Katana in One Paragraph

Katana is a ve-native, chain-level system that coordinates liquidity and emissions across the network. Instead of each protocol running its own incentive programme, applications compete for emissions based on their contribution and governance support, including through vote incentives, within a shared liquidity framework. Emissions are governed by vKAT holders and, over time, are funded by protocol revenues such as Vaultbridge yield, AUSD yield, Chain-Owned Liquidity returns, and sequencer fees, reducing the typical reliance on token emissions. This creates a more sustainable system where liquidity is rewarded for long-term contribution rather than short-term extraction.

Executive Summary

Katana’s vKAT Armory represents the next evolution of ve-tokenomics, transforming what began as protocol-level liquidity coordination into a chain-wide economic framework. Where Curve pioneered time-based governance alignment, Solidly introduced cooperative incentives, and Aerodrome demonstrated sustainable scaling, Katana extends these principles to the base layer of a network.

At its core, Katana treats liquidity not as an individual protocol concern but as shared infrastructure. Emissions are coordinated across the entire DeFi stack, allowing applications to grow symbiotically and competitively. This marks a structural shift from fragmented liquidity mining to a self-sustaining, performance-based economy.

A New Coordination Model

The system revolves around KAT, the native coordination token that drives KAT emissions and liquidity alignment but is not a gas token or a governance token. By locking KAT, holders gain the ability to direct emissions through gauges, influencing where incentives flow and how liquidity grows across the network. In return, voters earn fees generated by the pools they vote to direct emissions to. There are two options for the users:

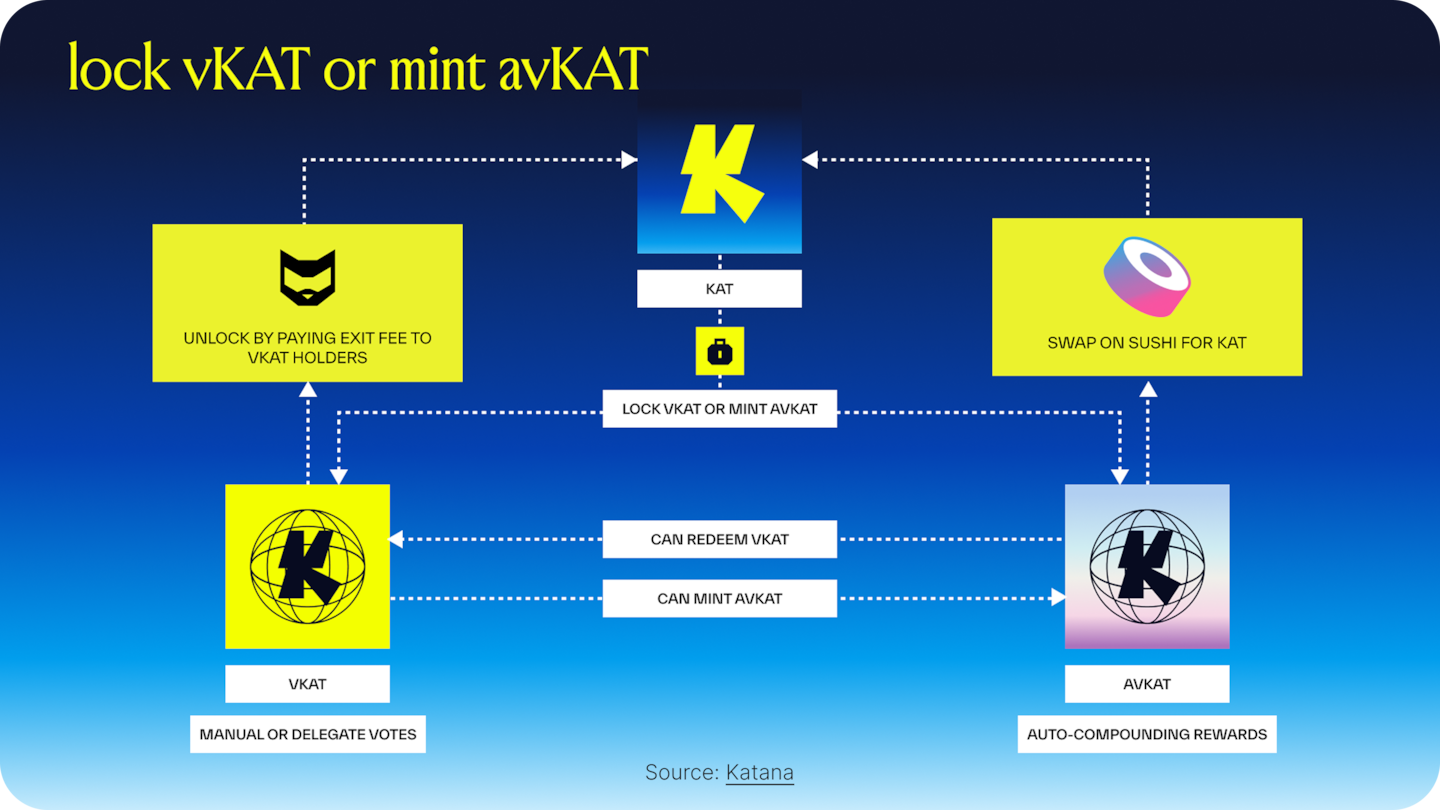

vKAT represents locked KAT and grants power to vote on emissions each epoch, ensuring that rewards are directed toward applications and earn fees from the pools they vote for.

