- JPMorgan analysts say Bitcoin could track gold higher, reaching up to $45,000.

- Pro traders, as well as commodities analysts, say Bitcoin is too speculative to be considered gold-like.

- The narratives underlie the surging cryptocurrency, which has gained about 50% this year.

Bitcoin’s digital gold comparisons are mounting with the top cryptocurrency trading back around levels last seen in July of last year.

JPMorgan analysts say Bitcoin could track gold higher over the next year. Even as sophisticated investors retreat from the top cryptocurrency, analysts say Bitcoin and gold were viewed as hedges to a “catastrophic scenario.”

NOW READ: Even non-crypto people are asking ‘what’s going on’ with Bitcoin’s surge to $30,000

For crypto natives, Bitcoin has long been framed as a haven outside the traditional finance sector, especially in times of economic and monetary strife. This year’s banking crisis, along with regulatory crackdowns on crypto exchanges, have helped fuel that idea.

Clouding this narrative is that for pro traders, Bitcoin is a risk-on asset. Indeed, Bitcoin has tracked the tech-stock heavy Nasdaq higher — the Nasdaq has jumped about 28% this year, while Bitcoin has rocketed up about 50%.

Bitcoin has enjoyed many narratives over its 14-year history, most dividing insiders and outsiders. The asset’s pseudonymous founder envisaged a peer-to-peer version of electronic cash that would allow users to avoid financial institutions.

“Bitcoin – the seminal cryptocurrency – has been many things over its 14 years of existence: a proof-of-concept, tech plaything, a monetary vehicle for criminals, digital gold, etc.,” Ryan Shea, a crypto economist at Trakx, wrote last month.

The digital gold narrative for Bitcoin is undergoing a renaissance, Shea added.

Hedges in catastrophic times

Bitcoin and gold were viewed as hedges during the US banking crisis in March, JPMorgan said. Institutional investors favoured gold while retail shifted to Bitcoin during the crisis that saw lenders like Signature Bank and Silicon Valley Bank shutter.

JPMorgan’s Nikolaos Panigirtzoglou said the banking crisis in the US “exposed the weaknesses of the traditional finance system,” driving crypto natives to Bitcoin. From a macroeconomic perspective, the bailouts of those banks played a role.

NOW READ: Hodling pays off for patient Bitcoin investors with 1,000x returns

“Extra liquidity, that’s the difference,” between the haven narrative and the cryptocurrency’s tendency to mirror more risk-on assets, Markus Thielen, head of crypto research and strategy at Matrixport, told DL News in March. He spoke after news of the US government’s intervention in the collapse of Silicon Valley Bank.

“It went risk-on when the Fed provided deposit guarantees and traders realised that liquidity would be pumped into the system,” even as “some parts of the economy are in stress,” including banks, he said. “This is helping Bitcoin.”

Demand for both

Demand for both may be rising in tandem, with some retail investors buying Bitcoin as a speculative play, while others buy gold for “all the usual reasons,” Metals Focus analysts told DL News.

“We would still not go as far as saying Bitcoin is a ‘digital’ form of gold even though they may have benefitted from the same drivers recently,” they added, noting that gold, the S&P 500 and Bitcoin have rallied together in the past, and, “nobody says stocks are the new gold.”

Bitcoin is too speculative in nature with too many structural unknowns to be considered gold-like, Metals Focus analysts added, noting that the exchange’s collapse can drive the price of Bitcoin.

