- Bitcoin’s share of the total crypto market has risen alongside its price this year to date.

- The cryptocurrency’s dominance and on-chain metrics are showing positive signals according to experts.

Investors are flocking to Bitcoin.

The top cryptocurrency has soared about 60% this year, fuelled in part by a flurry of big finance moves into crypto, most notably BlackRock’s plan to launch a Bitcoin exchange-traded fund.

That has led Bitcoin, or BTC, to strengthen its dominance in crypto markets. Bitcoin’s dominance, the market capitalisation of Bitcoin relative to the total crypto market cap, jumped past 50% this week, for the first time since 2018.

Normally, this is a sign of a “weak market,” said macro analyst Noelle Acheson on Twitter, as investors pull out of riskier tokens leaving Bitcoin as the relatively safer dominant trade.

Indeed, K33 research said that since the US Securities and Exchange Commission slapped lawsuits against exchanges Binance and Coinbase earlier this month, a shift to Bitcoin and stablecoins “has been a key trend” as investors scramble to relative safety.

NOW READ: Bitcoin’s ‘digital gold’ narrative sees renaissance — even as pro traders balk

But this time, Acheson said of the Bitcoin dominance: “It signals the consolidation of an inflection point, with BTC leading the beginning of a rally as the main ‘onramp’ into the crypto-asset investing world.”

She noted, citing data firm Paradigm, that traders are piling into bullish June 30 call options that pay off when Bitcoin rallies.

And holders are putting their Bitcoin into wallets and keeping it there. Such “illiquid supply” reached a record 15.2 million Bitcoin this week. Around 146,000 Bitcoin a month is flowing into wallets with very little history of spending. Glassnode says that signals a steady and gradual accumulation by long-term holders.

Bitcoin “liveliness,” which shows the propensity of Bitcoin holders to spend or hold their coins, is currently at a multi-year macro downtrend. It peaked in May 2021 when the bear market first set in, Glassnode said.

The data analytics firm notes this is a trend that typically acts as a precursor to a bull cycle.

Bitcoin has been a bright spot in an otherwise grim year for crypto traders.

What started with scandals and lawsuits after the collapse of FTX in November has snowballed. Trading volume hit a three-year low in May. The SEC’s crypto crackdown has led exchanges to de-list tokens.

Bitcoin users are looking to April when Bitcoin’s “halving” is expected to boost its price even further. The halving refers to when the reward for securing the Bitcoin blockchain will fall to 3.125 Bitcoin from 6.25. As a result, the amount of new Bitcoin being created every day will fall.

Currently around 144 blocks are mined a day, at 6.25 Bitcoin per block which equates to 900 new Bitcoin a day on average. Coinbase Institutional’s head of research, David Duong, said in a recent report that the halving could have a positive impact.