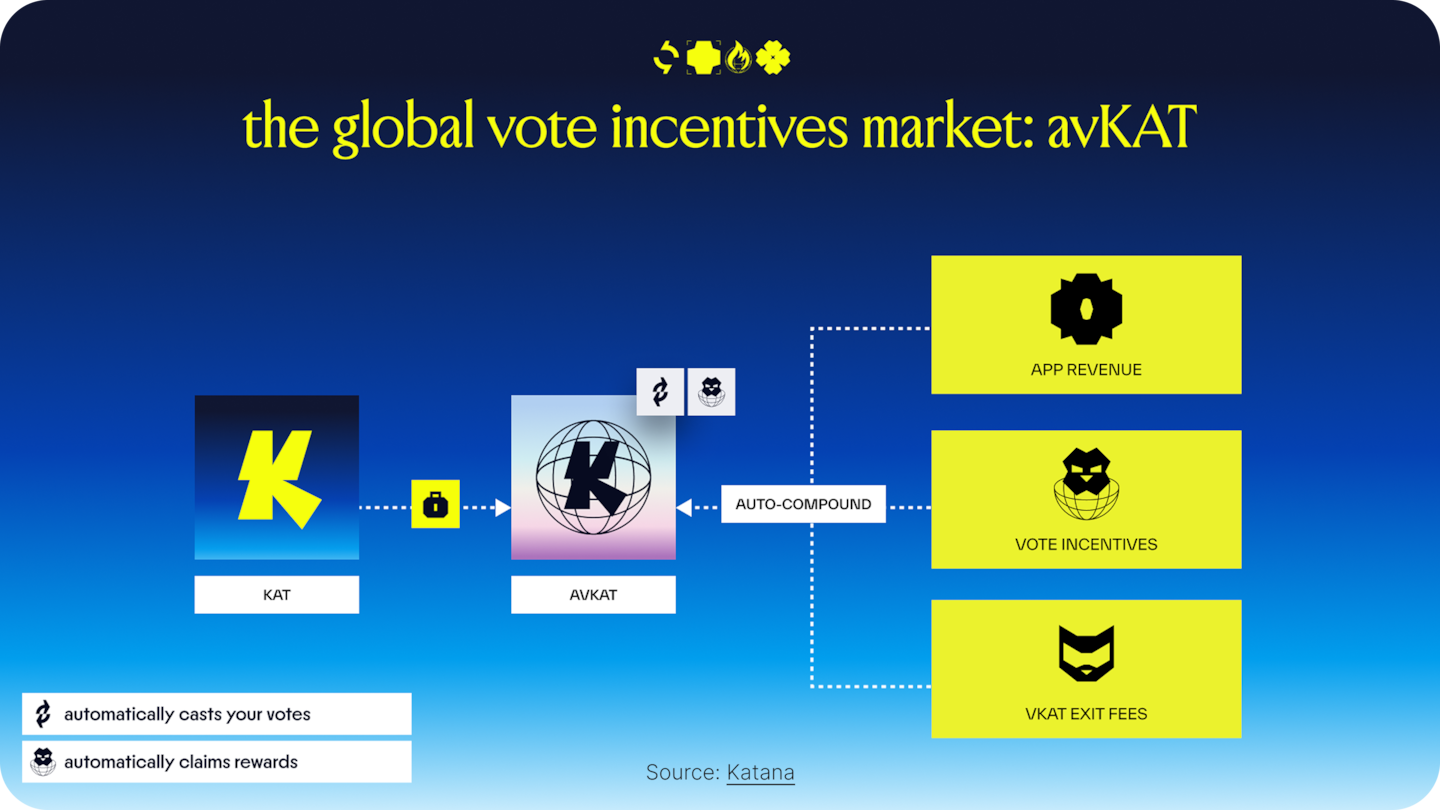

avKAT is a liquid, yield bearing representation of vKAT. It auto votes for the most profitable pools and autocompounds all yield. This is done by using a permissionless, profit-maximising relayer that abstracts away the need for users to manually direct emissions to pools, as required with vKAT.

At the same time, avKAT is a fully liquid ERC20 token meaning it can be used all across defi, like in lending protocols and DEXs

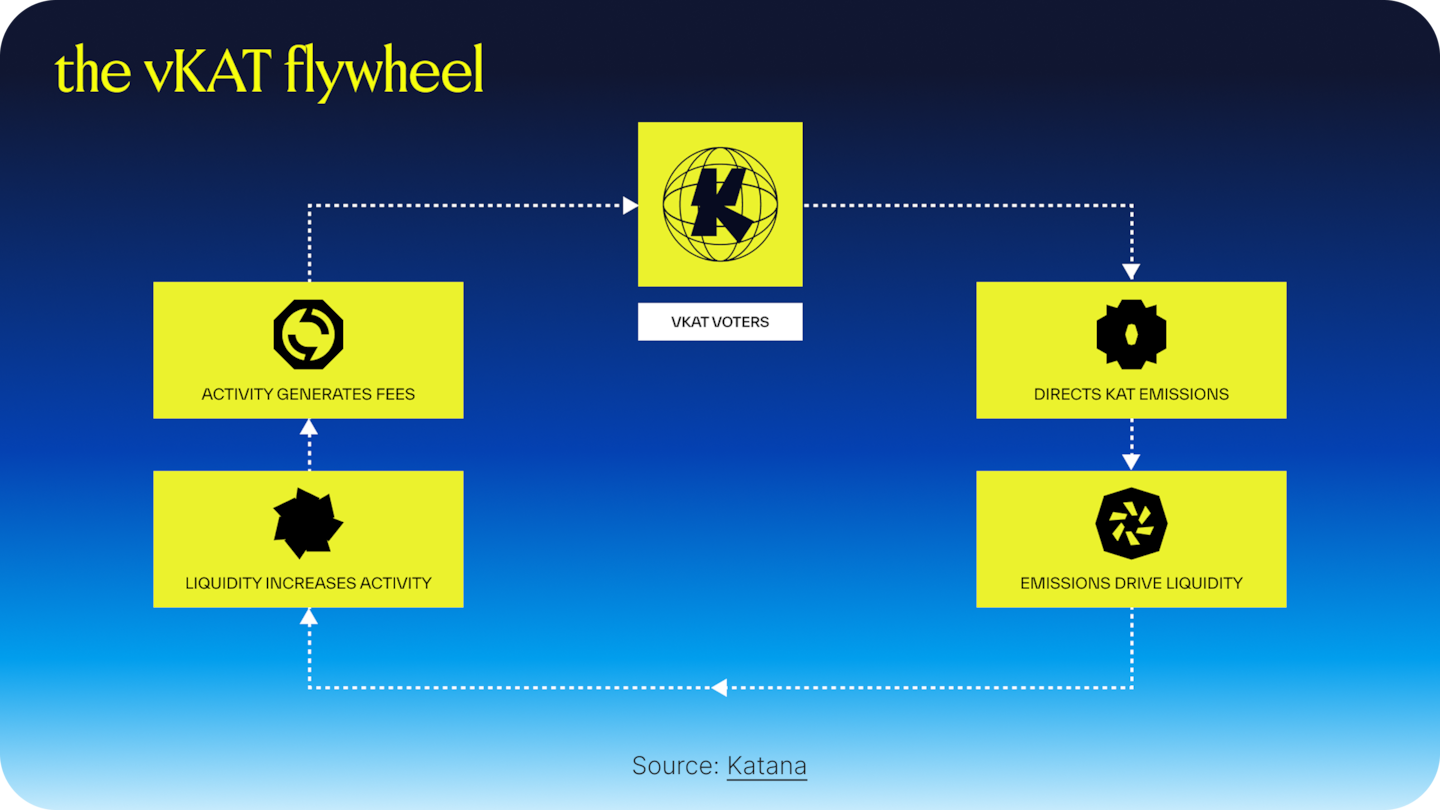

Together, these components form the Katana vKAT Flywheel: a feedback loop where emissions attract liquidity, liquidity enhances execution, activity generates fees, and those fees are redistributed to aligned participants. Over time, emissions act less as a subsidy and more as a catalyst, gradually giving way to sustainable, revenue-driven growth.

Roadmap and Vision

The project’s rollout follows a deliberate path:

Phase 1 (Q1 2026): Live deployment of the vKAT Armory, Sushi integration, and initial KAT emissions voting epochs.

Phase 2 (Q1–Q2 2026): Expansion across DeFi verticals (lending, perps, yield), integration of avKAT, automation of relayers, and preparation for cross-chain coordination via Agglayer.

Each phase progressively decentralises liquidity control while adding new yield sources to vKAT/acKAT, strengthening the ecosystem and ensuring Katana transitions from emission-driven growth to a sustainable network where revenue offsets emissions.

Introduction

Over the years, DeFi has evolved from fragmented experimentation to structured economic design. Yet sustainability remains a persistent challenge, as liquidity across most chains often proves transient rather than enduring. Attracting and retaining liquidity has become one of the sector’s defining struggles.

It all began with liquidity mining, a catalyst for rapid growth that also introduced inefficiencies, drawing capital that chased short-term rewards instead of building lasting depth. The emergence of vote-escrow (ve) models offered the first meaningful solution to this problem by rewarding long-term commitment and aligning governance with protocol success.

