- Almost 90% of the stablecoin is now held on Binance.

- Binance has aggressively promoted TUSD this year, but the stablecoin has faced scrutiny.

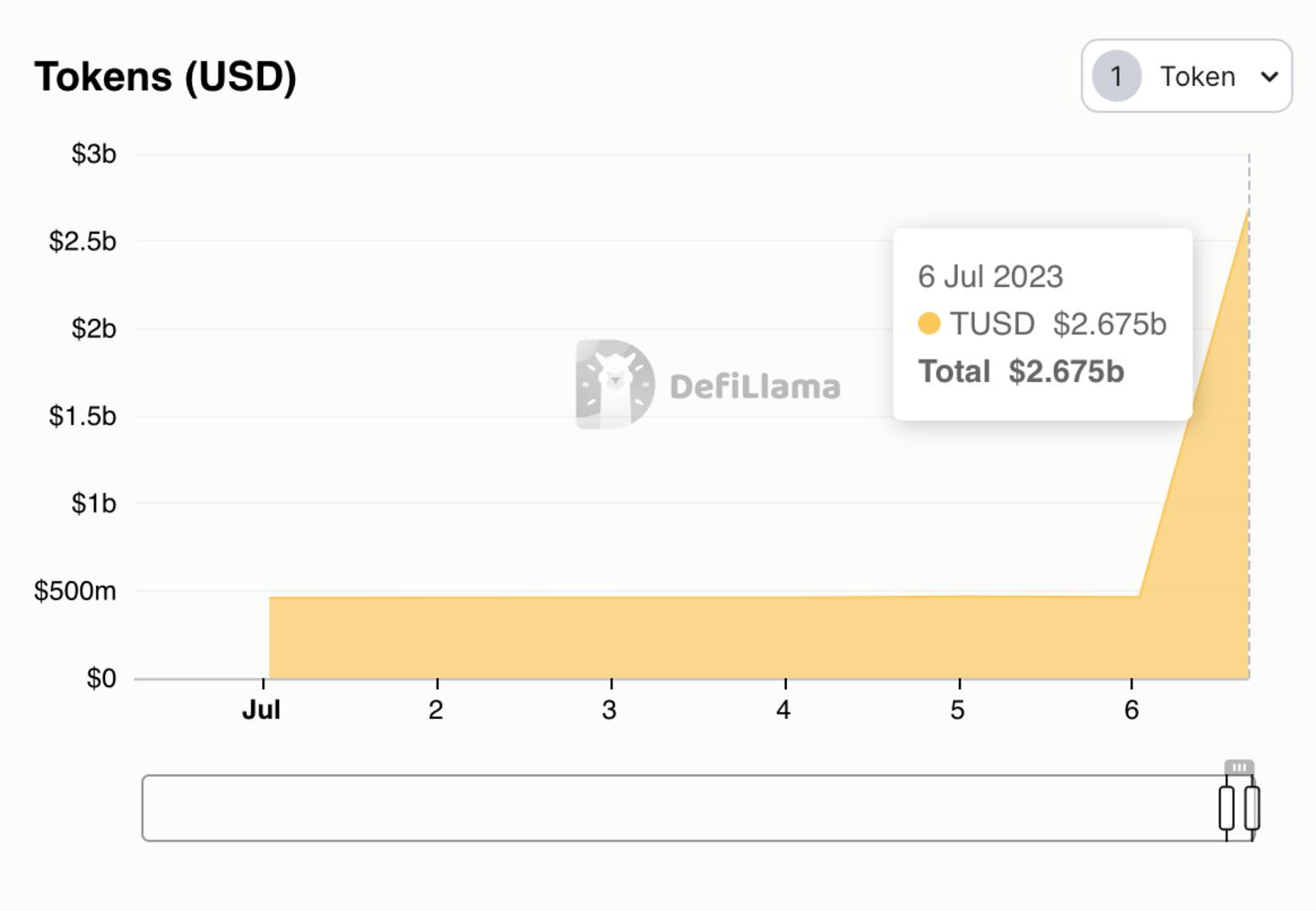

Binance holds almost 90% of TrueUSD after a recent spike that saw more than $2 billion of the dollar-pegged stablecoin move to the world’s largest crypto exchange.

