Purpose and scope of the report

This report examines how kpk structures and operates curated vaults, and what that implies for liquidity, risk controls, and governance under stress and real market conditions. Rather than treating curation as an abstract category, the report examines concrete design choices, including governance structure, permissioning, automation, and liquidity management, and situates kpk within the broader curation landscape.

While this report focuses on kpk’s Morpho vaults, kpk applies the same curation discipline across lending venues, including Gearbox.

The report is intended for multiple audiences:

- for DAO treasuries, institutions, and allocators, it serves as a diligence reference for understanding how kpk vaults are structured and governed.

- for technical readers and protocol teams, it provides a high-level overview of the architectural primitives and execution model underpinning kpk’s approach.

- for sophisticated DeFi users, it offers transparency into how risk and execution are handled onchain beyond headline yield.

At a high level, kpk’s vision is to make onchain asset management scalable, predictable, and auditable, without relying on bespoke mandates or continuous discretionary intervention. This reflects a broader shift toward standardising how capital is deployed and managed in DeFi, moving away from ad-hoc governance-driven execution and toward infrastructure where policy is expressed directly in code and enforced continuously.

The report is organised in a progressive way. It begins by describing the market context that has made curation increasingly central to DeFi. It then explains how kpk’s historical role as a treasury manager shaped its move toward infrastructure-led curation. The following sections dive into how kpk’s curation philosophy is implemented in practice, covering vault architecture, governance, automation, and risk management. The report then places kpk within the broader landscape of curators, before examining concrete case studies, risk trade-offs, and the longer-term roadmap.

Transparency and verification

The claims in this report are designed to be verifiable. The most useful starting points are:

- Live Dune dashboards covering allocations, utilisation, and performance across kpk vaults on Morpho and Gearbox.

- Vault documentation describing the curator model, risk limits, and governance roles for each vault.

- Onchain transactions and permissions, which show what actions agents can take, and when they acted.

- A public example of rebalancing cadence shared by kpk’s Head of Risk Curation.

Market context: why curation is becoming central

DeFi has matured, and with that maturity has come a new kind of complexity. Yield generation is no longer primarily about identifying opportunities. It is increasingly about operating within constraints, including a practical one that often dominates under stress: withdrawable liquidity. The latter means the share of vault assets that can be withdrawn immediately onchain, without waiting for borrower repayment or manual intervention. Protocol design has grown more sophisticated, risk parameters more granular, and governance processes slower and more political. At the same time, liquidity has become fragmented across chains, markets, and products. What was once manageable through direct interaction now requires continuous oversight.

Even in stable market conditions, managing capital onchain has become a specialised discipline. Decisions around asset selection, exposure limits, oracle design, liquidity buffers, and exit conditions are tightly coupled, such that adjusting one variable often affects several others. For larger pools of capital, this interdependence compounds quickly.

As institutions and large DAOs increased their onchain exposure, the bar rose further. Capital allocators began to prioritise auditability, predictable execution, and clear accountability alongside returns. This is also true for DeFi yield aggregators, which need predictable exits for end users and therefore value withdrawal liquidity, not just headline APY. Direct interaction with protocols ceased to be a tactical choice and became a job in itself, requiring dedicated teams, tooling, and operational processes.

In response, curation is emerging as a core layer of DeFi infrastructure. It provides structured access to onchain strategies while absorbing the operational complexity that no longer scales for individual actors.

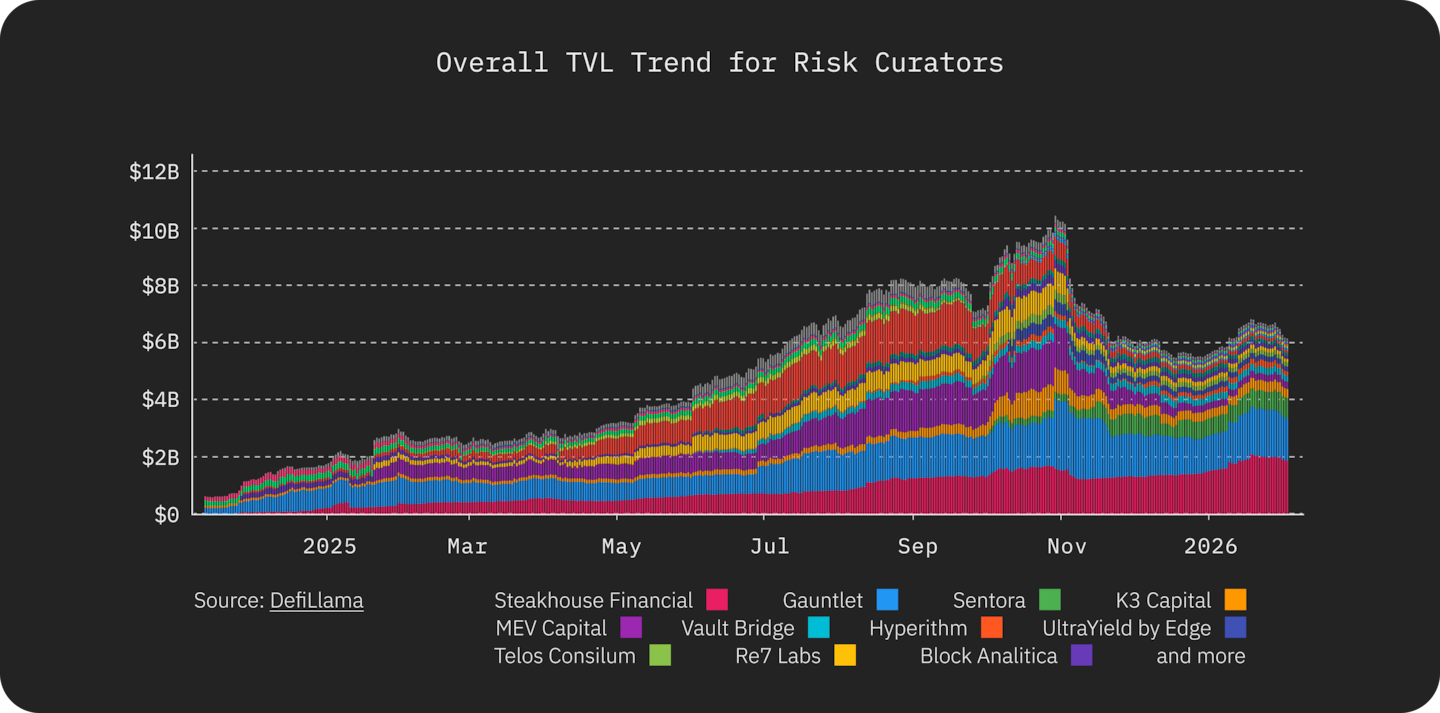

This evolution is already visible in market structure. In early 2025, approximately 31 entities were categorised as active risk curators, with only 7 exceeding $100 million in TVL. As of today, that number has grown to 43 curators, including 12 above $100 million in TVL. Over the same period, aggregate TVL across curated strategies expanded from roughly $2 billion, peaked near $10 billion in November 2025, and has since stabilised around $6 billion.

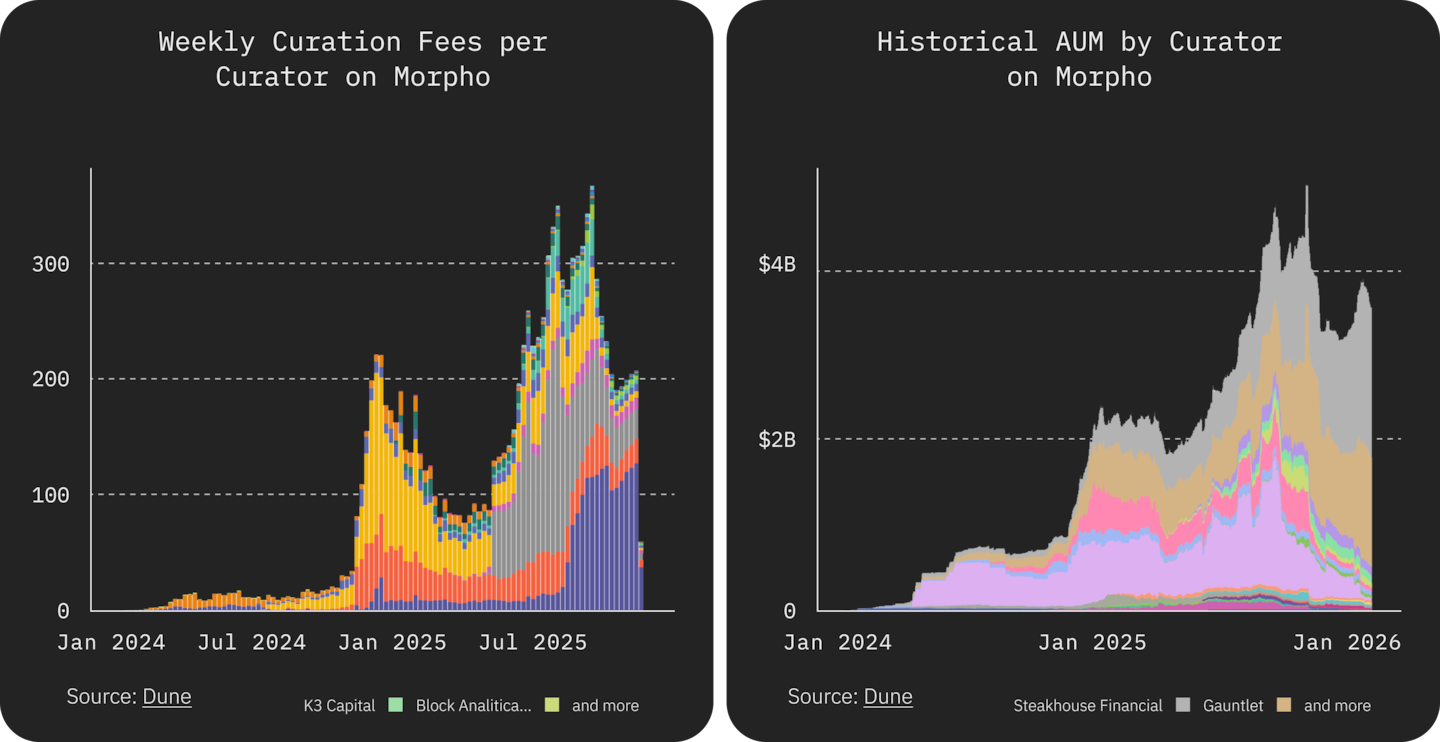

Vaults have emerged as the dominant interface through which this curation is delivered. This trend is clearly illustrated by Morpho. Asset Under Management on the protocol increased from just under $2.2 billion at the beginning of 2025 to a peak of approximately $5.0 billion, before settling around $3.8 billion. Over the same period, the number of active curators on Morpho doubled, from 7 in early 2025 to 14 today. Growth in assets has been accompanied by a sharp increase in curation fees, which rose from roughly $10,000 per week at the end of last year to more than $200,000 per week in the second half of 2025.

