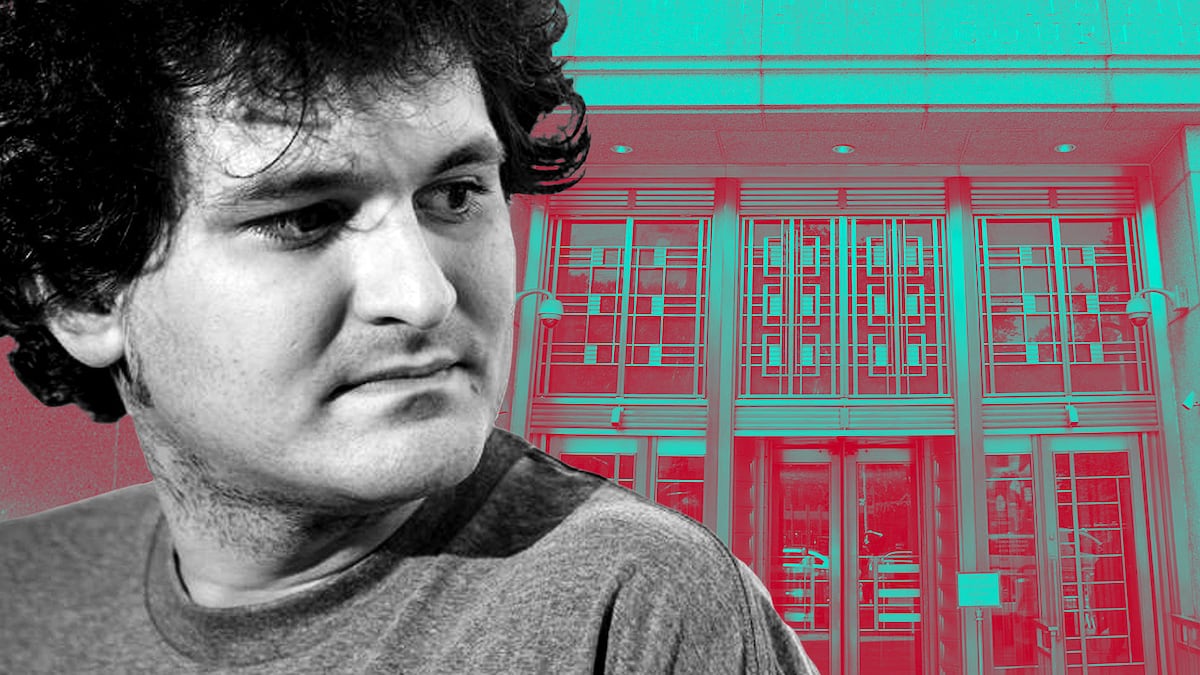

- Sam Bankman-Fried’s defence failed to do much damage in its cross-examination of former FTX head of engineering Nishad Singh.

- But his attorney did poke some holes in Singh’s characterization of himself and Bankman-Fried.

- The defence has yet to decide if it’s going to present a case of its own.

Sam Bankman Fried’s defence had mixed results Tuesday in its cross-examination of the government’s third and final star witness, former FTX executive Nishad Singh, who yesterday had testified that he had repeatedly clashed with Bankman-Fried over his companies’ lavish spending.

As he had last week during the cross examination of another Bankman-Fried confidante, defence attorney Mark Cohen jumped from one topic to another, began lines of questioning only to abandon them shortly thereafter, and tested the patience of famously surly judge Lewis Kaplan.

On more than one occasion, Kaplan rebuked Cohen for repeatedly asking Singh the same question, apparently unsatisfied with his answers.

Nevertheless, Cohen did manage to score some points, most notably during an exchange toward the end of Singh’s cross-examination that chipped away at Singh’s self-presentation as a do-gooder who tried to get Bankman-Fried to course-correct after learning of fraud at FTX.

As the day wound down, prosecutors said they expect to conclude their case against Bankman-Fried next week. Defence attorneys, meanwhile, have yet to decide whether to put on a case of their own, and potentially whether to call Bankman-Fried himself as a witness, which would be a huge gamble.

If they do put on a case, it wouldn’t last more than a week-and-a-half, Cohen said Tuesday afternoon.

Bankman-Fried has pleaded not guilty to seven charges, including fraud, conspiracy, and money laundering. If he’s found guilty of all seven, he could face a lifetime in prison.

Singh has pleaded guilty to six charges, but is cooperating with the prosecution in the hope of securing a lenient sentence. He faces a maximum sentence of 75 years in prison.

Singh’s testimony on Monday

On Monday, Singh recounted his tumultuous time at FTX.

A Berkeley-trained software engineer, Singh eventually became FTX’s head of engineering and a billionaire through his stake in the company — the third-largest, behind that of his boss, chief technology officer Gary Wang, and of Bankman-Fried himself.

Singh said he repeatedly fought with Bankman-Fried over his spending as head of FTX. Through FTX and sister company Alameda Research, Bankman-Fried spent lavishly, Singh said, investing in start-ups, sponsorship deals, and luxury real estate.

In September 2022, Singh learned Alameda owed FTX $13 billion and that FTX would be unable to honour withdrawals if users decided to pull their money en masse.

“I was blindsided and horrified,” Singh said Monday.

All of this was possible, Singh said, due to a line of code he had been instructed to write years earlier that allowed Alameda to borrow from FTX practically without limit.

Bankman-Fried’s plan to plug the hole included raising billions from outside investors and launching new, revenue-generating products, Singh said.

Nevertheless, Bankman-Fried’s companies continued to invest hundreds of millions in others, including a venture capital firm reportedly run by a former girlfriend.

The cross-examination

On Tuesday, Cohen tried to pick apart the image Singh had painted of Bankman-Fried as an unprincipled and free-spending founder.

Under questioning, Singh said that sponsorship deals could help grow FTX’s business and that some were warranted. He also said FTX employed marketing experts who would advise Bankman-Fried.

Singh also said that not all the company’s venture investments were bad; he himself wanted to invest in Anthropic, the AI firm that FTX invested $500 million in whose valuation has since surged.

Toward the end of the cross examination, Cohen was able to punch a hole in Singh’s presentation of himself as a business partner wracked with guilt.

In October 2022 — a month after he first learned of fraud at FTX — Singh bought a $4 million home on Orcas Island in Washington State.

Cohen, reviewing transcripts of Singh’s interviews with prosecutors, noted that Singh originally said he hadn’t felt guilty about buying the home, only to backtrack weeks later.

Buying the home was “egregious, unnecessary and selfish,” Singh admitted on the stand Tuesday.

In other moments, however, Cohen’s questioning faltered.

Cohen quickly changed topics after misstating Singh’s Monday testimony regarding financial documents Singh said he’d altered in 2021 at Bankman-Fried’s request.

At another point, Cohen asked Singh several times whether he would have been okay with Alameda’s borrowing had it been “offset by sufficient assets,” only to abandon it after Singh’s repeated denials.

Cohen’s persistence wore on Kaplan. On more than one occasion, the judge told Cohen that Singh had already answered his question and to move on.

Their most pointed exchange came early in the morning.

“I’m setting up the question, your honour,” Cohen told Kaplan, frustrated, after prosecutors objected to his line of questioning. “This is cross examination.”

Kaplan glared at the defence attorney.

“Mr. Cohen, I understand what’s happening in this courtroom,” he said after a tense pause.

Aleks Gilbert is DL News’ New York-based DeFi Correspondent. Got a tip about the SBF trial? Reach out to him at aleks@dlnews.com.