If you look back at the last cycle of Decentralised Finance (DeFi), the primary issue for capital was discovery. Allocators, DAOs, and treasuries spent the majority of their resources simply trying to find where yield existed. The market was sketchy, opportunities were fleeting, and the highest APY was the only metric that truly moved liquidity.

That era has shifted. In the current market, yield discovery is no longer the primary constraint. Aggregators, dashboards, and automated optimisers have commoditised the search for return. We now face a different structural challenge: the immense operational burden of liquidity fragmentation and governance complexity.

As DeFi has matured, liquidity has separated across hundreds of chains, layer-2s, and isolated protocols. For a DAO or institutional treasury, managing a portfolio now involves bridge risk, governance latency, and multiple execution environments. Maintaining a position can require more operational overhead than the yield it produces.

This shift has forced a re-evaluation of what performance means. In the early days, performance was synonymous with a high annual percentage yield (APY). Today, sophisticated allocators understand that withdrawal liquidity is just as important as the return itself.

A high APY is meaningless if the exit door is too small when you need it most. We have seen countless examples where optimised positions became trapped positions during market volatility because the underlying strategy ignored the mechanics of exit.

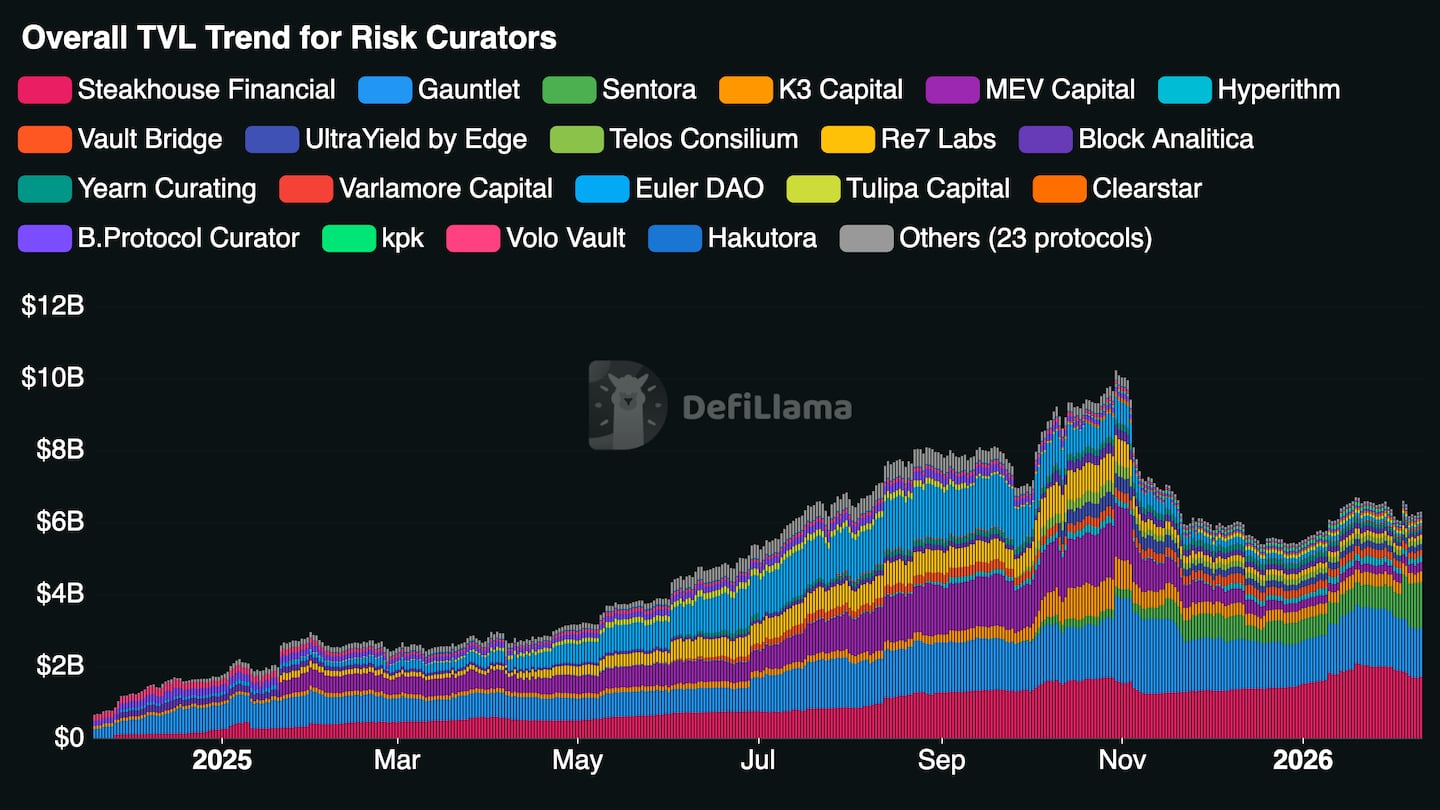

Consequently, Vaults have emerged as the dominant interface for capital. They are now active management layers that remove the complexity of fragmentation. However, not all vaults are built equal. We are witnessing a massive consolidation of curation into a specialised layer.

This layer builds the operational rails required to access it safely. This is where the industry is moving: away from raw yield hunting and toward operationally resilient infrastructure.

Delegation vs. curation: the institutional pivot

As we analyse the State of DeFi reports for 2025, a critical distinction has emerged in how capital is managed: the difference between Delegation and Curation.

While often used interchangeably, they represent different architectures of trust.