This growth was not driven by speculative yield alone, but by demand for structured access to DeFi under clearly defined risk conditions. Rather than exposing users to the full operational complexity of underlying protocols, vaults translate strategy intent into enforceable rules. Risk constraints, allocation limits, and response mechanisms are encoded directly into execution, allowing capital to be deployed under a defined mandate without requiring participants to continuously monitor utilisation rates, oracle health, or governance changes in real time.

Crucially, this form of abstraction does not require the transfer of custody or discretionary control. While delegation hands decision-making authority to an external actor, curation defines the boundaries within which capital is allowed to operate. It involves selecting eligible markets and strategies, setting exposure limits, enforcing risk controls, and defining how the system responds as conditions change, while execution remains rule-based and verifiable.

This distinction matters. Delegation relies on trust in individuals. Curation relies on rules, constraints, and observable behaviour. And while many actors can deploy vaults, only a small number can operate them with the depth of risk management, automation, and governance discipline required at scale. As curation becomes central to onchain asset management, quality of execution becomes the differentiating factor, and the market is already concentrating around a first class of curators capable of combining technical expertise, operational rigour, and institutional standards, such as Gauntlet or Sentora.

This is the context in which kpk’s approach to curation should be understood.

kpk’s evolution and product framing

kpk’s move into curation is not an expansion into a new business line. It is the natural outcome of years spent managing onchain capital under real constraints.

Before vaults, kpk operated as a treasury manager for large DAOs and protocols. This work involved overseeing significant balances, executing strategies under governance oversight, and operating within strict security and accountability requirements. Decisions were public. Execution had to be predictable. Errors were not abstract. They carried real consequences.

Over time, this mandate-based model proved effective, but it also revealed its limits. Each mandate required a bespoke setup. Permissions had to be tailored. Strategies were customised to specific governance preferences. Execution relied on processes that, while robust, were slow to adapt and difficult to replicate. As the number of mandates increased, operational overhead grew alongside them.

The constraint was not demand. It was scalability.

As DeFi matured, manual capital management began to show its limits. Protocols became more modular, interactions more standardised, and capital flows increasingly mediated through onchain primitives rather than bespoke execution. Managing exposure through governance actions, ad-hoc transactions, or human intervention no longer scaled in an environment where conditions change continuously and execution speed matters.

At the same time, standards such as ERC-4626 and the emergence of permissioned and permissionless vault architectures made it possible to express capital management directly in code. Risk frameworks, permissioning systems, monitoring logic, and response mechanisms could be formalised into reusable components. Across mandates, the underlying execution logic increasingly converged. What differed were the parameters, constraints, and risk tolerances applied to it.

This shift shaped kpk’s product direction. Rather than continuing to scale through bespoke governance mandates and manual execution, kpk began formalising its internal systems into a structured infrastructure stack. The objective was to make institutional-grade execution repeatable, verifiable, and accessible, without relying on continuous human intervention or custom governance processes for every deployment.

Curated vaults are the first product deployment of this stack.

Curated vaults provide a structured execution environment where kpk’s risk constraints and response mechanisms are encoded onchain: policies are inspectable, authority is fragmented through tightly scoped permissions, and withdrawal liquidity is treated as a first-order design objective.

In practice, kpk frames its Morpho curation around three focus areas: market selection and withdrawal reliability, operational scalability through automation, and custom market deployments where needed. On Ethereum, this spans Prime vaults and higher-yield variants (e.g. kpk USDC Yield and kpk ETH Yield), designed for depositors seeking higher yield within clearly defined safeguards. The same operating model extends beyond Morpho to other environments, including Gearbox.

This combination is intentional. It allows kpk vaults to serve two audiences at once. Sophisticated DeFi users gain access to curated execution without surrendering transparency or control, while traditional funds and institutions gain an entry point into onchain markets that align with their expectations around risk management, auditability, and operational clarity. kpk deploys its own treasury alongside depositors across its vaults.

Separately, kpk also deploys bespoke lending markets where standard market structures are not a fit (standalone markets, not vaults). Two public examples are the most recent savETH/WETH and savUSD/USDC markets, which reached more than $1 million and $2 million of supply-side deposits, respectively, in under a week.

Growth in assets under management remains a familiar metric in asset management, but for kpk it is not the primary objective. kpk’s approach is intentionally anchored in how vaults behave, not how large they become. Ensuring predictable liquidity under stress, maintaining flexibility in deposits and withdrawals, and delivering consistent execution are fundamental requirements for kpk, and they take precedence over scale in the design and operation of its vaults as we will see later in the report.

Curated vaults are not the endpoint. They are the foundation.

At their core, curated vaults standardise execution. They define how capital is deployed, rebalanced, and withdrawn under a single strategy, with risk constraints, permissions, and response paths enforced directly onchain. Vaults answer the question of how capital behaves.

Over the longer term, this same infrastructure extends toward kpk Funds (previously called onchain investment vehicles or OIVs), which standardise exposure across strategies and chains within a single tokenised structure. A later section in this report below describes kpk’s Funds in more detail.

Curation framework and methodology

The starting point is not yield. Instead, kpk begins by defining the conditions under which capital can be deployed, adjusted, or withdrawn. These conditions set the boundaries of acceptable behaviour. Yield is then generated within those boundaries. In this model, yield is the result of disciplined execution, not the objective that drives every decision.

This approach reflects kpk’s experience managing onchain treasuries under real constraints. When capital is large, liquid, and politically visible, mistakes do not remain isolated. They propagate quickly, attract attention, and are difficult to reverse. Decisions are public, and execution failures carry real consequences. For that reason, kpk treats curation as a continuous responsibility rather than a one-time selection process.

Curation as a lifecycle

Curation begins before capital is ever deployed, and it continues for as long as a vault remains active.

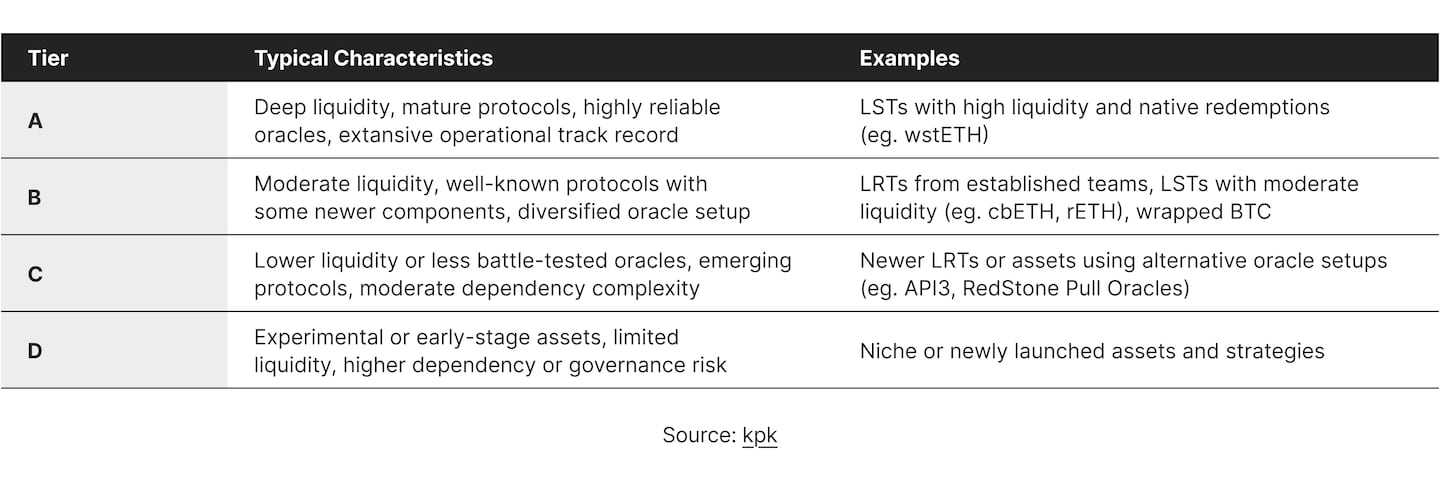

The first stage is inclusion. Markets and strategies are evaluated against a structured set of criteria covering risk, liquidity, dependencies, and failure scenarios. This process is intentionally conservative. The objective is not to support as many markets as possible, but to define a universe of components that are expected to behave predictably when conditions deteriorate.

