- Spot Bitcoin ETFs are the biggest news in town, but there are other metrics to look at.

- Interest rates could also have a massive impact on the price of Bitcoin.

A version of this story appeared in our The Roundup newsletter. Sign up here.

Bitcoin exchange-traded funds continue to dominate crypto markets.

Grayscale’s GBTC has caused a drag on the price of Bitcoin. The newly converted ETF has seen $2.2 billion in outflows in the first seven days of trading.

The bleed from Grayscale’s ETF could get worse, JPMorgan said Thursday. The investment bank said it could reach up to $10 billion.

In New York, Coinbase asked a federal judge to throw out the Securities and Exchange Commission’s case against it. A source close to the crypto exchange told DL News ahead of the hearing that they were impressed by the judge “digging into the details.”

Following the hearing, Bloomberg Intelligence senior litigation analyst Elliot Stein said there’s a 70% probability of the case being dismissed outright.

Binance’s pretrial hearing to dismiss is slated for Monday after the court postponed the proceedings due to the weather.

What we’re watching

Bitcoin ETF euphoria has been a key driver for markets over the past few months. Now that spot ETFs have been approved, launched and taken wins, it’s time to consider other influences, such as interest rates.

Following dovish signals from the US Federal Reserve in December, market participants factored in multiple interest rate cuts in 2024, which would have been a boon for Bitcoin’s price. Those hopes are now fading.

Lower interest rates benefit risk assets like Bitcoin as investors take more risk in search of returns.

This also increases the money supply, which would impact Bitcoin due to its high correlation, Fidelity Digital Assets noted in its 2024 outlook.

But investors can’t bank on rate cuts. Several Fed policymakers have warned against cutting rates too soon. European Central Bank Chief Christine Lagarde shared similar hawkish remarks, saying optimism isn’t helping the fight against inflation.

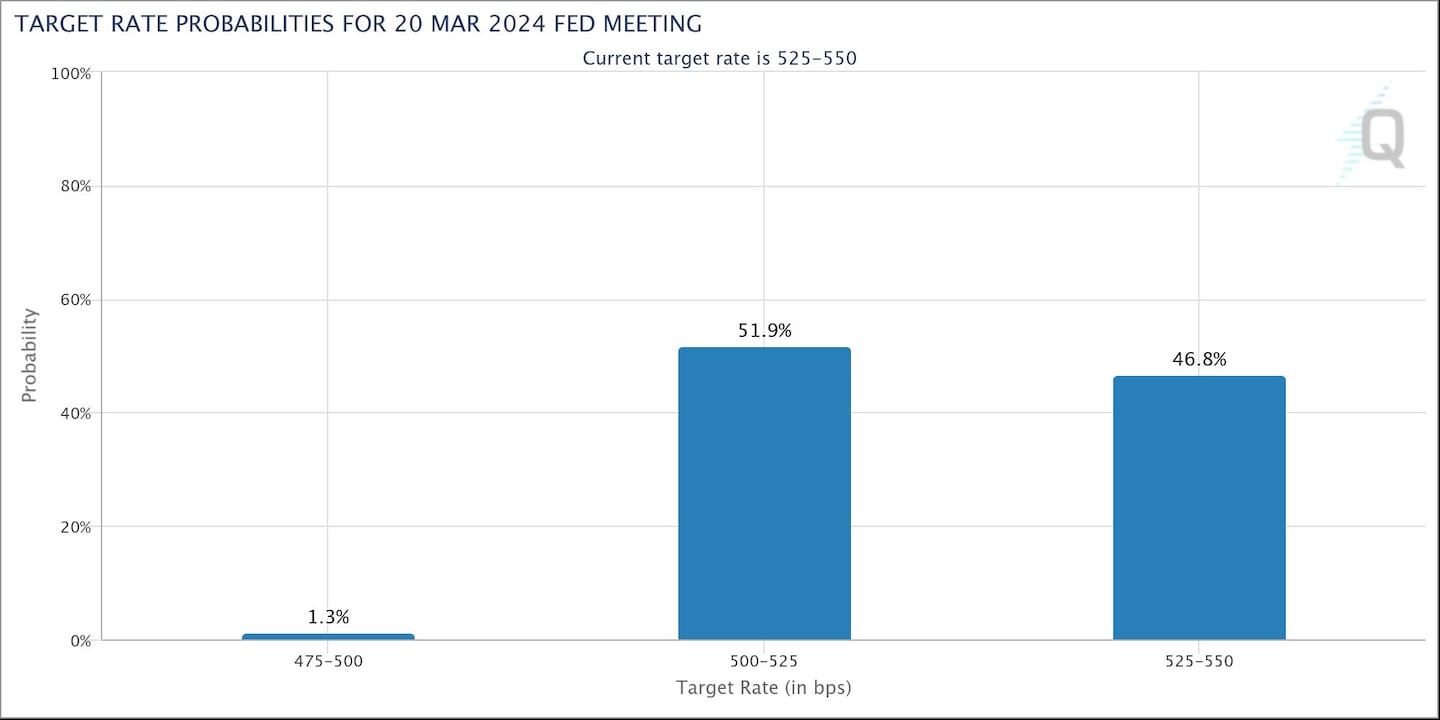

The market responded by repricing its expectations this week. The probability of the Fed cutting rates by 25 basis points in March has fallen to 52% from 77% a week ago, according to the CME’s FedWatch tool.

The US dollar is also influenced by rate cuts, and it’s been performing well since the beginning of January. The dollar index is up nearly 2% so far this year, signalling improved strength in the dollar relative to other currencies.

Bitcoin’s price has a negative relationship to the dollar. When the dollar is performing well Bitcoin has historically underperformed. Its continued strength poses a significant headwind for Bitcoin.

The EU is about to outlaw and restrict some of the most prized features in crypto

Restricting self-custody wallet payments. Increasing the tracking of crypto transfers. Banning privacy coins. These are three critical changes European Union lawmakers mulled over this week.

Telegram trading bot Unibot hits record use on Solana after Ethereum success

Telegram bots welcome a flood of new users from the memecoin trading community on Solana. Trading volumes through Unibot are now heavily dominated by Solana, and competitors are taking note.

BlackRock and Fidelity are dominating the ‘two-horse race’ for Bitcoin ETF billions

Investment bigwigs BlackRock and Fidelity have emerged as the two frontrunners in the spot Bitcoin ETF race. Both firms’ ETFs have reached over $1 billion in assets under management as of Friday.