- The S&P 500 denied including Strategy into its equity index last week.

- Strategy met all of the S&P 500’s various requirements.

- The rejection sets a “higher bar” for crypto companies, says analyst.

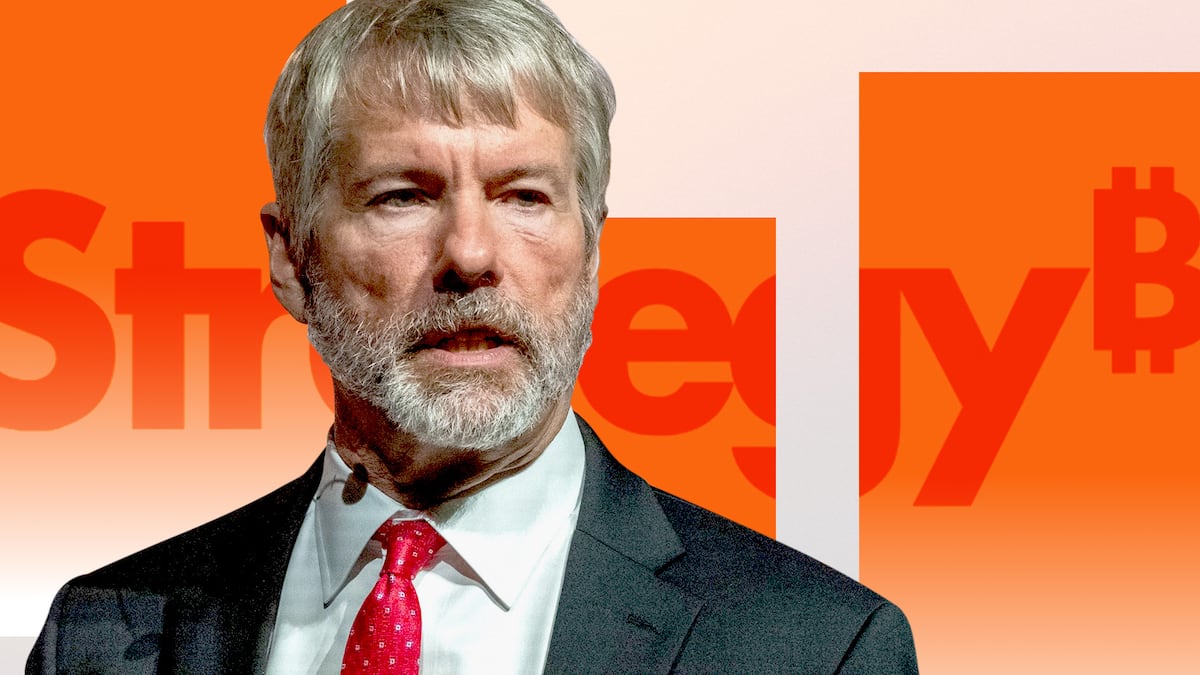

Last Friday, the S&P 500 slammed the door in Michael Saylor’s face when it denied Strategy’s inclusion into the world’s most prestigious equity index.

Now, JPMorgan analysts are saying it’s a clear signal that the committee won’t accept firms that are “effectively Bitcoin funds” masquerading as operating businesses.

“This rejection is a blow to not only MicroStrategy but also other corporate crypto treasuries that have proliferated in recent months,” JPMorgan analysts wrote in a note to investors on Wednesday, warning that the denial suggests Bitcoin’s “encroaching into investors’ portfolios via the back door may be reaching its limits.”

Strategy’s rejection comes at a dire time for Bitcoin treasury companies.

One in every three firms of 172 publicly traded Bitcoin treasuries are trading below their premiums, according to Capriole Investments.

Just last week, the first Bitcoin treasury to risk delisting from the New York Stock Exchange, Sequans Communications, had to turn to a convoluted reverse stock split scheme to stem the risk.

‘Higher bar’

On paper, Strategy checked every box for an S&P 500 inclusion: profitable for four consecutive quarters, sufficient market capitalisation, and adequate liquidity.

But the problem for the committee, which holds discretionary power over inclusions, came from the source of some of Strategy’s capital.

“A large share of its profits in the last quarter came from extraordinary profits relating to unrealised gains on their digital asset holdings, which may have triggered some qualitative scrutiny,” Alexandre Schmidt, analyst at CoinShares, told DL News.

For Schmidt, that doesn’t mean game over.

But the rejection “does show that the S&P still has some reluctance with regards to crypto businesses, and has set a higher bar for companies in this sector to clear,” said Schmidt.

Strategy has already been added to the Nasdaq 100, MSCI World, and Russell 2000 indices. The S&P 500 would have been the crown jewel, however, compelling every other index fund to buy Strategy shares and that way indirectly own Bitcoin.

But treasuries are starting to face a multi-front assault on their business models.

Dire straits

The tech-heavy Nasdaq has reportedly begun requiring companies holding crypto assets to seek shareholder approval before issuing new shares to fund purchases.

That’s a direct shot at Strategy’s dilution-heavy playbook.

In August, Strategy itself dropped its no dilution promise barely one month after it made the vow, signaling some desperation in its ability to keep the Bitcoin buying going.

The Paris-based chipmaker turned Bitcoin stockpiler consolidated every 10 shares into one in a desperate bid to maintain its exchange listing after shares dropped below $1.

Shares for Sequans are down 72% this year, now trading at $0.98.

Moreover, data from JPMorgan shows the Bitcoin treasury trade is hitting a wall.

Equity issuance by these companies has “slowed in the most recent quarter,” while share prices have “come under pressure due to overcrowding and investor fatigue.”

Indeed, investors are feeling the lethargy.

Shares of Strategy and Metaplanet, both bulwarks in the crypto treasury game, have sunk to multi-month lows, despite Bitcoin reaching new all-time highs.

Metaplanet is down 60% from its June peak, while Strategy trades at around $323, a figure well below July’s $500-plus levels.

Domino effect

For JPMorgan, the real danger is contagion.

“Other index providers that have already included MicroStrategy or other corporate crypto treasuries into their equity indices might rethink their approach,” wrote the analysts.

If the Nasdaq or MSCI follow the S&P’s lead, and boot Strategy from their indices, it could trigger forced selling by every fund tracking those benchmarks, which means billions could potentially flow out of these firms, cratering both Strategy’s stock and the broader Bitcoin treasury sector.

Coinbase analysts have already warned of systemic risk brought on by Saylor copycats, while short sellers have relentlessly targeted stocks of Bitcoin treasuries.

To be sure, Schmidt remains optimistic.

“As more crypto businesses become listed, grow and mature, it will be natural that they become part of major indices just like other sectors,” he told DL News.

There’s one man who will help move the needle: Donald Trump.

“The current crypto-friendly US administration and regulatory environment could help accelerate the process,” Schmidt said.

Pedro Solimano is DL News’ Buenos Aires-based markets correspondent. Got at a tip? Email him at psolimano@dlnews.com.