- About 13% of Coinbase’s total trading revenue hangs on 13 tokens named in today’s SEC filing.

- Some 70% of this revenue and gross profit impacts are driven by trading just three tokens: Solana, Cardano, and Polygon.

The Securities and Exchange Commission’s case against Coinbase leaves the firm facing yet another battle.

Coinbase — charged with allegedly operating an illegal exchange and permitting investors to trade in assets that aren’t registered as securities — makes some 13% of its revenue from 13 coins named in the SEC lawsuit.

The SEC only has to be right once, Coinbase needs to be right 13 times, Gary Gensler explained to television host Jim Cramer this morning, showcasing the task at hand for Coinbase.

Meanwhile, KBW analysts said in a note to expect a “prolonged legal battle between the SEC and COIN, with the outcome providing significant uncertainty for COIN shareholders.”

NOW READ: SEC charges Coinbase with running an illegal exchange in fresh blow for crypto

The filing classifies 13 altcoins trading on the platform — including Solana, Cardano and Polygon — as securities, and takes aim at so-called staking services offered to customers. Those coins accounted for as much as 13% of Coinbase’s $2.4 billion in transaction revenue last year, analysts at KBW calculate.

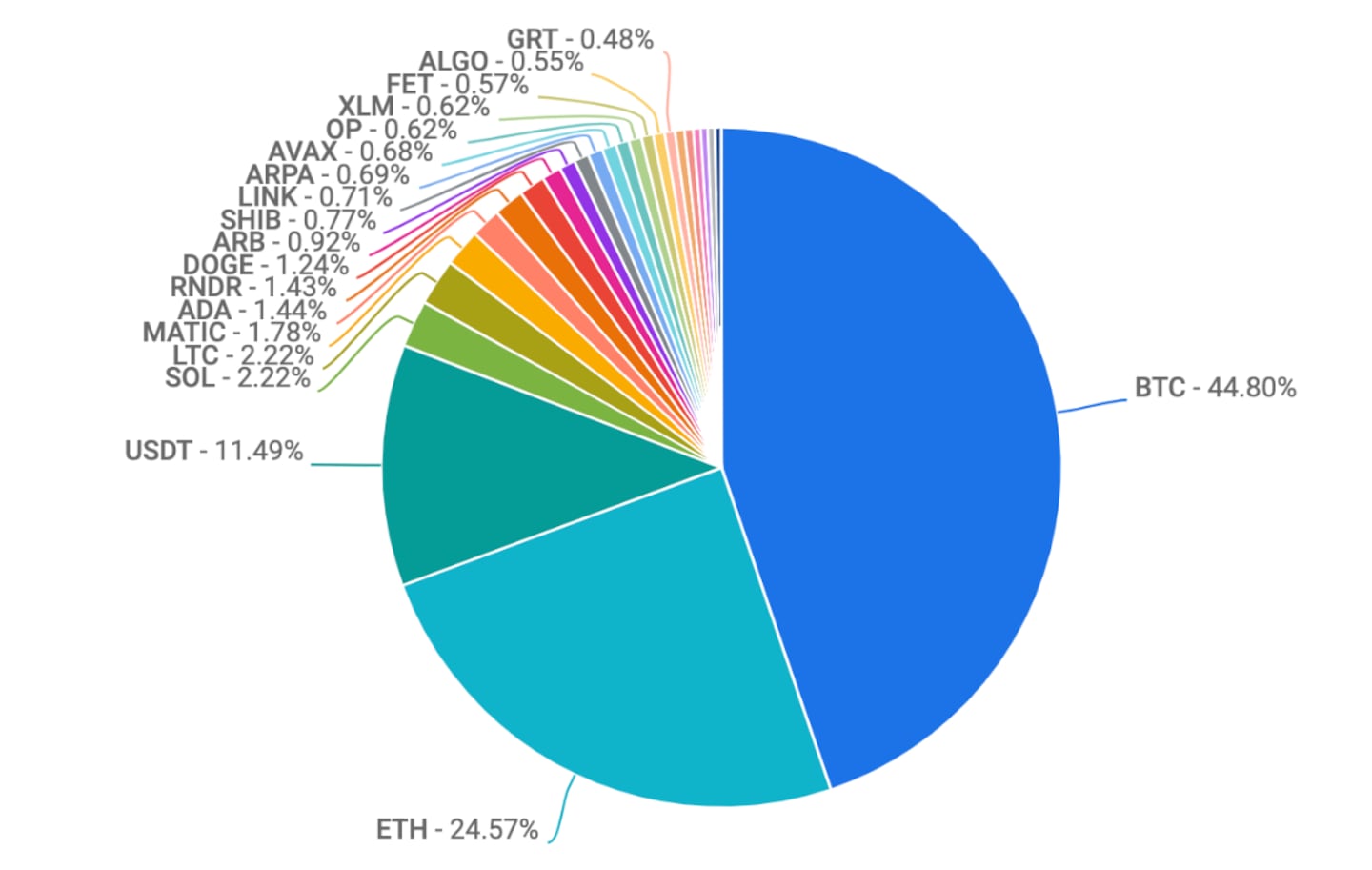

Bitcoin and Ethereum accounted for 70% of trading volume on Coinbase. These volumes can’t always be relied on.

One-third of revenue at risk

Coinbase now has to prove it doesn’t offer unregistered securities to its customers, or risk losing a major revenue source.

Altcoins accounted for $172 million of transaction revenue in the first quarter. Transaction revenue for the quarter was up 16% to $375 million. Total company revenue relating to fees from altcoin trading was 22% during the period, according to Mizuho Bank analysts.

NOW READ: Stablecoins and Binance next in SEC crosshairs after Coinbase warning

Last week, Bitcoin and Ethereum accounted for 70% of trading volume on Coinbase, according to the exchange’s latest weekly report. These volumes can’t always be relied on, say Mizuho analysts.