Curve established the foundation, Solidly introduced cooperative alignment through ve(3,3), and Aerodrome refined the model with adaptive monetary control. However, these systems remained confined to individual protocols. They succeeded in coordinating liquidity locally but could not extend that alignment across ecosystems.

Katana represents the next step in this evolution by extending ve-based coordination from the protocol level to the chain level. It unifies emissions, governance, and liquidity across the entire network, with applications competing for a shared, chain-level pool of liquidity rather than isolated protocol-specific incentives.

This report explores how Katana transforms ve(3,3) into a network-wide coordination engine powered by KAT, vKAT, and avKAT. It examines the system’s underlying mechanics, governance and security framework, and the roadmap guiding its path toward a self-sustaining liquidity economy for DeFi’s next era.

Historical Context: The Evolution of veTokenomics

Before ve-tokenomics, early AMM models such as Uniswap V2 relied on liquidity mining to attract capital. This approach succeeded in bootstrapping usage, but rewarded liquidity indiscriminately and encouraged short-term, mercenary behaviour. Capital flowed to the highest emissions rather than where it supported sustainable depth, and once incentives reduced, liquidity often migrated elsewhere. Governance power also sat largely disconnected from long-term commitment or economic alignment.

The ve model emerged as a response to these limitations. Instead of transient liquidity incentives, it introduced time-based commitment, governance participation, and reward structures designed to keep capital aligned with a protocol’s long-term health rather than short-term yield rotation.

Curve: Time-Locked Governance and Liquidity Commitment

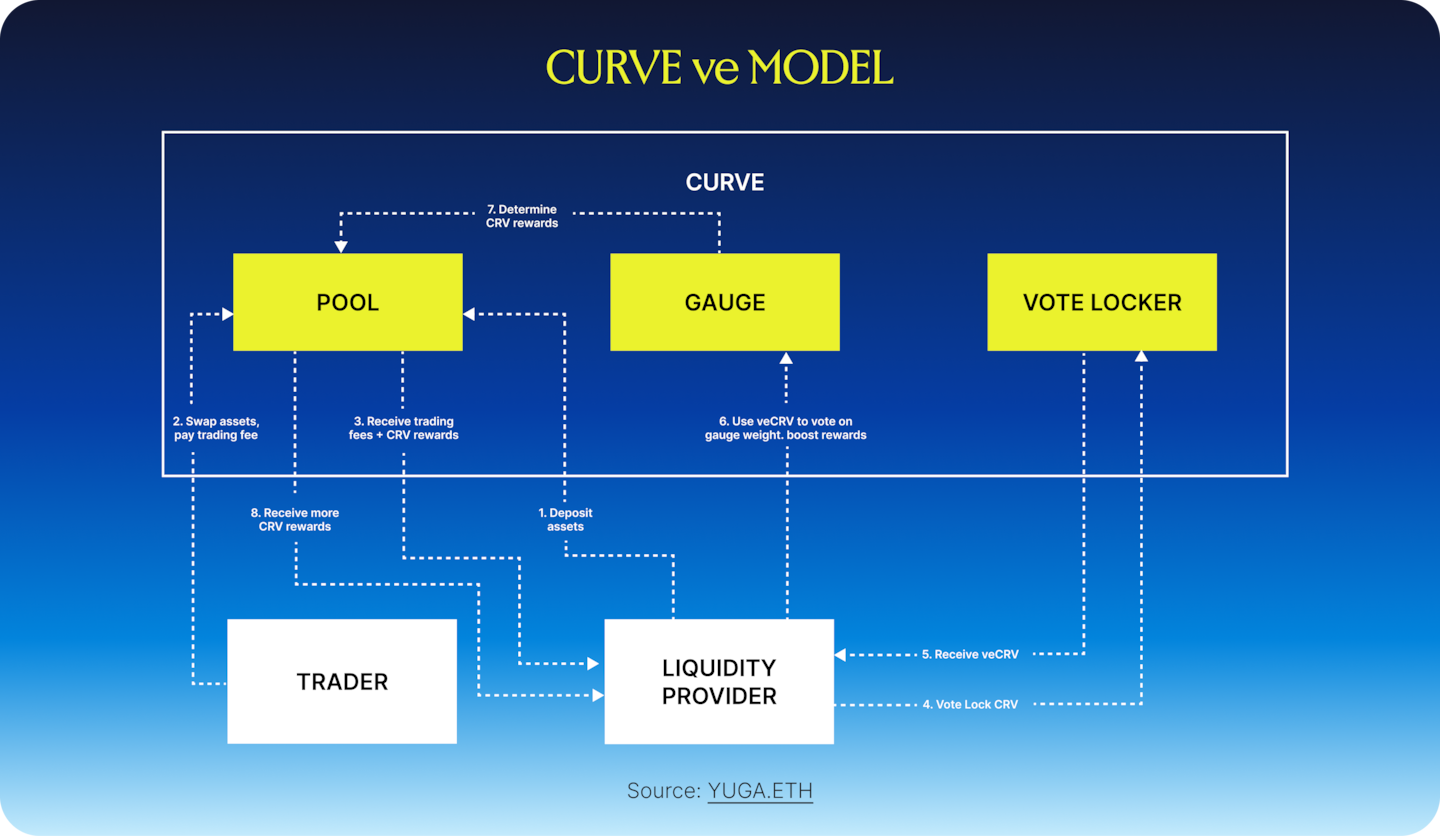

Curve introduced the vote-escrow model in 2020 and set a new standard for incentive alignment in decentralised finance. At its core, the framework rested on a simple but powerful principle: participants who commit to the protocol for longer should hold greater influence and capture a higher share of value.

Users can lock CRV for up to four years to receive veCRV, a vote-weighted asset whose power increases with lock duration and gradually decays towards expiry. In return, veCRV holders gain governance rights and a portion of protocol fees.

This structure achieved two major outcomes. First, it allowed Curve to attract deep and sticky liquidity across stable asset pairs. Second, it shifted governance towards participants with genuine long-term commitment rather than short-term speculation. Each epoch, veCRV holders vote on gauge weights to direct CRV emissions toward specific liquidity pools. In return, veCRV holders earn a share of Curve’s admin fees, which represent a portion of total swap fees collected by the protocol and vary by pool configuration. Liquidity providers, incentivised by emissions, direct their capital toward the pools governance prioritises. This design ensured consistent depth across Curve’s pools and cemented the protocol as the foundational stable-swap layer in DeFi.

As the system matured, a secondary market for governance influence developed. External protocols began offering bribes to veCRV holders to attract emissions to their pools, and platforms such as Convex and Hidden Hand emerged to coordinate this behaviour. Convex model, in particular, accelerated Curve’s adoption by pooling veCRV and boosting yields for depositors. However it also concentrated a significant portion of governance power (more than 50%) raising persistent concerns around centralisation and fair influence distribution.

Beyond vote concentration, the design of veCRV rewards introduces additional limitations. Because veCRV holders earn fees from the entire protocol, they can allocate votes based primarily on near-term incentives, particularly bribe revenue, without necessarily prioritising pools that support Curve’s long-term strategic growth. Liquidity providers, meanwhile, tend to optimise for gauges offering the highest emissions or strongest bribe flows rather than providing sustained liquidity where it may benefit the network most. As a result, while the system successfully encourages long-duration commitment, it does not always ensure that behaviour aligns with broader protocol objectives.

