- Binance has lost yet another executive as institutional account manager Marcus Bacchi-Howard left the firm.

- The crypto exchange has seen a slew of executives leave amid regulatory scrutiny and a reported criminal investigation by the DOJ.

- Reports on Monday said the DOJ is seeking over $4 billion from Binance to settle charges.

The steady flow of executive exits at Binance shows no signs of slowing down amid ongoing uncertainty at the world’s largest crypto exchange by volume.

A slew of executives have left Binance in recent months. Marcus Bacchi-Howard, who worked as an institutional client account manager at the exchange, is the latest to depart, according to a source with knowledge of the matter.

Bacchi-Howard’s LinkedIn profile also shows he has left Binance as of November 2023.

The former executive spent a decade at Morgan Stanley and then worked as a derivatives trader before joining Binance in May 2022.

Bacchi-Howard joins other exits such as chief strategy officer Patrick Hillmann, global product lead Mayur Kamat, senior director of investigations Matthew Price and senior vice president for compliance Steven Christie in leaving Binance.

Meanwhile, Binance’s US entity lost its CEO, Brian Shroder, in September, as well as its chief risk officer and head of legal.

Binance co-founder and CEO Changpeng Zhao said Shroder was leaving to take a “deserved break,” but the exchange has come under pressure since two US regulators opened investigations into the firm.

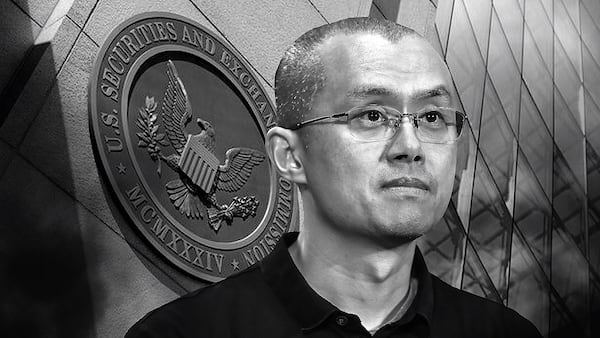

The Commodity Futures Trading Commission and the US Securities and Exchange Commission filed lawsuits against Binance earlier this year, while the US Department of Justice has reportedly been investigating the exchange over the past year.

Bloomberg reported on Monday that the DOJ is seeking over $4 billion from Binance in order to drop the criminal case against the exchange.

Zhao could still face charges in the US, however, to resolve the investigation into money laundering, wire fraud and sanctions violations, sources close to the matter told Bloomberg.

Binance did not immediately respond to a request for comment from DL News.

Adam Morgan McCarthy is a Markets Correspondent at DL News. Got a tip about Binance? Reach out to adam@dlnews.com.