Executive summary: DeFi in 2025

In 2025, DeFi moved further away from a cycle-defined speculative arena and closer to a durable financial system with recognisable primitives, maturing market structure, and increasingly institutional-grade infrastructure. Growth was real, but it was uneven. A handful of sectors reached escape velocity and began to resemble scaled financial businesses, while others failed to sustain product market fit once incentives faded and risk was repriced.

Across the report, a coherent picture emerges. Stablecoins became the monetary base layer for onchain activity. Trading infrastructure converged into an interconnected stack that links issuance, spot, derivatives, and event-driven markets. Credit and yield matured into a more fixed-income-like ecosystem built on stablecoin collateral and tokenized real-world assets. Execution quality improved as routing shifted toward private channels, solver-based systems, and more industrial MEV supply chains, which reduced some user-facing harm while concentrating power in fewer intermediaries. Governance and token design professionalised, proposal cadence slowed, delegation intensified, and value capture became more explicit. Meanwhile, treasury capacity, both at the DAO level and in public equities, proved to be a major determinant of who could endure volatility and keep building.

The year’s central theme was maturation through specialization. Liquidity, revenue, and user activity increasingly accrued to systems that delivered reliable execution, credible risk controls, and clear economic models. Where the foundation was weaker, 2025 imposed a repricing.

Stablecoins became core financial infrastructure

Stablecoins are no longer a peripheral crypto product. In 2025, they functioned as the settlement layer connecting payments, trading, collateralisation, and treasury operations into one interoperable system. After the post-Terra contraction, supply resumed sustained expansion, and stablecoin settlement volumes continued to rival the scale of the largest global value-transfer networks.

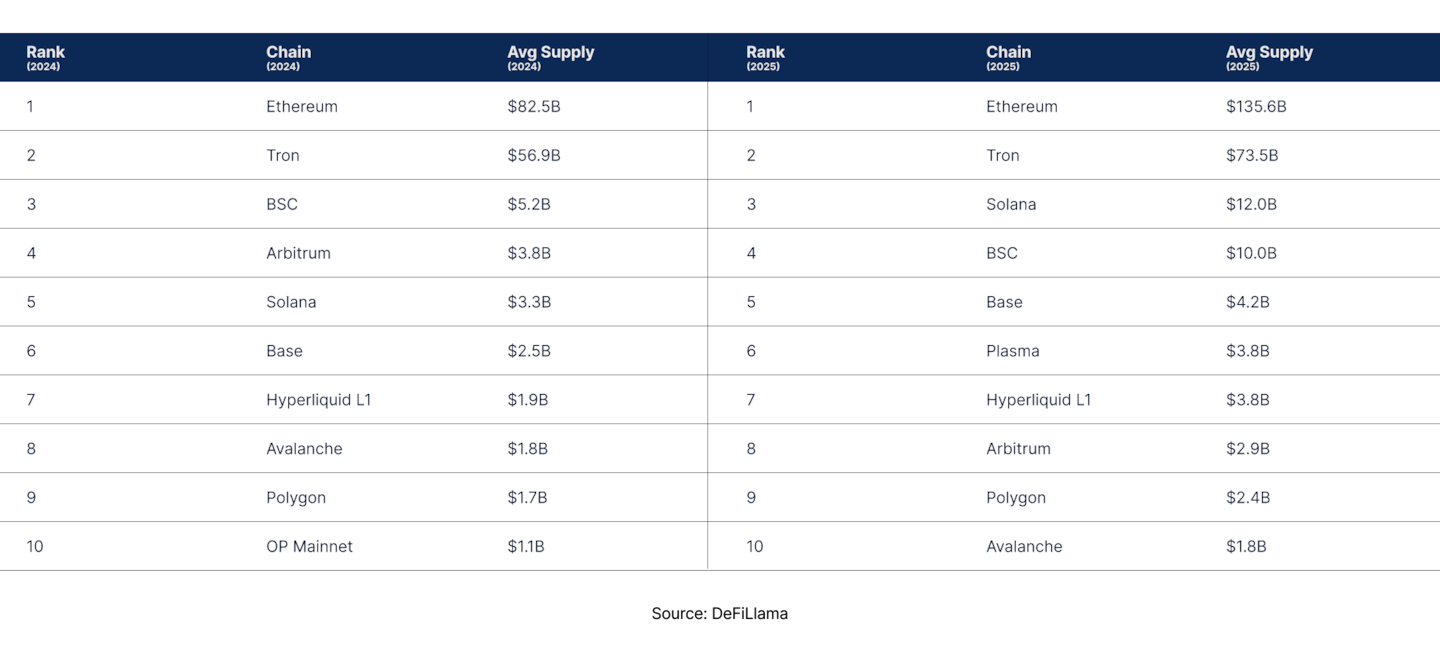

The chain distribution reinforced a two-pole structure. Ethereum remained the dominant DeFi-native monetary base, anchored by security-first settlement preferences and institutional-grade integrations. Tron continued to function as a high-throughput transfer rail, with stablecoin usage shaped more by exchange and payment flows than DeFi composition. A second tier of growth formed in high-velocity trading environments, where stablecoins increasingly behaved like working capital for issuance funnels, spot routing, and derivatives margin.

Issuer diversity expanded, but concentration remained intact. The market became broader at the edges, yet the core stayed dominated by the largest reserve-backed issuers. The practical implication for the rest of DeFi is straightforward. If stablecoins are the unit of account and the primary collateral form, then the monetary system’s health is increasingly tied to issuer behavior, regulatory posture, and integration depth, not just onchain mechanics.

Value capture expanded, but concentration stayed structurally high

Revenue growth broadened across major DeFi verticals in 2025, but value capture remained concentrated. A relatively small set of protocols continued to take the majority share of fees and revenue, with stablecoin issuers sitting far above the application layer. This concentration is not a failure of competition, it is a reflection of how reserve-based monetary models scale and how sticky liquidity and distribution advantages can be.

Below the issuers, the competitive map changed meaningfully. Perpetuals established themselves as a durable revenue engine with increasingly mature behavior, less dependent on market direction and more tied to continuous risk transfer and execution quality. Primary issuance rails emerged as a major standalone category, monetizing attention, distribution, and entertainment rather than traditional liquidity provision. DEXs and aggregators grew in absolute terms, but their business performance remained more tightly linked to market activity and volatility. Lending and yield expanded more gradually, with a visible shift toward more structured and institutional-facing designs.

A key enabling condition sat underneath all of this. Execution became cheaper. Falling infrastructure costs allowed applications to scale further than previous cycles, reinforcing the shift from base-layer value capture toward application-layer economics.

The trading stack converged into a continuous system

The structure of onchain markets changed fundamentally in 2025. What previously looked like separate layers, swapping on AMMs, trading perps, minting tokens on new rails, and speculating on events, began to behave like a single connected trading system. Liquidity rotated faster across layers, catalysts propagated more quickly, and user behavior increasingly responded to execution quality and distribution rather than chain identity alone.

Spot markets continued their migration onchain. DEX share of global spot trading rose materially, but the more important change was competitive and architectural. Dominance diluted across more venues, and the user experience continued to abstract away decision-making. The market moved from manual venue selection, to aggregation, to intent-based execution, where users express an outcome and solver networks compete to deliver best execution across venues and across chains. Over time, that pushes the system toward a world where routing and settlement become invisible, and where market structure risk shifts from “which AMM” to “which execution intermediaries.”

Perpetuals matured even faster, and the mechanism of maturation was microstructure. The sector rotated away from early vault-based or vAMM-style designs and toward exchange-grade matching, deeper orderbooks, unified collateral, cross-margin, and more robust liquidation pathways. In practice, perps liquidity increasingly gravitated toward execution-first environments and hybrid architectures that prioritize throughput and predictable fills. The key competitive axis moved from chain branding to performance, risk management, and capital efficiency.

Issuance rails functioned as the ignition layer of speculative cycles, onboarding users at scale and feeding downstream spot and derivatives activity. Prediction markets expanded into a catalyst and information layer, increasingly shaping positioning behavior through probability signals that traders translate into hedges and directional bets elsewhere in the stack.

The net effect is a loop. Issuance captures attention. Attention becomes spot flow. Spot flow pulls derivatives demand. Event probabilities modulate positioning and funding dynamics. This is not just more activity, it is a more integrated market system.

Credit and yield matured, restaking repriced, RWAs became core collateral

On the balance-sheet side of DeFi, 2025 was defined by maturation and repricing.

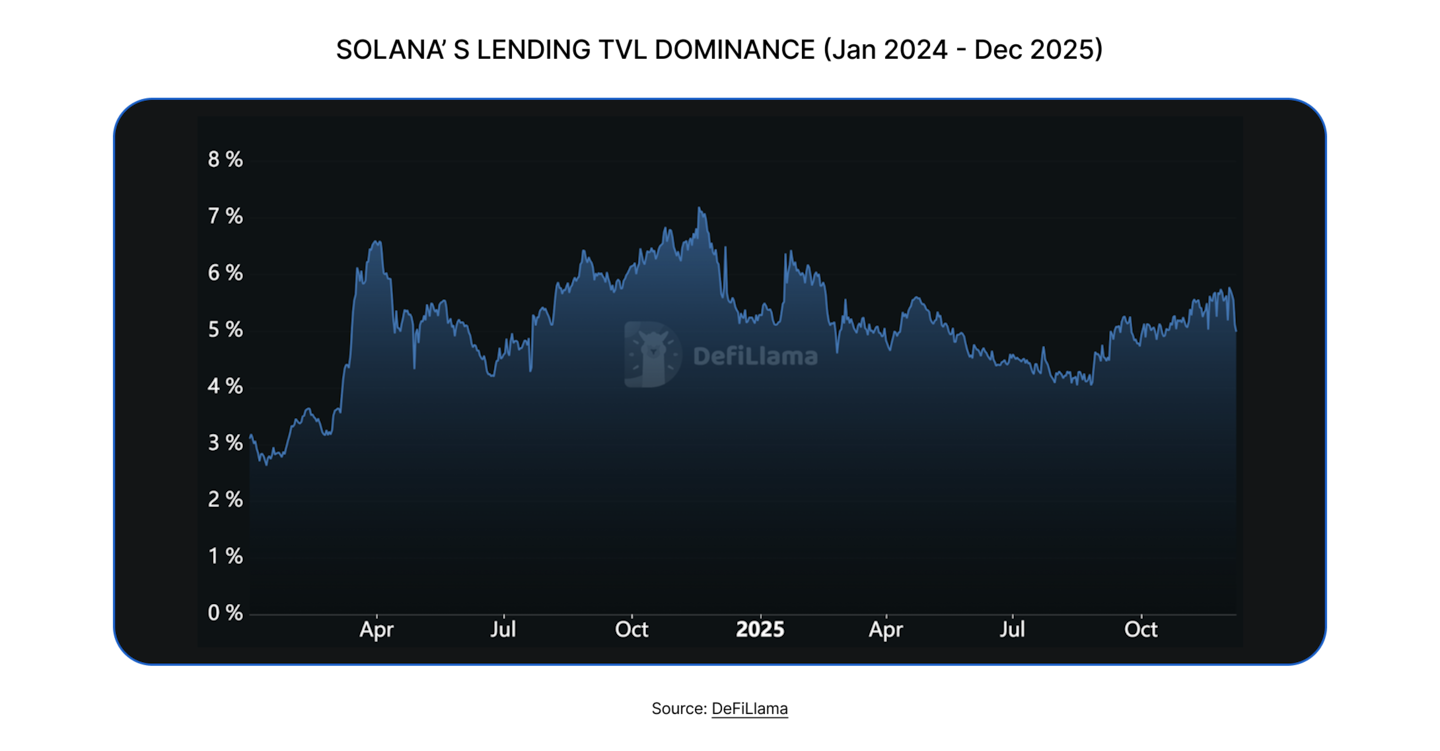

Lending expanded and remained concentrated in a small number of dominant venues, with market share shifting toward platforms perceived as operationally strongest and most institutionally legible. The deeper change was not only who held deposits, but how efficiently platforms converted deposits into productive credit. Market design, risk calibration, and borrower demand increasingly determined fee outcomes.

