In decentralised finance (DeFi), a protocol’s governance model often determines its long-term viability. Many projects rely on symbolic governance, where token holders vote on abstract proposals but lack real, measurable influence over the protocol’s economic engine. Katana, however, redefines governance entirely through its vKAT system, transforming voting into an active engine for directing future KAT emissions and driving sustainable value accrual across the entire network.

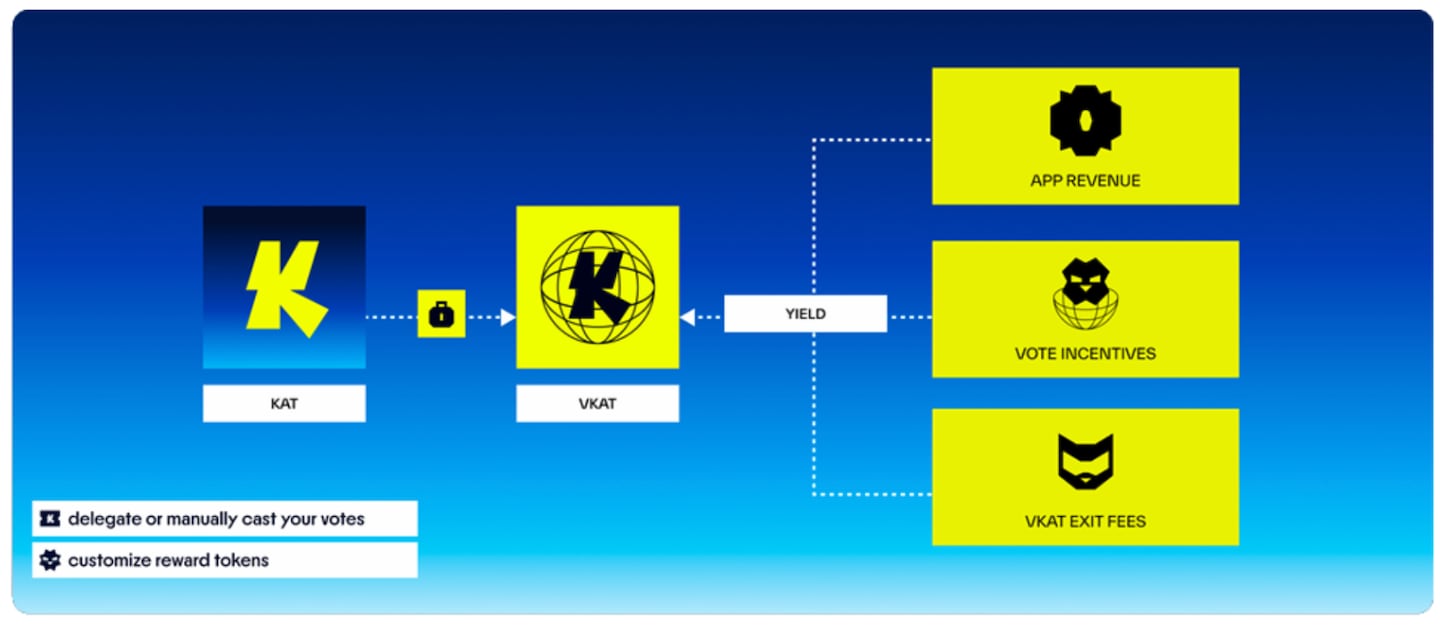

The vKAT system is a veTokenomics framework used within the Katana DeFi network. The system is designed to drive sustainable growth and align broader network incentives by giving token holders a direct say in how future KAT emissions are allocated (and earning a portion of the fees from the pools they vote for).

This spotlight explores the high-level mechanics of vKAT, revealing how it builds on the proven principles of veTokenomics while leveraging Katana’s underlying chain-level design to create a robust, economically productive DeFi flywheel.

From Symbolic Governance to Productive Control

The traditional DeFi token model has a core flaw: the governance token, while conferring voting rights, often lacks intrinsic utility beyond speculation. This creates misalignment, where short-term participants gain influence without true long-term commitment to the protocol’s success.

Katana’s solution is to make governance operational, not ceremonial.

The vKAT system redefines the core function of the token holder. Rather than passively voting on abstract changes, vKAT holders directly control one of the network’s most valuable resources: the flow of KAT emissions to boost DeFi pools. Token holders actively shape liquidity, incentives, and the distribution of value across the chain’s core markets. This mandate transforms the governance token from a speculative asset into a powerful financial instrument tied to the network’s productivity.

The Armory: How vKAT Works

The vKAT Armory serves as the command centre for the Katana governance system, functioning as the primary user interface for long-term ecosystem alignment.

The mechanism is straightforward yet impactful:

Minting vKAT and Voting Power

Users lock their native KAT tokens to mint vKAT (voting KAT). Unlike time-weighted models, vKAT receives its full voting power immediately upon minting. There is no concept of “longer lock equals more voting power.” This design prioritises participation and aligns incentives through its unique exit mechanics rather than time-based locks.

