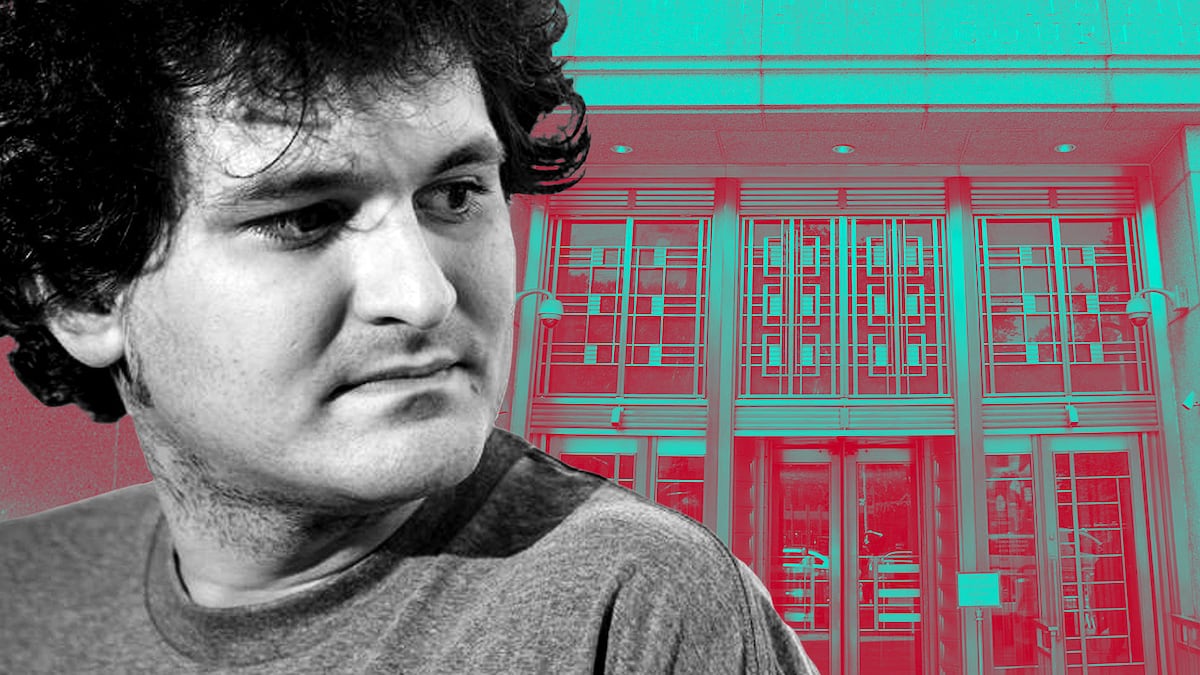

- Jury selection is scheduled to begin Tuesday in Sam Bankman-Fried's trial in federal court in New York.

- Bitcoin volume has cratered in the last year, hitting five year lows.

- Before the fall of FTX, Bankman-Fried vowed to plough riches into health care and managing artificial intelligence.

And so it begins…

Tomorrow morning, US marshals will transport Sam Bankman-Fried from a jail in Brooklyn to the Daniel Patrick Moynihan United States Courthouse in Lower Manhattan.

The immediate agenda entails selecting jurors to sit in judgement of the onetime crypto billionaire, charged with multiple counts of fraud, money laundering, and campaign finance offences in connection with the failure of the exchange FTX last November.

A byword for lawlessness

Yet over the course of the trial, which is expected to last about six weeks, crypto itself may be in the dock along with Bankman-Fried, who has pleaded not guilty.

Worth $32 billion at its peak, FTX has become a byword for the lawlessness associated with the digital assets market. And with his slob chic vibe and commitment to “effective altruism,” the 31-year-old entrepreneur has come to epitomise crypto for many in the mainstream.

‘He wanted to build a machine – a growing sphere of influence… and wash over the world as a force for good.’

— Aditya Baradwaj

“He didn’t just want to build a company,” said Aditya Baradwaj, a tech engineer at Alameda Research, the hedge fund Bankman-Fried managed in concert with FTX, in a recent post. “He wanted to build a machine – a growing sphere of influence… and wash over the world as a force for good.”

Yet by shifting billions of dollars worth of FTX deposits to cover losses in his hedge fund, prosecutors say Bankman-Fried violated one of the bedrock laws in finance — never tap customer deposits to juice your own trading book.

Suspicions confirmed

Prosecutors are expected to try and prove that is exactly what he did, bolstered by testimony from several of Bankman-Fried’s former associates, including his ex-girlfriend Caroline Ellison.