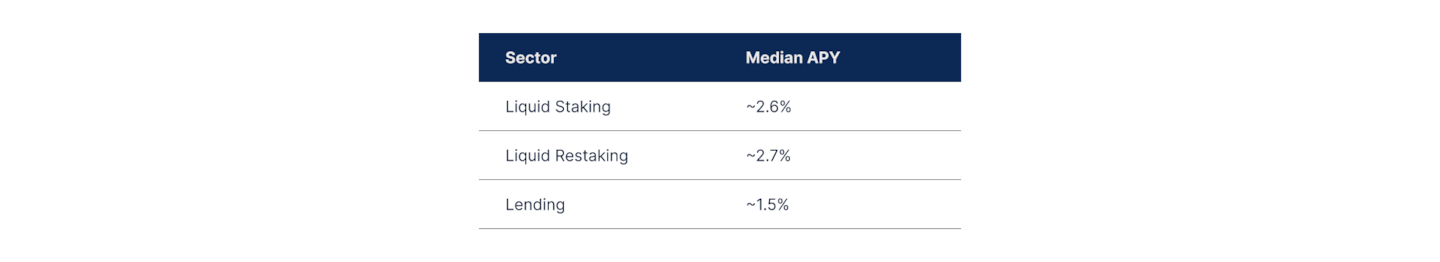

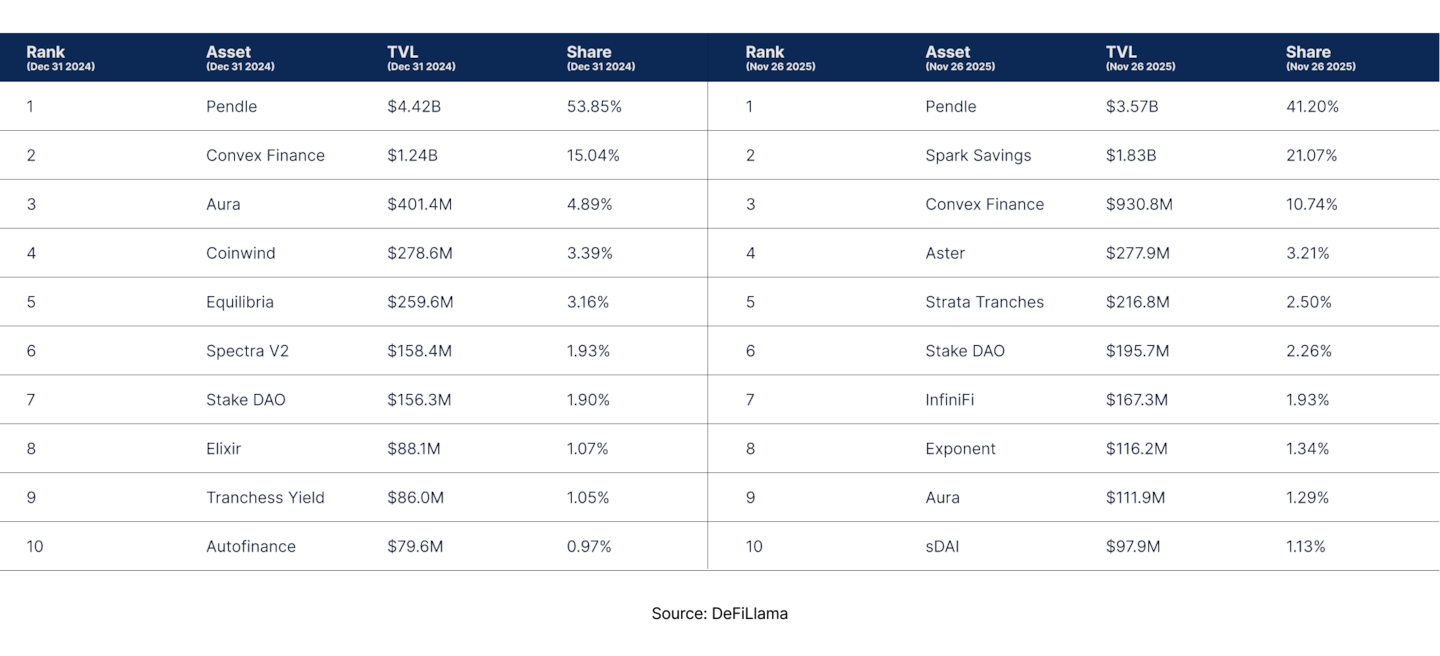

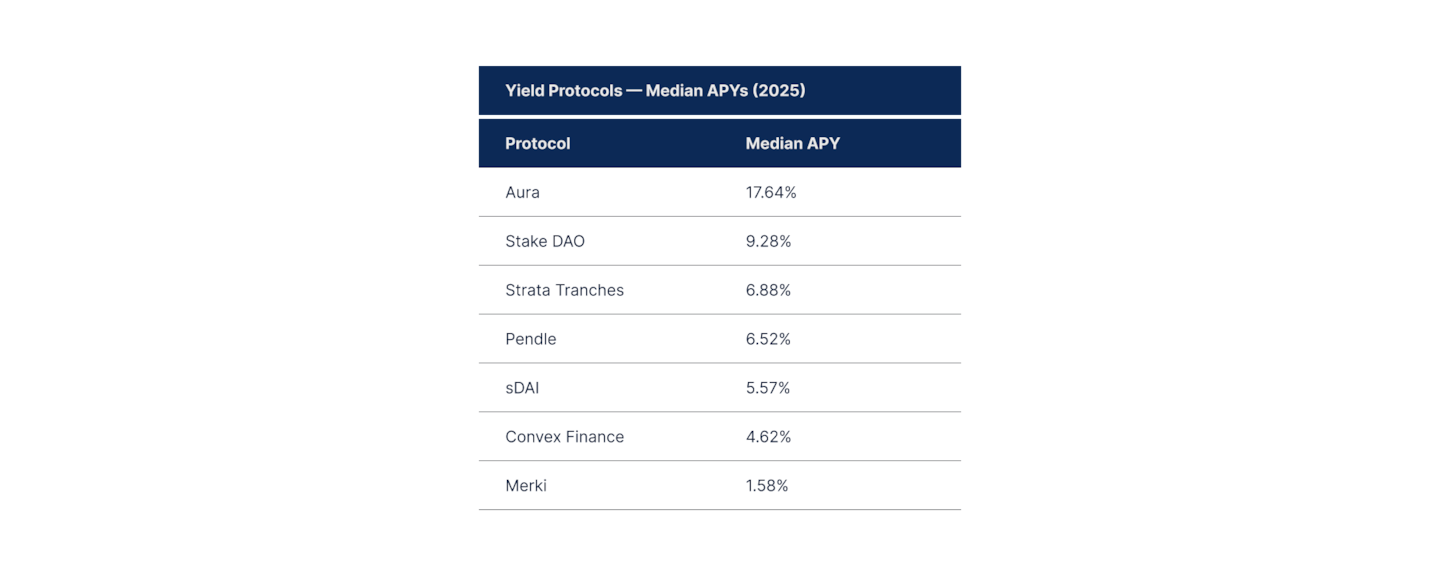

Yield markets evolved more in structure than in size. Duration trading matured, and “onchain fixed income” became more legible through stablecoin-centric collateral and more structured rate exposure. Pendle remained central to active rate expression, but competition increased, and the market’s collateral composition tilted toward layered, yield-bearing stablecoin structures. That shift improved composability and predictability for allocators, while also creating new forms of concentration risk around a narrow set of stablecoin and synthetic-yield ecosystems.

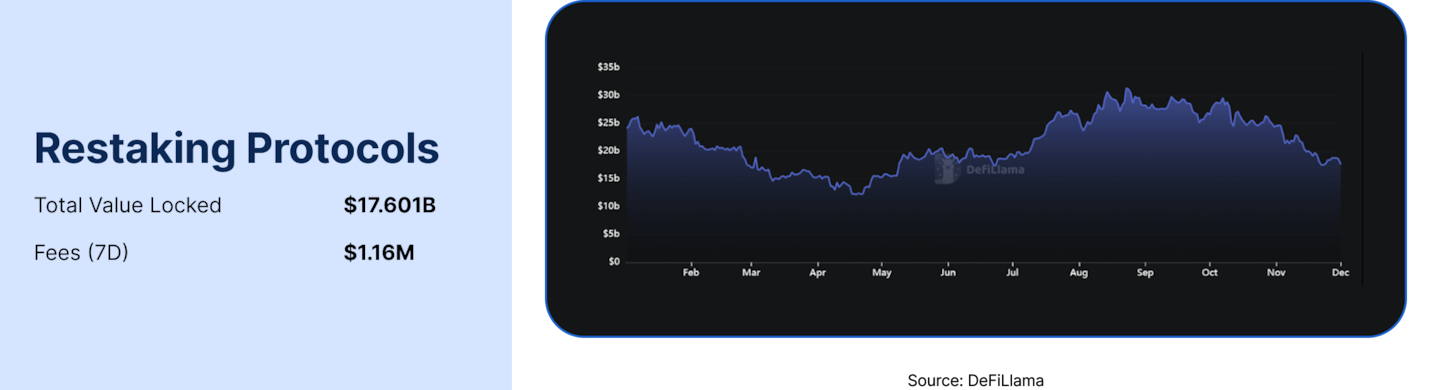

Liquid staking held up as a durable capital base, with gradual share shifts away from early incumbents and toward exchange-linked or more institutionally packaged wrappers. Restaking moved in the opposite direction. As incentives normalized, the sector faced a tougher risk-return trade. With less obvious incremental reward for added complexity, capital rotated out and consolidated into the most established venues. The story shifted from points-driven growth to explicit security and slashing risk, which is a very different equilibrium.

