- Hoskinson railed against supporters of the latest market structure draft.

- The bill would delegate oversight of the industry between the CFTC and the SEC.

- In it's current form, however, it gives too much power to the SEC, said Hoskinson.

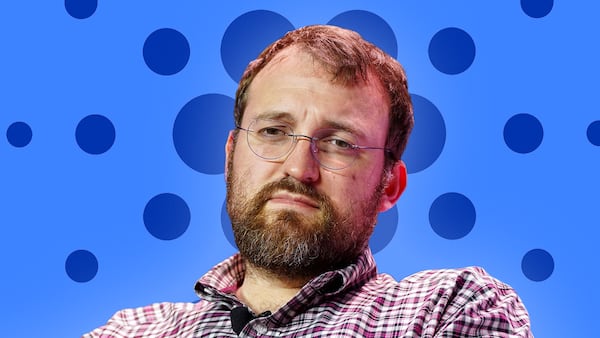

Charles Hoskinson slammed Ripple’s CEO on Monday after Brad Garlinghouse shared his support for a draft version of key crypto legislation.

Garlinghouse commended the US Senate Banking Committee’s version of the Clarity Act on January 14.

“Ripple and I know firsthand that clarity beats chaos, and this bill’s success is crypto’s success,” the Ripple executive said.

“I remain optimistic that issues can be resolved through the mark-up process.”

The Clarity Act would determine which financial regulator will oversee the crypto industry. It’s a crucial piece of legislation for furthering ties between the crypto industry and wider financial markets.

While long-overdue, this move by @SenatorTimScott and @BankingGOP on market structure is a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers. Ripple (and I) know firsthand that clarity beats chaos, and this bill’s success is… https://t.co/EWcml1NpBE

— Brad Garlinghouse (@bgarlinghouse) January 14, 2026

For some, such as Hoskinson, the bill doesn’t meet the mark.

“It hands the entire keys to the crypto kingdom to the Securities and Exchange Commission,” the Cardano founder said during a nearly 30-minute video posted on Sunday. “You have to go beg and plead to make them not a security.”

“And you still got people like Brad, saying, ‘Well, it’s not perfect, but we just got to get something. It’s better than no clarity,’” he said.

“Sorry Brad, it’s not better than chaos. Take the chaos and fight for what’s right!”

‘A bad bill’

Infighting among the crypto elite has erupted after several executives and industry groups backed new legislation to regulate the industry.

The current draft states that cryptocurrencies would first fall under the Securities and Exchange Commission’s purview unless the team behind the cryptocurrency can prove the project is sufficiently decentralised.

Once they meet that bar, the Commodity Futures Trading Commission would become the regulator.

For some, including Coinbase CEO Brian Armstrong, that’s still far too much power for the SEC. He added to his list of complaints, a “de facto ban on tokenised equities” and “draft amendments that would kill rewards on stablecoins.”

“We’d rather have no bill than a bad bill,” the executive wrote. “Hopefully, we can get to a better draft.”

The Senate has since delayed its vote on moving the bill to a markup, a phase in the US legislative process through which politicians can make further adjustments to a bill’s language.

“I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith,” Senate Banking Committee Chair Tim Scott said on January 14, when announcing the delay.

Liam Kelly is DL News’ Berlin-based DeFi correspondent. Have a tip? Get in touch at liam@dlnews.com.