Additionally, the fixed four-year lock introduces meaningful rigidity. While it rewards conviction and reinforces alignment, it removes flexibility in volatile market environments. veCRV holders are exposed to extended periods of price fluctuation and inflation without the ability to exit early, which can be challenging in fast-moving DeFi cycles.

Curve established the intellectual foundation for ve-tokenomics and demonstrated that long-term locking can build durable liquidity and a powerful governance base. At the same time, its experience highlighted that time-based commitment alone does not guarantee strategic coordination.

Solidly: Introducing Cooperative ve(3,3) Incentives

Solidly emerged as a response to the rigidity embedded in Curve’s design. Its core innovation was the adaptation of Olympus DAO’s cooperation logic into the vote-escrow model, giving rise to ve(3,3). The objective was to move from enforced alignment through extended lock periods, to earned alignment through mutually reinforcing incentives.

The first major change was that vote-locked positions became liquid through veNFTs. Instead of treating commitment as fixed and illiquid, Solidly made governance power transferable, allowing market-driven price discovery and greater flexibility for participants.

The second key change was a tighter alignment between voter behaviour and liquidity provision. In Curve, ve holders earn fees from the entire protocol while LPs simply receive emissions. Solidly instead linked rewards to active, aligned participation. ve holders earn a share of fees and bribes only from the pools they support, with their voting power maintained through rebasing to avoid dilution. Liquidity providers, in turn, earn 80% of the fees, pool-specific bribes, and emissions only when they supply liquidity to those same pools under specific conditions. This design encouraged both voters and LPs to behave in a way that supported the protocol’s long-term success.

This approach effectively embedded Olympus-style cooperative game theory into liquidity incentives. Curve encouraged commitment through immobility; Solidly attempted to drive commitment through shared economic outcomes, where value compounds when participants remain aligned and erodes when they act opportunistically.

The concept was strong, but execution suffered from launch dynamics. Mercenary capital and a front-loaded emissions curve encouraged early extraction, while liquid governance positions made rapid exit easier. Without stabilising mechanisms, long-term alignment struggled to form.

Solidly ultimately served as a critical proof-of-concept. It revealed the promise of ve(3,3) and the limitations of relying on voluntary cooperation alone. It moved the ve model beyond rigid time-locking and toward behaviour-aligned incentives, laying the groundwork for more structured and resilient iterations to follow.

Aerodrome: Scaling ve(3,3) with Alignment and Monetary Control

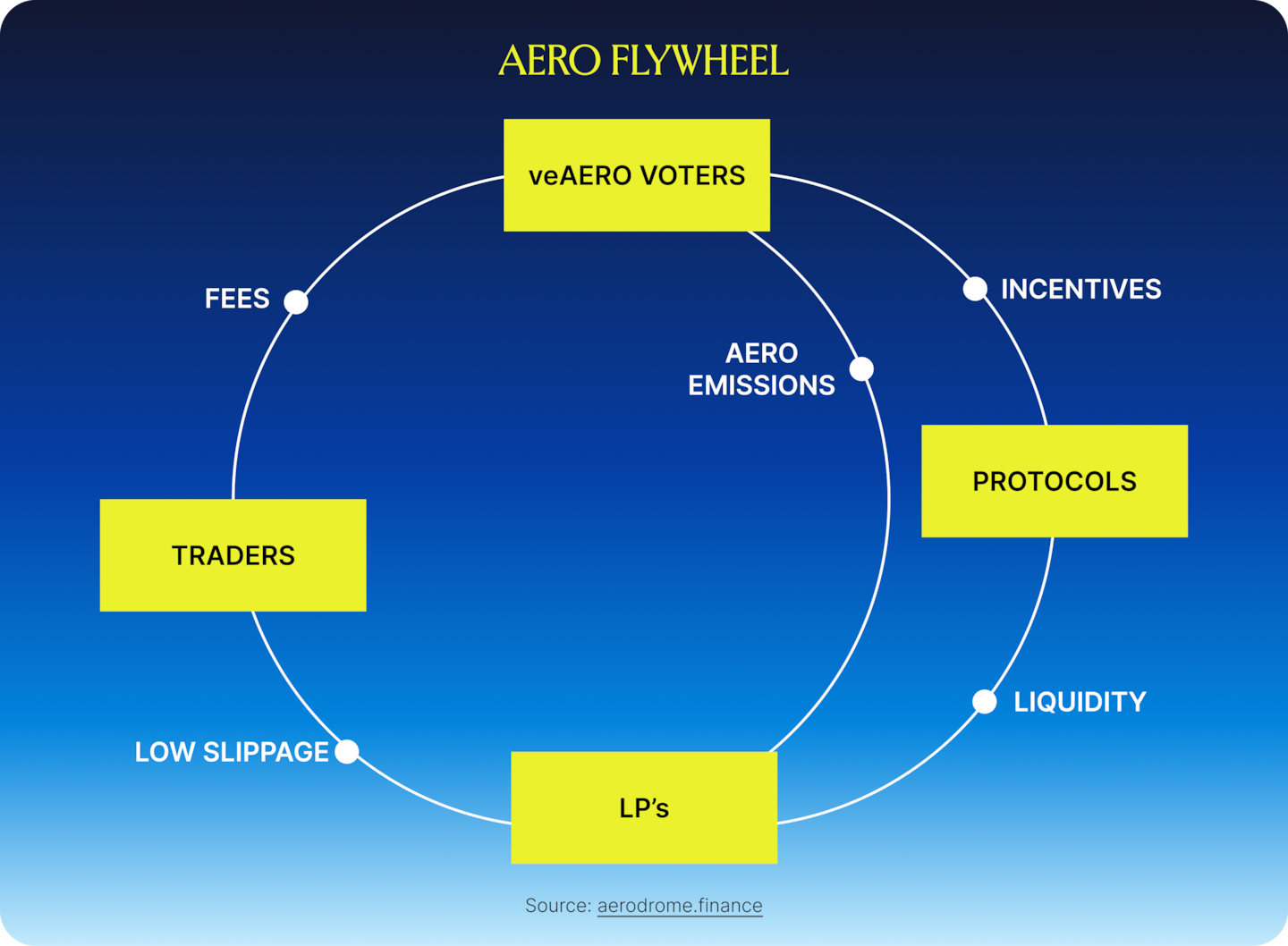

Aerodrome represents the next stage in the evolution of ve-token models, building directly on the ve(3,3) foundations introduced by Solidly and Curve and executing them in a structured, aligned, and sustainable way.

Like Solidly, Aerodrome uses liquid vote-escrow positions in NFT form, giving users flexibility while retaining long-term alignment. Users lock AERO to receive veAERO, which rebases to offset dilution from emissions, allowing holders to maintain voting power over time. veAERO holders decide where emissions are directed and earn 100% of the fees from the pools they vote for, along with bribes from protocols seeking to bootstrap or reinforce liquidity. This dynamic encourages voters to balance between high-bribe pools, which tend to be newer and in growth phase, and well-established pools that generate consistent fees.

Liquidity providers earn emissions by supplying liquidity to pools supported by veAERO holders and are incentivised to lock and compound rewards, further aligning them with long-term network health.