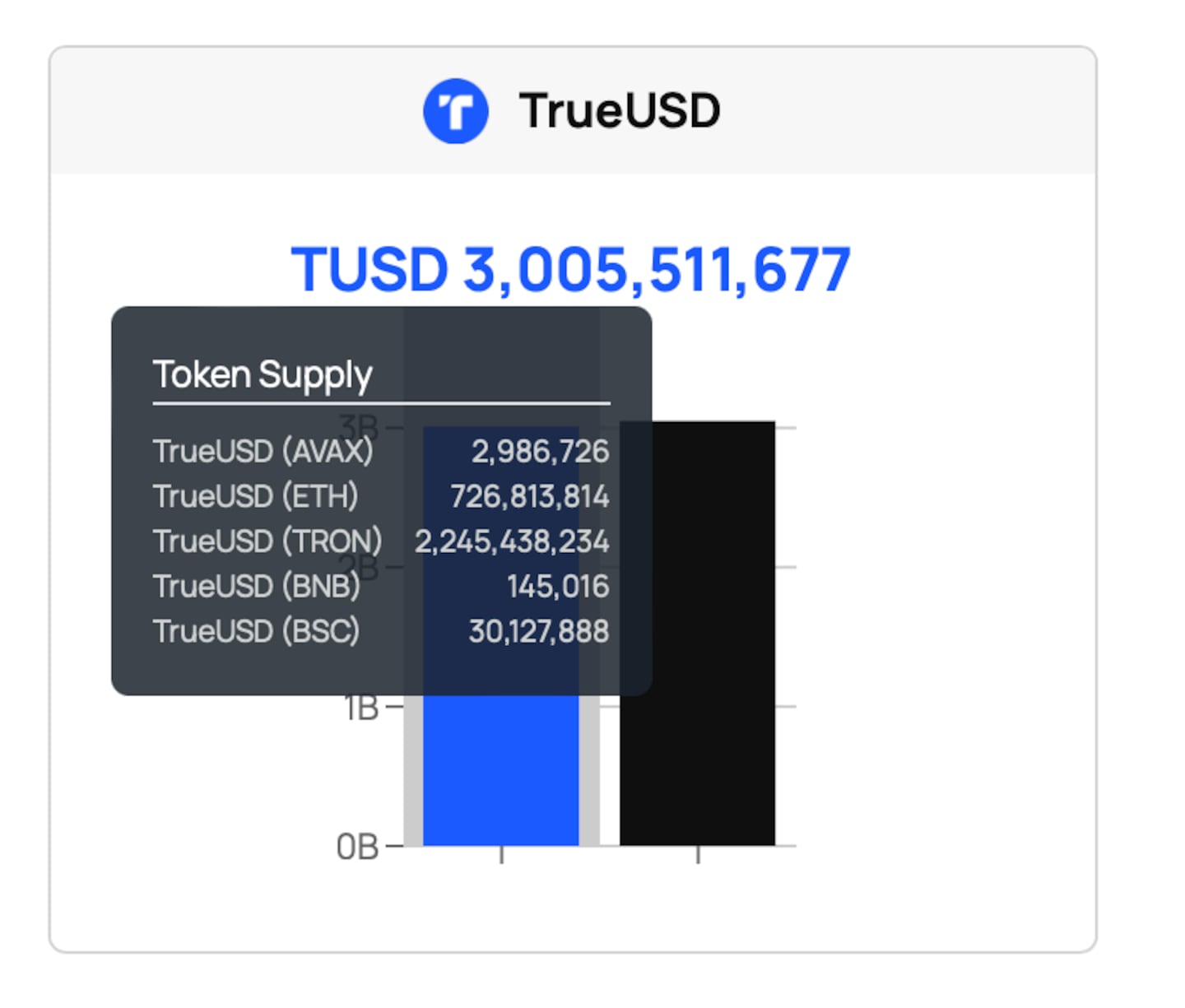

Dollar-pegged stablecoin TrueUSD’s circulating supply was just above $3 billion Thursday afternoon, according to the token’s website and crypto price tracker CoinGecko.

Binance holds almost $2.7 billion, according to DefiLlama data.

Binance’s TUSD holdings appears to have spiked on DeFiLlama today after the exchange shared an updated batch of addresses with the data tracker, DeFiLlama told DL News.

DeFiLlama said although the site live-tracks Binance’s holdings, the exchange regularly changes its addresses and periodically declares them. Binance may have added a new address holding TUSD a while ago, DeFiLlama said, but the site wouldn’t track it until today’s declaration from Binance.

A representative for Archblock, the San Francisco-headquartered firm that issues TrueUSD, did not immediately respond to DL News’ request for comment.

TrueUSD is the fifth largest stablecoin, and the only major dollar-pegged stablecoin to have grown in market capitalisation in 2023, due in part to its heavy promotion by Binance.

As of June 30, Binance does not charge maker fees on all TUSD spot and margin trading pairs.

NOW READ: Investors pull $4bn from Binance as regulators and rivals close in

As a result, TUSD’s trade volumes “are almost exclusively concentrated” on Binance, according to crypto research firm Kaiko.

Daily TUSD trade volumes on decentralised exchanges averaged about $2 million in the second quarter of 2023, the firm said in a research report published Monday, and about $2 billion on Binance.

Of the $3 billion TUSD in circulation, more than $2.2 billion are on the Tron blockchain. Another $700 million are on Ethereum.

It’s unclear clear why Binance has recently become the largest holder of TUSD — especially at a time when the stablecoin has faced scrutiny due to its association with Nevada-based crypto custodian Prime Trust. The recent collapse of Prime Trust set off concerns regarding TUSD’s backing.

NOW READ: BlackRock’s aim to make crypto cheaper should scare Coinbase

Earlier this year, hundreds of millions of dollars of TUSD collateral was deposited with Prime Trust. Last week, Nevada’s financial watchdog said the company was insolvent, with a shortfall of roughly $80 million and AUDIO, the governance token of NFT music platform Audius, accounting for most of its remaining assets.

Prime Trust holds almost one-third of the AUDIO in circulation, meaning any fire sale would move the token’s price and likely net it less than the $60 million it is worth today.

But TUSD auditors claim only $26,000 in TUSD collateral was trapped at Prime Trust at the time of its collapse, according to a report available on TUSD’s website. Prime Trust has said users can still deposit dollars and mint TUSD via the company’s other banking partners.

Binance did not immediately respond to a request for comment.

Update, July 7: The overnight spike on the DeFiLlama data was clarified as related to Binance’s communication of new addresses with the data tracker.