Directing Emissions

vKAT holders use their voting power to direct KAT emissions (liquidity mining rewards) to specific DeFi pools and markets on the chain. This gauge system is where the economic power lies, ensuring rewards flow to the markets that the community deems most productive or strategically important.

Voting Flexibility

vKAT holders are not required to actively vote in every 14-day epoch to participate. The system is designed for flexibility:

- a) Votes from one epoch automatically roll over to the next, ensuring continuous participation and less operational overhead for voters.

- b) vKAT holders can delegate their voting power to ‘relayers’. Relayers are permissionless, non-custodial services that allocate votes each epoch based on a pre-defined criteria (profit-maximising, specific pools, etc.). Holders still choose a customised payout token mix for their rewards.

- c) Users can convert vKAT into avKAT (auto-voting KAT), a transferable ERC-20 token. avKAT auto-votes via a profit-maximising relayer strategy and auto-compounds all fees and incentives back into more vKAT under the hood, offering a “set-it-and-forget-it” governance solution. Holders can convert between vKAT and avKAT at any time with no fee.

vKAT Exit Mechanics

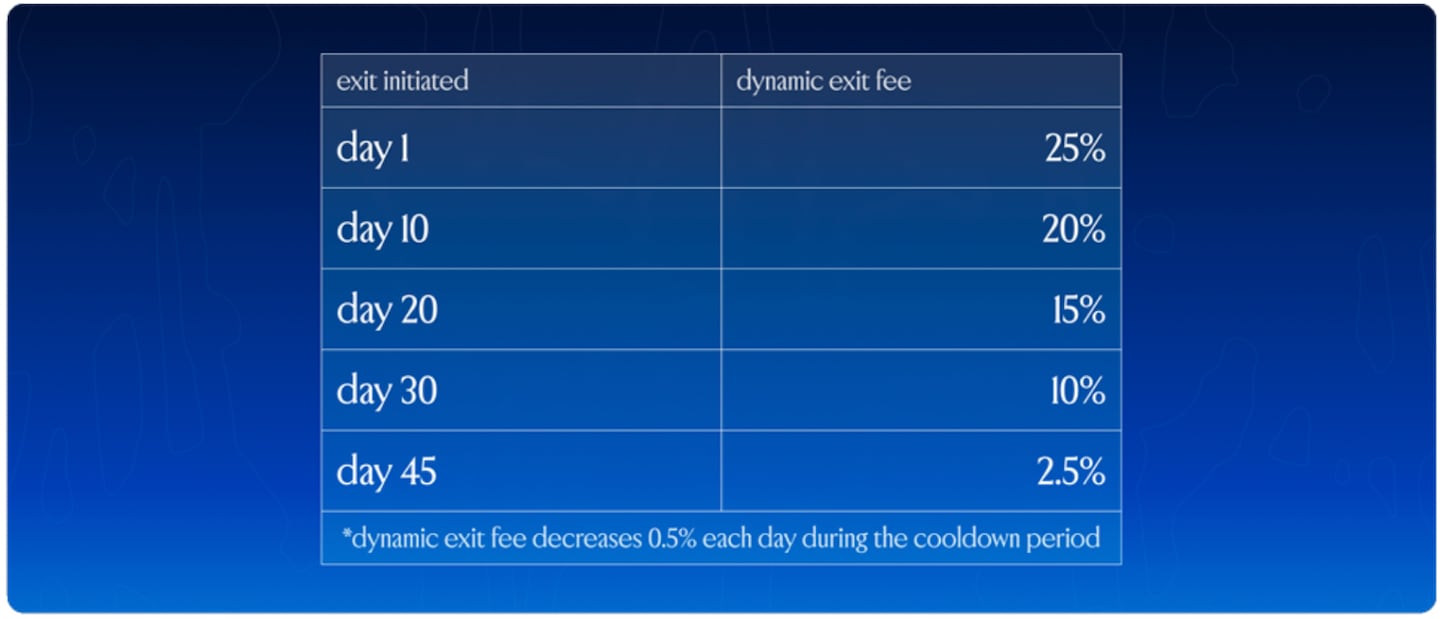

To exit the system and redeem KAT, holders initiate a 45-day cooldown period. During this cooldown window, the user’s vKAT has no voting power and earns no rewards. A linear fee is applied to the withdrawal, starting at 25% on day 1 and decreasing linearly to 2.5% over the 45-day period. This mechanism ensures a committed capital base while still providing a clear path to liquidity.

Users needing immediate liquidity have two options: exit immediately by paying the fee corresponding to that day in the cooldown curve, or convert vKAT to avKAT to trade on a DEX at market price. As a liquid wrapper, avKAT may trade at a market discount reflecting vKAT’s exit fee curve; or unwrap avKAT → vKAT (no fee) and use the cooldown.

vKAT Holder Revenue

As active participants, vKAT holders earn revenue from three distinct sources:

- Pool Fees: A portion of the trading fees (or similar) from the specific liquidity pools they vote for.

- Protocol Vote Incentives: Rewards (or “bribes”) paid by other protocols or parties who want to attract vKAT votes to their pools.

- vKAT Unlock Fees: A share of the fees collected from other users who are exiting the vKAT system.