A major refinement is the introduction of the Aero Fed, a governed monetary lever that allows veAERO holders to adjust vote weight inflation in response to market and liquidity conditions. This adds a decentralised monetary policy layer to Aerodrome, enabling emissions incentives to adapt as the network matures rather than following a fixed curve.

Another important factor in Aerodrome’s success is its launch environment. As the primary DEX on Base, Aerodrome began with aligned partners and protocols who benefit from the platform’s long-term success rather than extracting value from it. This cooperative foundation created the right social and economic conditions for ve(3,3) to work as intended, avoiding the mercenary behaviours that challenged Solidly at launch.

Of course, the model is not without limitations. Aerodrome still relies heavily on emissions, and its long-term sustainability depends on balancing incentives with token value. AERO depreciation remains a risk, and buyback mechanisms have been introduced to support price stability and confidence.

Nevertheless, Aerodrome stands as the first successful proof that ve(3,3) can operate sustainably at scale when paired with alignment, governance discipline, and flexible monetary tools. It marks a pivotal step in the evolution of incentive models, moving the system from a theoretical experiment to a functioning liquidity coordination engine for an entire ecosystem.

Katana: Extending ve-Economics to the Chain Layer

Curve introduced long-term alignment through time. Solidly expanded this into cooperative alignment through shared incentives. Aerodrome demonstrated that ve(3,3) can operate sustainably at scale when supported by aligned stakeholders and adaptive monetary policy. All three represent the evolution of ve-tokenomics at the protocol level, focused on strengthening individual platforms.

Katana builds on this foundation by extending the model to the chain layer. Rather than directing incentives and liquidity to a single application, Katana applies ve-based coordination across the entire network. Emissions and capital flows are designed to benefit the applications that contribute most to the ecosystem, turning ve from a protocol tool into a network-wide economic mechanism.

At the centre of this model is KAT, the native coordination asset. KAT plays a similar role to CRV, SOLID and AERO, but with a far broader mandate: when locked, it directs incentives, liquidity and strategic focus across an entire chain rather than a single venue. Users can lock KAT to participate in emissions through vKAT and avKAT, representing different levels of commitment and influence for users and applications.

By elevating ve-based coordination from the protocol level to the network layer, Katana aligns incentives across the ecosystem. Protocols still compete for emissions based on their performance and bribes, but they do so within a shared growth engine where capital, builders, and governance incentives are structurally aligned at the chain level.

In the next sections, we explain how this framework operates in practice and introduce the mechanics behind KAT, vKAT and avKAT, establishing the foundation for Katana’s economic design and growth model.

Katana’s Chain-Wide Adaptation

The vote-escrow model was originally conceived to manage incentives within individual protocols. Katana extends this logic to the scale of an entire chain. The principle remains unchanged: those who commit capital and participate in emissions governance decide where incentives flow. What evolves is the scope. Rather than coordinating liquidity for one application, Katana coordinates liquidity for an ecosystem.

Why Chain-Level Tokenomics Matter

Liquidity in DeFi has long been fragmented. Each application competes for deposits, often launching its own token and emissions programme to attract users. These initiatives succeed briefly but rarely sustain. Capital rotates rapidly, incentives overlap and emissions are spent inefficiently. The result is high headline TVL but low long-term sticky productive TVL and assets parked for short-term emissions rather than deployed into strategies that generate durable fees and activity.

Chains have tried to solve this with grant programmes and temporary liquidity mining incentives. While they bring short-term activity, they rarely form a coherent long-term strategy. Protocols chase funding cycles, users act opportunistically, and the network bears the cost. Incentives become a recurring subsidy rather than a coordination tool.

The problem is structural. When each protocol manages its own incentives, liquidity becomes siloed and competition replaces collaboration. For DeFi ecosystems to mature, applications must thrive together. Lending, derivatives, trading and structured products rely on one another’s depth and stability.

Katana addresses this by consolidating incentives at the chain level. It brings incentives together at the base layer so that all the whitelisted applications (the ones which are integrated with the vKAT mechanism) benefit from the same shared source of incentives and alignment. In practice, this removes the need for protocols to fund costly liquidity wars, chase grants or maintain isolated reward structures. When a protocol attracts users, drives volume, or generates fees for the chain, it naturally receives greater support through KAT emissions. When it fails to contribute meaningfully, incentives shift elsewhere.

By placing incentives and decision-making at the base layer, Katana ensures that competition between protocols becomes constructive for the network rather than extractive. The model aligns participants across three core dimensions:

Stability - Capital remains anchored to the chain as long-term participation becomes more rewarding than temporary migration.

Efficiency - Liquidity is directed where it is most productive, avoiding wasteful incentive spending across isolated protocols.

Fair Access - Builders do not need to launch a token or emissions plan to attract liquidity. They join an existing system that supports them when they create value.

By treating liquidity as shared infrastructure, Katana positions the chain as the coordination layer for DeFi rather than a passive settlement environment. At the centre of this system stands KAT, the token that powers coordination, aligns incentives and transforms liquidity into a collective resource for the entire ecosystem.

KAT as the Coordination Engine

To realise this vision, Katana relies on its native token, KAT. Unlike conventional L1 tokens used primarily for gas or security, KAT functions as a DeFi coordination token, comparable in role to assets such as AERO or CRV. Its purpose is to direct liquidity and economic activity through the collective decisions of its holders, rather than through fixed emission schedules or centralised grants.

When users lock KAT, they receive vKAT, which grants them voting power over the future allocation of KAT emissions. vKAT holders determine where emissions flow each epoch, guiding liquidity toward the applications and pools that strengthen the network. Their decisions may be influenced by performance metrics, protocol fees, vote incentives or broader strategic priorities, but ultimately, what happens is the expansion of the network itself: deeper liquidity improves execution, increases trading volume and enhances fee generation which globally benefit the voters.

The following section examines these mechanisms in detail, outlining how KAT, vKAT and avKAT interact to create the flywheel that powers Katana’s incentive engine at the chain level.