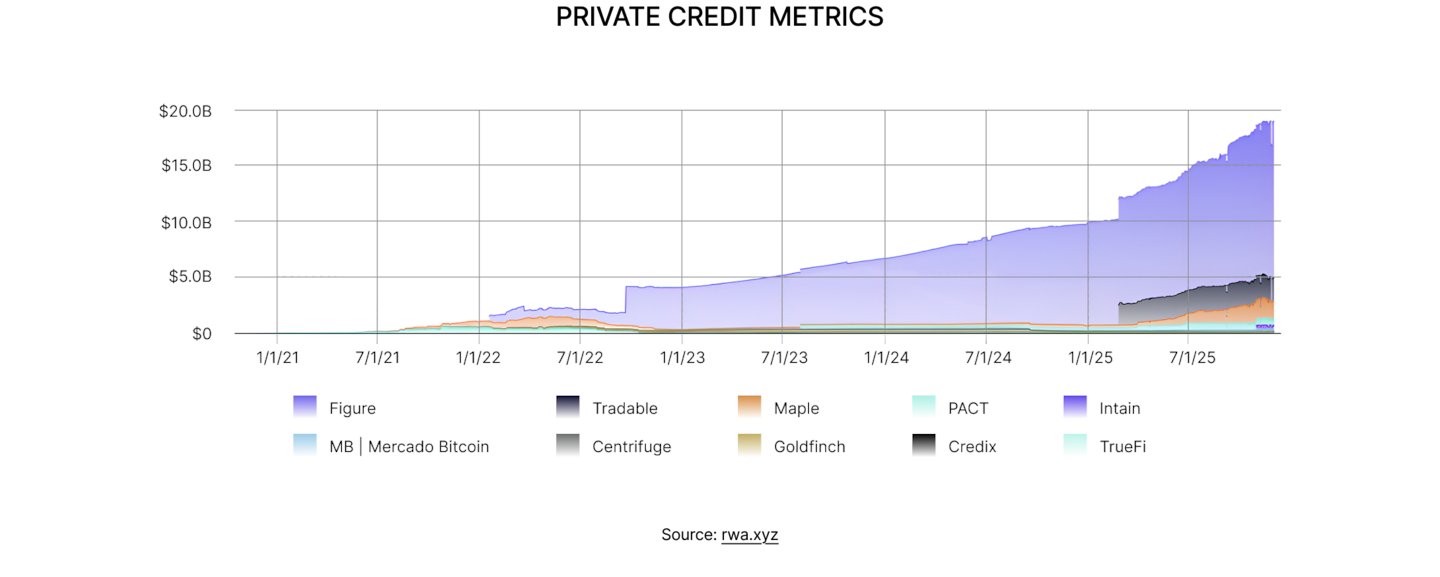

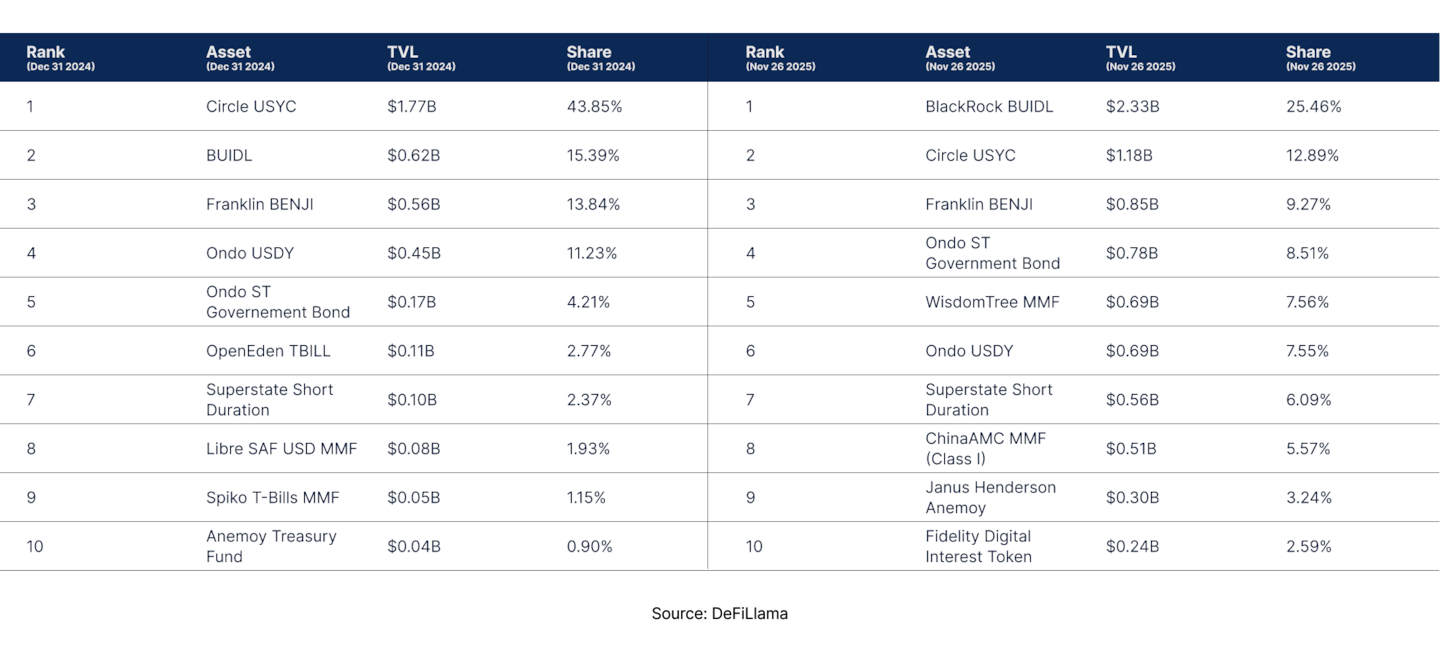

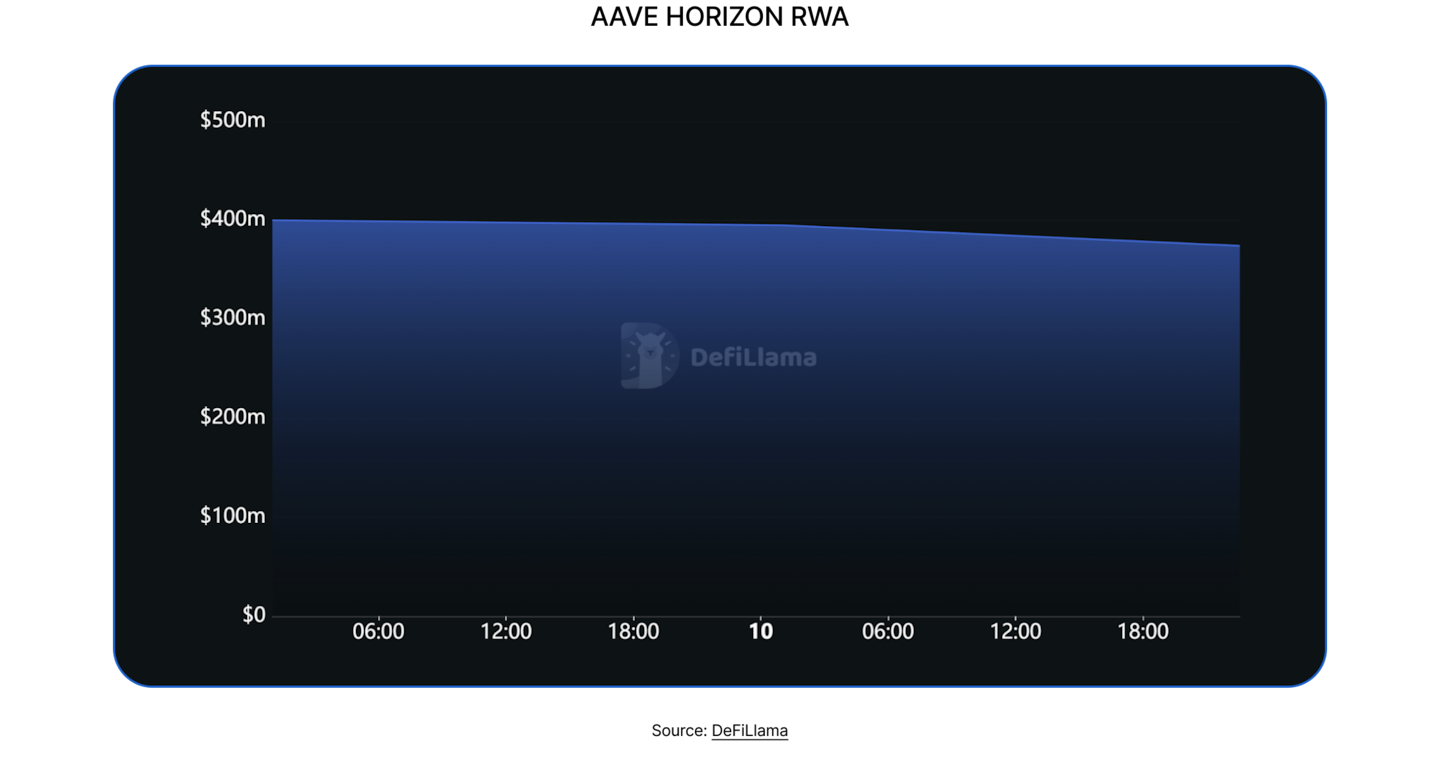

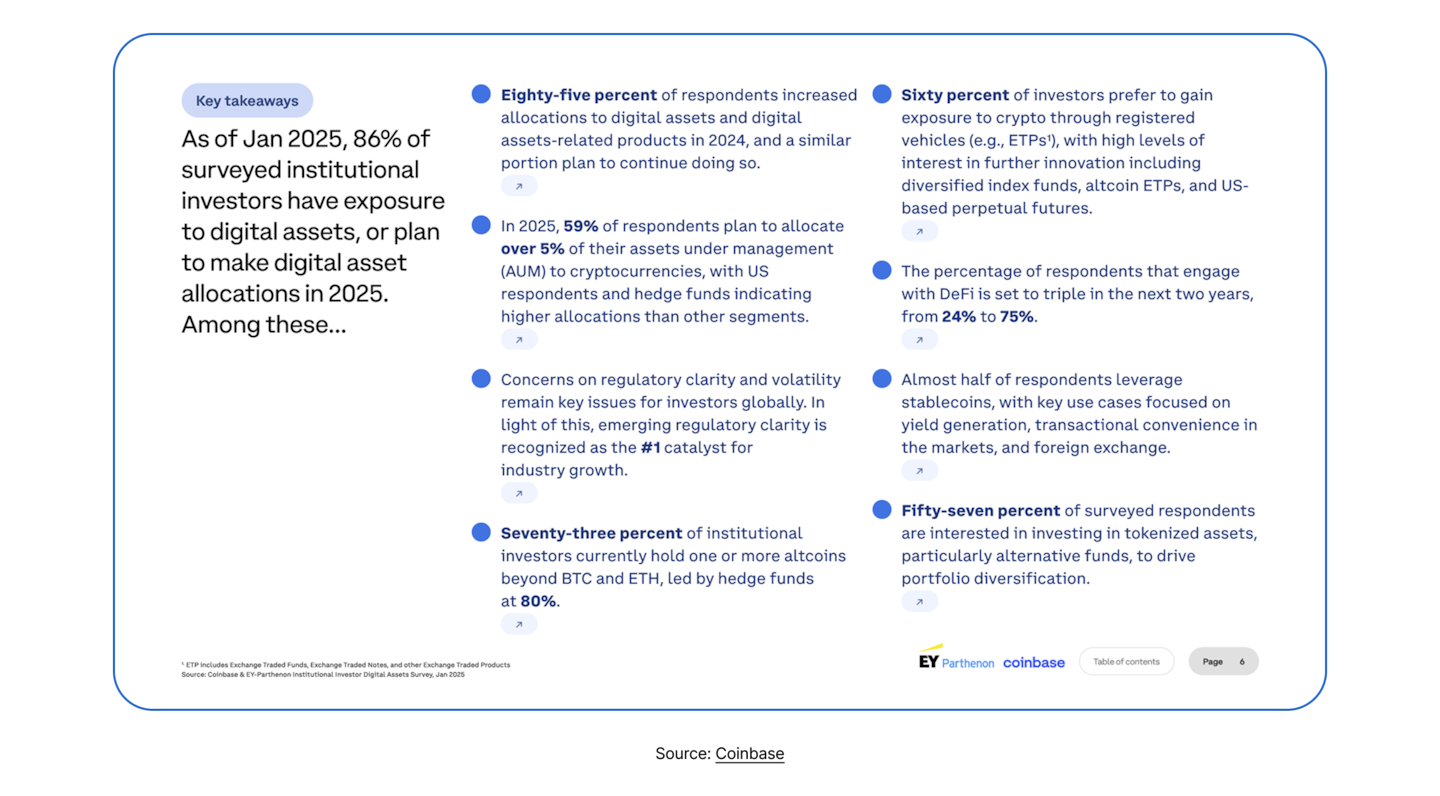

Real-world assets moved from niche to core yield and collateral infrastructure. Tokenized Treasuries, private credit, and institutional fund wrappers scaled quickly, and leadership increasingly rotated toward recognizable asset managers and regulated issuers. The important takeaway is not simply “RWAs grew,” it is that DeFi’s collateral stack is becoming more dollar-native, more institutionally distributed, and more aligned with familiar fixed-income primitives.

