In the fifteen years since Bitcoin’s launch, crypto has gone from a niche experiment to a foundational part of the digital economy, yet adoption patterns remain deeply uneven. To provide a more complete view beyond simple trading volume, the Bybit World Crypto Rankings Index was built to measure how deeply and in what ways countries are adopting crypto.

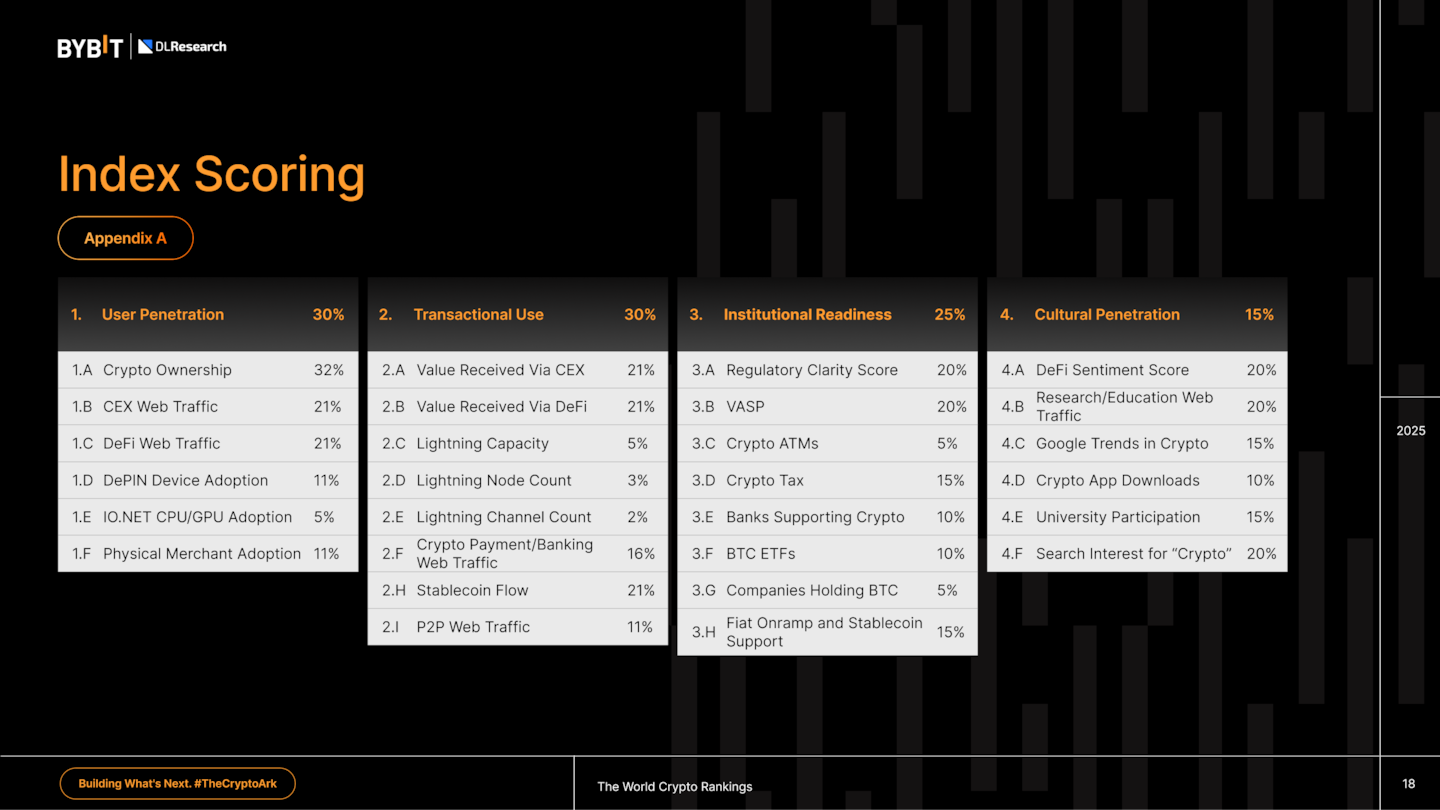

Most existing measures overlook critical distinctions between grassroots usage and institutional participation, but the Index, developed in partnership with DL Research, offers a more complete view by drawing on 94 underlying data points across four key pillars.

Some countries have welcomed crypto into the fabric of their financial systems. Others have tried to shut it out. And in many more, it exists in a grey area, used by millions, yet still lacking legal recognition or policy support.