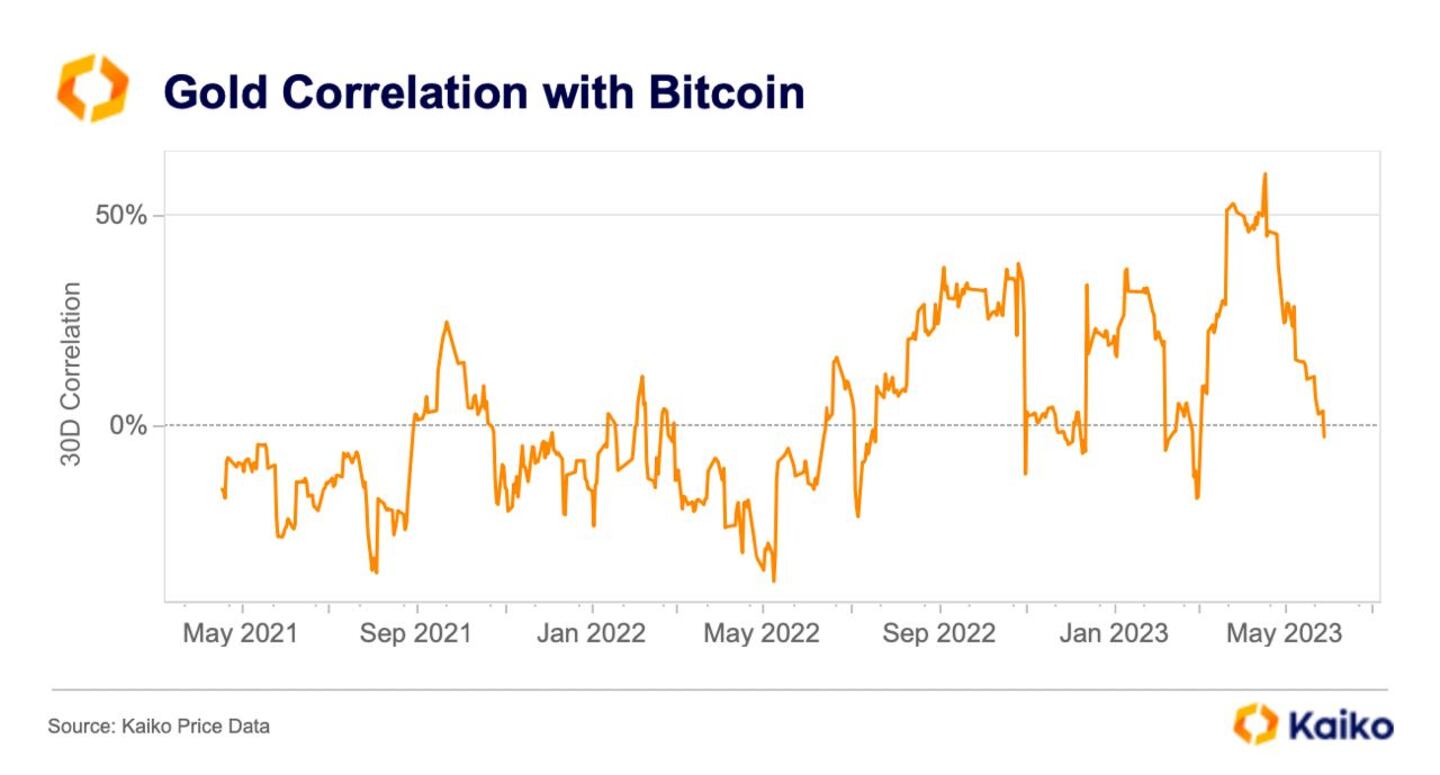

Bitcoin’s correlation with gold turned negative today for the first time since March.

Pro traders and their crypto-native counterparts are also dealing with signs of the dollar’s eroding hegemony.

“As the de-dollarization narrative starts to take shape, it would be rational to expect both risk assets and gold to perform, which would act as a secular tailwind for Bitcoin,” Jonah Van Bourg, global head of trading at DRW’s Cumberland, told DL News.

NOW READ: Bitcoin becomes haven during bank bloodbath with 28% surge: ‘Extra liquidity, that’s the difference’

Bitcoin will eventually trade on its own fundamentals, Ed Moya, senior markets analyst at Oanda told DL News. “It might not necessarily end up being digital gold,” he added. “We could see a strong divergence” next year.