Once a market or strategy is included, curation does not stop. Conditions change over time. Liquidity fluctuates. Utilisation rises and falls. Governance actions can materially alter protocol behaviour. Rather than assuming that initial approval implies permanent safety, kpk monitors these dynamics continuously and adjusts exposure as conditions evolve.

Crucially, this adjustment process is gradual. Curation is not binary. Exposure does not move from fully enabled to fully disabled in a single step. Caps can be tightened, buffers increased, or allocations reduced progressively. This allows capital to be repositioned without forcing abrupt exits, particularly during periods of market stress when liquidity is most fragile.

Curation ends only when a strategy no longer satisfies the conditions under which it was initially approved. Even then, exits are handled deliberately, with the aim of preserving orderly behaviour rather than maximising short-term returns.

Risk as a design input

In kpk’s framework, risk is not assessed after a strategy has been selected. It is the constraint that shapes the strategy from the outset.

Risk considerations determine which assets and markets are eligible, how much capital can be allocated, and how quickly that allocation is allowed to change. Exposure limits, liquidity buffers, and tiered allocation structures are defined upfront. This ensures that no single component can dominate the behaviour of a vault or create hidden fragility.

This reflects a clear priority. Preserving liquidity and avoiding forced exits takes precedence over maximising short-term yield. The objective is not to eliminate risk, which is neither possible nor desirable, but to make risk observable, bounded, and manageable.

By embedding these constraints directly into the curation framework, kpk aims to ensure that vault behaviour remains predictable even as underlying market conditions evolve.

Automation with boundaries

At scale, continuous curation cannot rely on manual intervention alone. However, automation without constraints introduces its own set of risks.

kpk uses deterministic agents to support curation. These agents operate within tightly defined permissions and do not exercise discretion. Their role is to execute predefined actions when specific conditions are met, such as reallocating liquidity within approved markets or reducing exposure in response to risk signals.

Importantly, automation is deliberately limited. Agents can act quickly, but only within clearly defined bounds. They cannot introduce new strategies, expand exposure beyond approved limits, or bypass risk constraints. In this model, automation reinforces discipline rather than replacing judgment.

The result is execution that is fast and consistent, while remaining transparent and verifiable.

Human oversight and separation of powers

While automation handles routine adjustments, exceptional situations require human oversight.

kpk maintains a clear separation between day-to-day execution and high-impact decisions. Routine actions operate within predefined policies. Changes to those policies, or actions that materially alter system behaviour, require additional oversight.

This oversight is provided by a dedicated Security Council. Its role is not to optimise performance, but to act as a governance backstop. By requiring broader consensus for sensitive actions, the Security Council reduces key-person risk and ensures that no single actor can unilaterally change core parameters.

This separation reinforces the non-custodial nature of kpk’s products while providing institutions and DAOs with a governance structure that feels familiar and credible.

Why this framework scales

kpk’s curation framework is designed to scale across protocols, strategies, and user types because it is expressed through rules rather than bespoke arrangements.

The same logic can be applied in different environments, from allocator-based systems to permissionless lending markets. On Gearbox, kpk curates Earn pools by defining risk limits and operational safeguards within Gearbox’s architecture, rather than reallocating across lending markets as on Morpho. The common thread remains: constrained permissions, continuous monitoring, and a focus on withdrawal reliability under stress. For sophisticated DeFi users, this provides curated execution without sacrificing transparency or control. For institutions, it offers a structured entry point that aligns with expectations around auditability, risk management, and operational clarity.

Most importantly, this framework is extensible. The principles that govern curated vaults also form the foundation for more advanced onchain investment structures. By standardising execution and embedding risk discipline at the infrastructure level, kpk creates a path from individual vaults to broader investment vehicles without changing its underlying philosophy.

In this sense, curation is not a feature of kpk’s products. It is the organising principle of its approach to onchain asset management.

Vault architecture and risk management

kpk’s curation framework is only meaningful if it can be enforced continuously, under changing market conditions, without relying on manual intervention. For this reason, vault architecture is treated as a risk-control surface rather than a product wrapper.

Each kpk vault is designed to translate high-level policy into constrained execution. Authority is fragmented by design. Actions are scoped before they are authorised. Automation is used to enforce discipline, not to introduce discretion. Together, these choices ensure that vault behaviour remains predictable even as conditions change.

Governance, roles, and permissions

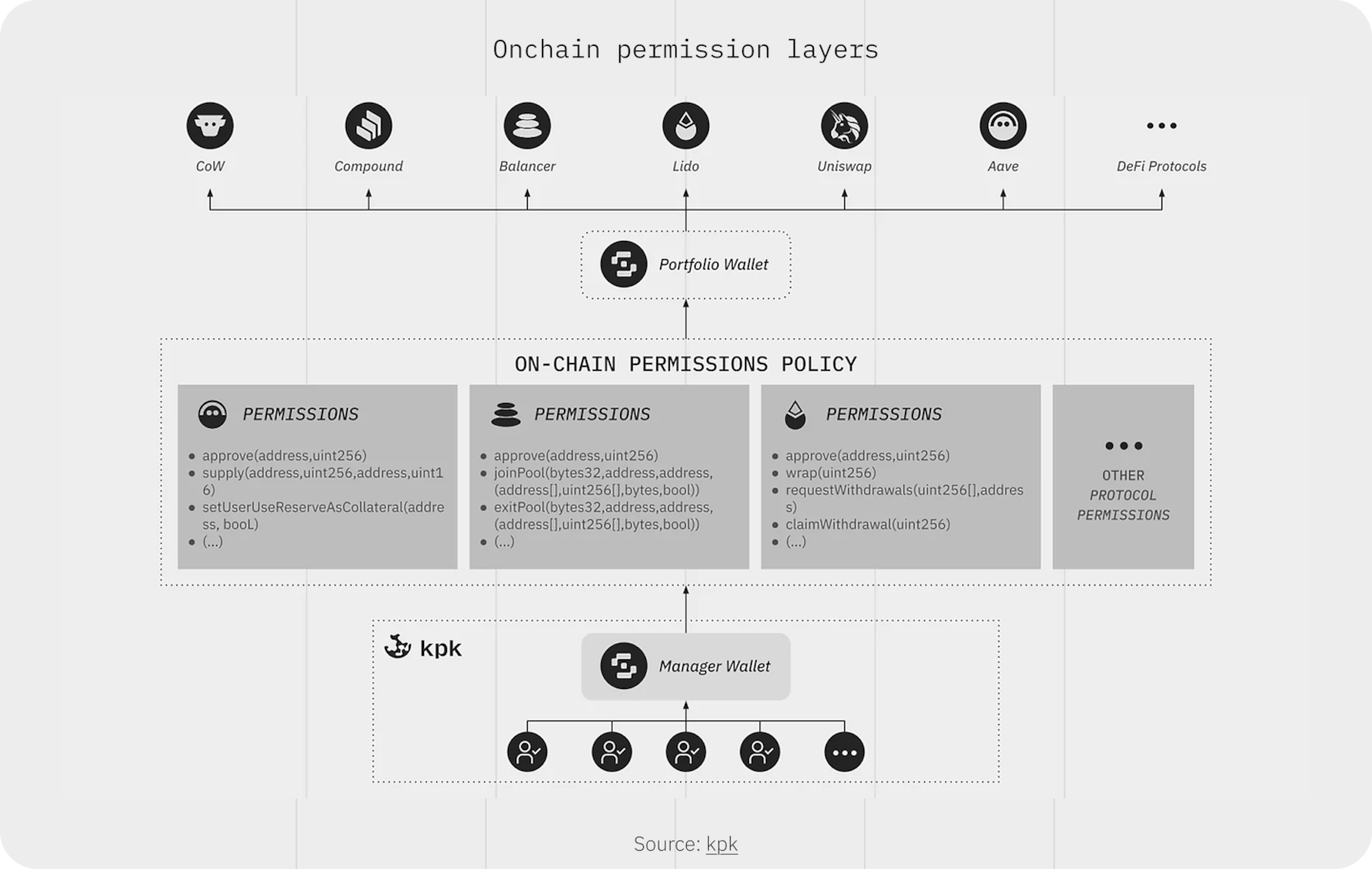

At the base of every kpk vault sits a Safe smart account that holds user assets. This Safe does not grant broad discretionary control. Instead, it is extended through a layered permission system that defines exactly which actions are allowed, by whom, and under which conditions.