Execution quality improved, market structure centralized

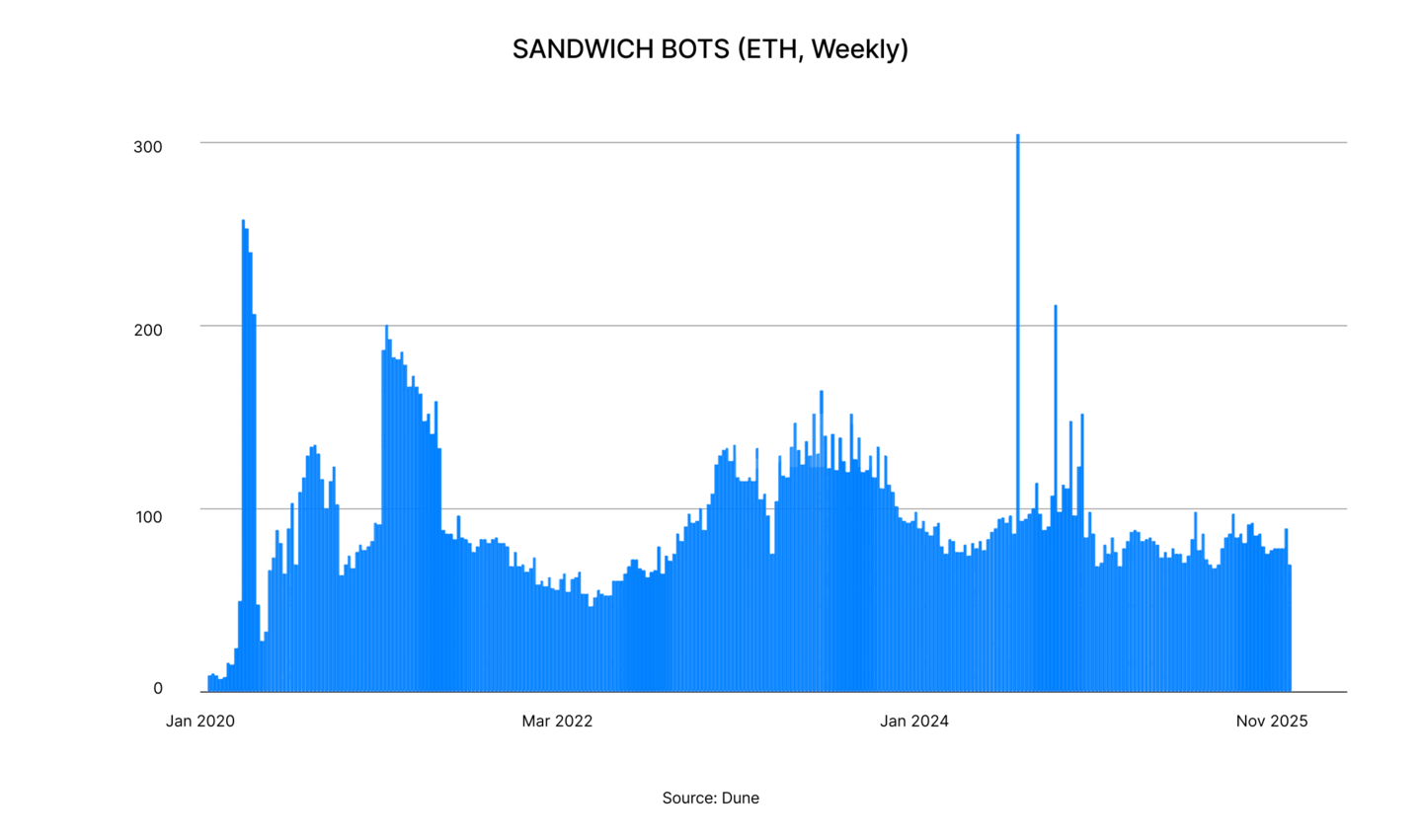

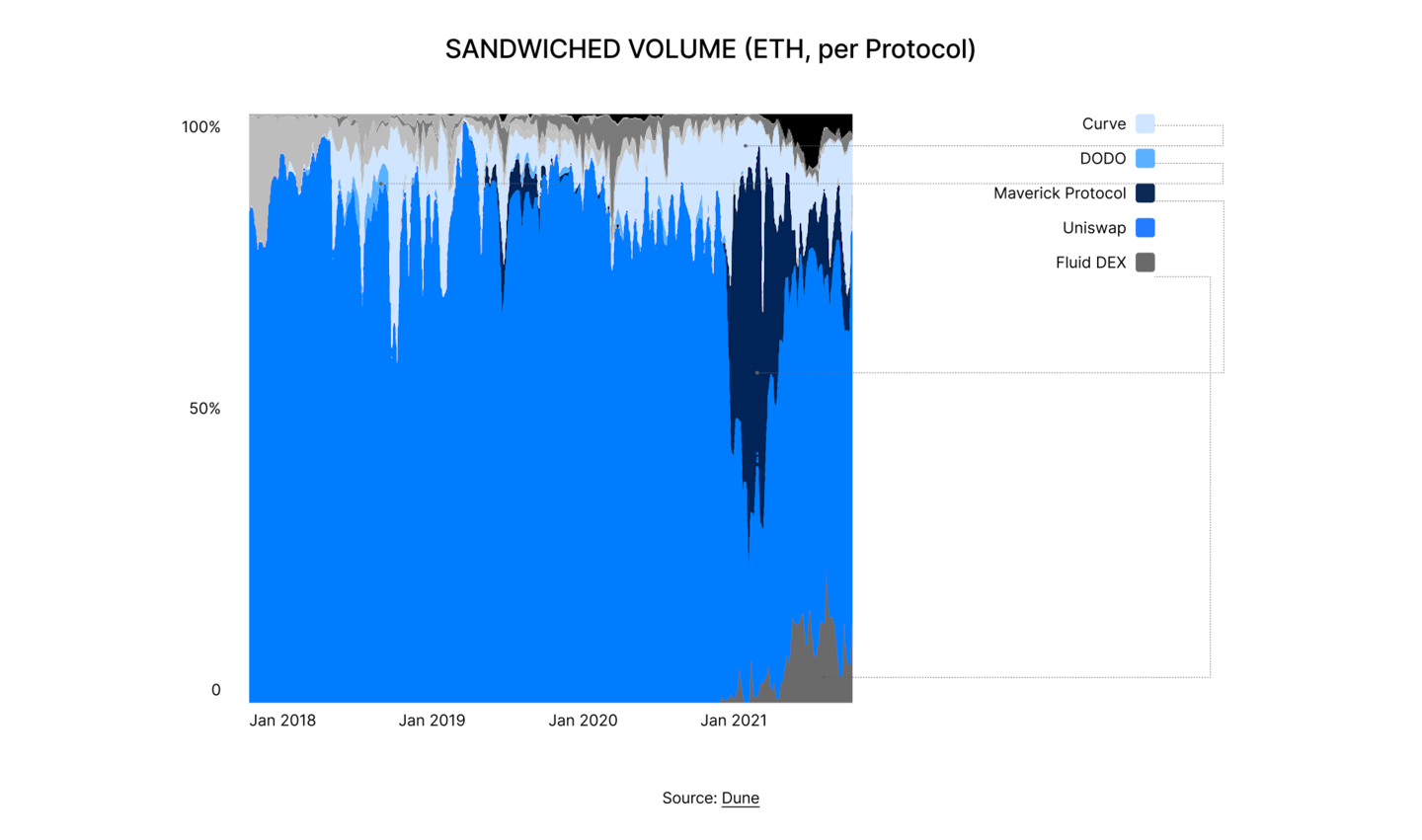

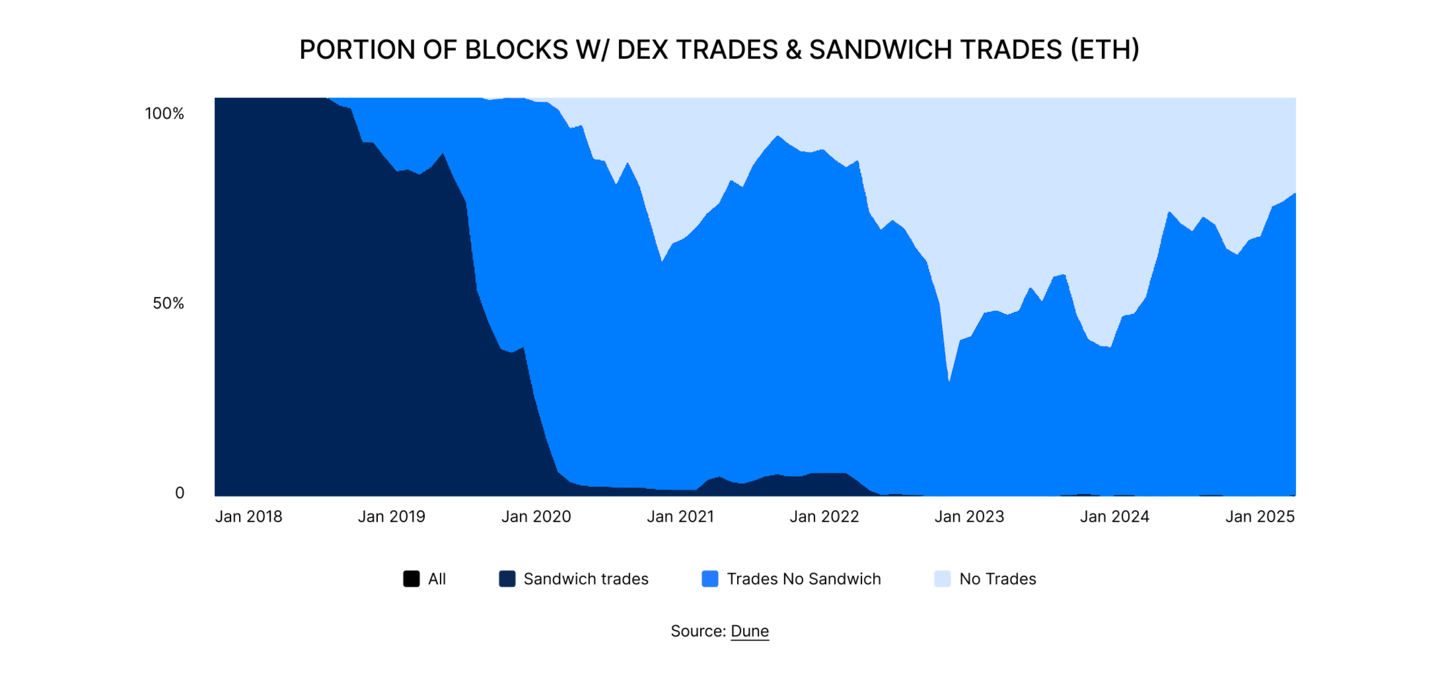

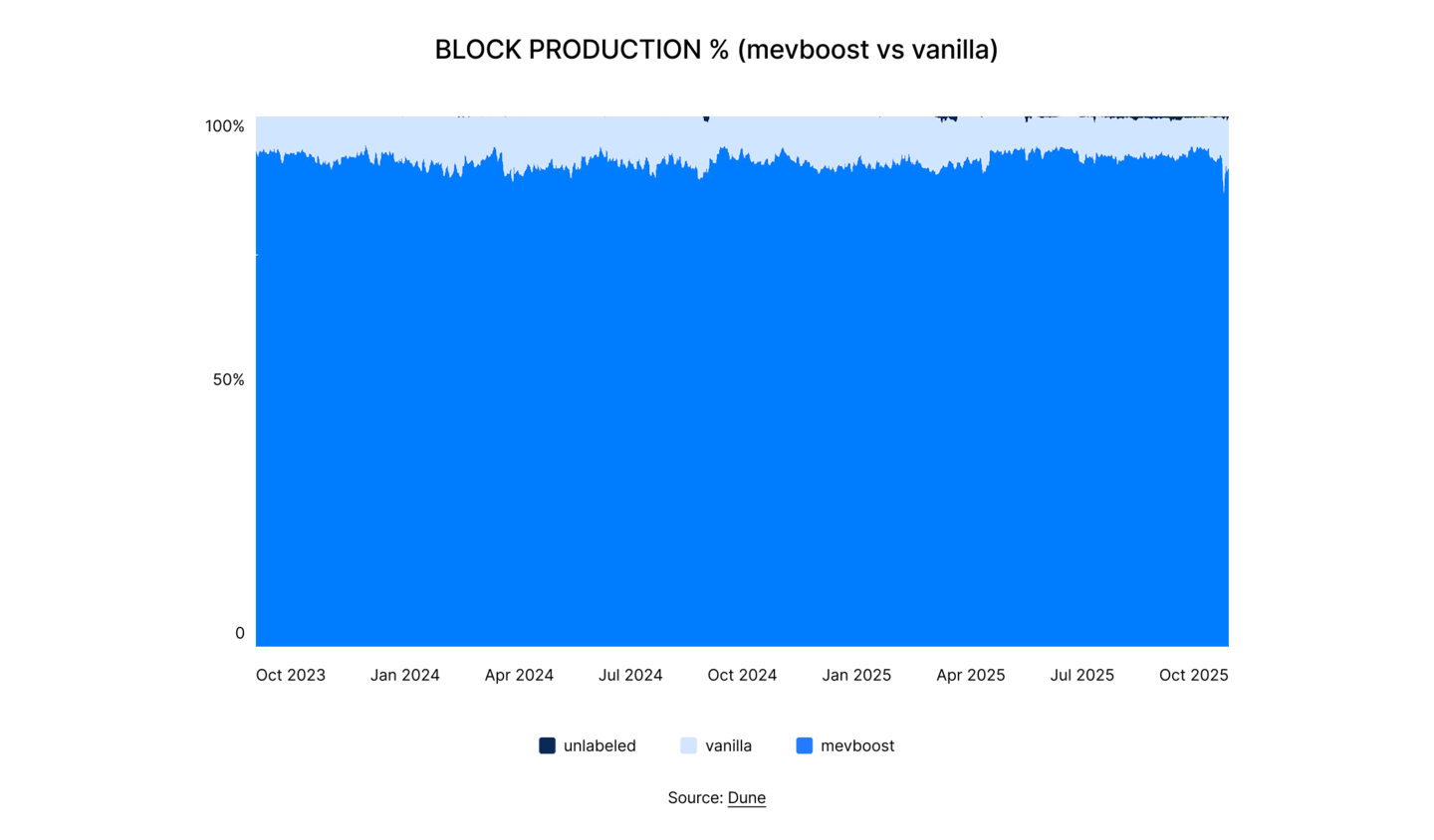

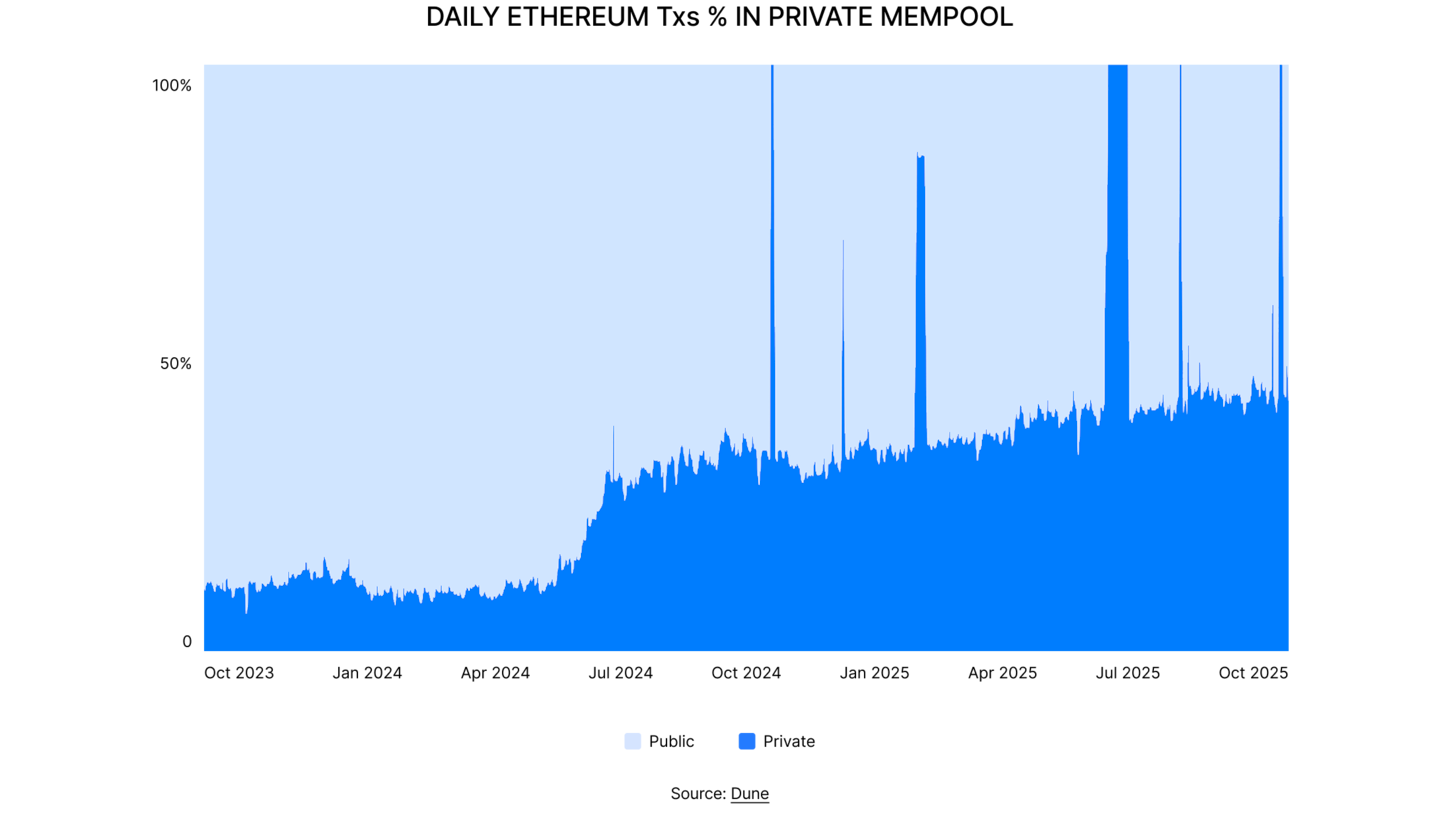

MEV and execution in 2025 looked less like an adversarial byproduct and more like an institutional supply chain. Across major ecosystems, value extraction became more mediated by builders, private routing, RFQ layers, solver markets, and auctions. User outcomes improved in many cases, especially for larger trades on core assets, but the system became more dependent on a small number of intermediaries.