Most existing measures of adoption, whether focusing on trading volume or market capitalisation, only capture part of the picture. They tend to favour the biggest markets and overlook critical distinctions: between grassroots usage and institutional participation, between speculation and real-world utility, and between markets that are driving adoption out of opportunity versus those responding to necessity.

The Bybit World Crypto Rankings Index was built to offer a more complete view. Developed in partnership between Bybit and DL Research, it compares how 79 countries are adopting crypto, not just by how much, but by how deeply and in what ways.

The Index evaluates 79 countries across four pillars: user penetration, transactional use, regulatory infrastructure, and cultural engagement, utilizing 30 metrics derived from 94 inputs. It aims to measure who’s furthest along the path to meaningful and mainstream crypto adoption.

A Comparative Adoption Framework

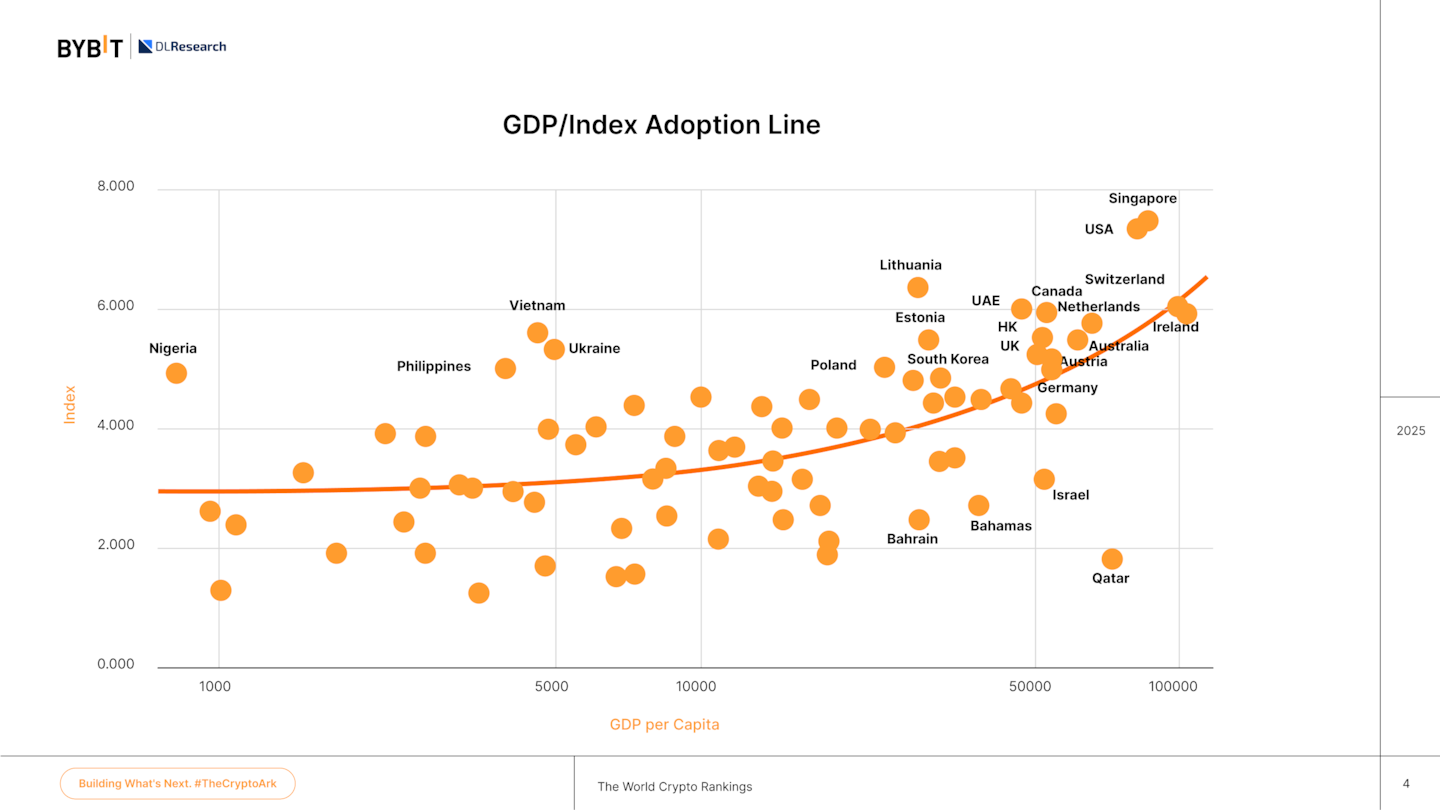

Rather than a leaderboard, the Index offers a comparative framework. Scores are relative, showing how countries stack up against each other, not how far they’ve come in isolation.