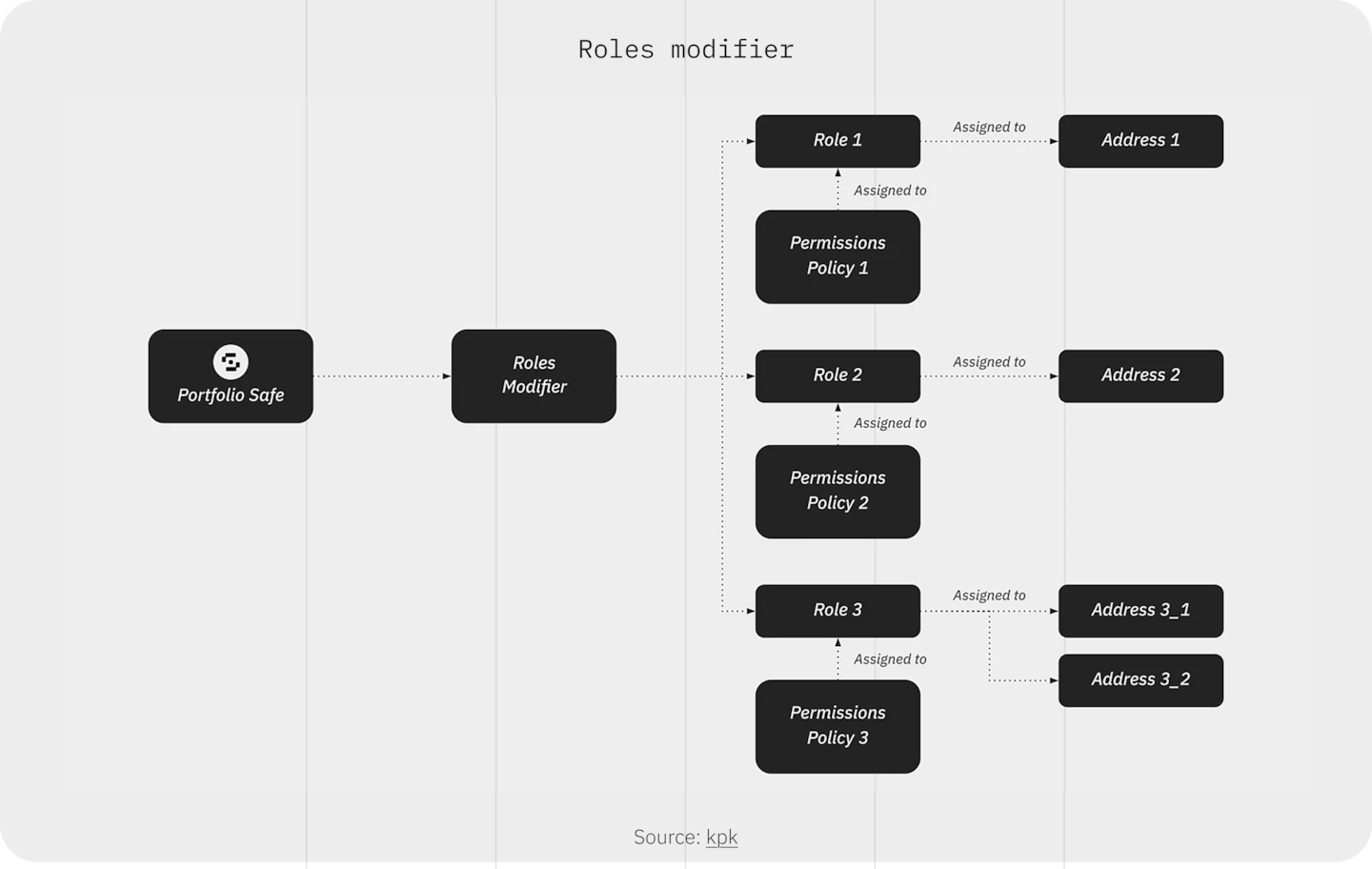

kpk builds on the Zodiac Roles framework to define granular, role-based permissions. Each role is associated with a narrow set of approved actions, explicit parameter bounds, and rate limits. Roles can be assigned to human operators or to automated agents, but no role is ever granted open-ended authority.

To support continuous operation without expanding the attack surface, kpk introduces an additional delegation layer through sub-roles. High-level roles define the outer boundaries of what is permissible. Sub-roles enable day-to-day execution within those boundaries, without requiring frequent multisig approvals. This structure allows vaults to react quickly to market changes while preserving strict control over what actions can be taken. Delegated accounts can never exceed the permissions defined at the higher level, even when acting in parallel.

Structural changes are intentionally separated from routine operations. Modifying global parameters, altering permission scopes, or cancelling timelocked actions requires approval by the Security Council. The Security Council is a high-threshold Safe that owns the core vault contracts and acts as a governance backstop, reducing key-person risk and ensuring that no single operator can unilaterally alter vault behaviour.

A defining property of this architecture is that policies are enforced onchain. Permissions, limits, and authorised actions are publicly visible and reviewable. This makes the system auditable by construction and ensures that vault behaviour is governed by rules rather than discretion.

Agents, monitoring, and execution

Continuous curation at scale is not feasible without automation. At the same time, unconstrained automation introduces its own risks. kpk’s approach is therefore deliberately narrow and rule-driven.

kpk vaults are operated by deterministic agents that execute whitelisted smart-contract functions through the Permissions Layer. These agents are not AI systems. They do not invent strategies or interpret intent. They act strictly within predefined policies and parameter bounds.

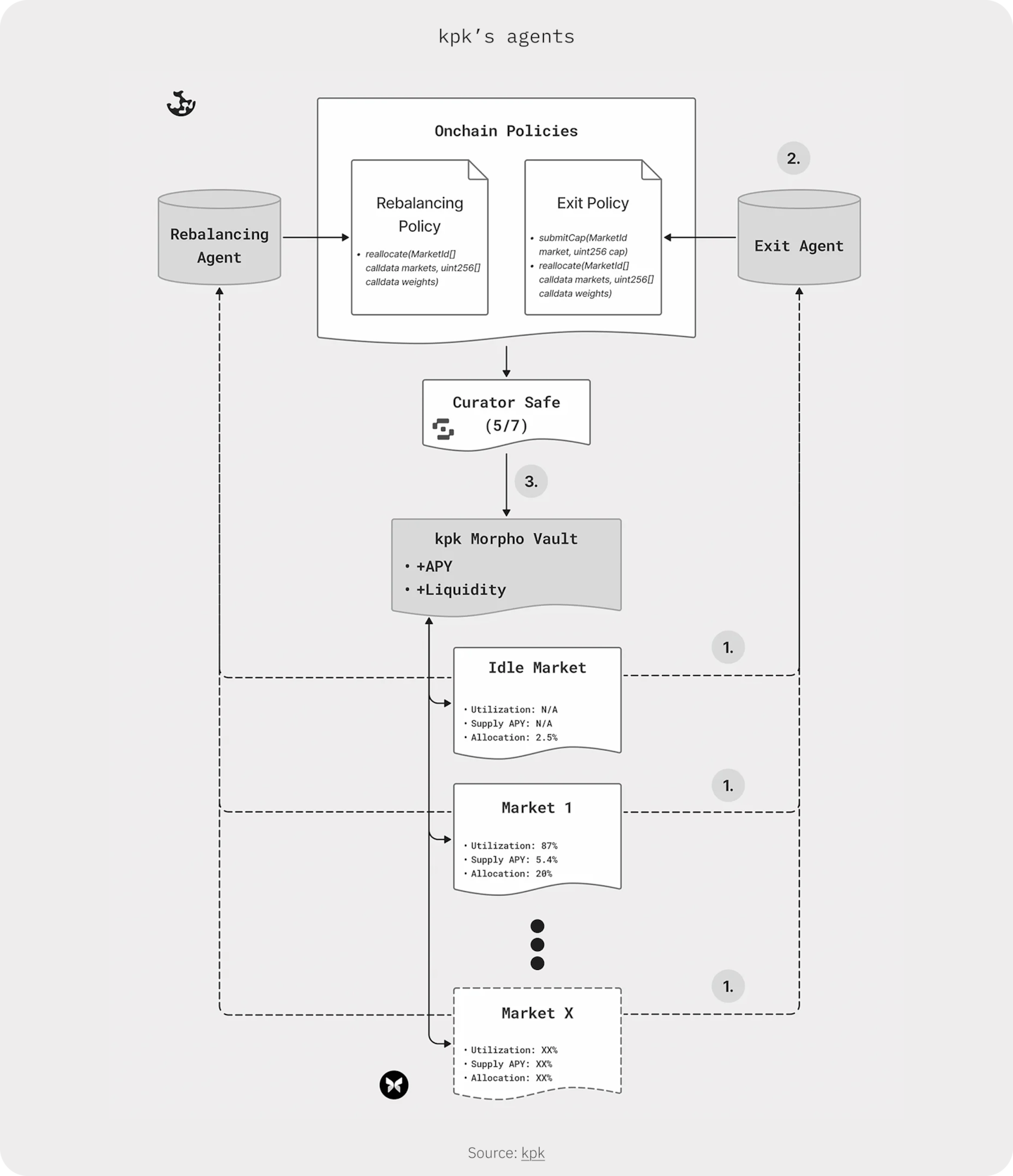

Two distinct agent types are used, each serving a specific role.

The Rebalancing Agent operates under normal market conditions. Its function is to maintain efficient capital allocation across approved markets as supply, borrowing, and utilisation levels change. Reallocations follow tier- and cap-aware rules, ensuring that exposure limits and diversification constraints are respected at all times. The objective is stable utilisation and yield without introducing concentration risk.

A public example illustrates the cadence. An onchain deposit of roughly $1 million into the kpk USDC Prime vault was followed by a rebalancing transaction around 45 seconds later (source). On Arbitrum, the same workflow has been shown in under 30 seconds, reflecting faster confirmations. This is one illustrative example: there are many such rebalancing transactions. As shown on the public dashboards, more than 4,500 automated rebalancing transactions have taken place since kpk began these activities in October 2025. This cadence is deliberately tuned to balance gas, compute, and net yield.

The Exit Agent is designed for adverse conditions. It responds to explicit risk signals such as oracle staleness, sustained price divergence from reference venues, or emerging liquidity stress. When triggered, the Exit Agent can act within seconds to reduce or disable exposure to affected markets, increase idle balances, and prioritise safe exits within predefined limits. The intent is to prevent illiquidity scenarios rather than manage them after the fact.

Both agents operate continuously and are supported by a comprehensive monitoring stack. This includes onchain signals such as utilisation levels, liquidity depth, oracle liveness, and price deviations, as well as external alerts from specialised risk providers. These signals do not trigger discretionary decisions. Instead, they feed into predefined response paths that are either executed automatically or escalated when additional oversight is required.

