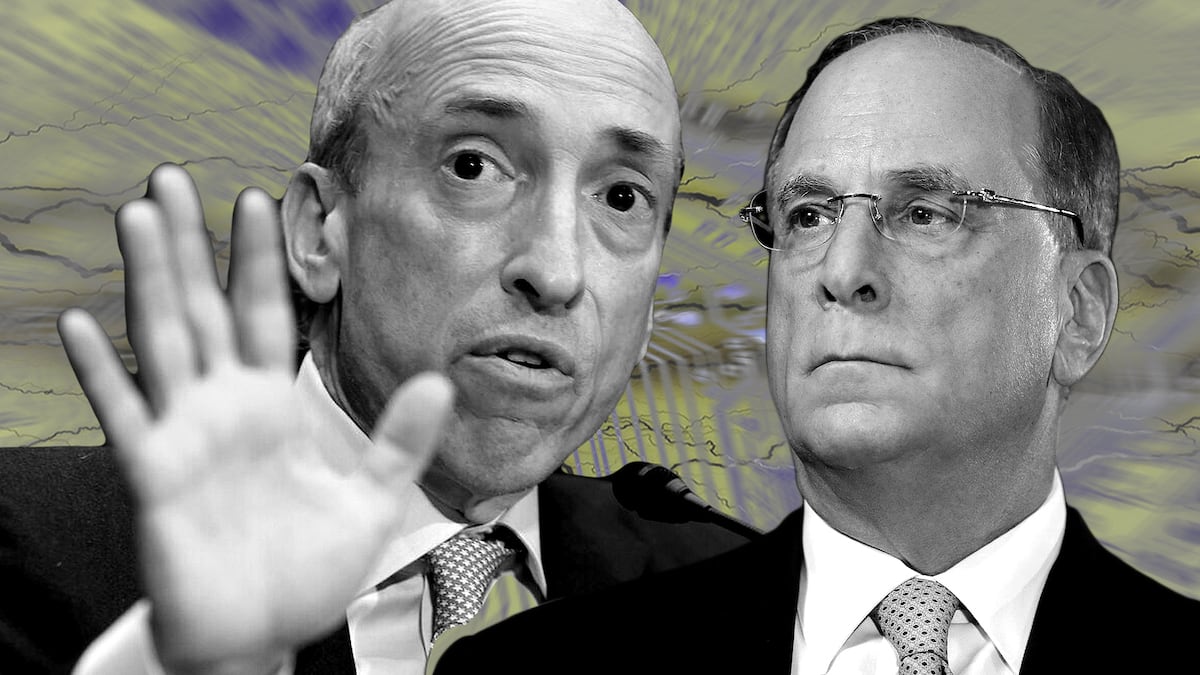

Gary Gensler’s Securities and Exchange Commission has taken a bold approach to regulating the crypto industry — and so far no one has been successful in their spot Bitcoin ETF aims. That’s part of why BlackRock’s filing came as such a surprise.

‘Holy crap, they did it!’

”Holy crap, they did it! BlackRock has officially filed for a spot Bitcoin ETF,” Eric Balchunas wrote on Twitter. Coindesk first reported on BlackRock’s ETF plans.

The application — which would target the so-called spot market for instant pricing and transactions — comes just under 10 years after the first application by the Winklevoss twins’ exchange, Gemini.

While several Bitcoin futures ETFs exist in the US, the SEC has not approved a spot Bitcoin ETF. The regulator says there is a potential for price manipulation because most exchanges are unregulated, overseas, or both.

The application was a “shocker,” the Bloomberg Intelligence Senior ETF analyst added, saying there have been no signs the SEC is willing to approve one. “Maybe they know something,” that others don’t when it comes to a path to approval, Balchunas said.

BlackRock’s considerable sway was mentioned by several commentators, including a colleague of Balchunas, James Seyffart, an ETF analyst at Bloomberg Intelligence.

“If there’s anyone in the ETF world that can essentially tell Gary to go pound sand – it’s Larry Fink,” Seyffart said on Twitter, referring to SEC Chair Gary Gensler.

NOW READ: ‘Tether is next’ says short seller who bet against Silvergate and Signature Bank

BlackRock currently offers two blockchain-focused exchange-traded products in Europe.

ETPs, which include ETFs, are financial instruments that track the performance of an underlying security, index, or financial instrument. For example, the iShares Blockchain Technology ETF tracks the NYSE FactSet Global Blockchain Technologies Capped Index.

BlackRock’s two products in Europe offer exposure to companies working on developing and researching blockchain and cryptocurrency technologies and applications.

The firm might be applying despite knowing it will be rejected, “it’s not going to happen,” argued Noelle Acheson, author of Crypto is Macro Now and former head of market research at Genesis.

NOW READ: Silvergate short seller says he’s betting against Signature: ‘Binance is next’

Larry Fink could be trying to send a political message with this application, she added. After all, he is a prominent Democrat, Acheson concluded.

The BlackRock CEO has changed his tune on crypto in recent times. Six years ago Fink labelled Bitcoin an “index for money laundering,” however, his firm has started to explore opportunities in offering customers the opportunity to gain exposure to Bitcoin in recent years.

Fink touted the promise of tokenisation in his annual shareholder letter earlier this year. “The tokenisation of asset classes offers the prospect of driving efficiencies in capital markets, shortening value chains, and improving cost and access for investors,” The CEO said.

Join the queue

BlackRock joins a long list of applicants.

Gemini made the first spot Bitcoin ETF application in the US nearly a decade ago in 2013. Bitcoin was trading at around $100, according to Statista, and it had thin volume.

The application was denied, as has every application since –– some live applications remain.

The SEC’s most recent rejections include CBOE’s second attempt to list an ARK 21Shares Bitcoin ETF. It reapplied for the third time in May, meaning Ark is ahead of BlackRock in line. It could be a big win for them, according to Balchunas.

Ark isn’t the only firm waiting on a response, long-term petitioner Grayscale is waiting to hear back on its appeal following last summer’s rejection. Oral arguments were heard in March.

Grayscale argued that basic norms govern the actions of the SEC, as such they should “conduct themselves in a manner that is not arbitrary and capricious, and they’ve got to engage in reasoned decision-making.”

The SEC has acted in an arbitrary and capricious manner by taking like cases and treating them differently, the asset manager says. In essence, the regulator’s decision to approve Bitcoin futures ETFs and not spot market ETFs is unfair, per Grayscale’s argument.

Coinbase, Nasdaq, and recognising risk

BlackRock’s application names Coinbase as its custodian, with Nasdaq as its pricing partner.

The fund is dependent on a custodian holding the underlying Bitcoin. BlackRock has chosen Coinbase for custody of the digital asset. The firm has a prior relationship with Coinbase.

In August 2022, Coinbase announced a partnership with BlackRock to offer the asset manager’s Aladdin customers access to crypto trading and custody.

Coinbase is currently embroiled in its own battle with the SEC. The exchange faces allegations of operating as an unregistered exchange.

Nasdaq will oversee pricing data for the fund, something which was a sticking point for the SEC with previous applications. BlackRock is acutely aware of this, Balchunas said, noting that the asset manager said the price of Bitcoin could be adversely affected by exchanges which are mostly unregulated and could be subject to manipulation.

That’s the SEC’s main issue with approving a spot ETF.