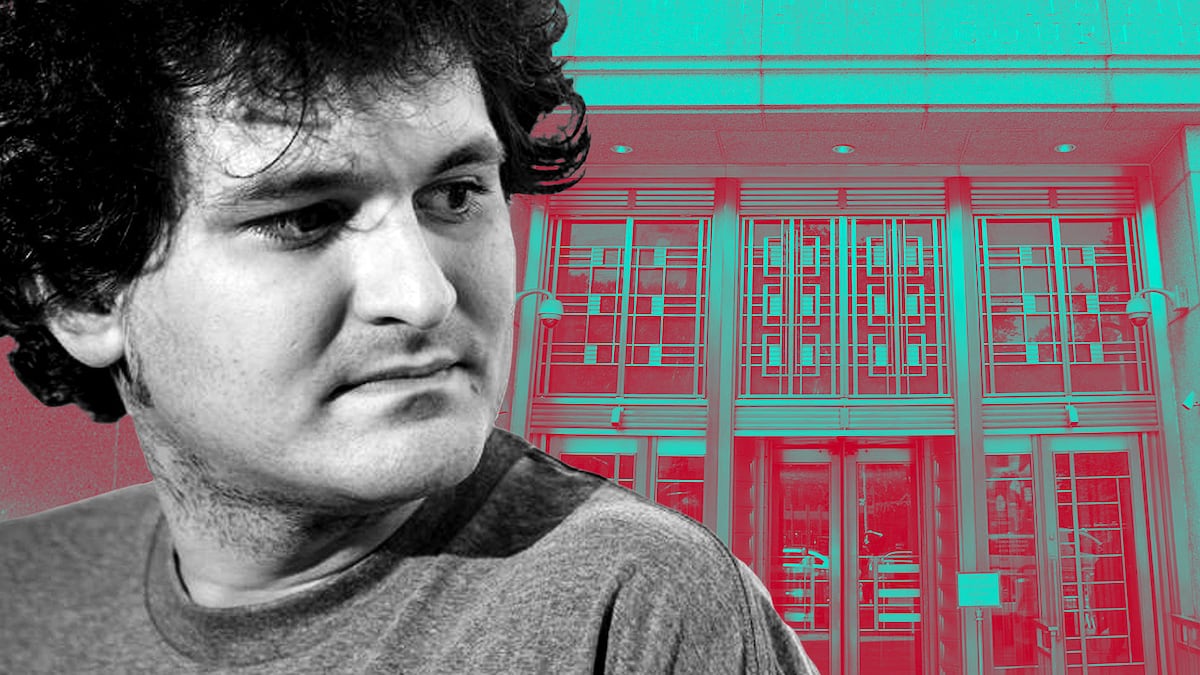

- Sam Bankman-Fried testified in front of jurors Friday after appearing solely before the judge on Thursday.

- He disputed testimony from his former co-workers, who said they committed fraud at his behest. According to Bankman-Fried, it was a series of mistakes they made that caused the collapse of FTX and Alameda Research.

- Prosecutors are expected to begin their cross-examination of Bankman-Fried on Monday morning.

Sam Bankman-Fried’s hail mary in front of the 12 jurors who will decide his fate began in earnest Friday morning with a sort of mea culpa.

When he founded FTX in 2019, he set out to “move the [crypto] ecosystem forward,” Bankman-Fried told jurors. “It turned out basically the opposite of that. A lot of people got hurt.”

But it wasn’t his fault, he maintained.

Over almost six hours in a packed courtroom with views of the Brooklyn Bridge and One World Trade Center, Bankman-Fried suggested his friends and former business partners were to blame for the collapse of FTX and sister company Alameda Research.

Caroline Ellison, Alameda’s CEO (and Bankman-Fried’s on-again, off-again girlfriend), had ignored his repeated order to hedge bets the crypto trading firm had made, Bankman-Fried said.

Meanwhile, changes to FTX software made by Gary Wang and Nishad Singh, the company’s top software developers, allowed Alameda to go into debt by borrowing billions of dollars from FTX customers, money Alameda used to plug a massive hole in its balance sheet.

It all amounted to a bold request from Bankman-Fried: trust me, not them.

Over the past three weeks, Ellison, Wang, and Singh, each of whom is cooperating with prosecutors, said they had committed fraud at Bankman-Fried’s behest.