Liquidity buffers are treated as a first-order constraint. Vaults are configured to maintain idle liquidity sufficient to support withdrawals without forcing reactive unwinds. When buffers are drawn down, agents rebalance gradually to rebuild them, favouring orderly behaviour over short-term yield optimisation.

Configuration choices such as timelocks, alert thresholds, and response delays materially shape vault behaviour. Shorter delays increase responsiveness but raise coordination risk. Longer delays improve stability but reduce agility. These trade-offs are made explicitly and conservatively, reflecting kpk’s preference for predictability over aggressive optimisation.

Automation reduces operational risk and human error. At the same time, it introduces configuration and coordination risk. kpk addresses this by tightly constraining agent authority, separating responsibilities across roles, and maintaining human oversight for exceptional situations.

Asset universe and example vault

Vault architecture is closely coupled to the asset universe in which it operates.

For conservative strategies, kpk defines a “Prime” asset universe. This typically includes major assets such as ETH and BTC, widely used forms of staked ETH with native or highly liquid redemption mechanisms, and high-quality stablecoins. Assets are admitted only after structured due diligence and are assigned risk tiers that determine allocation limits and monitoring intensity.

Diversification is enforced not only at the asset level, but also across issuers, wrappers, and dependency stacks. Where possible, kpk avoids concentrating exposure in a single implementation, oracle design, or governance structure. These considerations are encoded directly into allocation caps and rebalancing rules rather than left to operator discretion.

A representative example of this approach is a “Prime” stablecoin vault on Morpho. Such a vault accepts a single deposit asset and allocates it across multiple approved lending markets. The objective is capital preservation combined with steady, predictable yield. Parameters are conservative. Each market is assigned a tier and a supply cap. Idle buffers are maintained to support withdrawals. Rebalancing and exit agents operate continuously to enforce these constraints in real time.

In practice, this architecture has delivered tangible benefits. During periods of elevated utilisation, agent-driven vaults have been able to restore withdrawal liquidity within seconds by reallocating capital, while manually managed vaults remained illiquid for extended periods. Under comparable market conditions, agent-operated vaults have also achieved higher realised yields from identical underlying markets, illustrating how disciplined execution translates into measurable outcomes.

Taken together, this architecture ensures that kpk’s curation framework is not aspirational. Policy is expressed as permissions. Permissions are enforced by agents. Exceptional authority is gated by governance. The result is a system designed to behave predictably under both normal and stressed conditions.

Comparative landscape and positioning

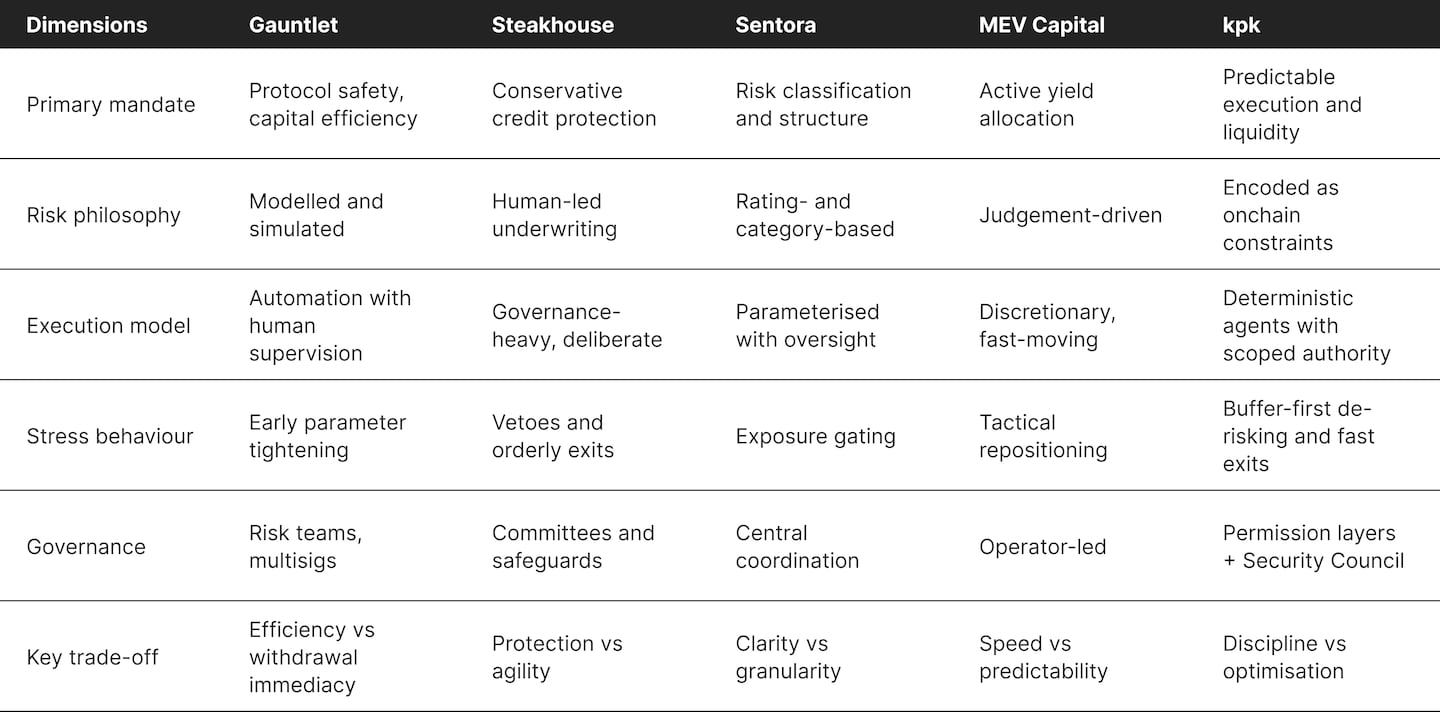

As curation becomes a core layer of onchain asset management, a growing number of actors are emerging, each leading on different fronts. While curators are often grouped under a single label, their approaches differ materially in how risk is defined, how execution is enforced, and which failure modes are prioritised.

The purpose of this section is not to rank curators or declare winners. Instead, it is to surface the design trade-offs embedded in different curation models. Vaults that appear similar at a high level can behave very differently under stress, during liquidity shocks, or when governance conditions change. Understanding these differences helps allocators, DAOs, and institutions assess alignment with their own objectives and constraints.

To make these trade-offs explicit, the report examines a selection of well-established curators in the ecosystem. Each is analysed through the same lens: mandate, risk philosophy, execution model, behaviour under stress, and the implications of those design choices. This framework also serves to position kpk clearly within the broader curation landscape.

Gauntlet

Gauntlet’s primary mandate is protocol safety and capital efficiency. Its work is deeply rooted in quantitative risk management, with a strong emphasis on simulation, stress testing, and optimisation under adverse scenarios.

Risk is conceptualised as something to be modelled and minimised. Gauntlet relies on agent-based simulations and historical stress scenarios to estimate insolvency probabilities and liquidity shortfalls. Vault parameters and allocation limits are adjusted to keep these risks within tight tolerances, often prioritising insolvency avoidance as the dominant objective.

Execution is supported by automation but remains closely supervised by human risk teams. While rebalancing and parameter updates can be triggered automatically, escalation paths and discretionary intervention play an important role when model assumptions are challenged or market conditions evolve rapidly.

Under stress, Gauntlet-managed vaults typically respond by tightening parameters, reducing exposure, or reallocating capital early to preserve solvency. This approach is highly effective at minimising bad debt and protecting protocol health, but may place less emphasis on immediate withdrawal liquidity for end users.

The trade-off implied by this design is a strong focus on safety and capital efficiency, balanced against a more centralised supervision model and a stress response optimised primarily around insolvency risk.

Steakhouse

Steakhouse approaches curation through the lens of conservative credit underwriting and governance-driven risk control. Its vaults are designed to prioritise capital preservation and depositor protection, often through explicit safeguards and veto mechanisms.

Risk is assessed through structured due diligence and ongoing human oversight. Rather than relying primarily on automated optimisation, Steakhouse places significant weight on risk committees, predefined escalation paths, and conservative assumptions about market behaviour.

Execution reflects this philosophy. Timelocks, depositor protections, and kill-switch mechanisms are commonly used to ensure that changes to vault behaviour occur deliberately and with sufficient notice. Automation is present, but it operates within a framework that favours caution over speed.

During periods of stress, Steakhouse-managed vaults tend to prioritise downside protection and orderly exits, even if this comes at the cost of reduced agility. The emphasis is on avoiding irreversible outcomes rather than reacting quickly to every market signal.

This approach offers strong guarantees around capital protection and governance control, while accepting slower responsiveness and higher operational friction as a consequence.

Sentora

Sentora positions itself around risk classification and structured exposure. Its curation model focuses on categorising assets, strategies, and protocols according to defined risk frameworks, and using those classifications to guide allocation decisions.

Risk is expressed through ratings and categories rather than continuous optimisation. Vault behaviour is shaped by how assets are classified, with allocation limits and eligibility determined by these risk buckets. This provides clarity and consistency across products, particularly for allocators seeking comparable exposure profiles.

Execution is typically parameterised and centrally coordinated. While automation supports routine adjustments, classification changes and higher-impact decisions are overseen through governance processes and human review.

Under stress, Sentora-managed vaults respond by gating exposure or adjusting allocations as assets move between risk categories. This allows for structured de-risking, though responses may be less granular or less immediate than fully agent-driven systems.

