- Outflows from GBTC are pushing down prices in crypto markets, JPMorgan said Thursday.

- If GBTC loses its liquidity advantage it could see an additional $10 billion in outflows, the bank said.

Spot Bitcoin exchange-traded funds in the US have clocked up big volumes in the first week of trading, yet Bitcoin has fallen 11%. JPMorgan blames investors ditching Grayscale’s ETF.

Grayscale’s spot Bitcoin ETF, GBTC, has seen over $1.5 billion in outflows since January 11. The exodus has acted as an “additional drag for crypto markets,” JPMorgan analysts led by Nikolaos Panigirtzoglou said in a report shared with DL News on Thursday.

Things could get worse for GBTC, as the investment bank estimates an additional $10 billion could leave the fund.

“Liquidity and market depth also matter but again there is risk for GBTC on that front also if other spot Bitcoin ETFs manage to reach critical mass in terms of size and liquidity,” JPMorgan said.

Liquidity typically refers to the ability to sell an asset for cash. Less liquidity poses a risk for investors as they could find it hard to sell their shares.

“A lot more capital, perhaps an additional $5 billion to $10 billion, could exit GBTC if it loses its liquidity advantage,” the report said.

Price pressure

Following the fund’s conversion from a close-ended trust, investors have taken the opportunity to exit their GBTC positions. Some of these investors “have been taking full profit post ETF conversion by exiting the Bitcoin space entirely rather than shifting to cheaper spot Bitcoin ETFs,” the report said.

Based on JPMorgan’s estimates, which were made pre-approval, Panigirtzoglou says another $1.5 billion could leave GBTC in the next few weeks. This would put further pressure on Bitcoin’s price, the report said.

“Whatever the motive behind the past few days’ $1.5 billion of outflows from GBTC, these outflows are exerting pressure on GBTC to lower its fees,” the report noted, referring to the fund’s 1.5% management fee.

Grayscale is charging far more than its competitors. Ark Invest launched with zero fees for the first year and 0.21% thereafter. BlackRock, the world’s largest asset manager with $10 trillion in assets under management, charges 0.12% for the first year, or on the first $5 billion, rising to 0.25% after that.

Inflows into these competing funds have been “decent,” JPMorgan’s report said. The inflows are comparable to previous Bitcoin-related launches, such as Bitcoin futures on the CME and Bitcoin futures ETFs.

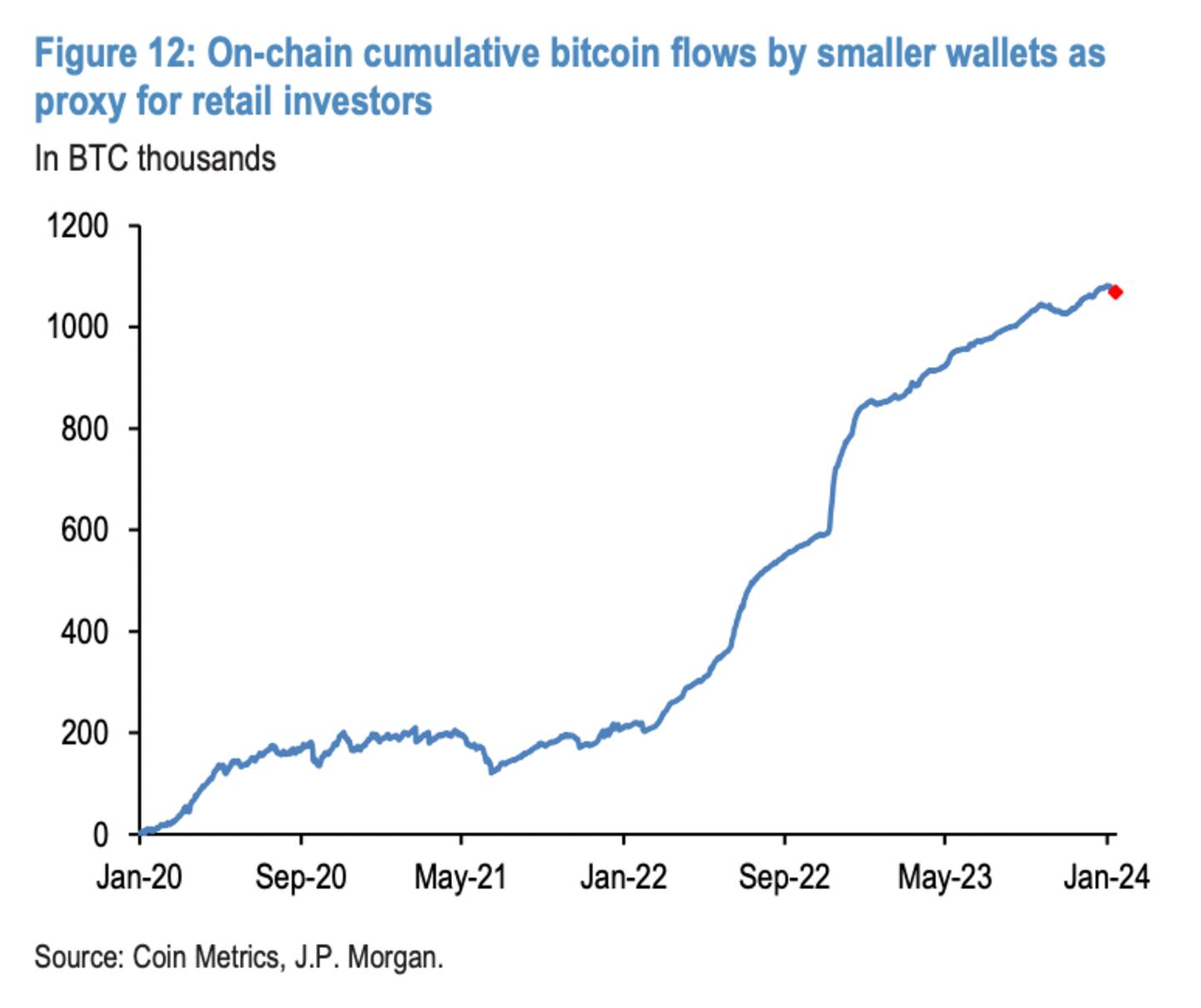

“Most of this $3 billion of inflow reflects a rotation from existing Bitcoin vehicles,” JPMorgan said. But it’s not just institutional investors that are moving money. Retail traders appear to be shifting from exchanges to cheaper spot Bitcoin ETFs.

“Smaller Bitcoin wallets, typically attributed to retail investors, have seen some retrenchment in recent days,” the bank said. JPMorgan uses on-chain cumulative Bitcoin flows of smaller wallets as a proxy for these investors.

Adam Morgan McCarthy is a markets correspondent for DL News. Have a tip? Contact the author at adam@dlnews.com.