Bankman-Fried and his attorneys had previewed this line of defence in comments made immediately after the fall of FTX, the trial’s opening statements, and during cross-examination of the government’s witnesses.

Bankman-Fried, 31, has pleaded innocent to the seven charges levelled against him, including conspiracy to commit fraud and money laundering. If convicted on all counts, he could face decades in prison.

It’s rare for criminal defendants to take the stand because prosecutors can expose discrepancies in their past statements and solicit damaging admissions.

Bankman-Fried is hoping to persuade the 12-member jury to reject the testimony of his former colleagues and roommates, which painted him as a manipulative mogul who orchestrated widespread fraud at FTX and Alameda.

To hedge, or not to hedge?

Under US law, Alameda, which was controlled by Bankman-Fried, should have operated at arm’s length from FTX to ensure that customer deposits at the exchange were not misused to cover losses at Alameda.

Yet that is precisely what happened, Ellison told the court in mid-October.

She testified that Bankman-Fried directed her to secretly funnel customer deposits from FTX into Alameda to cover billions of dollars in losses as the crypto market cratered in the summer of 2022.

In tearful testimony, Ellison said Bankman-Fried asked her to prepare numerous false balance sheets to conceal Alameda’s deteriorating financial condition from creditors.

“I didn’t want to be dishonest, but I also didn’t want them to know the truth,” Ellison told the jury.

When presented on Friday with the balance sheets in question, Bankman-Fried said he had only discussed one version with Ellison.

He also suggested it was her recklessness that resulted in Alameda’s multibillion-dollar losses.

On Ellison’s watch, Alameda had made a big bet on the crypto economy’s continued growth, Bankman-Fried said.

In late 2021, he urged her to hedge that bet, to limit the company’s losses in the event investors soured on crypto, but she never did, Bankman-Fried said.

The engineers

Bankman-Fried also attempted to rebut damaging accounts from Wang, FTX’s co-founder and chief technology officer, and Singh, its head of engineering.

At the outset of the trial, Wang testified that Alameda enjoyed a staggering $65 billion line of credit on the exchange. The testimony underscored the prosecution’s contention that Bankman-Fried used FTX as a piggy bank for Alameda, which constituted fraud.

“We allowed Alameda to withdraw unlimited funds,” Wang, a former roommate of Bankman-Fried at MIT, told the court. He also pleaded guilty last December to multiple counts of fraud and conspiracy.

Bankman-Fried suggested Friday that Wang had made that unlimited borrowing possible without his knowledge.

Singh, meanwhile, testified that much of Alameda’s deficit was the result of Bankman-Fried’s spending habits and desire to rub shoulders with the rich and famous. He said Bankman-Fried’s spending on venture investments, sponsorship deals, and political donations were ill-advised and “reeked of excess.”

On Friday, Bankman-Fried said those purchases and investments were made in good faith and that he believed they came from company money, rather than FTX customer funds.

He also denied that he had ordered Singh and another company executive, Ryan Salame, to donate to politicians, or that he had ordered Singh to doctor certain financial records in order to inflate FTX’s profits.

What’s next

Bankman-Fried’s direct examination will likely end Monday morning, according to his attorney, Mark Cohen.

At that point, he will be questioned by the prosecution. Courthouse observers were given a preview of his cross-examination on Thursday, when he testified without jurors present.

Judge Lewis Kaplan had sent jurors home Thursday so he could hear part of Bankman-Fried’s planned testimony before deciding whether it was appropriate for the jury to hear.

For the most part, it was not, Kaplan said Friday morning.

That testimony had focused on advice Bankman-Fried had been given by FTX’s attorneys, withBankman-Fried saying his key decisions had all been greenlit by the company’s lawyers.

Allowing Bankman-Fried to say that in front of jurors “would, in my judgement, be confusing and highly prejudicial,” Kaplan said Friday, “by implying that lawyers, with full knowledge of the facts, blessed what the defendant is alleged to have done.”

Jurors will hear closing arguments once the prosecution has finished its cross-examination and rebuttal, which is when the prosecution gets to address points that were made by the defence and has another opportunity to call witnesses.

Aleks Gilbert is DL News’ New York-based DeFi Correspondent. Reach out to him with tips at aleks@dlnews.com.