The trade-off here is transparency and comparability of risk profiles, balanced against reduced flexibility in execution and a reliance on periodic reclassification rather than continuous response.

MEV Capital

MEV Capital represents a more strategy-driven approach to curation, rooted in active allocation and market expertise. Its mandate is centred on identifying attractive yield opportunities and repositioning capital dynamically as conditions change.

Risk management is closely tied to operator judgement and market experience. While risk limits and controls exist, decision-making remains relatively discretionary, allowing for rapid adaptation to new information or emerging opportunities.

Execution is therefore fast and flexible, with human operators playing a central role. Automation may assist with monitoring and execution, but it does not fully constrain decision-making in the way that policy-enforced systems do.

In stressed environments, MEV Capital’s approach enables tactical repositioning and opportunistic exits. This agility can be advantageous in rapidly changing markets, but it also places greater weight on operator judgement and introduces variability in behaviour.

The trade-off implied by this model is speed and flexibility versus predictability and formalised guardrails.

kpk

kpk’s approach to curation is infrastructure-first. Its mandate is not to optimise yield or tune protocol parameters, but to ensure that capital behaves predictably under a wide range of conditions. This approach is applied across lending venues, including Morpho and Gearbox.

Risk is treated as a design constraint rather than a variable to be continuously optimised. Asset eligibility, allocation caps, diversification rules, liquidity buffers, and response paths are defined upfront and enforced directly onchain. Rather than relying on discretionary intervention, kpk encodes acceptable behaviour into vault architecture itself.

Execution is handled by deterministic agents operating within tightly scoped permissions. These agents do not exercise judgement or introduce new strategies. They execute predefined actions when specific conditions are met, while structural changes remain gated by governance through a Security Council.

Under stress, kpk-managed vaults prioritise withdrawal liquidity and orderly behaviour. Exposure can be reduced gradually, buffers rebuilt over time, and exits executed quickly within predefined bounds. The objective is not to eliminate risk, but to ensure that risk remains observable, bounded, and manageable.

Reading these comparisons

From this analysis, it becomes clear that curators emphasise different dimensions of risk and execution depending on their philosophy, client expectations, and operating model. None of these approaches is inherently superior. Each reflects a coherent view of where risk should concentrate, how much discretion operators should retain, and which failure modes are considered acceptable.

Nevertheless, kpk’s positioning is distinct within this landscape. While several curators focus on maximising efficiency within a given protocol or mandate, kpk approaches curation as infrastructure. Its design choices prioritise bounded authority over discretion, policy enforcement over manual optimisation, and predictable behaviour over opportunistic yield capture. Risk is not shifted to operators or governance processes, but expressed directly through permissions, caps, buffers, and automated response paths.

In practice, this places kpk closer to an execution layer than a strategy manager. Compared to peers that rely more heavily on human intervention or mandate-specific tuning, kpk emphasises repeatability, auditability, and behaviour under stress as first-order design objectives. The resulting model may sacrifice marginal upside, but it is engineered to remain liquid, observable, and controllable as capital scales and conditions deteriorate.

Case studies and examples

So far, the report has described kpk’s approach to curation through a conceptual lens, positioning it as an infrastructure layer within the curation landscape. The value of this approach, however, is best assessed in practice. Concrete examples, particularly during periods of market stress, provide clearer insight into how design choices translate into observable behaviour.

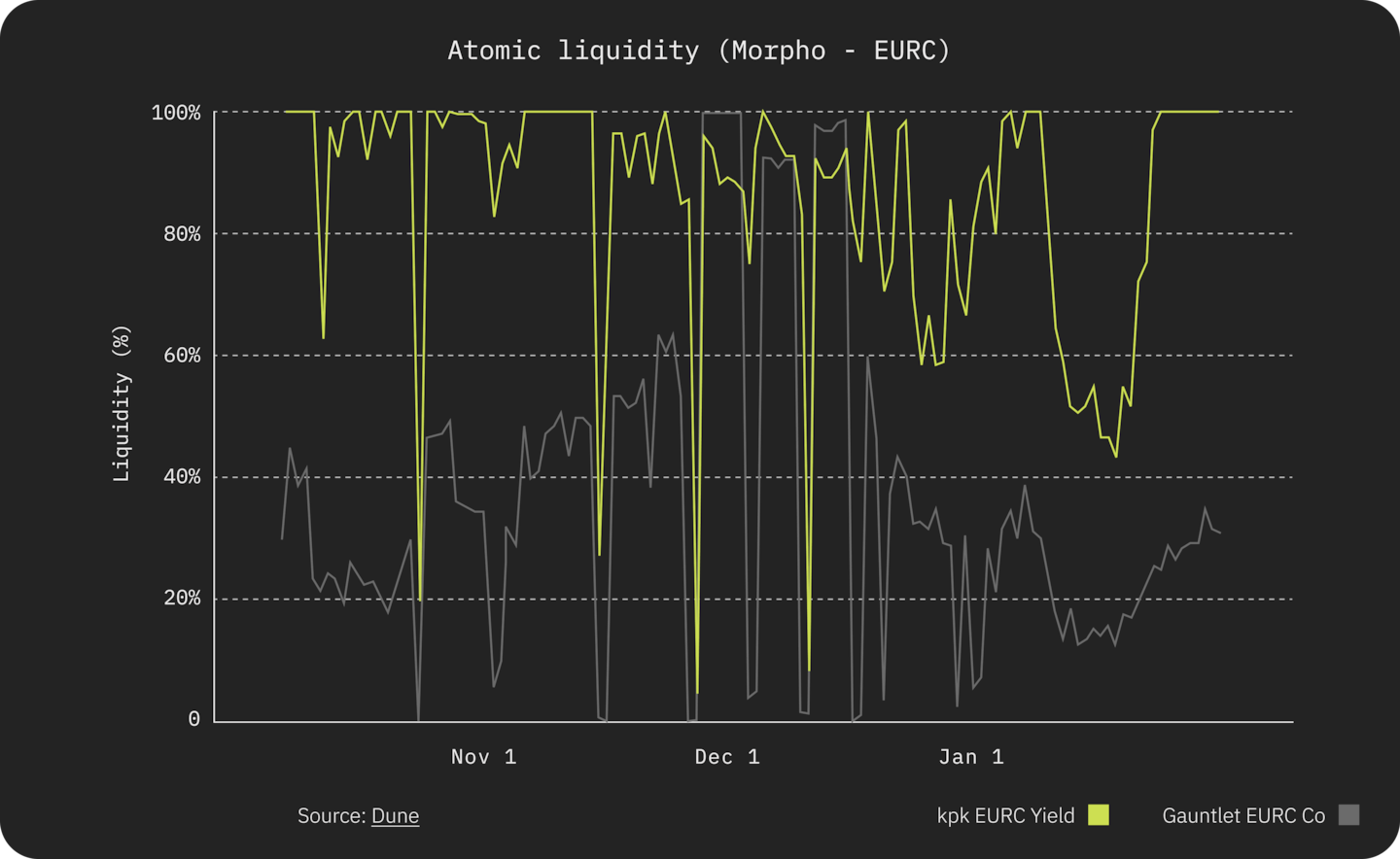

Stress event: EURC liquidity dislocation

A representative example comes from a period of liquidity stress affecting EURC lending markets on Morpho. As borrowing demand increased sharply, utilisation in several EURC markets approached saturation. Available withdrawal liquidity collapsed, creating a situation in which depositors in multiple vaults were unable to exit without waiting for borrowers to repay or for manual intervention to take place.

In kpk-operated EURC vaults, predefined utilisation and liquidity thresholds were breached when utilisation exceeded 97%. These conditions triggered automated alerts and activated the Exit Agent. Acting strictly within pre-approved permissions, the agent reduced exposure to the affected market, reallocated capital toward markets with available liquidity, and increased idle balances held at the vault level.

This sequence of actions was executed within seconds. As a result, approximately 19% of total vault liquidity was restored almost immediately, allowing withdrawals to resume while broader market conditions remained stressed. This can be expressed as a change in withdrawal liquidity (the share of assets readily withdrawable without waiting for borrower repayment), which kpk tracks publicly for its Morpho vaults. Allocator behaviour reflects this priority: strategy aggregators and DAO treasuries allocate to Prime vaults precisely because they can enter and exit without relying on manual coordination.

In contrast, comparable manually managed EURC vaults remained effectively illiquid for several hours, as rebalancing required human coordination, governance approvals, or delayed execution.

The difference was not access to superior information or discretionary judgement. It was the ability to translate policy into action without latency. Liquidity preservation was prioritised over yield retention by design, and execution followed a predefined response path rather than ad-hoc decision-making.