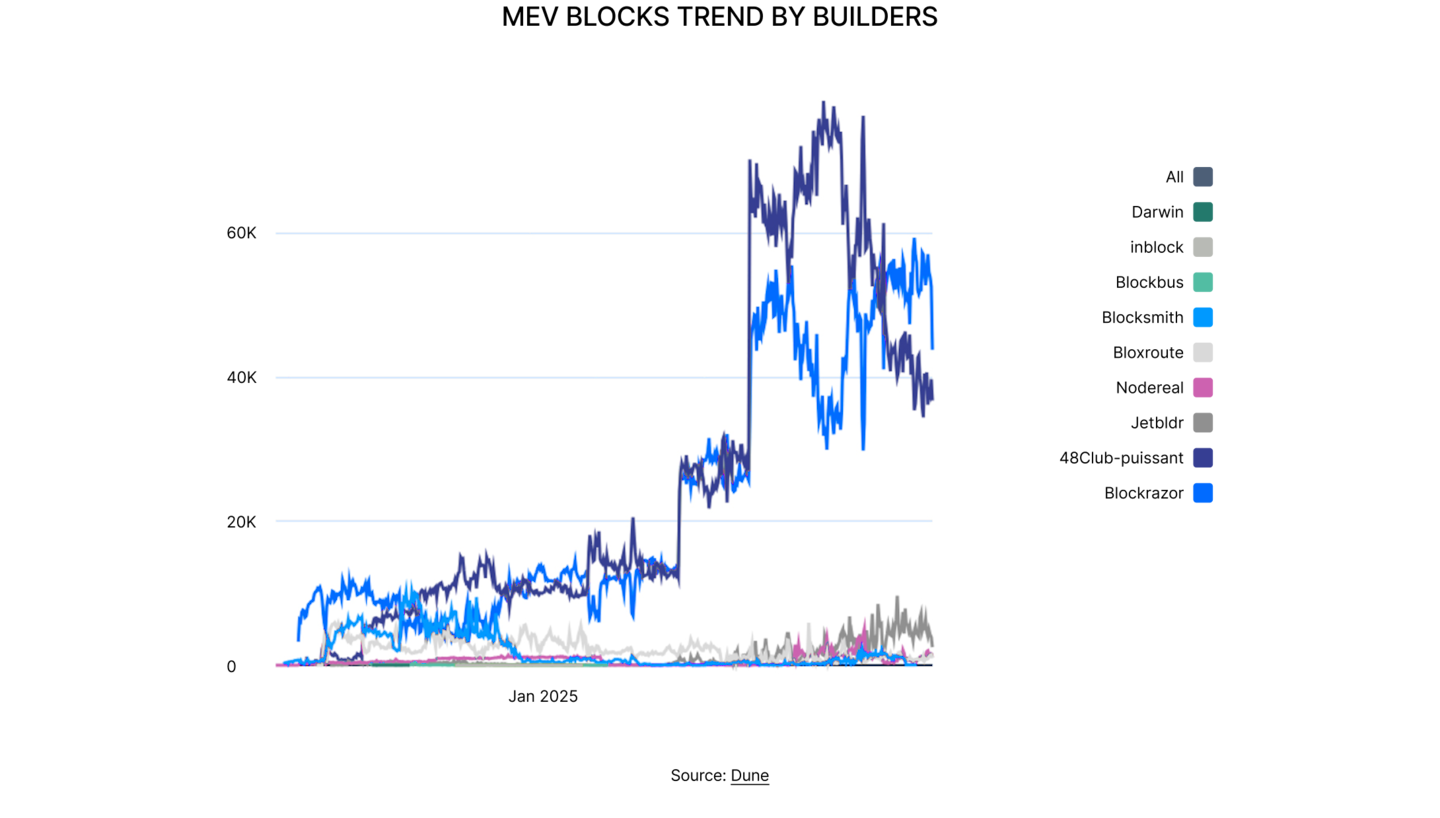

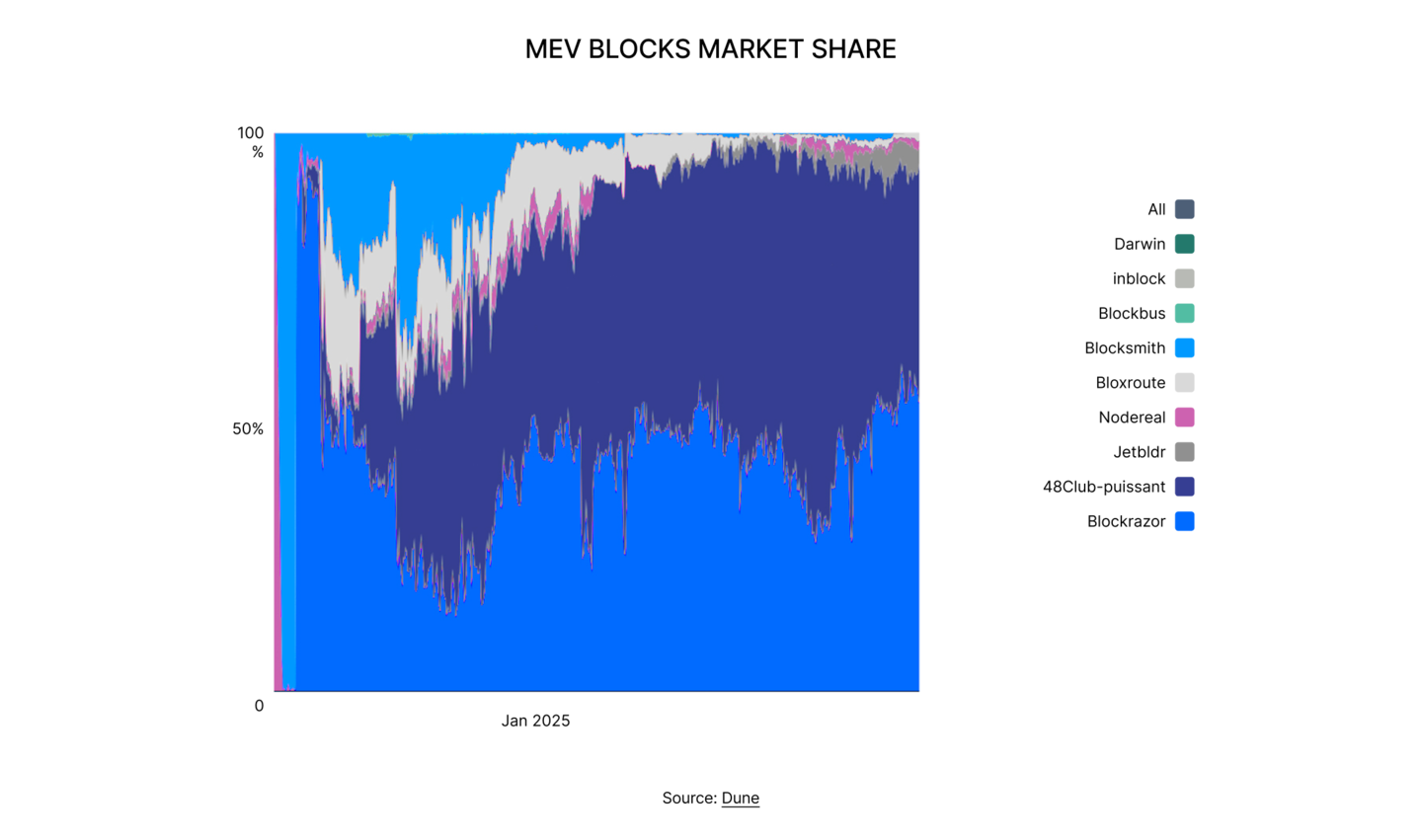

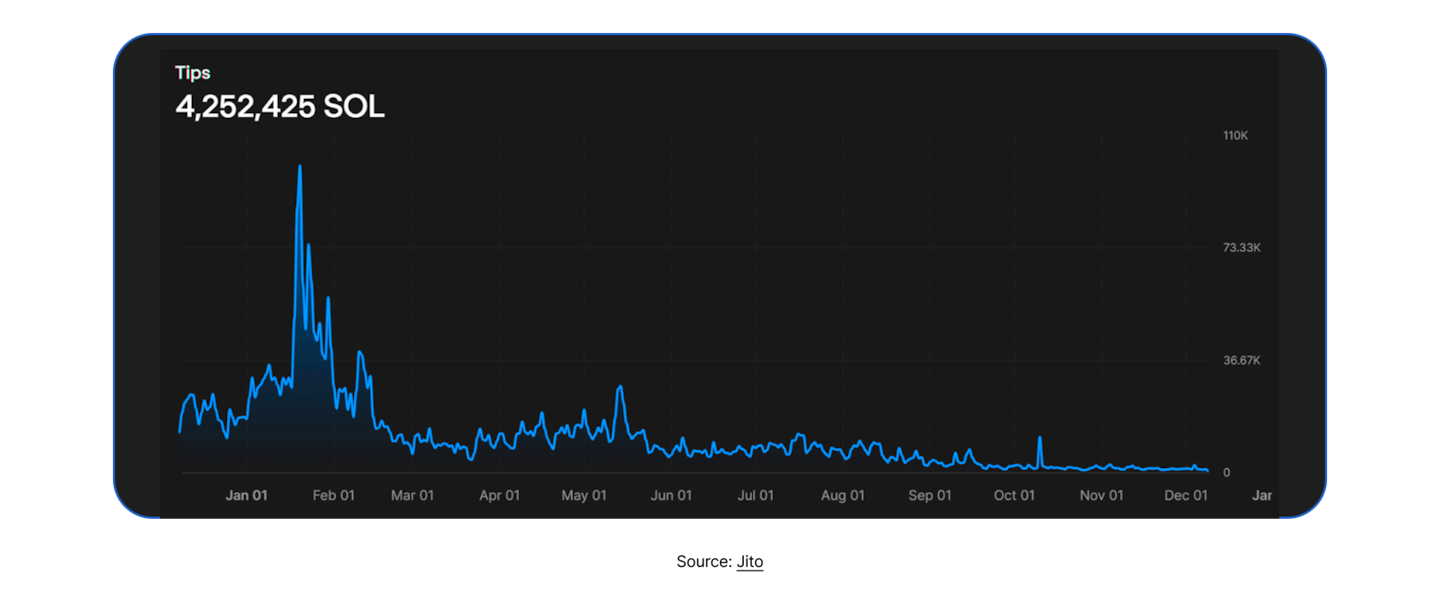

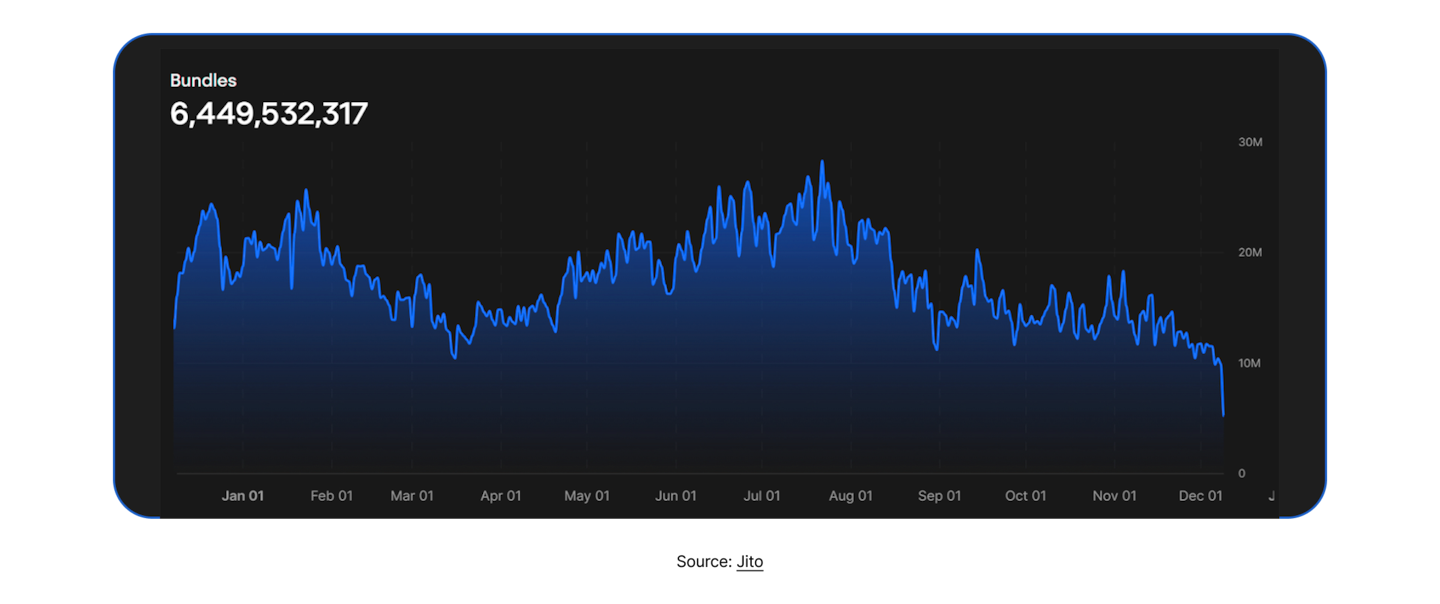

On Ethereum, toxic MEV did not disappear, but it showed signs of stabilizing rather than expanding mechanically with DEX usage. More flow moved into protected pathways, including private routing and solver-mediated execution, which dampened some user-visible harm. On BNB Chain, MEV became more systematized through builder-led production, with strong concentration among a small set of builders. On Solana, MEV remained validator-centric through tip-based auctions and massive bundle throughput, with competition intensifying even as economic density normalized after early-year volatility.

The tradeoff entering 2026 is clear. The market is getting better execution, but it is doing so by routing a growing share of economically sensitive flow through narrower, more industrial rails. That improves performance and often reduces slippage, yet it increases concentration risk, reduces pre-trade transparency, and makes market integrity more dependent on the behavior and resilience of a small set of service providers.

Governance, token design, and treasuries shifted toward professionalization and payouts

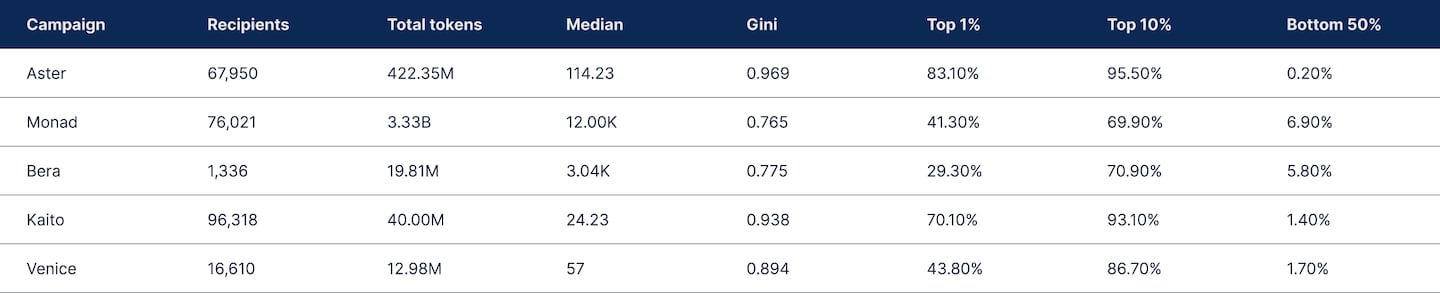

Airdrops remained a primary user acquisition mechanism, but their onchain outcomes continued to show a consistent reality: broad recipient counts rarely translate into broad economic ownership. Allocation design differentiates sharply between tiers, and claim timing has become a key lever that shapes how supply enters markets and how price discovery forms.