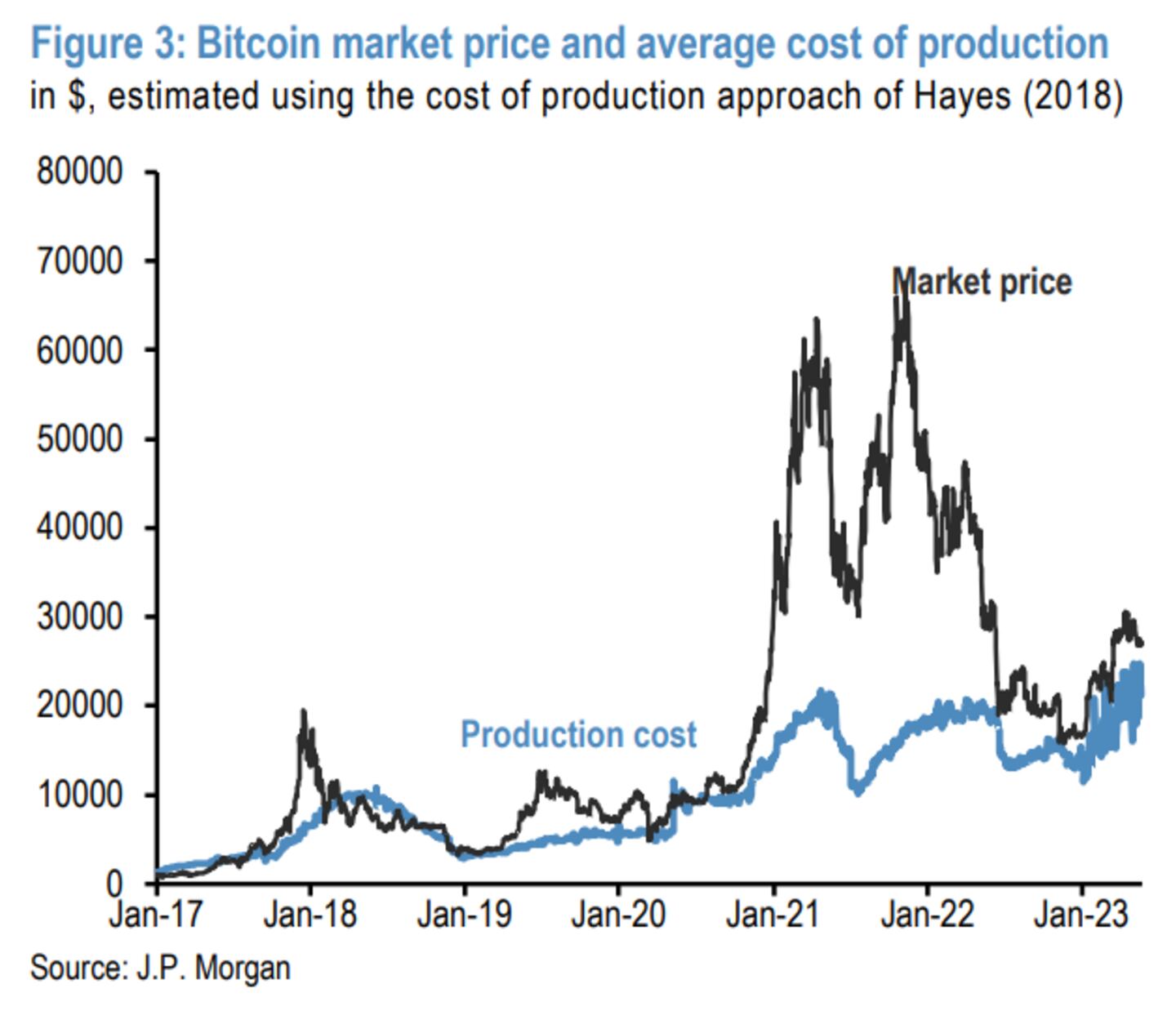

JPMorgan analysts argue the halving could see Bitcoin’s price jump to between $40,000 and $45,000 given the cost of production’s tendency to act as a price floor for the asset. The cost of production for miners will increase as the reward drops, rising to around $40,000.

Paul Howard, head of sales at Standard Chartered’s Zodia Markets, and a former trading executive at Goldman Sachs and Morgan Stanley, told DL News that he expects crypto prices to trade in a range between $22,000 and $32,000 leading up to the halving.

NOW READ: Deutsche Bank, Citadel Securities signal the crypto land grab is accelerating

Investors in other crypto assets are bracing for the rest of 2023 as Bitcoin users look ahead. What’s not helping: the Fed signalled two more interest rate hikes before the year is out. That spooked investors in riskier assets among broader financial markets.

Federal Reserve Chair Jerome Powell is expected to push again his higher-for-longer message on Wednesday in his two days of congressional testimony on monetary policy.

No sure bet

Bitcoin’s halving is no sure bet. Bitcoin’s big supply-side event next year might not be the panacea crypto natives hope for.

For one, Duong questioned the speculative nature of the halving.

“With only three halving events historically, we have yet to see a clear pattern fully emerge, particularly as previous events were contaminated by factors like global liquidity measures,” he said.

This time around it looks like global liquidity has peaked in the near term, Duong said, and with another nine months or so until the halving it is “unclear what the net effect on Bitcoin’s price behaviour might be.”

Other alternatives

Still, investors seeking Bitcoin alternatives are running out of options. Howard said that 98% of what he called “junk coins, are just that,” and “probably mostly worthless” by 2024.

Tether has gained, and its total circulating supply reached a record recently.

The stablecoin, which comes with its own potential problems, benefited from investors selling Circle’s USDC after it depegged in March and Binance USD slowly being removed from circulation.

The rotation into these cryptocurrencies leaves altcoins thin on liquidity — traders dumped Polygon, Cardano, and Solana because they were named in the SEC’s lawsuit.

Celsius could allow creditors to swap their altcoins into BTC and ETH starting on July 1 — creating around $218 million in sell-side pressure.

Duong said decisions like this have impacted altcoin liquidity. Meanwhile, big financial firms are piling into both the infrastructure and Bitcoin offerings. WisdomTree, Deutsche Bank and Citadel Securities all made big moves in the crypto space this week.

NOW READ: BlackRock’s Bitcoin ETF surprise sets up battle with Gensler’s SEC

The overall ecosystem, with Bitcoin at the helm, is in uncharted territory, noted Bernstein analysts this week:

”Multiple traditional institutions have remained engaged in their crypto strategy and build-out through this winter, which is unlike any other crypto bear market in the past.”

To share tips or information about Bitcoin or another story please contact the author at adam@dlnews.com.