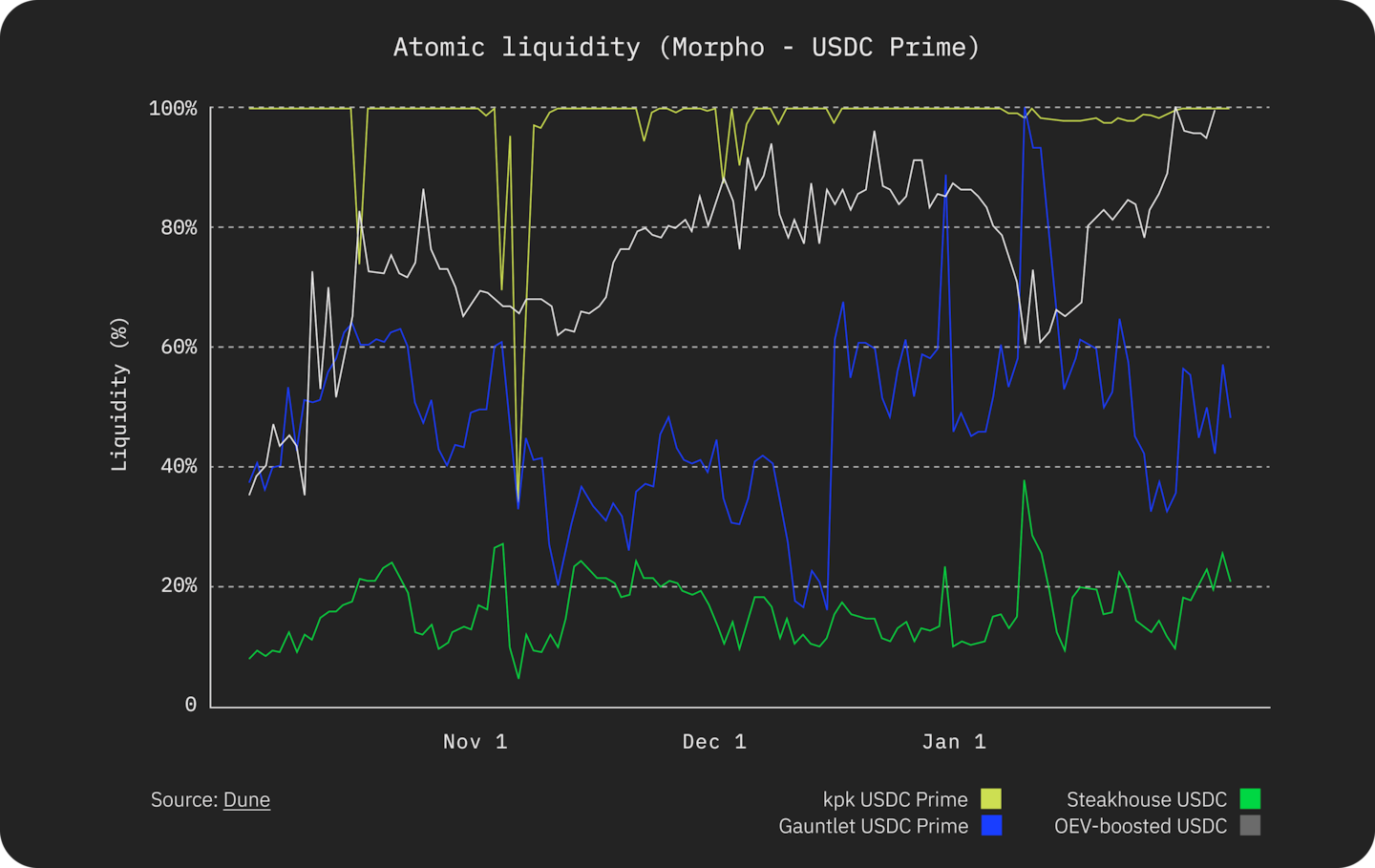

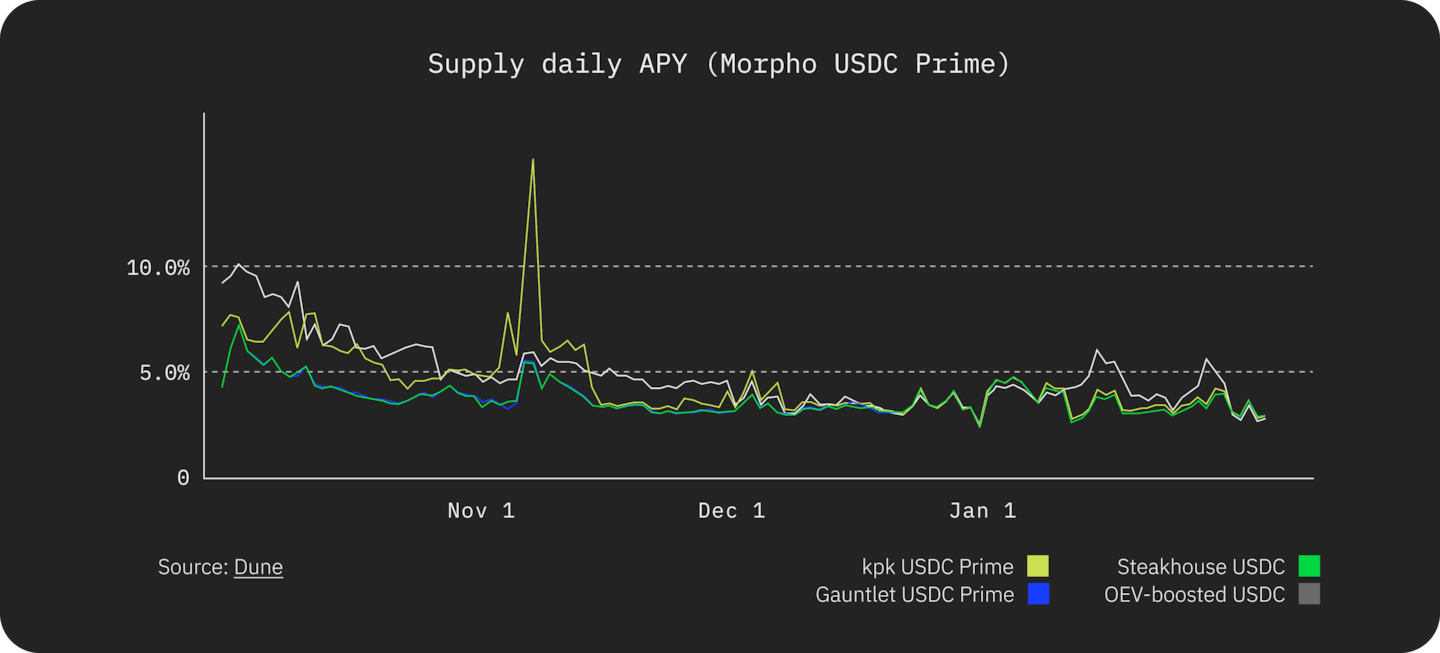

Steady-state behaviour: utilisation and yield management

The same architecture governs behaviour during normal market conditions. In periods of stable utilisation, kpk’s Rebalancing Agent operates continuously to maintain efficient capital allocation while respecting diversification and liquidity constraints.

A steady-state example can be observed in kpk-operated Prime stablecoin vaults. Capital is allocated across multiple approved lending markets, each assigned a tier and supply cap. As utilisation fluctuates, marginal capital is reallocated to maintain stable utilisation and avoid concentration, while idle buffers are preserved to support withdrawals.

Under comparable conditions, these agent-operated vaults have delivered realised yields equal to or higher than manually managed alternatives, despite maintaining materially higher withdrawal liquidity. This outcome reflects disciplined execution rather than aggressive optimisation. Yield emerges from efficient utilisation within constraints, not from maximising exposure to the highest-paying market at any given moment.

Lessons for curation design

These two examples illustrate a core principle of kpk’s approach. Vault behaviour is determined by design choices made upstream, not by decisions taken during moments of stress. Alert thresholds, buffer sizing, allocation caps, and agent permissions define the response space long before adverse conditions materialise.

Observed outcomes feed back directly into curation. Stress events inform cap calibration, buffer requirements, and escalation logic. Steady-state performance informs tiering, rebalancing frequency, and market inclusion criteria. Curation is therefore not static. It is a continuous process in which assumptions are tested against live conditions and refined over time.

The practical implication is straightforward. When policy is encoded as permissions and enforced by constrained automation, outcomes become predictable. When outcomes are predictable, risk becomes manageable rather than reactive.

Risks, limitations, and trade-offs

kpk’s curation framework is designed to make risk explicit and governable, not to eliminate it. Operating in permissionless markets necessarily exposes capital to technical, market, and coordination risks that cannot be fully removed. The objective of kpk’s approach is therefore to shape how risk manifests, how it is detected, and how the system responds when conditions change.

