- New digital assets subcomittee mixes together DeFi and TradFi representatives to stoke dialogue on regulation.

- Approach contrasts with Gary Gensler and SEC, which have virtually no dialogue with crypto leaders.

- Rebecca Rettig of Polygon says panel devoted to bringing ‘safety and soundness’ to sector.

The Commodity Futures Trading Commission just offered the crypto industry a rare bit of good news — it’s taking soundings from influential ventures such as Polygon Labs and Uniswap as it eyes new policies for the sector.

Even as the Securities and Exchange Commission has engaged in virtually no dialogue with the industry amid its crackdown, its sister markets regulator is signalling a willingness to work closely with providers of digital assets.

On June 30, the CFTC appointed the membership of a digital assets subcommittee that mixes DeFi folk and TradFi figures.

Guidance and proposals

The panel, backed by Commissioner Caroline Pham, is designed to provide guidance and proposals on various regulatory challenges for blockchain and crypto-related technologies and firms in the derivatives space.

Many industry participants have been expecting the CFTC to take a different tack than the SEC, so the new membership doesn’t come entirely as a surprise. But now that the panel has been named, the initiative can move into its next phase — shaping policy.

‘It signifies regulators’ commitment to bring safety and soundness to the crypto-asset sector on both domestic and global fronts.’

— Rebecca Rettig

Rebecca Rettig, chief legal and policy officer at Polygon Labs, said Pham’s approach is a refreshing change at a time of so much acrimony between the industry and the Biden Administration.

NOW READ: Polygon decries ‘back-end way’ to regulate smart contracts in EU legislation

“It signifies regulators’ commitment to bring safety and soundness to the crypto-asset sector on both domestic and global fronts,” Rettig said in an email to DL News.

Rettig is joined by 35 more representatives from TradFi giants such as BlackRock, Nasdaq and JP Morgan, as well as crypto industry representatives from Crypto.com, Securrency, as well as Uniswap’s chief legal officer Marvin Ammori.

Multi-trillion dollar opportunity

The digital assets subcommittee falls under the CFTC’s Global Markets Advisory Committee, which is one of five groups that advise the commission.

“We also hope that the GMAC initiative, combined with legislation from Capitol Hill, will lead to a more clear and expanded role for the CFTC in the digital assets space,” said Nadine Chakar, CEO of blockchain compliance provider Securrency and fellow subcommittee member.

NOW READ: The ‘CryptoQueen’ is said to be dead but $4bn OneCoin fraud case springs back to life

She is confident that “the recommendations put forward to the GMAC will help to activate the multi-trillion dollar opportunity that lies ahead of us, while enhancing the competitiveness of US firms and markets on the global stage.”

The European Union is well ahead of the US when it comes to regulating blockchain technology and the crypto markets. The bloc is beginning to roll out its comprehensive set of laws for crypto markets.

It is also undertaking an ambitious blockchain infrastructure development project.

Closer alignment

“From a European perspective we welcome any initiatives that can bring our industry in closer alignment across borders,” Erwin Voloder, the head of policy at the European Blockchain Association, told DL News.

He is optimistic that the CFTC’s move is “a real chance to make good on some action items that US counterparts in the sector have been calling for.”

Whether it’s a real game-changer for US crypto regulation is “hard to say for sure as things are still very fluid,” he said, highlighting that time will tell whether it signals a shift in power dynamics over crypto markets.

NOW READ: Crypto lobbyists hope Maxine Waters is wavering on Gensler’s crackdown

While they tend to deny it, the SEC and CFTC are engaged in a notorious turf war for crypto. SEC chair Gary Gensler has made it clear that he considers most assets besides Bitcoin to fall under his aegis, while CFTC chair Rostin Behnam has laid claim to some of those same tokens.

The crypto industry has tended to regard the CFTC as the softer touch of the two agencies. Before the failure of FTX, Sam Bankman-Fried lobbied for the CFTC to oversee crypto.

Less strict watchdog

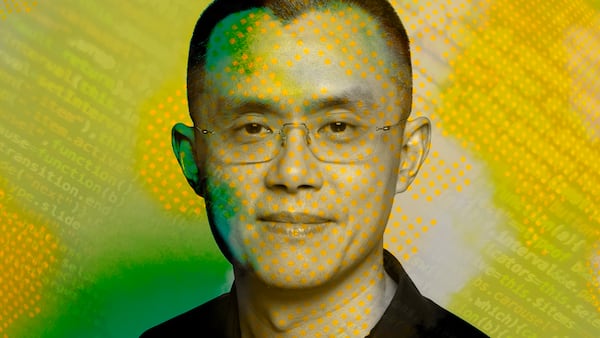

Behnam, however, has denied that the CFTC would be less strict a watchdog. And it hasn’t shied away from hammering crypto firms. It filed a hefty complaint against Binance and its chief Chanpeng “CZ” Zhao in March.

Other observers are concerned that the CFTC, which is a far smaller and less well-funded agency than the SEC, would not have the capacity to regulate crypto. While the SEC is funded from both the Treasury and fees, the CFTC makes very little in fees, and must rely on appropriations.

The CFTC’s $681.3 million budget is less than a quarter of the SEC’s $3 billion.

NOW READ: A 162-page bill would give the CFTC big chunks of US crypto markets. Here’s what else is in it

Commissioner Pham is a market structure expert who prior to her role at the CFTC advised global standards-setters and central banks. She spent almost eight years at Citibank as a managing director.

For decades, successive chairs of the CFTC have complained that it is underfunded for the mandate it currently has, let alone for a new asset class.

When it comes to crypto, the CFTC has authority over crypto derivatives, though only limited enforcement power when it comes to spot markets.

New bill

But that could change, if a new bill being discussed this month gets traction. The draft law, the result of an unusual cooperation between Republicans on two different committees in the House of Representatives, would hand spot markets to the CFTC.

The draft is just that — a draft, meant to start discussion among lawmakers. But its cosponsor, House Financial Services Committee chair Patrick McHenry, has said he plans to put it before the committee for debate later this month.

Have a tip about crypto regulation? Contact the authors at inbar@dlnews.com and joanna@dlnews.com.