This approach reveals adoption patterns that would otherwise be obscured. It explains, for instance, why smaller countries like Lithuania or Vietnam can rank alongside major financial hubs like the United States and Singapore.

What the results show is that crypto adoption is not following a single script. Countries are moving forward through different combinations of regulation, infrastructure, demand, and necessity. In some places, adoption is being driven from the top down. In others, it’s rising from the ground up.

Singapore and the United States lead the Index overall, with consistently strong performance across all four pillars. Their positions reflect deep integration of crypto into financial and technological ecosystems, as well as robust public engagement.

But countries like Vietnam and Lithuania also make the top tier, despite having vastly different economic and regulatory contexts. Vietnam, in particular, stands out for high grassroots activity and widespread usage of decentralised tools, even in the absence of formal support. Lithuania, on the other hand, has become a European licensing hub, with a strong policy framework attracting crypto firms and financial innovation.

These findings highlight an important truth: adoption can flourish under very different conditions.

Supportive regulation and mature infrastructure help, but they are not the only path. In many cases, users are finding ways to access and use crypto regardless of official policy, often because it meets a pressing financial need.

Countries like Nigeria, Ukraine, and the Philippines show that in places where inflation, instability, or remittance dependency are daily realities, crypto becomes a tool of economic resilience.

Patterns Behind the Rankings

One of the most striking divides revealed by the Index is how differently crypto is used in wealthy versus developing countries.

In high-income nations, adoption tends to be investment-led. People approach crypto primarily as an asset class, often as a speculative tool or a gateway to tokenised financial products.

In lower-income and middle-income countries, adoption is far more likely to be utility-led. Crypto is used to store value, bypass banking restrictions, send remittances, or receive salaries.

This behavioural split is evident when comparing the Index’s individual pillars. Wealthier countries generally score higher on user penetration, regulatory clarity, and cultural engagement. But they do not necessarily lead to transactional usage.

That pillar is dominated by countries where crypto is used not just as a hedge or a curiosity, but as a core financial tool, often in response to systemic gaps in local banking or monetary systems.

Across all these contexts, one product stands out as a universal driver: stablecoins.

Regardless of income levels or regulatory approach, stablecoins are the most widely adopted crypto instrument. In some markets, they serve as a safe haven in times of instability. In others, they function as a workaround to currency controls, a bridge for international payments, or a key to accessing decentralised finance.

Their adaptability across such different environments has made them a foundational layer of global crypto activity.

Emerging Adoption Trends

While the Index is a snapshot of where the world stands today, it also reveals where things are heading. Three emerging trends are reshaping how adoption evolves: the rise of local-currency stablecoins, the tokenisation of real-world assets, and the expansion of crypto payrolls.

In many markets, governments and private issuers alike are pushing to bring domestic currencies on-chain. Local stablecoins won’t replace dollar-pegged tokens, but they’re increasingly being positioned for everyday commerce, domestic payments, and regional trade.

In places like Nigeria, Ukraine, and Vietnam, these experiments are already underway, some led by central banks, others by decentralised teams.

Tokenisation, meanwhile, is moving from pilot to scale. The total on-chain value of tokenised real-world assets has surged in 2025, especially in jurisdictions with strong regulatory frameworks and institutional readiness. Countries like the United States, Lithuania, and Canada are building the systems to bring tokenised treasuries, real estate, and private credit into mainstream capital markets.