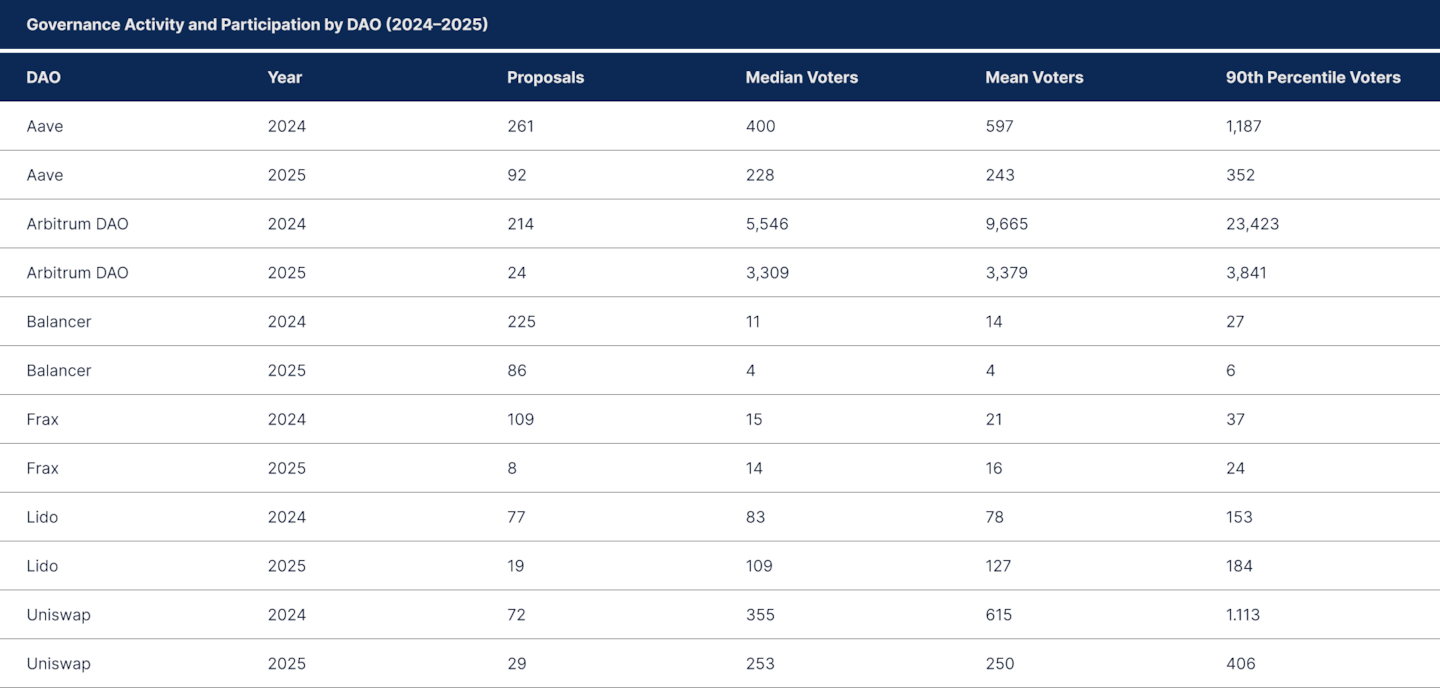

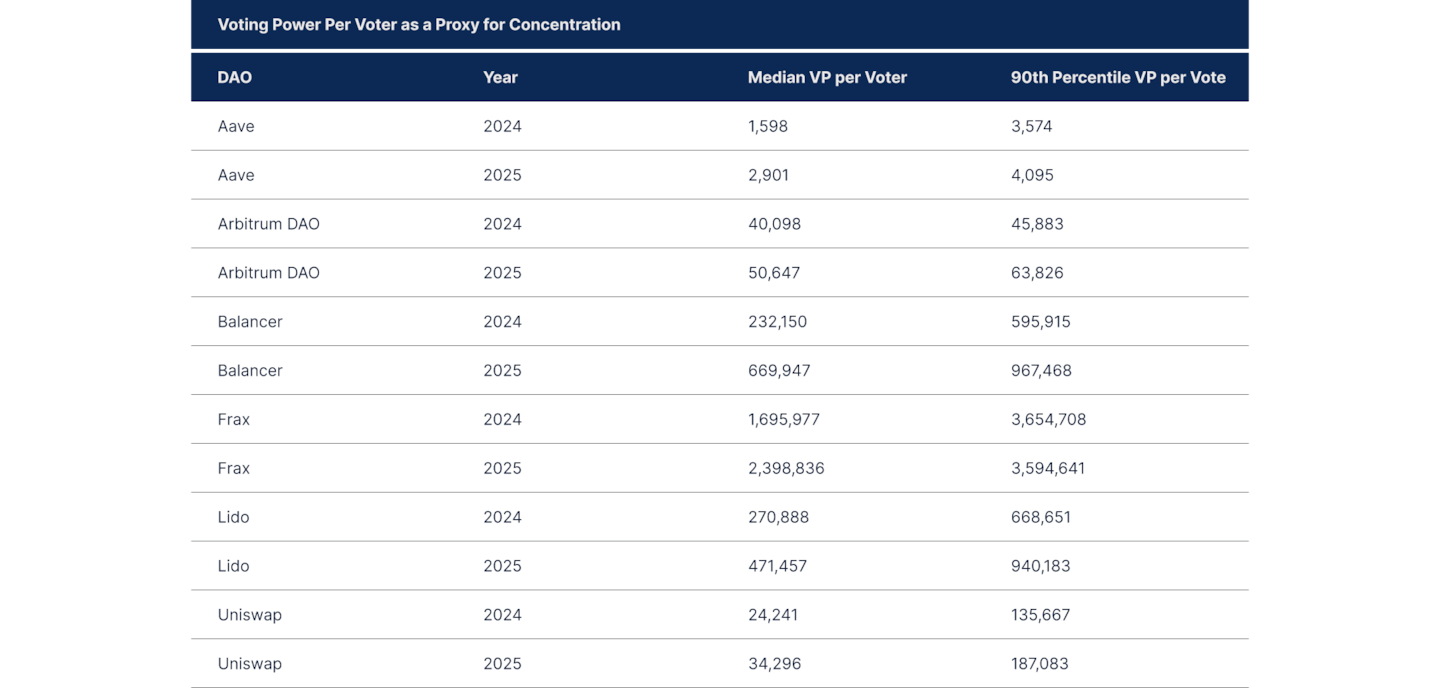

DAO governance moved from high-frequency experimentation toward professionalized control. Proposal counts fell, participation thinned, and delegation became more central. The economic weight of decisions increased even as the number of decisions declined. Governance increasingly functioned as a control layer for risk management, value capture activation, and crisis response, rather than a forum for continuous iteration.

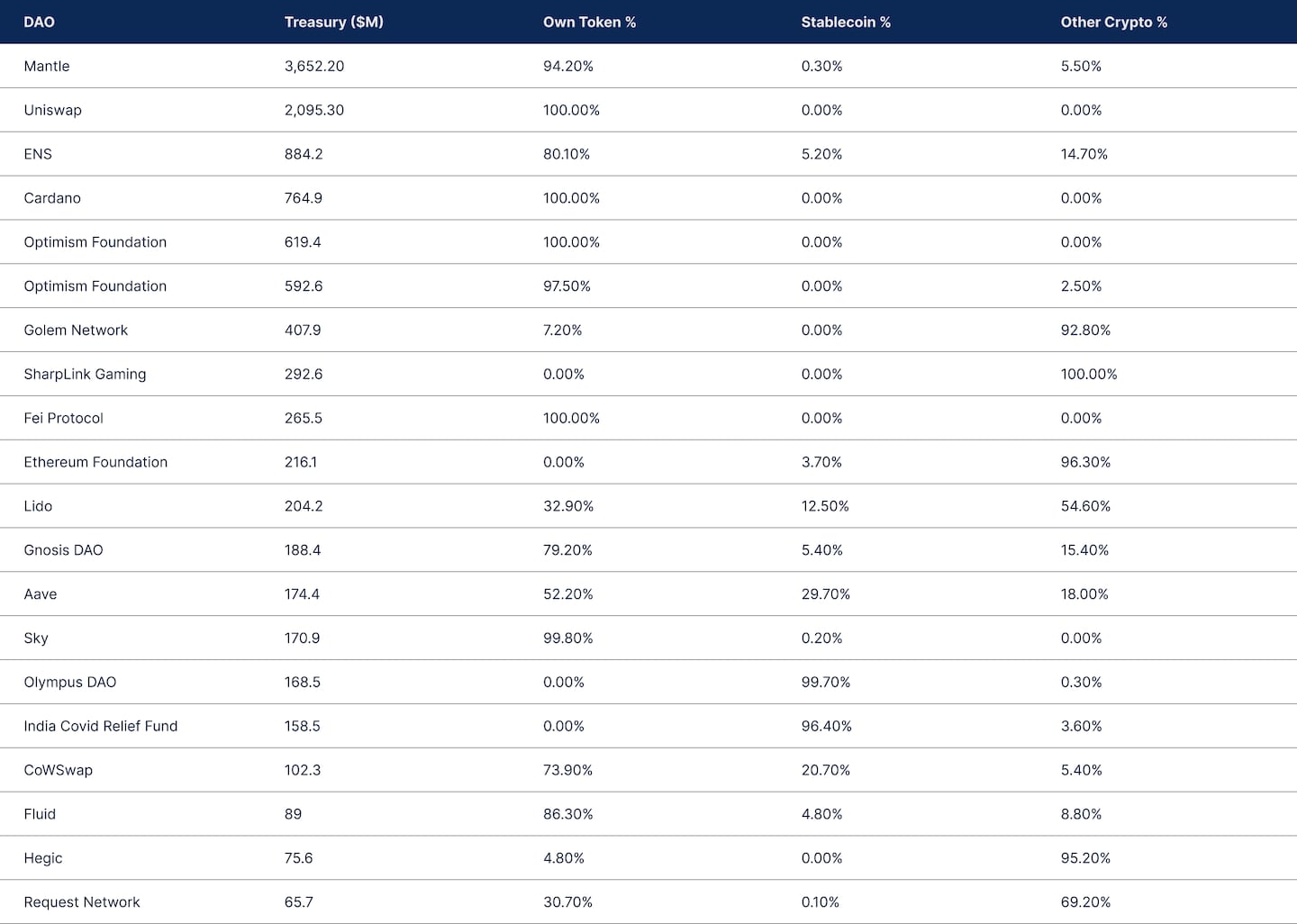

Treasury capacity became a structural separator. A small set of DAOs held the bulk of observable onchain treasury capital, while the long tail operated with limited runway. Composition also bifurcated. Many large treasuries remained heavily exposed to their own tokens, preserving optionality for incentives but tying operating capacity to token price. A smaller subset held meaningful stablecoin buffers and diversified reserves, enabling steadier operations and more credible institutional posture.

Token economics took a meaningful step forward. More protocols adopted explicit value capture through revenue sharing, burns, buybacks, or staking-linked distribution. The market increasingly rewarded designs that paired payouts with disciplined issuance, distinguishing sustainable models from older structures where tokens mainly represented governance narratives.

Closing thoughts

By the end of 2025, DeFi looked less like a single market and more like a layered financial system. Stablecoins formed the monetary base. Trading converged into a continuous stack spanning issuance, spot, derivatives, and event-driven markets. Credit and yield matured toward stablecoin-native, fixed-income-like structure underpinned by tokenized real-world assets. Execution improved through private routing and industrial intermediaries, while market power concentrated. Governance and token design professionalized, payouts normalized, and treasury capacity became an increasingly decisive advantage.

The year’s defining movement was structural differentiation. The winners were not simply the protocols with the most users or the most TVL, but those with durable execution, credible risk frameworks, and clear economic models that still function when incentives fade.

Stablecoins

Stablecoins are no longer a peripheral crypto product. In 2025, they became one of the primary settlement assets across payments, remittances, DeFi, institutional transfers and onchain treasury operations. In short, what began as a trading tool has evolved into a core monetary layer used across dozens of blockchains.

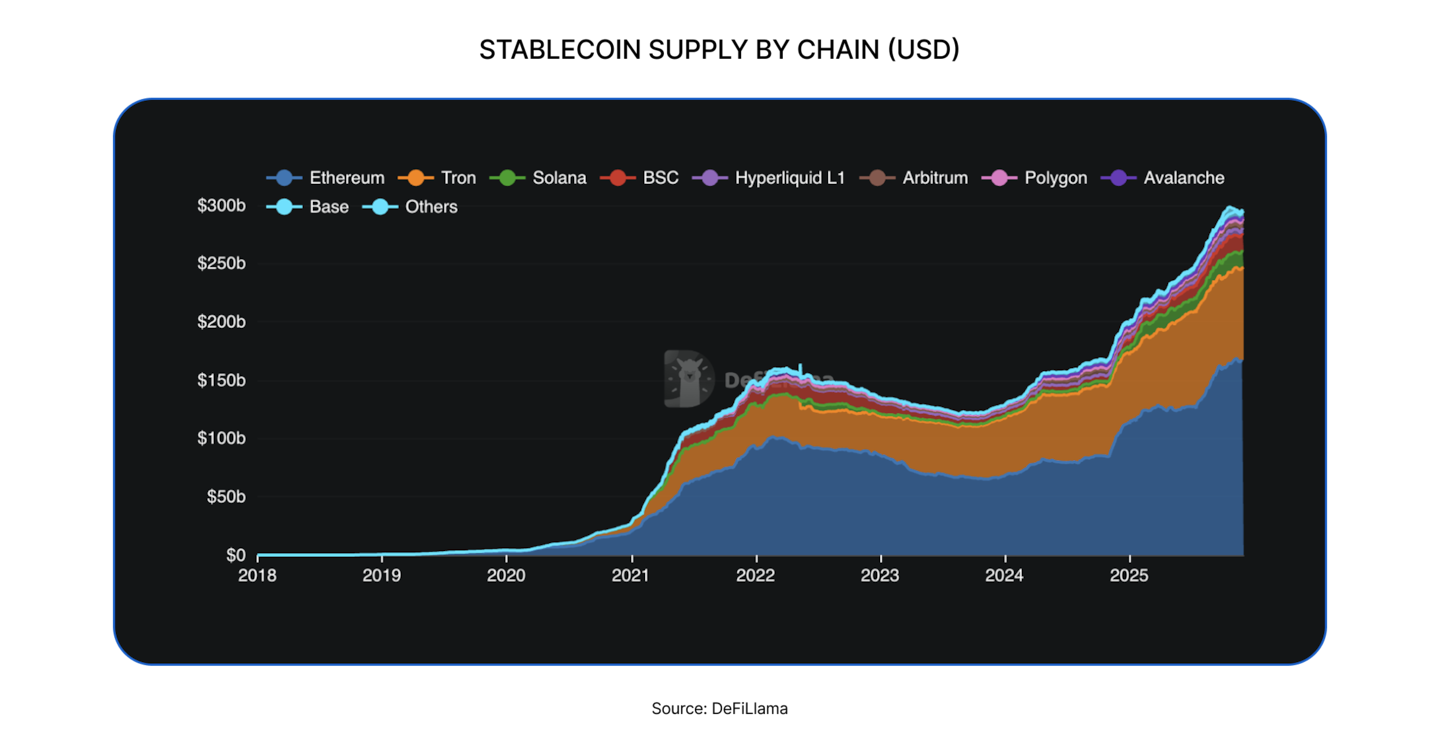

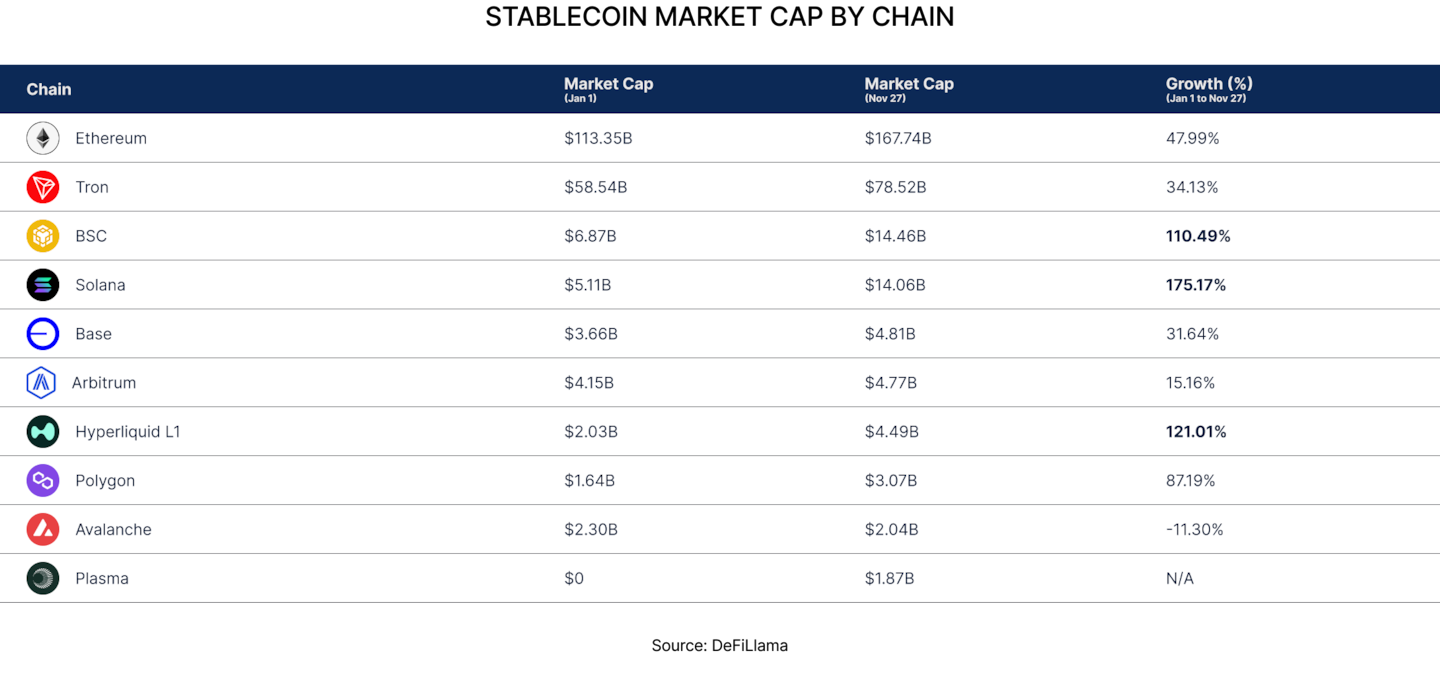

After nearly two years of contraction following the collapse of Luna’s TerraUSD in 2022, the sector entered a new expansion cycle. In November 2024, the total stablecoin market capitalisation broke its previous record of $185 billion and accelerated sharply from there, rising to $305 billion by early December from $204 billion at the start of the year a 50% increase within 12 months.

