- Popularity of stablecoins, crypto's 'killer app,' soars amid currency crisis.

- Businesses increasingly turn to USDT to facilitate payments.

- Binance plays a key role in driving crypto adoption in most populous African nation.

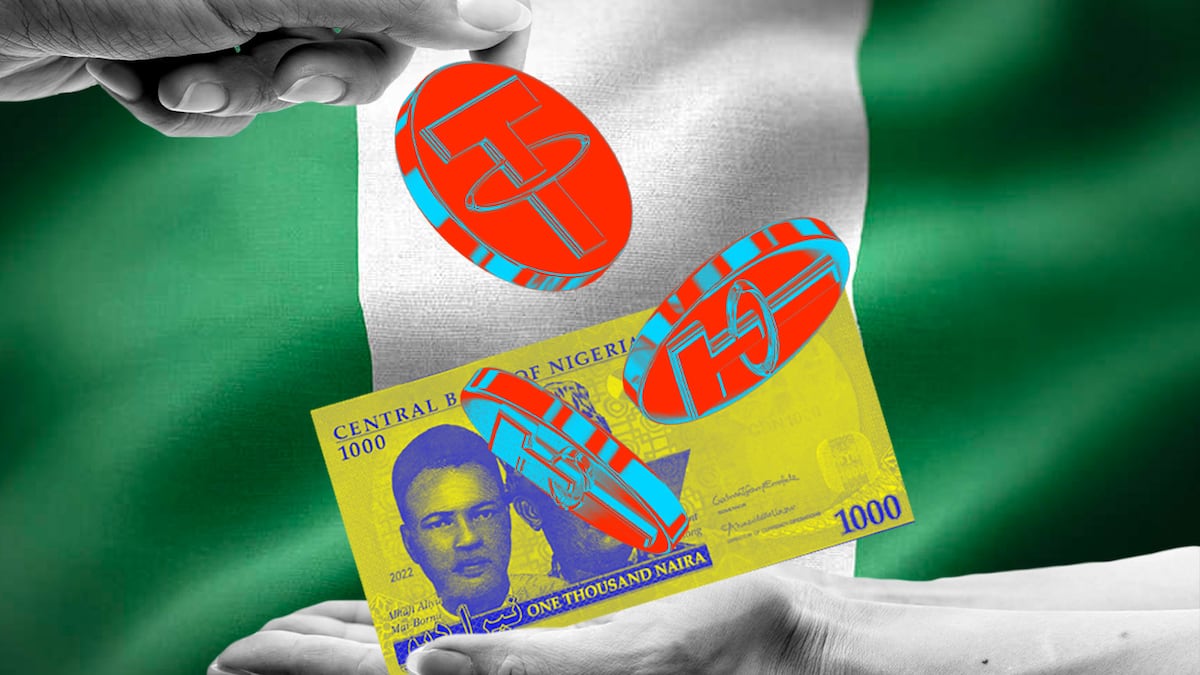

Nigerians still love crypto.

Especially Bitcoin and Tether’s USDT, a US dollar-pegged stablecoin.

This is the upshot from the latest global cryptocurrency adoption report produced by Chainalysis, the research group.

Crypto use climbed 9% in Nigeria over the last two years, making the most populous nation in Africa one of six countries worldwide where transaction volume jumped in that period, researchers found.

Volatility and falling fiat

That such an uptick would come in the midst of a crypto bear market may seem surprising. But the Naira, Nigeria’s fiat currency, has lost 65% of its value to the US dollar since June when the Central Bank of Nigeria decided to float the currency.

Households and businesses coping with the fallout are increasingly turning to stablecoins and Bitcoin to preserve their wealth and facilitate payments.

Bisola Asolo, CEO and co-founder of web3 billing platform Super, called stablecoins “crypto’s killer application for the African continent.”

“The use of stablecoins is the driver behind this adoption, because it acts as a better vehicle for preserving wealth for individuals, when compared to their local currency,” he told DL News.

Moreover, Binance, the world’s top crypto exchange with $19.7 billion in daily trading volume, offers a relatively easy path for Nigerians to access USDT and crypto.

Nigerian exchanges recorded $60 billion in stablecoin transactions between August 2021 and July 2023, Chainalysis said.

In Nigeria, the flight to safety appears to be propelled by rising inflation and the slide in the value of the Naira, the country’s national currency.

Floating the Naira — letting the market set its price — compounded an already volatile situation.

“The Naira to dollar rate has been terrible due to terrible economic policies,” Rume Ophi, executive secretary of the Stakeholders in Blockchain Technology Association of Nigeria, told DL News.

“Imagine buying USDT a few months back at 700 Naira per dollar, and today it is 1,220 Naira per dollar; That’s a 520 Naira spread,” Ophi said. “Apply this to $100,000 and that’s a lot of money.”

Ease of doing business

Businesses are also adopting USDT and other stablecoins to facilitate payments.It is no longer uncommon to see tour operators in Nigeria quote their packages in US dollars and offer USDT as a payment option.

“Stablecoins are easier to transfer value [and] doing business in Africa and transferring funds can be very stressful,” Ophi said. “Stablecoins will do that in minutes, and the value will be transmitted.”

Binance takes advantage

Meanwhile, Binance is taking advantage of the Central Bank of Nigeria’s decision in 2021 to prohibit commercial lenders from servicing crypto exchanges. This pushed crypto trading toward peer-to-peer platforms offered by the likes of Binance.

The Binance P2P exchange rate for USDT to the Naira has become a parallel currency market alongside the traditional one long operated by Bureaux De Change agents.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. To share tips or information about stories, please contact him at osato@dlnews.com.