Core risk categories

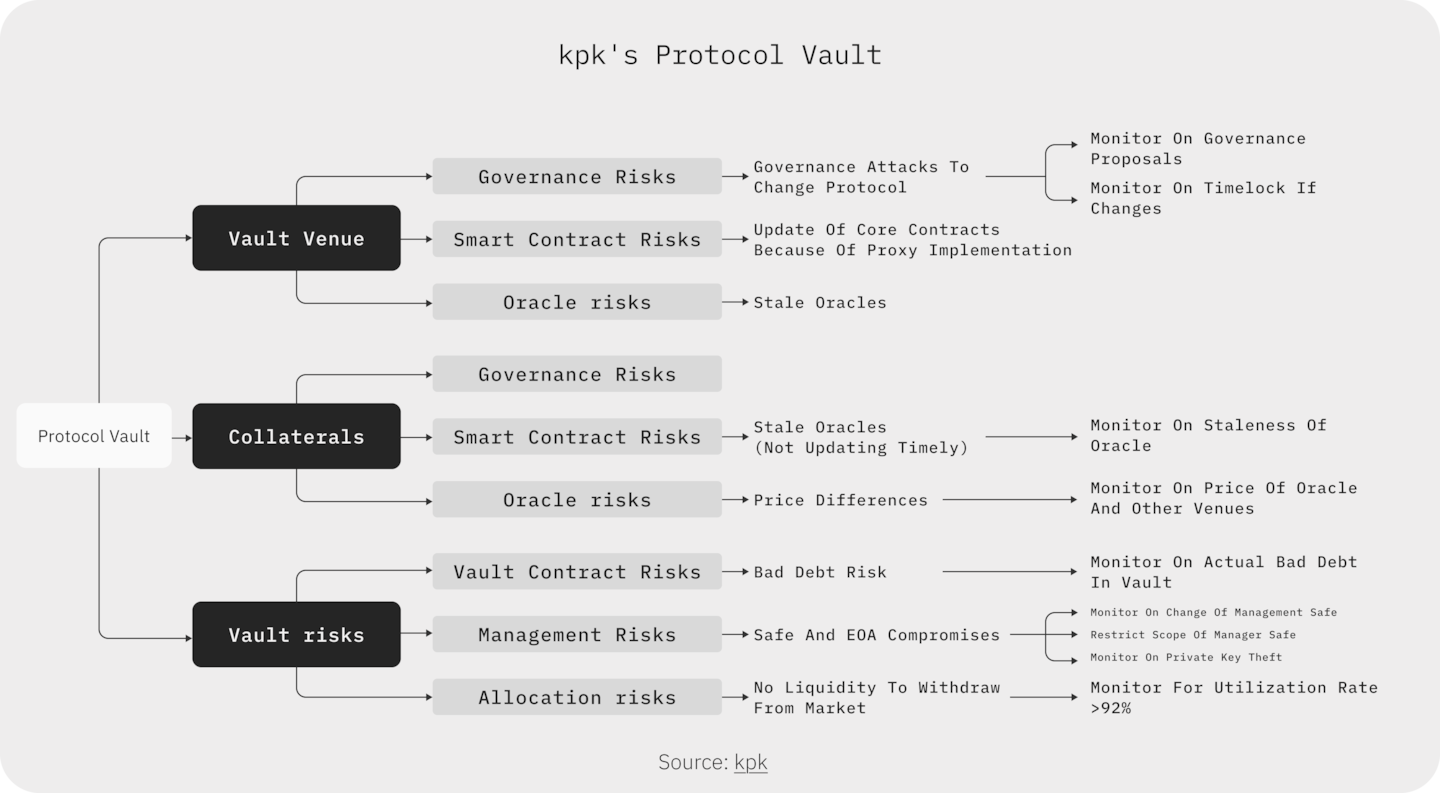

Several risk categories are inherent to onchain curation.

Oracle risk remains foundational. Price feeds may become stale, diverge from reference venues, or reflect structural weaknesses in underlying markets. These risks are addressed through conservative oracle selection, continuous monitoring, and predefined exit conditions that reduce exposure when signals deteriorate. While these mechanisms limit downside, oracle dependency cannot be fully eliminated.

Smart contract and dependency risk is intrinsic to composable systems. Vaults rely on a stack that includes Safe smart accounts, permission layers, Zodiac modules, agent contracts, and external protocols. Each component introduces potential failure modes, including unforeseen interactions across dependency chains. kpk mitigates this through layered permissions, separation of concerns, and constrained authority, but does not assume that any component is infallible.

Configuration risk is specific to automated systems. Thresholds, caps, buffers, and timelocks must be calibrated correctly. Parameters that are too permissive can increase fragility, while overly conservative settings can impair capital efficiency. kpk treats configuration as a first-order risk surface, favouring conservative defaults and incremental adjustment informed by observed behaviour rather than aggressive optimisation.

Extreme market scenarios remain a residual risk. In conditions of systemic liquidity collapse or correlated failures across protocols, even well-designed vaults may experience delayed withdrawals or capital impairment. kpk’s framework is designed to behave predictably in such environments, not to guarantee uninterrupted liquidity.

Automation as both mitigation and risk surface

Automation plays a central role in reducing operational risk. It removes execution latency, limits human error, and enforces discipline consistently across changing conditions. At the same time, automation introduces new forms of risk related to configuration and coordination.

kpk addresses this trade-off by constraining automation tightly. Agents execute predefined actions within narrow permission scopes and cannot introduce new strategies, expand exposure beyond approved limits, or bypass risk controls. Exceptional actions are gated by governance and subject to higher thresholds. This approach reduces the likelihood of catastrophic automation failure, while preserving the benefits of speed and consistency.

Yield, conservatism, and intentional positioning

There is an inherent trade-off between yield maximisation and liquidity resilience. Concentrated exposure to the highest-yielding markets can improve returns in benign conditions, but it amplifies downside and illiquidity risk when conditions deteriorate.

kpk positions its Prime vaults deliberately toward the conservative end of this spectrum. While kpk’s Yield vaults sit further along the risk–return spectrum, targeting higher returns while still operating within clearly defined safeguards (caps, buffers, and automated de-risking paths). Diversification across assets, issuers, and implementations limits upside in certain environments, but supports predictable behaviour and orderly exits under stress. Liquidity buffers further constrain yield in exchange for withdrawal reliability.

This positioning reflects an institutional risk posture adapted to permissionless markets. The objective is not to compete on headline yield, but to offer execution that remains stable across cycles and scales with capital size. This approach also aligns with the needs of yield aggregators and treasury allocators, which often prioritise withdrawable liquidity to support predictable exits.

Limits of performance interpretation

Historical performance, simulations, and observed outcomes provide valuable insight into system behaviour, but they are not guarantees of future results. Markets evolve, protocols change, and new failure modes emerge.

For this reason, kpk’s framework emphasises transparency of policy, observability of behaviour, and clarity around trade-offs. The goal is not to promise risk-free execution, but to ensure that risk is visible, bounded, and governed in a way that aligns with the expectations of sophisticated DeFi participants and institutional allocators alike.

In this context, risk management is not a defensive posture. It is the foundation that allows onchain capital to scale responsibly.

Roadmap and growth opportunities

kpk’s current curated vaults represent a foundation rather than a finished product. They show how execution, risk limits, and withdrawal behaviour can be enforced onchain today. The next stage builds on the same design philosophy, extending the stack from standardising execution within a single strategy to delivering structured, tokenised exposure across strategies and venues.

From curated vaults to Funds

The next stage of the roadmap is the evolution from standalone vaults to kpk Funds: composable onchain funds designed to provide institutional-grade exposure to DeFi yield strategies with non-custodial settlement and onchain accounting. Funds are deployed on kpk’s onchain fund infrastructure (previously called Onchain Investment Vehicles, or OIVs).

Where curated vaults focus on standardising execution, kpk’s Funds aim to standardise exposure. They introduce an additional abstraction layer that allows capital to be allocated across multiple strategies, assets, protocols and chains within a single coherent structure. Tokenisation, accounting logic, and composability are layered on top of the existing execution framework, rather than replacing it.

At launch, Funds will be issued exclusively by kpk’s trading desk as actively managed, tokenised funds. They are designed to provide permissionless access to fund shares while keeping controls explicit: assets remain in smart contracts (non-custodial), policy contracts constrain what actions the trading desk can execute, and NAV and share price calculations run onchain, enabling independent verification. Fund shares are ERC-20 tokens, designed for integration across DeFi. Funds run on Safe smart accounts to support sophisticated transaction payloads, and they can operate across multiple EVM networks while keeping accounting and security controls consistent.

Importantly, this evolution does not introduce new discretionary authority. The same principles apply. Policy remains onchain and inspectable. Risk constraints are enforced through permissions. Automation operates within defined bounds. In this sense, Funds are not a departure from kpk’s current approach, but a natural extension of it.

Governance and ecosystem participation

As the system evolves, governance mechanisms are expected to mature alongside it. The kpk Security Council already plays a central role as a governance backstop for high-impact actions. Over time, its scope may expand to include a broader set of participants, including ecosystem partners with relevant technical, risk, or operational expertise.

This expansion is intended to reinforce resilience rather than centralise control. By distributing oversight across multiple independent actors, kpk aims to reduce key-person risk while preserving the ability to act decisively when required. Governance remains focused on safeguarding system behaviour, not on optimising short-term performance.

At the ecosystem level, kpk’s infrastructure is designed to integrate with protocols rather than sit alongside them. Curated vaults and future Funds provide predictable, professionalised capital that can support protocol growth while respecting risk boundaries. This creates a natural alignment between curators, protocols, and depositors.

Closing Thoughts

This report has examined kpk’s curation framework from architecture to execution, positioning it within a broader landscape of vault-based asset management. Across governance design, agent behaviour, liquidity management, and comparative analysis, a consistent theme emerges: risk and execution are treated as infrastructure problems, not optimisation challenges.

kpk’s curated vaults demonstrate that institutional-grade behaviour can be enforced onchain today without introducing custody, opaque discretion, or governance bottlenecks. By encoding policy directly into permissions, caps, buffers, and deterministic agents, kpk shifts the locus of control from human intervention to verifiable rules. The result is execution that remains predictable as capital scales and conditions deteriorate.

The comparative landscape further highlights that no single curation model is universally superior. Different curators optimise for different constraints. kpk’s positioning is deliberately conservative, prioritising bounded authority, auditability, and behaviour under stress over marginal yield optimisation. This reflects a view that as vaults become infrastructure, predictability and control matter more than tactical advantage.

The case studies reinforce this point. Outcomes during stress were not driven by superior judgement or faster reaction, but by design choices made upstream. Where policy was explicit and automation constrained, liquidity was preserved and exits remained orderly. Where execution depended on coordination and discretion, delays and illiquidity followed.

Looking forward, curated vaults are not the endpoint. They are the foundation for more expressive onchain investment vehicles built on the same principles. Governance and incentives are expected to evolve in support of resilience and alignment, not as substitutes for sound execution.

In sum, kpk’s approach reflects a broader shift in onchain asset management: away from discretionary strategy execution and toward rule-based systems designed to scale responsibly. As DeFi continues to mature, it is this ability to make behaviour observable, bounded, and enforceable that will define the next generation of capital infrastructure.

Download the report

Download the Curation as an Infrastructure Layer - kpk’s Design Philosophy report (PDF)