At the chain level, Ethereum reinforced its position as the dominant stablecoin environment, maintaining roughly 55% of total supply and adding $50 billion in new issuance, driven primarily by institutional flows, tokenisation, and RWA infrastructure prioritising security and settlement guarantees. Tron, by contrast, continued to consolidate its role as the global remittance chain, growing its supply by 34% and adding $25 billion — showingclear evidence that demand for low-cost, cross-border transfer rails remains strong. Together, Ethereum and Tron account for 81% of all circulating stablecoins, declining a modest 3% over the year despite rapid expansion on other chains.

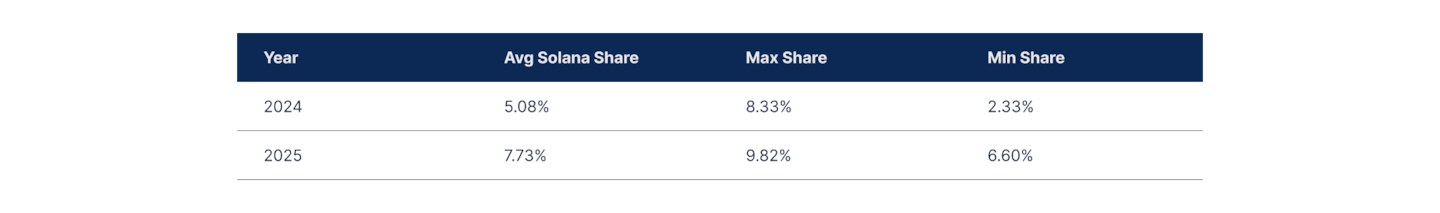

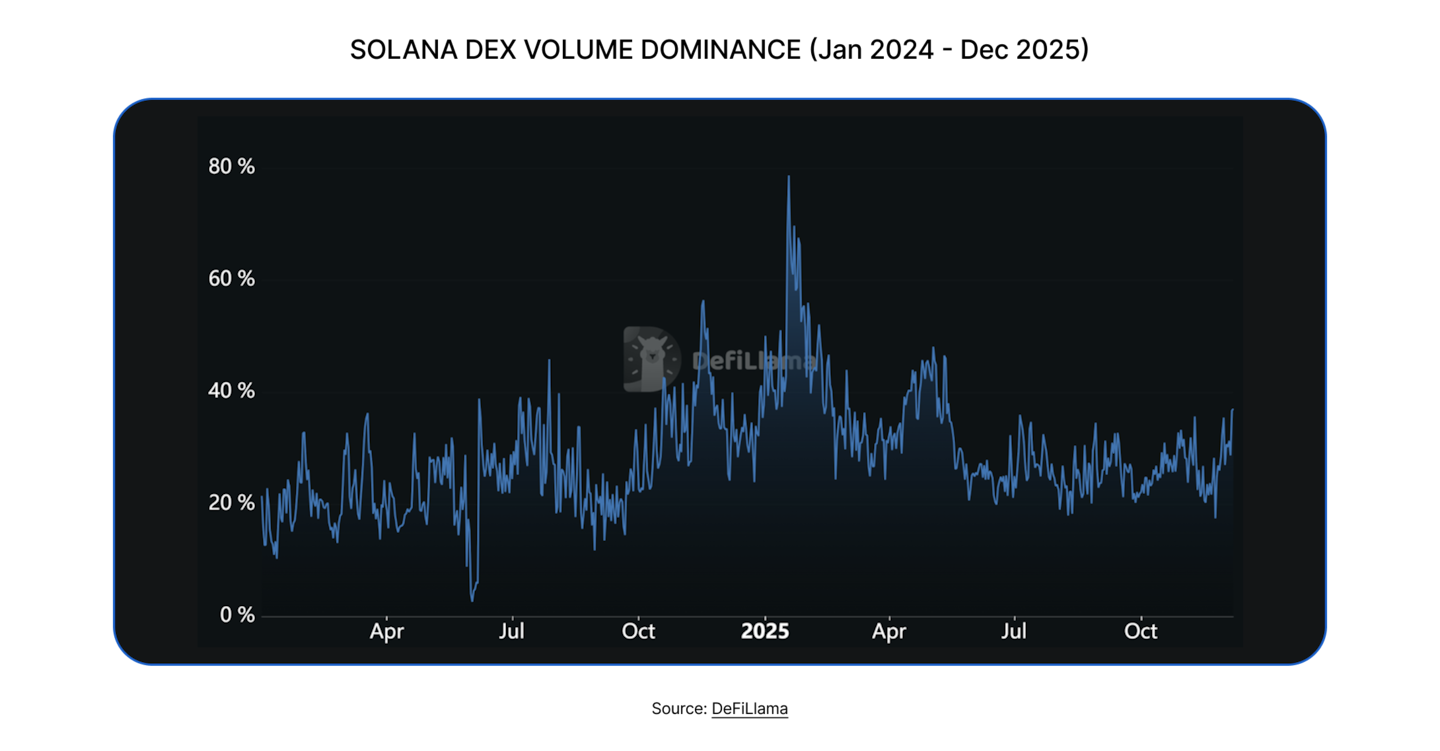

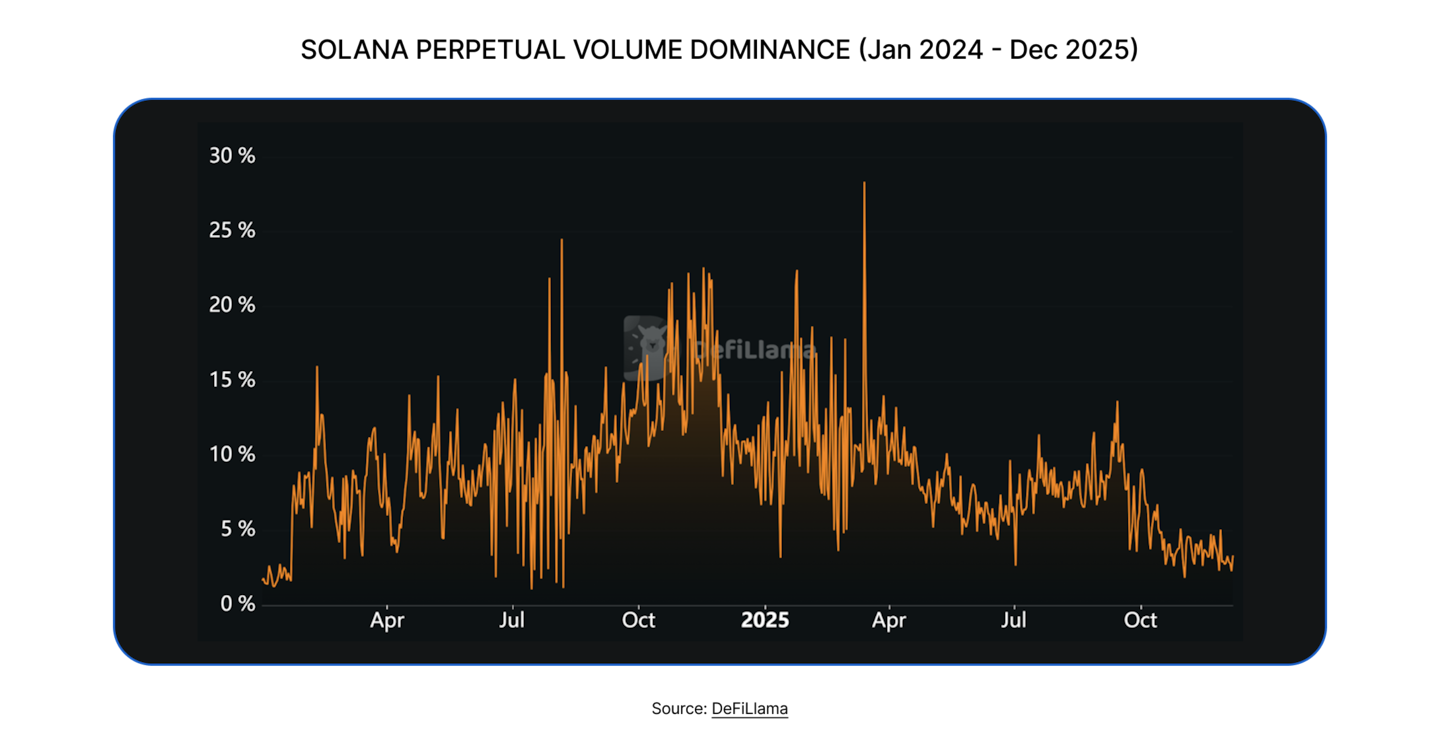

Solana expanded its stablecoin supply by more than 170%, driven not only by the memecoin cycle, which now represents around 5% of DEX activity, but also by rising activity in onchain perpetuals, payments and remittance flows. Binance Smart Chain and Hyperliquid Layer 1 followed similar trajectories, each recording triple-digit growth. On Hyperliquid, USDC emerged as the dominant margin and settlement asset. On BNB Chain, the launch of Four.meme, followed by Binance Alpha, a native token distribution program integrated directly into the Binance ecosystem, catalysed a renewed memecoin boom and sharply increased demand for stablecoin liquidity.

The number of stablecoin issuers and assets also grew materially throughout 2025. In early January, DefiLlama tracked 161 stablecoins, with 36 having a market cap above $50 million. By December, that number had increased to 214, with 51 exceeding the same threshold. At the top end, 18 stablecoins now surpass $1 billion in supply, up from 11 at the start of the year.

The two top stablecoins, Tether’s USDT and Circle’s USDC, still account for roughly 85% of the total supply. USDT expanded by 34% over the year, while USDC grew by more than 75%, driven by its increasing role as a chain-agnostic, easy-to-integrate payment currency.

Yield-bearing models, bank-issued tokens, fintech-native stablecoins and regional currency products all accelerated. Assets such as PYUSD (PayPal), RLUSD (Ripple), USDTB (BlackRock), USD1 (World Liberty Finance), USDF (Falcon), and USDG (Ondo) grew from negligible supply to multi-billion-dollar levels in a matter of months. Most of these issuers already operate in regulated financial environments and serve large, established user bases, which has enabled rapid scaling. Their entry into the market marks a clear shift: institutions are no longer observing the stablecoin sector from the sidelines, but are actively participating in it.

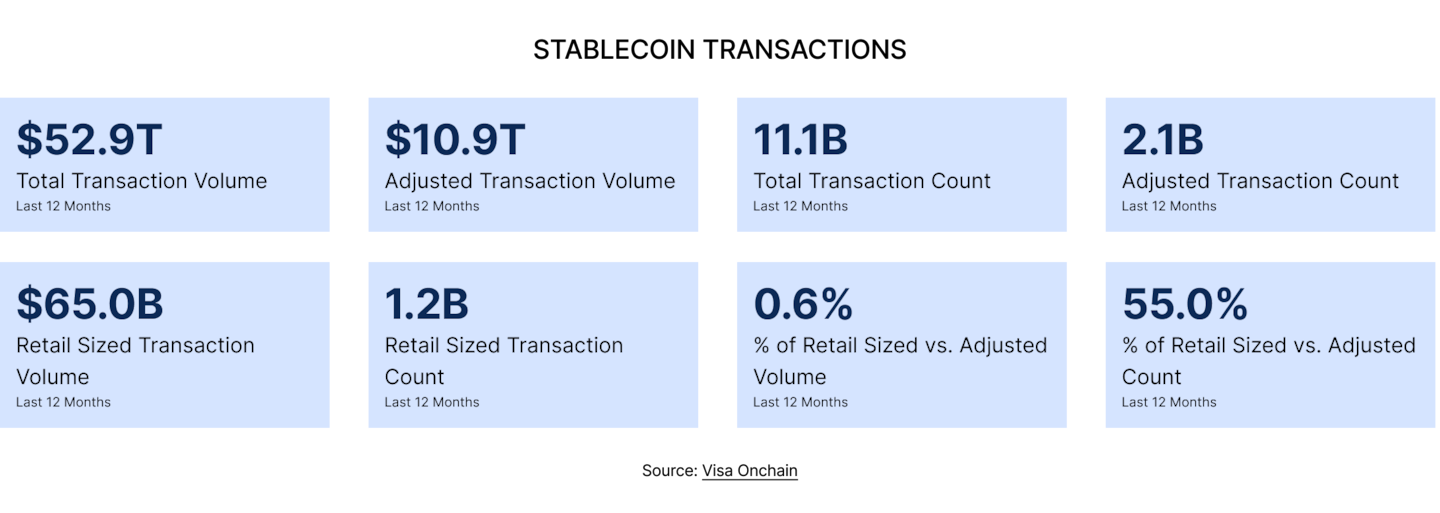

Stablecoin settlement volume underscores how deeply they are now embedded in real-world payments. In 2024, stablecoins settled more than $27 trillion in transaction value, surpassing Visa and Mastercard combined. Over the past twelve months, that figure nearly doubled to $52.9 trillion, placing stablecoins among the largest settlement systems globally.