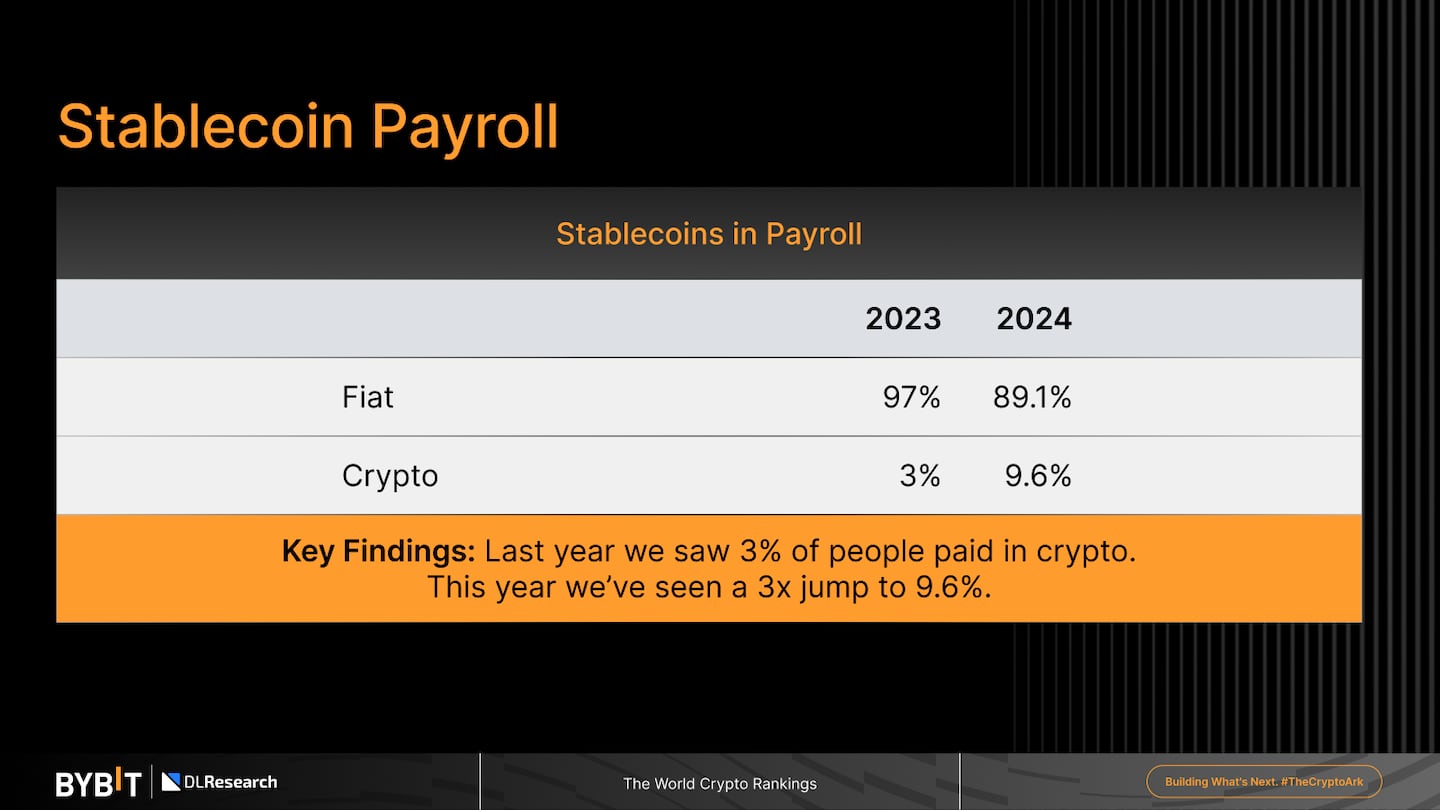

Perhaps the most human-facing shift is the formalisation of crypto payroll. Once limited to freelancers in web3, it’s now spreading to a broader class of remote workers and globally integrated firms.

Stablecoins, particularly USDC, have become a reliable method for sending salaries across borders. In high-remittance countries like the Philippines, Kenya, and Brazil, this trend is rapidly scaling.

For financial hubs such as the UAE, Hong Kong, and Singapore, it’s becoming a feature of enterprise operations and fintech integration.

Integrate or Be Left Behind

As crypto embeds itself more deeply into global financial infrastructure, the policy debate has shifted from if to how governments will respond to its inevitability.

Some countries will integrate it, building regulatory frameworks, licensing systems, and public infrastructure that support safe, scalable adoption.

These nations are likely to attract capital, foster innovation, and gain strategic advantages in the digital economy. Others will resist, turning to bans or restrictive licensing in an attempt to control growth. But history suggests that crypto activity will persist regardless, just outside the reach of those formal systems.

By 2030, you’ll see the divide will not be between adopters and non-adopters, but between integrators and restrictors. The countries that choose to integrate will shape crypto’s role in payments, markets, and the national economic systems where you build and invest. Those who don’t may find themselves simply reacting to changes they no longer control, creating a terrain of uncertainty.

Ready to dive deeper into the data? Explore the full Bybit World Crypto Rankings Index to see how countries compare, discover emerging patterns, and understand the future of global adoption.