A key lure for retail investors was the option to trade altcoins as well as Bitcoin and Ethereum, Ryan Coyne, senior associate at Mizuho, said in an email to DL News. Without these assets, he said, Bitcoin and Ethereum volumes could drop.

The SEC’s complaint also cites Coinbase’s staking program as an unregistered security, KBW analysts led by Kyle Voigt noted on Tuesday.

The investment bank estimates staking could account for “roughly 13.3% of Coinbase’s net revenues in 2023, but only 3.5% of its gross profit.”

Blockchain rewards, which include staking revenue, came to $74 million in the first quarter, about 10% of Coinbase’s revenue.

Kraken, a competing US-based exchange, shut down its staking services and settled with the Commission in February.

Circle stablecoin benefit

Coinbase benefited from interest income related to Circle’s stablecoin over the past several quarters –– and this revenue is already at risk.

Interest income from Circle’s stablecoin came to nearly $200 million in the first quarter of the year, about 82% of total interest income.

While the revenue generated in the fourth quarter of last year helped prop up the firm’s earnings amid dwindling retail trading volumes, according to analysts at KBW and Needham.

Circle’s circulating supply has decreased to $28 billion from $44 billion at the beginning of the year, according to DefiLlama data.

The Silicon Valley Bank collapse at the end of the first quarter will have a lagged effect on the exchange’s earnings, which it noted in its guidance last month.

“We expect lower subscription and services revenue quarter on quarter driven by lower USDC market capitalisation,” Coinbase said in its earnings report.

The stablecoin’s circulating supply has fallen roughly $3 billion since that guidance was shared.

The regulatory environment in the US could drive more investors offshore to more opaque firms such as Tether, further decreasing Circle’s share of the stablecoin market.

Mizuho Bank kept its EBITDA estimates unchanged, noting revenue declines “can be met with further cost cuts.”

Coinbase, in a tweet, said that “the SEC has taken a regulation by enforcement approach that is harming America.”