Institutions ditch Bitcoin

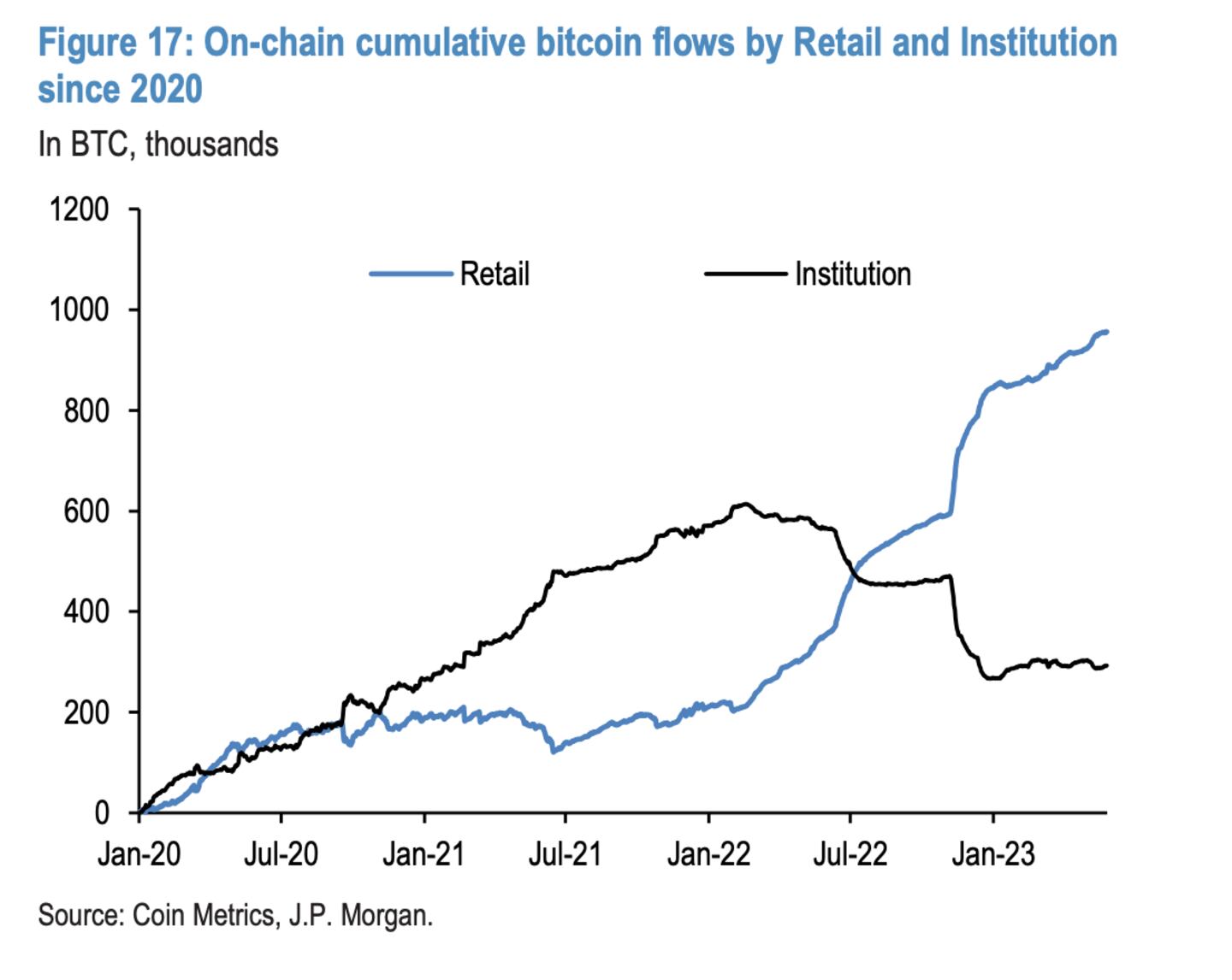

Bitcoin might be a gold-like play in the eyes of retail investors, but sophisticated traders have been decreasing their holdings over the past two years.

JPMorgan took wallets holding less than 10 BTC as a proxy for retail investors, and those with more than 10 BTC as a proxy for institutional investors –– which includes family offices and wealthy individuals, asset managers, crypto exchanges, Bitcoin miners, funds, ETFs, and early Bitcoin investors.

Retail traders have increased holdings this year, while institutional holdings have steadily declined.

“In fact, the institutional impulse has been declining since 2022,” JPMorgan said last week.

“Retail investors’ demand for bitcoin is likely to strengthen as we approach the April 2024 halving event,” JPMorgan said. The bank expects Bitcoin to trade in a range of $40,000 to $45,000 leading up to this.

Moya said that Bitcoin will likely trade between $30,000 and $40,000, “if the regulatory environment doesn’t kill crypto,” in the meantime.