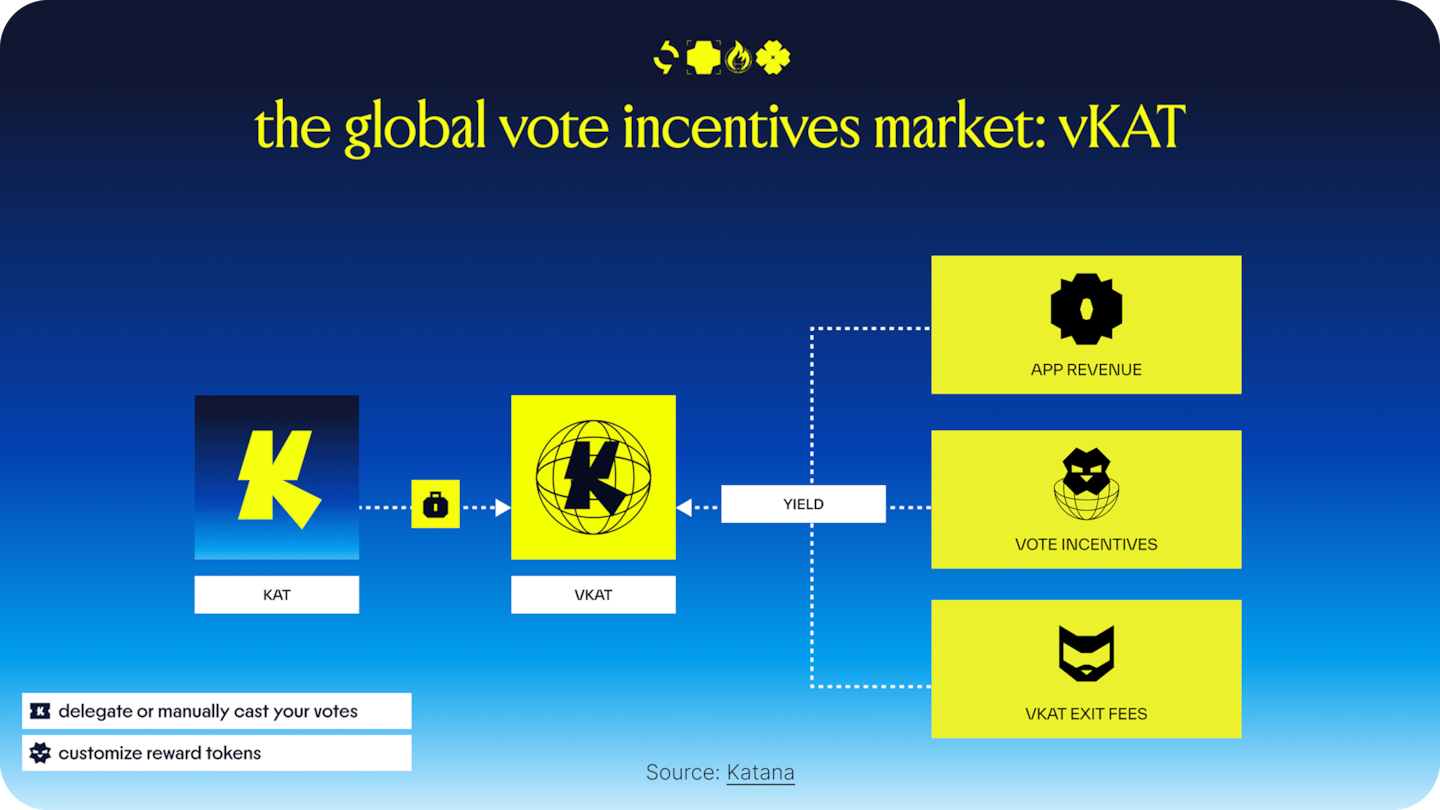

Inside the vKAT Armory

vKAT is the foundation of Katana’s incentive architecture, serving as the mechanism that aligns participants with the economic trajectory of the network. Where prior ve systems coordinated value within a single protocol, vKAT extends the model to chain-wide, ensuring that liquidity, governance, and capital deployment benefit the entire ecosystem rather than an isolated venue.

In this structure, users lock KAT to receive vKAT and participate in steering future emissions, liquidity flows, and ecosystem growth. Rewards then flow to those who direct their voting power toward the most productive markets and applications.

Unlike traditional liquidity mining, where emissions function as a short-term subsidy, vKAT transforms emissions into a capital allocation tool. Participants decide where liquidity is needed, where execution quality can improve, and where incentives will drive real utilisation. In turn, they earn fees and rewards from the pools they support, meaning yield is tied not simply to holding a token, but to actively contributing to the chain’s economic expansion. The result is a positive-sum loop that rewards genuine network participation.

Locking, Voting and Emission Direction

Locking KAT converts a user’s position into vKAT, a non-transferable asset representing long-term commitment and influence over KAT emissions. Each epoch (bi-weekly), vKAT holders allocate voting power across eligible liquidity pools and applications across the chain. Pools receiving more votes are allocated a proportionally larger share of KAT emissions for the following epoch.

This structure mirrors the voting flow pioneered by Curve, but extends it across the chain’s DeFi stack. Initially, incentives are directed toward liquidity venues such as Sushi pools, but will expand as the network matures to include lending markets, perpetual exchanges, yield markets, and other ecosystem applications.

Rewards for vKAT voters are earned through two core channels:

- Fees generated by the apps and pools they support

- External incentives from protocols seeking additional liquidity

Through this mechanism, voters become active liquidity allocators. Incentives move dynamically with demand and utilisation, and capital gravitates toward markets yielding genuine activity and fee generation. Over time, productive liquidity replaces subsidised liquidity, positioning emissions as a catalyst for long-term liquidity depth rather than a temporary incentive cost.

