- Strategy is building a cash cushion to avoid selling Bitcoin at depressed prices.

- The firm’s stock price is down 60% from its July highs.

- Market watchers are raising concerns about the company.

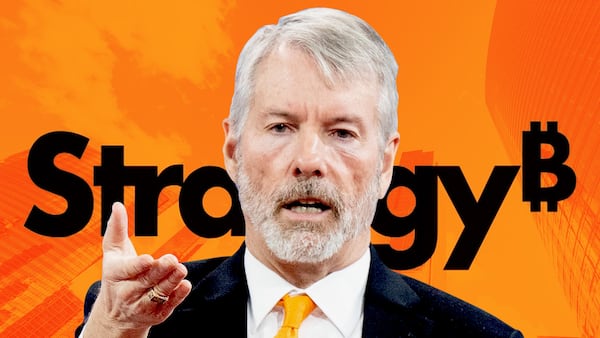

Michael Saylor’s Strategy has created a $1.4 billion cash reserve to shield the Bitcoin treasury firm from dramatic market swings.

Alongside the reserve, Strategy slashed its Bitcoin projection, saying the price may drop as low as $85,000 at the end of 2025. Its earlier estimates said Bitcoin would close out the year at $150,000. It currently trades at $87,000.

Chief executive Phong Le said Strategy made the move to “further reinforce our commitment to our credit investors and shareholders.” Le stressed that the firm now holds 650,000 Bitcoin, just over 3% of the total supply.

“We intend to use this reserve to pay our dividends and grow it over time,” Le said in the press release.

The Monday move marks a dramatic shift in the firm’s strategy. It is the first time that Saylor’s company has built a cash buffer to protect itself rather than purchase more coins. It comes as Bitcoin’s price is down more than 30% from its October peak.

The reserve will be funded by new stock sales. It is designed to cover at least 21 months of dividend and interest payments to investors.

The aim is to shield Strategy from the risk of being forced to liquidate Bitcoin at depressed prices. It comes as crypto markets continue to reel from a $1.4 trillion pullback.

US Bitcoin exchange-traded funds saw $3.5 billion in selling pressure in November, DefiLlama data shows. That makes it the worst month for traders to pull out of the asset since February. This has amped up the pressure on Strategy, which is a company whose model relies heavily on rising prices and constant retail inflows.

Strategy’s stock has plummeted more than 60% from recent July highs.

Meanwhile, investors are getting hammered. The top ETFs linked to Strategy’s stock price have plunged over 80% this year, according to Bloomberg data, making them the worst performing products out of some 4,700.

Why the move?

The firm raised fresh cash by issuing new stock. That dilutes existing shareholders, but gives Strategy money right away. And instead of buying Bitcoin with that money, they parked it in dollars, unlike in previous years.

The firm’s self-invented valuation metric, mNAV, which compares Strategy’s enterprise value to the value of its Bitcoin, has slid dangerously under 1.0 to .874, according to BitcoinTreasuries.NET.

Floating below the 1.0 level means Strategy is now worth less than the Bitcoin it owns, according to this metric.

That could force the company to sell Bitcoin at depressed prices to meet obligations, dragging down the whole market, a scenario Strategy wants to avoid.

“Today is the beginning of the end of [Strategy],” economist Peter Schiff, a prominent Bitcoin antagonist, said on X.

Crypto market movers

- Bitcoin is up 0.6% over the past 24 hours, trading at $87,000.

- Ethereum is down 1% over the past 24 hours trading at $2,800.

What we’re reading

- Kevin Hassett emerges as favourite to lead Fed as market price in new era of rate cuts — DL News

- Michael Saylor’s Strategy is now worth less than the Bitcoin it owns — DL News

- Why Wall Street Banks Need to Launch Their Own Stablecoins — Unchained

- Arthur Hayes’ Crypto Outlook: Why Markets Are Set to Rip Into 2026 — Milk Road

- Young people are so poor that they’re forced to invest in crypto, study says — DL News

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.