Delegation is largely discretionary. It creates a relationship where an asset owner hands over control to a manager, trusting their judgment to make the right call in the heat of the moment. It is a model inherited from traditional finance, which trusts the manager.

While flexible, this model scales poorly in crypto. It relies on human latency and introduces opacity. If the manager’s theory drifts, or if their risk appetite changes, the asset owner is often the last to know.

Curation, by contrast, is bounded authority enforced by rules. It is the architectural preference of the onchain economy. In a curated model, the parameters of execution, what can be bought, where it can be deployed, and liquidity thresholds are encoded into the vault’s logic before a single dollar is deposited.

Why do institutions increasingly prefer curation? Because it offers predictability. Large-scale capital allocators care less about squeezing out the final basis point of alpha and more about ensuring that execution adheres to a strict mandate. They require rule-based execution where the manager cannot wake up one day and decide to ape into a high-risk meme coin or an unverified lending market.

Governance-heavy models can introduce coordination latency that becomes mismatched with market speed. Relying on DAO votes for frequent parameter changes or reallocations can be operationally heavy at scale.

Transparency and enforceability are the new gold standards. It is not enough to promise a low-risk strategy because the strategy’s constraints must be visible onchain.

As treasuries mature, many move away from discretionary mandates and toward models that provide verifiable constraints on execution. The future of asset management is not about better human traders; it is about better onchain constraints.

Stress-testing the model: the EURC lesson

Theoretical distinctions between vault structures often feel abstract until the market provides a live stress test. We recently witnessed such an event involving EURC liquidity, a scenario that perfectly illustrated the differences in vault architectures.

During a localised liquidity stress event, the peg dynamics of EURC fluctuated, causing a ripple effect across lending markets and liquidity pools.

In the market, we saw immediate segregation of outcomes. Several yield-maximising vaults, which had allocated heavily to illiquid secondary markets to boost APY, suddenly found themselves gated. The underlying assets were technically solvent, but the withdrawal liquidity had evaporated. Users who wanted to exit were forced to wait or accept significant slippage.

In contrast, vaults structured with curation parameters behaved differently. Because these strategies prioritised liquidity buffers and operated within strict concentration limits, they were able to restore withdrawal liquidity very fast.

The automated monitoring systems, designed to detect de-pegs and utilisation spikes, triggered predefined reallocation logic within approved parameters, without requiring emergency governance intervention.

This event served as a validation of the risk-first approach. It highlighted that in DeFi, liquidity is a dynamic condition of the market. A vault that ignores this reality in favour of a higher headline rate is essentially shorting volatility.

The trade-off: optimisation vs. infrastructure

This brings us to the core philosophy of kpk. The market for curators is splitting into distinct camps, and it is important for allocators to understand the trade-offs involved.

Some curators optimise purely for protocol solvency. Their goal is to ensure the lending market itself doesn’t go into bad debt, often at the expense of the liquidity provider’s flexibility.

Others focus on governance safeguards, building elaborate multisig structures that, while secure, move at a glacial pace. And there remains a contingent that leans on discretionary speed, relying on active trading teams to outmanoeuvre the market.

kpk sees curation differently: they view it as infrastructure.

When you position curation as infrastructure, you accept a fundamental trade-off: you prioritise bounded behaviour over maximum theoretical upside. kpk vaults are designed with intentional constraints.

They utilise liquidity buffers and caps that may, at times, drag on the absolute ceiling of yield. A vault may exclude double-digit APY markets if liquidity depth or exit mechanics do not meet predefined criteria.

Optimisation maximises upside, but infrastructure prioritises survival and continuity. By treating the vaults as infrastructure, they ensure they can serve as the bedrock for other applications. A DAO cannot build its operational budget on a strategy that might be illiquid for three weeks during a downturn. They need reliable, liquid, and bound yield.

kpk implements automated monitoring and circuit breakers to prevent configuration drift, the silent killer of algorithmic strategies. Automated systems can introduce reflexivity if all agents respond identically to volatility. Deterministic parameterisation mitigates that effect.

If every agent reacts to a price drop simultaneously, they increase the crash. kpk avoids this by maintaining a deterministic approach to parameterisation. They don’t just ask “How much can we make?” They ask, “can we explain, observe, and control the risk exposure?”

From vaults to funds

Curation is not the endpoint, it is the foundation. We view the current market of curated vaults as the first step in a larger standardisation of the DeFi capital stack.

Currently, curated vaults are standardising execution. They take the messy reality of swapping, bridging, and lending, and wrap it into a predictable, tokenised interface. The next layer of this will standardise exposure.

We are now seeing the transition from single-strategy vaults to comprehensive, tokenised Funds. kpk is extending the same infrastructure logic that powers its curated vaults into Funds built on kpk’s onchain fund infrastructure, which provides onchain accounting, policy-enforced execution, and multichain support. The goal is to allow funds to retain strategic allocation decisions within rule-defined execution environments, while offloading operational complexity to infrastructure.

Imagine a fund structure where settlement is non-custodial, and accounting is entirely onchain. Instead of waiting for monthly PDF reports to understand Net Asset Value (NAV), the fund’s health is visible block by block. This is the hybrid portfolio allocation framework they are building towards.

A fund manager can retain high-conviction control over specific assets while delegating the safe, low-volatility portion of the portfolio to kpk’s infrastructure.

This roadmap leads to a future where risk assessment is based on verifiable, onchain data. Whether it is Real World Assets or liquid restaking tokens, the principle remains the same: if you can’t monitor the risk onchain, you can’t curate it safely.

We will detail this thesis, and the infrastructure kpk is building around it, in our forthcoming report next week.