- Crypto companies are recruiting for thousands of roles.

- But recruiters say they're increasingly tapping traditional finance for talent.

A version of this article appeared in our The Roundup newsletter on October 3. Sign up here.

Happy Friday! Eric here.

There’s a lot of buzz around traditional finance candidates in crypto right now.

That’s pretty much the upshot of the conversations I’ve been having over the past week when talking with people about the crypto industry’s latest hiring spree.

Not only are the top crypto companies in the world advertising to fill thousands of roles, but they’re increasingly looking for candidates that can navigate both the cryptosphere and that of traditional finance.

“People are increasingly looking for people with TradFi experience,” Sam Wellalage, a crypto industry recruiter at recruitment agency WorkInCrypto.Global, told me.

There has been no shortage of high-profile cases where people from financial firms have switched to roles at crypto ventures.

In September alone, PayPal’s Head of Capital Markets, David Knox, joined digital-asset treasury company Hyperion DeFi, and Stripe’s crypto head joined blockchain developer Polygon Labs.

The timing of these moves makes sense.

While Satoshi Nakamoto invented Bitcoin as a way to escape the financial system that caused the 2008 crisis, industry innovators increasingly find themselves joining forces with traditional finance.

Donald Trump’s second presidency is fuelling this shift.

The US president has spent his first nine months in office rolling out executive orders, signing laws, and appointing industry-supporters to key government positions.

This has given Wall Street institutions the green light to tap into crypto, either by launching services of their own or inking partnerships with the innovators in this space.

It has also opened the playing field for companies like US crypto exchange Coinbase, whose CEO Brian Armstrong has made no secret of his plans to replace banks as his customers’ primary financial account.

“What it really means is that TradFi and crypto are going to be [walking] hand in hand,” Wellalage said.

Apart from traditional finance experience, crypto companies also tell me that they’re looking for candidates from other industries that can help them tap into new technologies like artificial intelligence.

“Above all, we want exceptional individuals who raise our bar and embody our culture tenets,” Greg Garrison, VP of talent at Coinbase, told me.

So what about anonymous degens?

Since the cypherpunk origins of the industry, developers who value privacy and pseudonymity have driven crypto innovation.

Yet, as the industry is becoming more regulated, those innovators may find themselves cut out of some positions — at least if they’re unwilling to share their real identities with recruiters, Wellalage said.

The reason? The fear of cybercriminals using crypto job boards to infiltrate the industry.

“While pseudonyms can be maintained online, becoming an employee requires identity verification to meet our security standards and ensure we can build together effectively,” Garrison said.

Spokespeople at rival exchanges Binance and KuCoin echoed that sentiment to me.

Why Tether’s CEO says new US stablecoin will hit $1tn by 2030

Paolo Ardoino says it will take less than five years for Tether’s new stablecoin, USAT, to be worth $1 trillion, Liam Kelly reports.

Robinhood CEO: Here’s when the tokenisation ‘freight train’ will shake up the $115tn stock market

Vlad Tenev, CEO of Robinhood, made no secret about his ambitions to transform traditional finance with the power of tokenisation during a Token2049 talk this week.

Ripple CTO David Schwartz to step down amid crypto payments competition

David Schwartz, Ripple’s chief technology officer, announced on Tuesday that he will step down from his executive role at the firm at the end of the year, Tim Craig reports.

Post of the Week

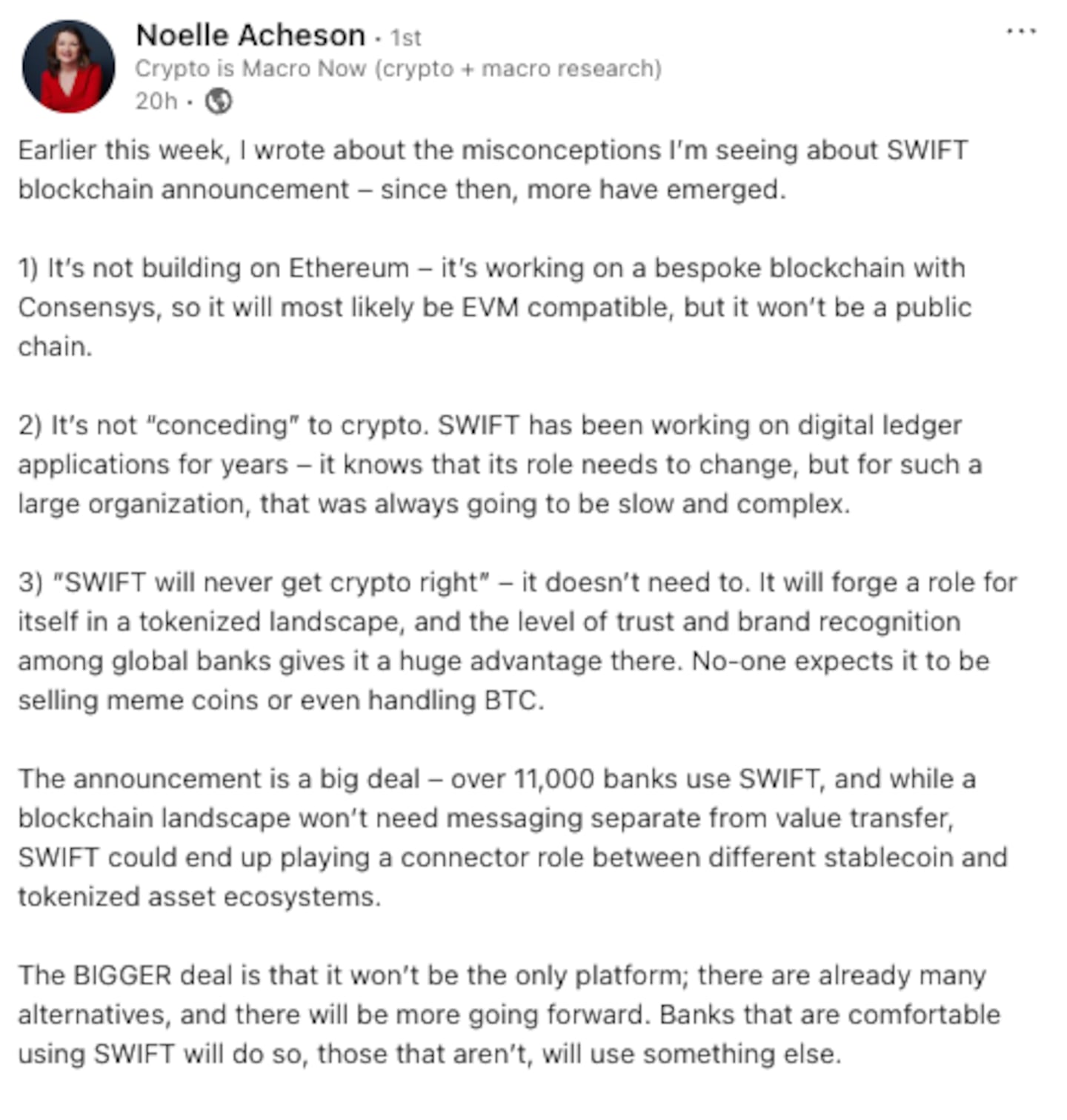

This week, Javier Pérez-Tasso, CEO of SWIFT, the organisation that provides the payment rails for banks and other financial institutions, announced that the company is working on evolving its business model with blockchain. Noelle Acheson, a renowned crypto analyst, made it clear why this was a big deal.