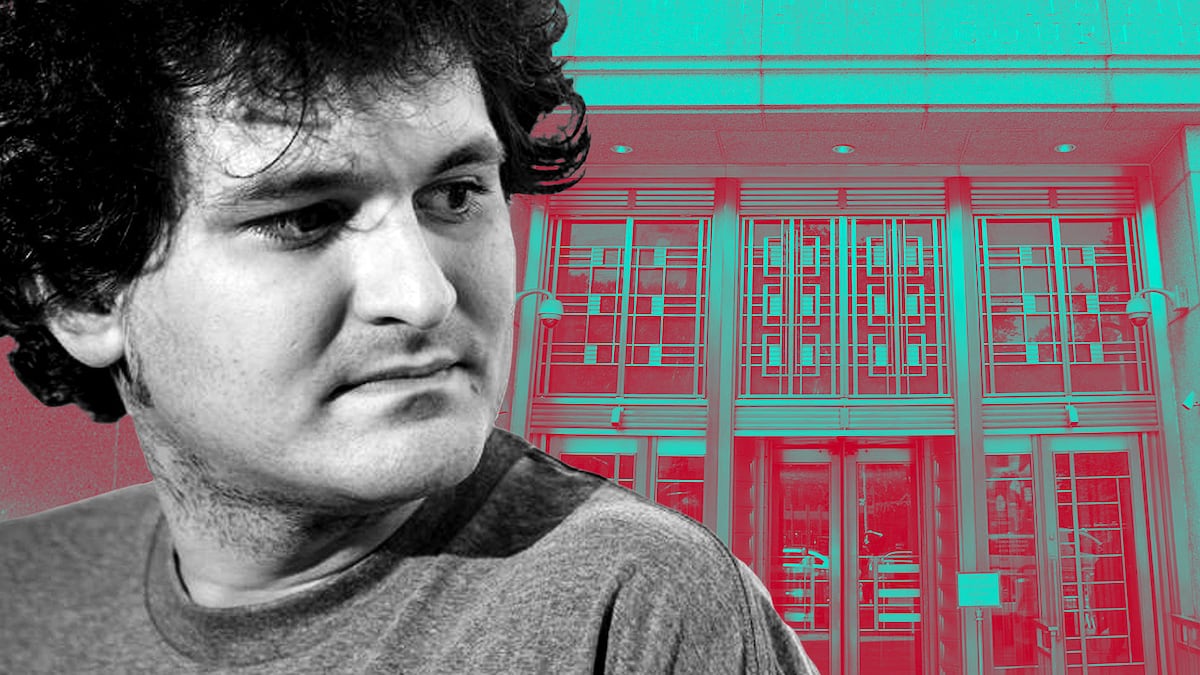

- In his opening statement Wednesday, Sam Bankman-Fried’s attorney said his client was an overwhelmed CEO who made honest mistakes.

- But the “dumb defendant defence” rarely works, according to one attorney.

Sam Bankman-Fried isn’t a fraudster, but a businessman who made catastrophic mistakes amid an industry-wide meltdown, his defence attorneys said in their opening statement Wednesday.

But it’s a Hail-Mary defence with only slim chances of success, according to one attorney following the case.

“The dumb defendant defence — like he’s too dumb to commit this crime — works only very, very rarely,” Carl Volz, a Chicago-based securities attorney who has defended crypto clients, told DL News.

The trial of FTX’s disgraced co-founder is expected to last several weeks, and opening statements from prosecutors and Bankman-Fried’s defence attorney gave observers a hint of the arguments to come.

The stakes are high. Bankman-Fried is facing seven charges and could spend the rest of his life in prison if found guilty on all of them.

In their opening statement, prosecutors said Bankman-Fried committed “fraud on a massive scale,” according to The New York Times.

“He was taking these customer deposits, and spending them for himself,” Thane Rehn, one of the prosecutors, said.

In their indictment, prosecutors accused Bankman-Fried of using those deposits to purchase luxury real estate in the Bahamas, donate to politicians and plug a multibillion-dollar hole at Alameda Research, the hedge fund he had founded prior to FTX.

Although he had named Caroline Ellison Alameda’s co-CEO (along with Sam Trabucco, who left the company prior to its implosion), Bankman-Fried called the shots, Rehn asserted.

Mark Cohen, Bankman-Fried’s attorney, countered by telling jurors his 31-year-old client was an overwhelmed CEO acting in “good faith.”

“You must consider what Sam did and said in real time,” Cohen said, The New York Times wrote. “He made business decisions that he thought were right when he made them.”

FTX and sister company Alameda Research, a hedge fund also founded by Bankman-Fried, were hammered by last year’s collapse in crypto prices, Cohen said.

To make matters worse, Alameda CEO Caroline Ellison failed to follow Bankman-Fried’s advice that she attempt to hedge Alameda’s positions in the event that crypto prices fell, Cohen said, according to reporting from Inner City Press.

“It’s not a crime to run a business in good faith that ends up going through a storm,” he said, according to The New York Times.

That defence is “the last harbour for someone who doesn’t have other avenues,” according to Volz.

The 12-member jury will decide whether Bankman-Fried is guilty on each of his seven charges. Part of the challenge facing Cohen is that a portrait of Bankman-Fried will emerge over the course of the trial — not of a dopey CEO, but a brilliant, imperious startup founder, Volz said.

“They’re going to show him on TV, they’re going to show him in front of Congress where he gives the impression that he thinks he’s the smartest guy around,” Volz said. “They’re going to say, he thought he was so smart, he thought he was so capable, but at the same time, he’s arguing he couldn’t manage this company.”

Got a tip on the Sam Bankman-Fried trial? Contact aleks@dlnews.com.