Exit and Cooldown Designed for Alignment and Flexibility

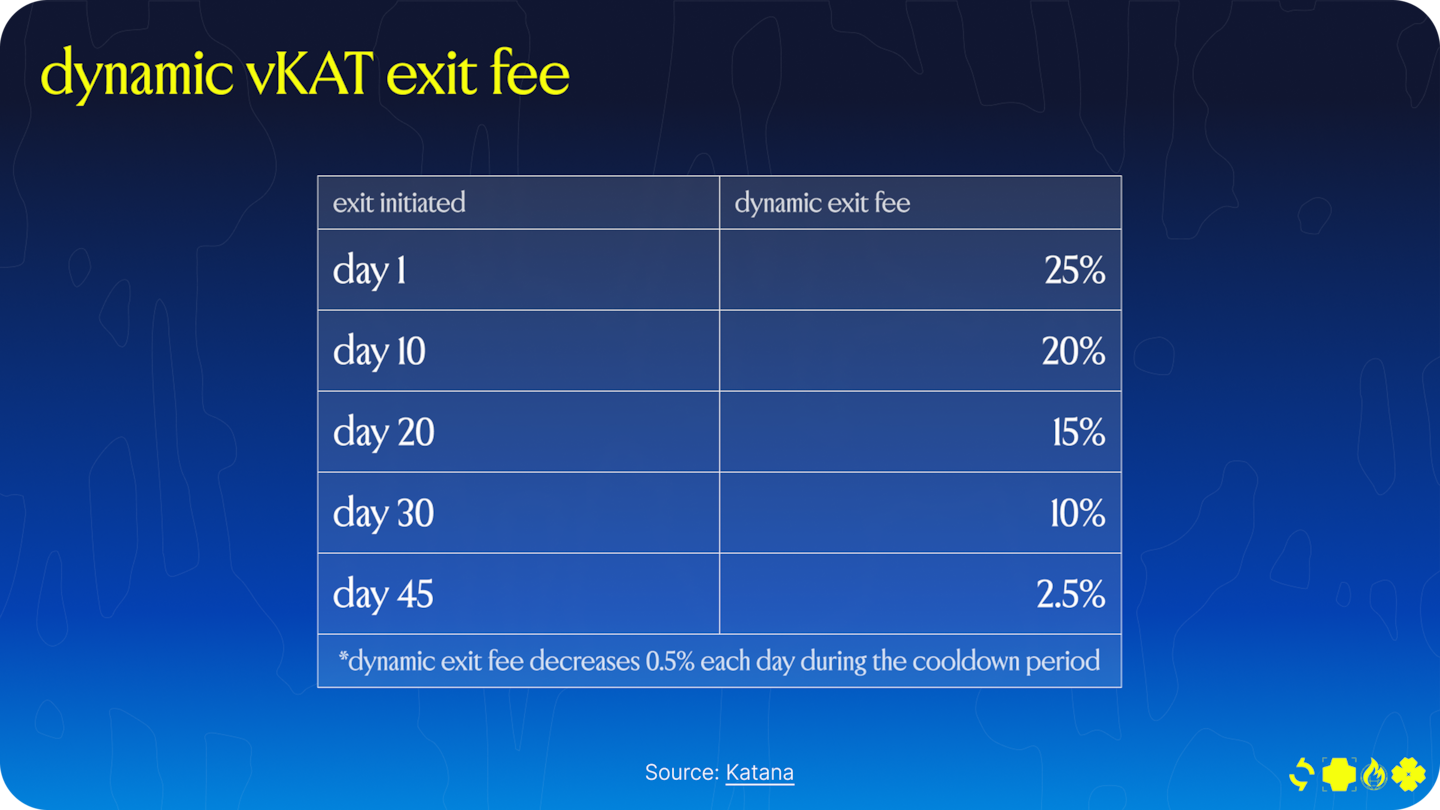

To preserve alignment between capital and governance, vKAT holders cannot exit their position immediately without cost. When a user initiates an unlock, they enter a structured forty-five-day cooldown period during which they retain their KAT but no longer vote or earn rewards. At any point during the cooldown, they may withdraw their tokens, subject to a sliding exit fee that falls from twenty-five percent (immediate exit) to two-and-a-half percent the longer they wait. The fees collected are redistributed to the remaining vKAT holders.

All exit fees are redistributed to remaining vKAT holders, reinforcing long-term participation and compensating aligned participants for temporary liquidity exit risk. The purpose is twofold:

- To prevent rapid cycling of capital and protect against mercenary flows

- To preserve flexibility while ensuring meaningful commitment to the system

In effect, the system values conviction but does not punish participants with inflexible lock structures, striking a balance between incentive rigidity and market practicality.

Delegated Participation and Liquidity Automation

Not every participant will actively manage voting strategies. To broaden participation while maintaining alignment, vKAT holders can choose between manual voting and delegation through relayers.

Relayers are permissionless, algorithmic voting logics that optimise votes according to predefined strategies. Each relayer operates autonomously, allocating votes every epoch based on yield potential, liquidity needs, or broader ecosystem health. Rewards flow back to the delegating user according to the chosen relayer’s strategy. Importantly, relayers can’t unlock, withdraw or modify the underlying KAT.

Delegation preserves the core principles of the ve model. Delegators remain locked, aligned, and economically invested in the network’s success, while more sophisticated participants can continue to vote manually and experiment with independent strategies.

avKAT: Liquidity Without Breaking Alignment

Vote-escrow systems are designed to reward commitment. They strengthen networks by encouraging participants to stay. Yet this same mechanism can limit flexibility. Once tokens are locked, users lose access to liquidity and optionality. Traditional ve models forced a choice between alignment and freedom.

Katana reduces this trade-off through avKAT, a transferable token that restores liquidity while preserving the underlying locked position.

What avKAT Represents

avKAT is a liquid, auto-compounding representation of vKAT. It gives participants liquidity without weakening commitment, transforming the vote-escrow model from a static lock into a living, auto-compounding position. Each token represents a share of locked governance power and accumulated yield, yet remains transferable and usable in DeFi, including lending protocols, CDPs, and more.

Unlike direct vKAT holdings, avKAT introduces three defining properties:

- Transferability. Holders can move, trade, or rebalance positions without waiting for unlock periods. However, avKAT may trade at a market-determined premium or discount depending on supply and demand.

- Automated voting. avKAT votes through a permissionless, profit-maximising relayer strategy that channels emissions toward productive pools.

- Auto-compounding rewards. Yield generated from emissions and fees is automatically used to lock additional KAT, increasing the vKAT collateral behind each avKAT. Holders can’t choose their reward tokens.

This design causes the avKAT:KAT ratio, initially 1:1, to rise gradually over time as each avKAT becomes backed by more vKAT. The result is a self-reinforcing asset that compounds value continuously while keeping holders aligned with the network’s growth.

avKAT transforms commitment into a flexible, yield-bearing state. Holders remain fully integrated in the Katana flywheel: they support liquidity and governance, share in ecosystem rewards, and retain the ability to adjust exposure or deploy liquidity elsewhere.

How It Works

Users can obtain avKAT in three ways: by locking KAT directly, by converting existing vKAT positions or by swapping assets for avKAT on sushiswap. Once issued, avKAT operates within Katana’s vKAT Armory infrastructure through automated voting logic. Its votes ensure that emissions continue to flow toward pools and applications that strengthen the network.

When rewards are generated, they are automatically converted into new KAT locks, increasing the total vKAT collateral behind every avKAT token. Over time, this mechanism lifts the intrinsic value of avKAT, similar to staking and reinvesting at every epoch, but executed continuously and without friction.

In practice, avKAT functions as a passive coordination asset. It keeps users aligned with Katana’s incentive economy while the protocol manages compounding, voting, and yield routing autonomously in the background.

Redemption and Market Liquidity

avKAT can always be redeemed for vKAT at its underlying value. From there, holders may initiate the standard cooldown to unlock their KAT, maintaining full parity with the core vKAT locking mechanism.

For those who prefer immediate liquidity, avKAT can also be traded on open markets, allowing users to exit or rebalance positions at current market rates. This dual-path design provides flexibility without compromising Katana’s economic alignment.

Whether redeemed or traded, avKAT ensures that every form of participation, active or passive, continues to serve the same objective: strengthening the network’s coordination flywheel and deepening the link between governance, liquidity, and growth.

Gauges, Coordination and Incentives

At the heart of Katana’s incentive architecture is a gauge-based voting system that links governance decisions directly to emissions. vKAT holders vote on gauges, which determine how KAT emissions are distributed across the network. Rather than each protocol independently competing for deposits, emissions are continuously reallocated by vKAT holders based on observed usage, performance, and demand.

Gauges as the Emission Engine

Every eligible pool or application within the ecosystem has an associated gauge. During each epoch, vKAT holders cast votes to assign weights to these gauges. The results determine how much of the upcoming emissions each pool receives.

This structure enables liquidity to flow where it delivers the greatest impact. A pool that drives volume and generates fees naturally attracts votes. A new protocol that demonstrates strong user traction can earn incentives immediately, without needing to issue its own token or fund a costly emissions campaign.

The result is a responsive incentive system in which emissions are determined through ongoing vKAT holder voting rather than fixed schedules. This allows rewards to track usage and demand over time, making liquidity a controlled and productive resource rather than a passive effect of inflation.

The Coordination Layer

As previously mentioned, Katana adds automation and transparency to this process through the Armory infrastructure and relayer network.

Relayers act as permissionless, algorithmic voting agents that can represent vKAT delegators. They optimise votes each epoch based on predefined strategies, such as maximising yield, balancing liquidity depth, or supporting ecosystem growth. Some of them will offer auto-compounding to maximise the user’s exposure to Katana.

Meanwhile, the Armory serves as Katana’s coordination backbone. It indexes data across all gauges, votes, and emissions, making this information openly accessible to protocols, users, and analytics platforms. This transparency allows participants to see where capital is flowing, why certain pools are receiving support, and how governance decisions affect liquidity across the chain.

The vKAT Flywheel

Together, KAT, vKAT, avKAT, relayers, and the gauge system form the vKAT Katana Flywheel, one of the engines that powers the network’s long-term sustainability. Each component reinforces the others in a continuous cycle of growth, alignment, and value creation.