The case has confirmed the suspicions of crypto critics that the sector is rife with Ponzi schemes and thievery, and emboldened watchdogs such as Gary Gensler, the chair of the US Securities and Exchange Commission, to crack down with a flurry of civil actions.

And while Bitcoin has rallied 60% since FTX filed for bankruptcy last November 11, its trading volume has nosedived — in August, it dropped to a five-year low. The days when BTC attracted mainstream investors appear to be over, at least for now.

Decentralised finance hasn’t been spared from the market malaise. According to DefiLlama data, the deposits, or total value locked, of the sector is still about a quarter less than before FTX’s downfall, at $38.7 billion.

Charmed celebrities

If Bankman-Fried did nothing else, he appears to have proven yet again that if something seems to be too good to be true, it probably is. Which is unfortunate given the amount of doing good that Bankman-Fried vowed to do.

In 2022, Bankman-Fried was running his FTX-Alameda empire from a $30 million penthouse in the Bahamas. He surrounded himself with colleagues who shared the luxe work-living space in the tropics.

Bankman-Fried charmed celebrities such as superstar quarterback Tom Brady and his former wife, supermodel Gisele Bundchen, who were energetic — and well compensated — spokespersons for FTX. And he landed Michael Lewis, the best-selling author of The Big Short and Moneyball, as his biographer.

Lewis, who is releasing his book on Bankman-Fried and FTX this week, told the BBC on Monday that he watched in amazement as the “most famous people in the world” would gather around the rumpled entrepreneur when he spoke. The young tycoon became known simply by his initials — SBF.

‘Quite utopian’

For Bankman-Fried, a maths whiz who graduated from MIT, cryptocurrencies were merely a springboard to amassing enough wealth to address epochal challenges such as pandemics and artificial intelligence. His chosen vehicle: “effective altruism,” or EA, a philosophical and social movement designed to maximise impact for the common good.

At FTX’s zenith, academics and intellectuals flew into the Bahamas to brainstorm with Bankman-Fried and his compatriots. DL News spoke to several individuals who were privy to these discussions.

“The crowd was quite utopian,” said one, adding that Bankman-Fried and his friends planned to fund projects in “genetic stuff as well as massively transformative AI.”

The interest in genetics, said the person, boiled down to a willingness to use gene editing to increase would-be parents’ odds of having kids who are happy, healthy, and smart.

“It could also extend to cows that don’t get sad, so you can have guilt-free meat,” said the person, who asked for anonymity as a condition of talking about dealings with Bankman-Fried.

The interest did not translate into action, however. “I think they probably wouldn’t have thought it was worth their time or money to actually do much on it,” the person said of the people who met with Bankman-Fried.

Vaccine factory

The Future Fund, as FTX’s philanthropic arm was known, committed $100 million to endeavours in pandemic prevention, addressing the risks of AI, and other futuristic projects.

And Bankman-Fried talked about building a “vaccine factory” in the Bahamas to address what he deemed an overly slow approval process by the US Food and Drug Administration, Baradwaj said in his post.

These projects were designed to safeguard humanity’s long-term future and were in keeping with the thinking around EA.

Another person familiar with Bankman-Fried’s work lamented that his alleged misdeeds tarnished EA. “Much that SBF wanted was cool and good and noble,” said the person.

$100 million in political donations

In 2022, Bankman-Fried turned his gaze on Capitol Hill. Intent on shaping fledgling crypto legislation, he donated heavily to Democratic and Republican lawmakers.

But the money wasn’t his, prosecutors say. In August, the Justice Department accused him of using funds deposited by FTX customers to make $100 million in political campaign contributions in the run-up to the midterm elections in November.

“The defendant perpetuated his campaign finance scheme at least in part to improve his personal standing in Washington DC, increase FTX’s profile, and curry favour with candidates,” prosecutors said in an updated indictment that month.

Taking his place at the defendant’s table Tuesday, Bankman-Fried will be the latest in a long line of bold-faced names who’ve faced justice in the federal court on Foley Square in downtown Manhattan.

Bernie Madoff, Ghislaine Maxwell, and Martha Stewart each passed through here on their way to guilty pleas or jury verdicts. Chances are the media spotlight will be just as hot when Bankman-Fried takes his turn.

As he does so, Bankman-Fried, who has been incarcerated for the last two months after violating the terms of his bail, faces the possibility he may not live outside the walls of penal institutions for decades.

If convicted, he faces a prison sentence of 20 years on each of the main counts in his indictment.

London-based writer Tom Ough has published work in The Prospect, the BBC, and The Independent. Edward Robinson is the story editor at DL News. Have a tip? Email the author at ed@dlnews.com.