Crucially, vKAT holders do not receive chain-level revenues (such as VaultBridge yield, CoL yield, sequencer fees, or AUSD revenue). These revenues are managed by the Katana Foundation to deepen liquidity and boost yields across the entire ecosystem, benefiting all participants indirectly. Emissions begin from the KAT treasury; over time the foundation intends to fund emissions via KAT buybacks using chain-level revenues.

Beyond veTokenomics: Scaling to the Chain Level

The concept of vote-escrowing was pioneered by Curve Finance (veCRV) to align liquidity incentives. This was later expanded by projects like Solidly and its successors, Velodrome and Aerodrome, which introduced the concept of bribery and decentralised revenue sharing.

Katana’s vKAT scales this established model to the chain level, representing a significant evolutionary leap:

Whole-Ecosystem Influence

In prior veTokenomics models, influence was restricted and siloed within a single protocol, such as voting on one DEX’s pools. Katana’s vKAT model fundamentally breaks this mould by elevating veTokenomics influence from the app level to the chain level. Instead of influencing just one application, vKAT holders can direct KAT emissions to eligible DeFi pools listed in the Katana vKAT armory (starting with Sushi; expanding to Morpho and other ecosystem apps).

This chain-wide scope means a vKAT holder’s influence is not confined to a single application. It allows them to steer incentives across all integrated dApps, including lending markets, perpetuals, and yield aggregators, and more.

Holders can strategically allocate network-wide rewards to bootstrap new protocols/assets, deepen critical liquidity, and earn a portion of the fees for the pools they voted for. This capability creates a unified incentive layer that aligns all participants around the network’s long-term collective growth.

Modular Implementation with Aragon

To ensure the system is secure, transparent, and built for future adaptability, Katana implemented its core veTokenomics logic using infrastructure from Aragon, a leading project that provides modular, production-ready frameworks for on-chain organisations.

This strategic choice guarantees that Katana’s sophisticated mechanics are deployed securely. It also empowers the Katana Foundation to safely manage its own critical parameters, from voting epochs to reward distributions.

Because the framework is modular, protocols can adapt and evolve. New features can be added or existing parameters can be securely modified through transparent, on-chain proposals.

The Growth Flywheel: Linking Governance to Real Yield

The ultimate test of any tokenomics model is its ability to create a sustainable, compounding economic loop, or governance flywheel. Katana achieves this by separating its governance model from its chain revenue streams, creating two parallel engines for growth.

Reduced Supply & Long-Term Alignment

Locking KAT tokens to mint vKAT (1:1) immediately removes them from circulation. The 45-day exit cooldown and fee structure strengthen the network’s long-term alignment, stabilising governance and providing a consistent economic base.

Emissions Drive Productivity

vKAT holders direct emissions to strategically important markets, improving trading execution and attracting more capital, thereby increasing overall network activity.

Accrual and Use of Chain Revenue

As activity and volume grow, the network generates revenue through several proprietary mechanisms, including:

- VaultBridge Yield: Assets bridged into Katana are not idly locked. Instead, they are deposited into secure, yield-generating strategies on the Layer 1 network (e.g., Morpho lending vaults on Ethereum).

- Sequencer Fees: As a Layer 2, Katana collects sequencer fees from all transactions. Katana funnels 100% of its net sequencer fees and a portion of chain revenue into chain-owned liquidity. A permanent liquidity fund managed by the Katana Foundation to provide bear-market resilience and a base layer of DeFi liquidity on the chain.

- AUSD Treasury Yield: The T-Bill-backed stablecoin, AUSD, generates yield that flows back to the DeFi ecosystem.

- Yield from Chain-Owned Liquidity (CoL): A portion of the fees and yield generated from the above sources flow into the CoL, a permanent liquidity reserve managed by the Katana Foundation. This treasury can, in turn, be used to further seed core markets, deepen liquidity, and provide sustainable incentives.

These chain-level revenues are managed by the Katana Foundation, not paid to vKAT holders. The Foundation uses this treasury to seed core markets, deepen liquidity, and provide sustainable incentives, creating a healthier ecosystem for everyone.

This creates a powerful, self-reinforcing cycle: Commitment (vKAT Lock & Exit) → Operational Control (Emissions Direction) → vKAT Revenue (Pool Fees, Incentives) AND Ecosystem Growth (Foundation-managed Chain Revenue).

A Governance Model That Works

Katana’s vKAT system fundamentally transforms governance from a passive right into an active, vital economic function. In this model, governance is no longer just a disconnected vote. It is directly tied to the network’s real yield and tangible success, making every holder an active participant in value creation.

In a competitive market where token utility is often diluted or abstract, vKAT’s utility is clear and measurable. It is quantifiable through its direct control over network emissions, its power to direct fee streams, and the observable liquidity outcomes it produces. This creates a transparent feedback loop where token holders can see the direct economic impact of their decisions.

Ultimately, Katana’s governance model offers a powerful template for the entire decentralised economy. It provides a working mechanism for aligning the incentives of all participants (users, builders, and capital providers) around a shared goal of long-term, verifiable productivity.