- Wise is advertising for a digital asset product lead.

- The firm has declined to use blockchain technology in the past.

- Successful candidates can earn up to $194,600.

Wise is finally entering the crypto race.

The $9.7 billion fintech is advertising for a digital asset crypto lead to spearhead the payments company’s foray into blockchain.

“If you’ve built wallets and/or payments [solutions] based on stablecoins and you now want to do it at Wise apply through the ad or DM,” Matthew Sailsbury, product director at Wise, posted on LinkedIn.

Since its launch in 2011, the company has declined to tap into crypto, instead relying on traditional financial rails to transfer money between countries.

But as a slew of financial tech firms plough into the crypto space and scoop up industry talent, the about face is less striking.

‘Great on paper’

For years, Wise’s leadership has maintained that it won’t need blockchain technology to transfer money across borders.

Instead, it has relied on a network of local bank accounts to make international transfers worth $40 billion per quarter, according to the company.

Wise has hinted that it has looked into it in the past, but had found them wanting.

In 2018, co-founder Taave Hinrikus said that the company, which was previously known as TransferWise, hadn’t “found anything which enables us to do what we do in a way that is cheaper or faster.”

The problem?

Not enough banks were using the technology to make blockchain transfers more efficient than prevailing payments systems, he said.

The Trump effect

Fast-forward to 2025 and things have changed dramatically.

US President Donald Trump has fired off executive orders, tapped industry supporters for top government roles, and has signed the Genius Act into law.

The landmark stablecoin bill creates the ground rules for the issuing and running of stablecoins in the US.

The stablecoin market has exploded as a result. It topped a total market cap of $300 billion earlier in October.

And that’s just the beginning, according to market watchers.

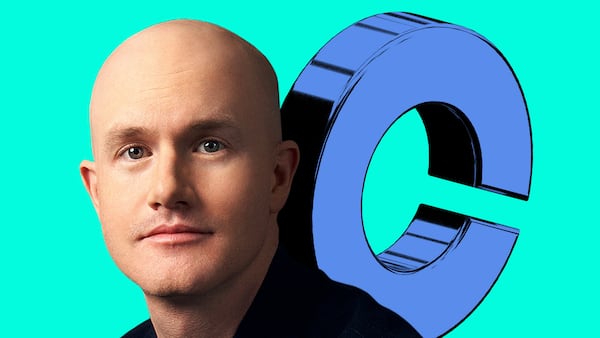

In August, crypto exchange Coinbase forecast that the market will reach $1.2 trillion by the end of 2028. Standard Chartered puts it at $2 trillion in the same period. And Citi expects it to clear the $4 trillion mark by 2030.

This has incentivised banks like Wells Fargo, Santander, and Société Générale as well as fintech firms like Stripe and Revolut to either launch or to reportedly explore the new technology.

Now it seems as if Wise will join them.

Digital assets product lead

The fintech firm now advertises for digital assets product lead to joining its London team.

A successful candidate can cash in an annual salary of up to £145,000, or $194,600, according to the ad.

“We want to find someone who can help us explore how customers can hold digital assets within their Wise account and provide the same seamless, convenient experience our customers love today for fiat currencies,” the ad said.

Wise declined to comment.

Eric Johansson is DL News’ managing editor. Got a tip? Email at eric@dlnews.com.