- Emissions attract liquidity.

- Liquidity deepens offering better execution.

- Improved execution increases activity and fees.

- Fees flow back to vKAT and avKAT holders as yield.

- Rewards compound into more locked KAT.

The gauge system and reward structure are designed to favour voting that supports long-term network growth. While protocols can still compete for emissions, including through vote incentives, liquidity on Katana is increasingly tied to contribution rather than short-term rental. Strategic deployments can also be supported directly by the Katana Core Team using its KAT allocation.

Over time, emissions distributed via the vKAT armory are intended to be funded through KAT buybacks from Katana’s core revenue streams, including Vaultbridge yield, AUSD yield, chain-owned liquidity yield, and sequencer fees. This shifts incentives away from pure inflation and toward a more sustainable, revenue-backed model for rewarding productive liquidity.

The Katana Flywheel creates a structure where growth reinforces itself, with emissions serving as the catalyst that bootstraps long-term liquidity and real economic activity. As network usage and fee generation expand, reliance on emissions naturally declines, giving way to sustainable liquidity grounded in productive capital.

Roadmap, Risks, and Next Steps

Katana’s vKAT Armory rollout is structured in deliberate phases designed to progressively expand liquidity coordination while maintaining operational reliability. Each stage builds on the prior by expanding vKAT and avKAT integrations, automating emissions across applications, and reinforcing the network’s self-sustaining liquidity loop.

Phase 1 (Q4 2025 – Q1 2026): Live Rollout Underway

The first phase of the vKAT Armory deployment is about to go live and forms the foundation of Katana’s vKAT Flywheel.

vKAT and avKAT deployment: The vKAT/avKAT locker is operational, enabling users to lock KAT and participate in governance through direct emissions voting. The Sushi gauge integration has entered mainnet testing, allowing early participants to direct rewards across liquidity pools.

avKAT integrations: avKAT will begin to integrate into external DeFi protocols, allowing applications to compound their governance power through sustained performance. This will tie incentives more tightly to onchain value creation rather than short-term rewards.

Relayer automation: The relayer framework will evolve into an autonomous layer capable of real-time emission balancing, dynamic vote routing, and adaptive reward calibration.

Core infrastructure integration: The Katana app now incorporates indexer and relayer tooling, providing real-time emission data and voting analytics. The staking interface and auto-compounding logic have been integrated with the Armory, enabling users to manage positions and track yields seamlessly.

Ecosystem coordination: The first liquidity cycles are underway, with emission distributions actively tuned to balance rewards between deep liquidity and sustainable fee generation.

Analytics and transparency: Onchain dashboards now monitor reward flows, gauge participation, and the distribution of productive TVL, offering a transparent overview of how value circulates through the ecosystem.

This phase represents the operationalisation of Katana’s liquidity engine, transforming vKAT voting from a theoretical model into a live coordination mechanism.

Phase 2 (Q1 – Q2 2026): Ecosystem Expansion

The second phase focuses on extending Katana’s coordination model across all DeFi verticals and scaling its vKAT voting infrastructure beyond Sushi.

Expanded voting reach: vKAT voting will extend to lending, perpetuals, and structured yield products built on Katana, connecting emissions directly to productive activity across the entire DeFi stack.

Cross-protocol analytics: vKAT Armory dashboards will expand to display multi-protocol metrics, enabling the community to monitor liquidity efficiency, productive TVL ratios, and chain-aligned activity across all Katana-native applications.

By the end of Phase 2, Katana will operate as a fully integrated liquidity network, coordinating yield and incentives across its application stack.

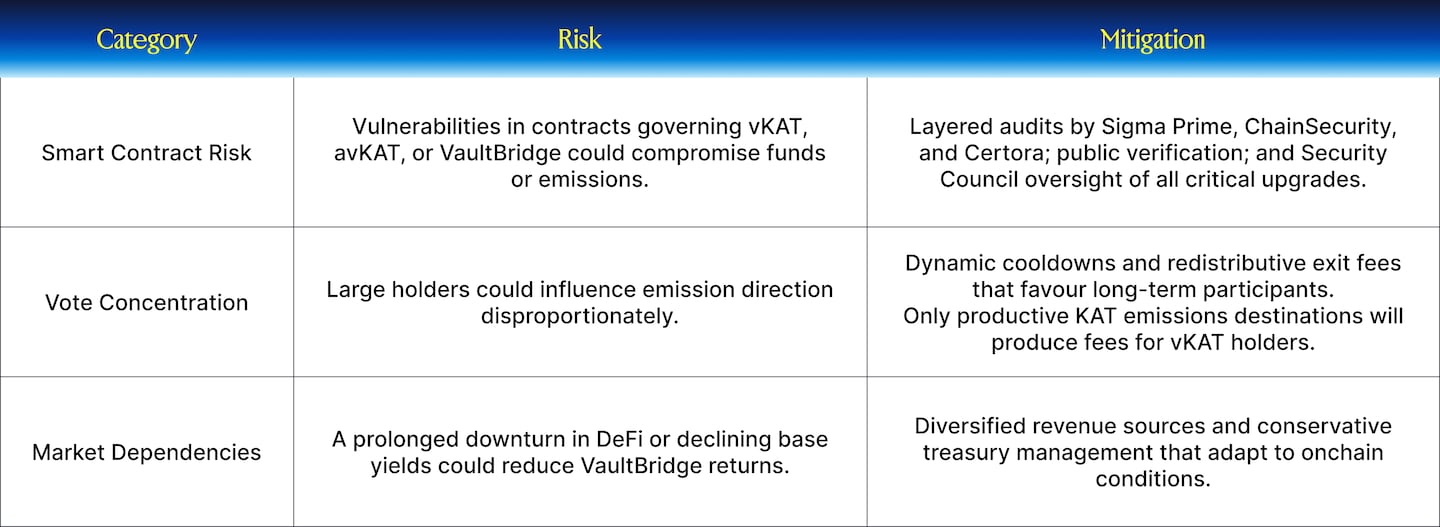

Risk and Mitigation Overview

Katana’s vKAT Armory architecture integrates safeguards across smart contract execution, governance, and market dynamics. Its layered structure minimises systemic risk and ensures that key components remain continually assessed and strengthened over time.

Conclusion

Katana’s model marks a shift in how DeFi ecosystems organise growth. By embedding emission coordination at the chain level, it reduces the inefficiencies of fragmented liquidity and short-lived incentive programmes. Emissions are directed toward productive activity, vKAT voting provides allocation discipline, and liquidity deepens where it generates sustained fees and usage.

As Katana’s incentive mechanisms mature, control over emissions becomes more widely distributed and increasingly informed by real economic signals. Over time, emissions transition from a primary subsidy into a secondary accelerator, supporting liquidity that is already justified by usage, fees, and yield generation.

As the vKAT Armory expands, vKAT holders gain access to a broader set of yield sources beyond emissions alone, including protocol revenues, external integrations, and application-level fees. This diversification reduces reliance on inflationary rewards and strengthens the long-term attractiveness of holding and voting with vKAT.

Over time, Katana could become the blueprint for the next generation of onchain economies: aligned, efficient, and sustainable by design.

Download the report

Download the Katana: Bringing ve(3,3) to the Chain Level report (PDF)