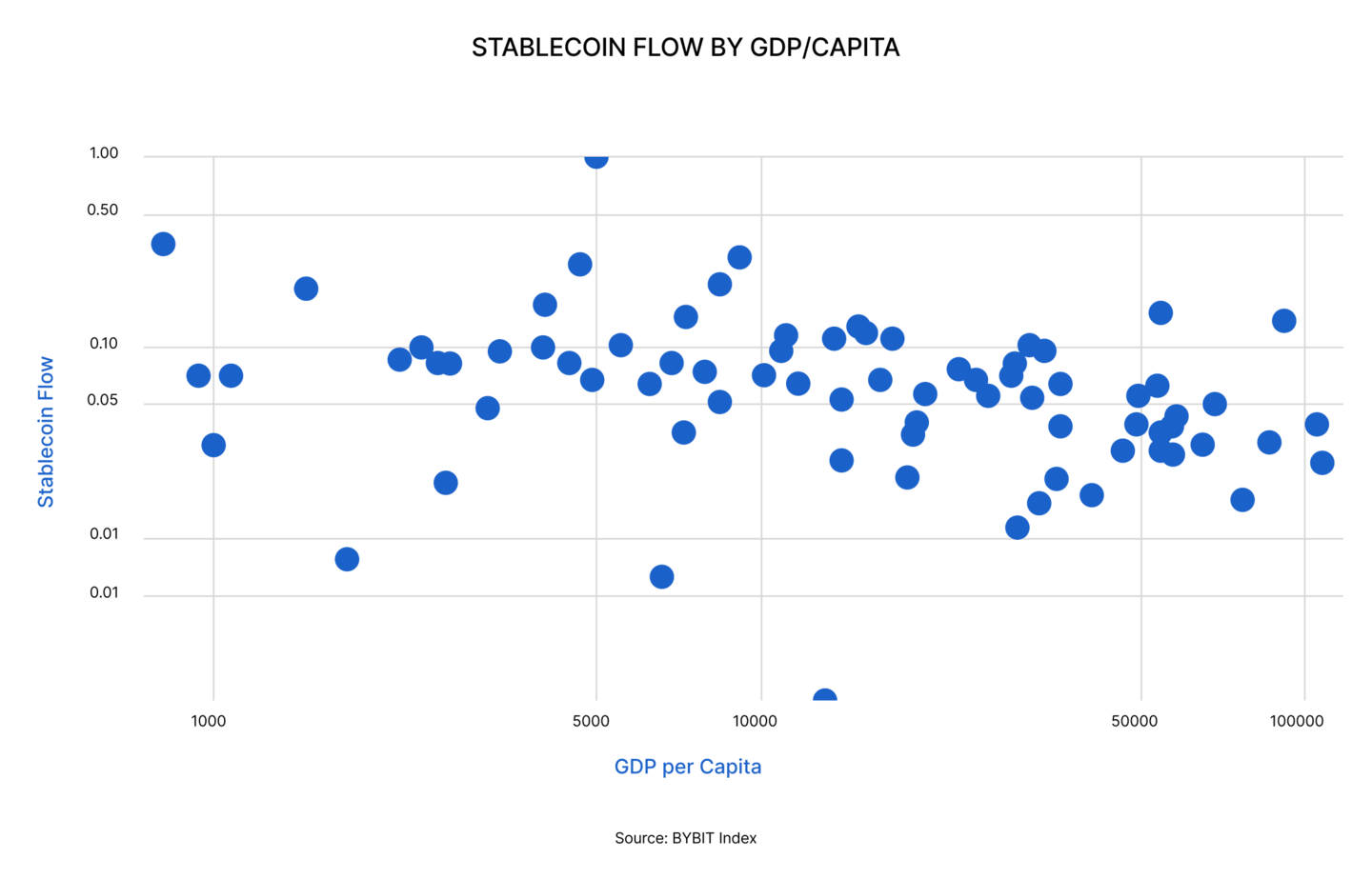

Notably, stablecoin adoption is not tied to national wealth. When stablecoin flow is analysed relative to GDP per capita, there is almost no correlation. Usage is widespread across advanced and emerging markets alike, but for different reasons. In countries facing instability or limited banking access, such as Nigeria or Ukraine, stablecoins primarily serve as remittance tools and secure stores of value. In wealthier economies, they are used as financial instruments, enabling efficient access to crypto markets, liquidity pools and yield-generating products. This bifurcation reflects the universal appeal of stablecoins: they solve completely different problems across completely different contexts, yet rely on the same underlying infrastructure.

The Regulatory Shift: Clarity Unlocks Institutional Adoption

The resurgence of stablecoins in 2025 did not arise from market momentum alone. It was the result of a structural shift driven by regulation, institutional engagement and macroeconomic forces aligning for the first time since the sector emerged.

A central driver was the GENIUS Act in the United States, which established the first comprehensive federal framework for dollar-backed stablecoins. It set strict 1:1 reserve requirements, mandated audited transparency standards and introduced a dual state-federal licensing model that traditional financial institutions could operate within. For the first time, the market gained a clear distinction between fully collateralised and regulated issuers versus experimental designs, a distinction institutions had been waiting for since 2022.

This shift was mirrored across multiple jurisdictions. In the European Union, the Markets in Crypto-Assets Regulation framework, MiCA, introduced harmonised rules for issuance, redemption and reserve composition, creating a predictable operating environment for euro-denominated stablecoins. Hong Kong implemented a licensing regime for issuers, while Singapore advanced rapidly with tokenised deposit infrastructure. Across the Gulf, particularly in the UAE, regulators began competing to attract stablecoin and tokenisation businesses. In short, major jurisdictions are no longer resisting adoption, they are shaping it.

Regulatory alignment coincided with the maturation of the products themselves. Over the past three years, leading stablecoins demonstrated resilience through bank failures, liquidity shocks, interest-rate volatility and major crypto drawdowns. Fully collateralised models such as USDT and USDC, as well as the increasingly popular RWA-backed or crypto-backed designs, proved robust under stress. The market internalised the lessons of the Luna collapse, and undercollateralised models gradually lost relevance.

As a result, banks, corporations and financial technology companies moved from pilots to real deployment. PayPal expanded PYUSD issuance, BlackRock’s USDTB attracted billions in demand, and Ripple’s RLUSD scaled rapidly across several chains. Stripe integrated stablecoin settlement into its payments stack, enabling merchants and platforms to accept and move digital dollars directly. At the same time, corporate treasurers, onchain lenders, market makers and remittance providers shifted a growing share of their operations to stablecoin rails.

The macro environment amplified this transition. Elevated US interest rates increased the appeal of fully backed stablecoin models whose reserves are invested in short-term Treasury instruments. Tether, for example, has become one of the largest holders of US Treasury bills globally. This environment also supported the emergence of new US-backed stablecoin designs, while yield-bearing stablecoins developed to pass these returns directly to users. At the same time, inflationary pressures across emerging markets pushed consumers and businesses toward dollar-denominated assets, accelerating adoption where local currencies remain fragile.

By 2025, the effects of these forces were visible in the data: stablecoin supply reached record highs, institutional issuers entered the market at scale and settlement volumes surpassed traditional payment networks.

The Technology Shift: Stablecoins Become an Infrastructure Layer

Regulatory clarity laid the foundation for stablecoin expansion, but technology played an equally important role as stablecoins became also the infrastructure rather than just assets.

USDC is a major player in this transition. Circle’s multichain strategy and the adoption of CCTP turned USDC into a native, burn-and-mint asset that can move seamlessly across networks without relying on conventional bridges. Liquidity is unified, fragmentation is reduced and applications can settle across multiple chains with the same token standard. For institutions, this model resembles a global settlement network allowing fintechs, exchanges and payment platforms to treat stablecoins as infrastructure. A similar transition is underway with USDT. The launch of USDT0 through LayerZero messaging allows Tether’s supply to be treated as chain-agnostic, eliminating one of the largest sources of operational friction in the market: fragmented liquidity.

At the same time, a new class of networks is emerging that redefines settlement around stablecoins entirely. Take Plasma:a chain built from first principles to support stablecoin flows, with stablecoins functioning as the native asset rather than an add-on. In a few months, it grew to nearly $2 billion in circulating supply, driven by an environment optimised for high throughput, low fees and predictable settlement. This design mirrors the success of Tron, which proved that specialising around a single financial primitive can sustain massive daily volume and meaningful fee revenue. Plasma is not alone, other projects are following the same direction like Stable, Arc (Circle) and Tempo (Stripe) all signal that stablecoin-first settlement layers are becoming a strategic priority.

The Usage Shift: Payments, Safety and Yield

Stablecoins entered a new phase in 2025. What began as a trading convenience now operates at the centre of payments, remittances and onchain finance. Users leaned toward safer fiat-backed assets, while institutions embraced yield-bearing models that turned digital dollars into productive capital. These shifts reshaped stablecoin behaviour, creating adoption patterns grounded in real economic use rather than speculative cycles.

Payments, Remittances and Financial Instruments

As real-world integrations expanded throughout the year, stablecoins increasingly moved beyond passive storage and into everyday payments. The growth of crypto cards, merchant onramps and direct checkout options made stablecoins far easier to spend. Examples abound, with Shopify and Stripe now supporting crypto-based payments, while the number of crypto cards surged throughout the year.

This broader usability naturally reinforces stablecoins’ role in remittances, one of their most persistent and necessity-driven use cases. The speed and low cost of cross-border settlement directly address geopolitical and banking frictions. In Ukraine, stablecoins provide reliable access to funds amid ongoing disruptions. Workers in the UAE use them to avoid high remittance fees, and in Nigeria they have become a trusted alternative to fragile local banking systems. These flows are clearly not speculative, they respond to everyday financial realities.

At the same time, stablecoins continued to serve as the reference asset for onchain finance. They remain the preferred unit for trading, liquidity provision and collateral across DeFi, primarily because of their price stability.

As a result, stablecoins increasingly function as the core settlement and accounting layer linking payments, transfers and financial markets within a single system.

A Preference For Fiat-Backed Stablecoins

The preference for fully collateralised, fiat-backed stablecoins continued to strengthen. USDT and USDC account for roughly 85% of total supply, a dominance that has barely eroded the proliferation of new issuers. The reasons are straightforward: post-Luna risk aversion, clearer regulatory standards and stronger institutional participation have all reinforced demand for audited, conservative designs. As corporates and financial institutions deepen their use of digital dollars for settlement and liquidity management, this preference for safety has become a structural feature of the market.

Yield Bearing Stablecoins, a Fast Growing Market

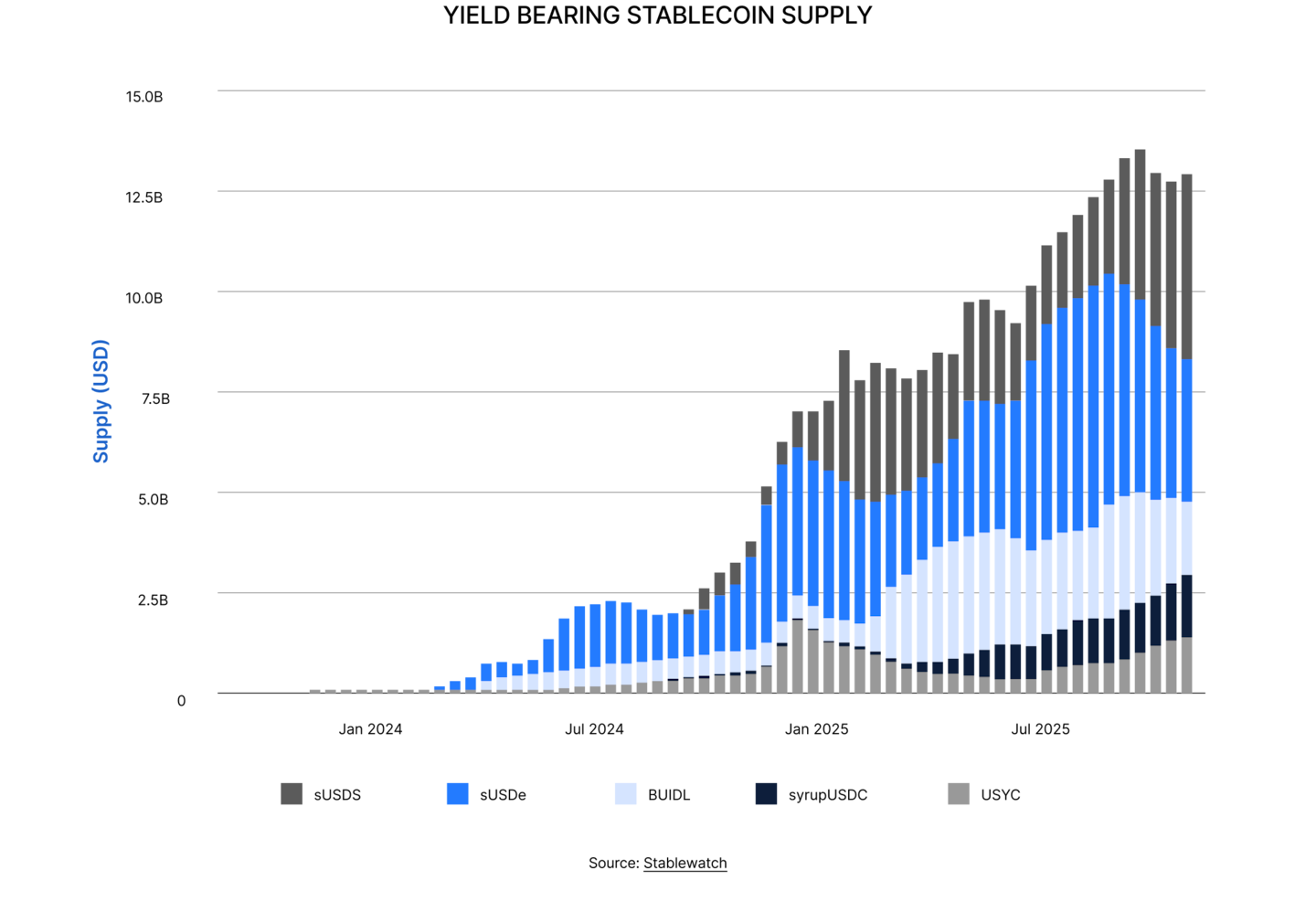

Yield-bearing stablecoins have also expanded rapidly, growing from $9.5 billion at the start of 2025 to more than $20 billion today. Instruments such as sUSDe, BUIDL and sUSDS attracted most of the inflows, while more than fifty additional assets now populate the broader category. Yields can range from 2% to 10%, with an average around 5%, placing them slightly above traditional money-market rates. These instruments blur the line between cash, deposits, DeFi yield strategies and tokenised treasuries, transforming stablecoins from passive wrappers into income-generating assets.

These patterns reinforce one another. Payments and remittances drive global distribution and high-frequency activity. Fiat-backed models provide the safety and credibility required for institutional adoption. Yield-bearing designs offer predictable yields and deepen liquidity onchain. Together, they form a usage landscape that is broader and more durable than any single narrative. Stablecoins are no longer tied to a single function, they have become the primary medium for value transfer, liquidity management and risk-controlled yield across the digital economy.

Stablecoins Enter the Mainstream Financial Layer

If 2025 was the year stablecoins regained scale and credibility, 2026 is set to mark their entry into mainstream finance. The combination of regulatory clarity, maturing infrastructure and diversified usage now provides a clear path toward broader integration across consumer finance, corporate operations and global payments.

Regulation remains the primary catalyst for 2026. The implementation of the GENIUS Act and MiCA brings standardised rules for issuance, reserve requirements and supervision, creating the first coordinated global framework for stablecoins. More jurisdictions are expected to follow, with active discussions in Asia around yuan-backed models and other regional currencies. This regulatory alignment should accelerate the arrival of non-USD stablecoins and open the door for a new wave of institutional issuers entering digital assets at scale.

Yield-bearing stablecoins are the segment to watch in 2026. Their value proposition is simple: stability, predictability and yield in a single product. With supply having doubled over the past year, they are positioned to become a core collateral type in DeFi and an emerging cash alternative for DAOs, corporates and investment platforms. As global interest-rate dynamics shift, competition between issuers and protocols around yield-bearing structures is likely to intensify.

Payments and settlements are also poised to accelerate. Stablecoin payrolls, contractor compensation and SME cross-border transfers are becoming more common as companies seek faster, cheaper alternatives to banking rails. B2B settlements between exchanges, liquidity providers and fintech platforms are increasingly moving onchain, with early signs extending to trade finance, ecommerce payouts and treasury operations. The rise of virtual cards and credit products backed by stablecoin balances strengthens the bridge between onchain money and everyday financial activity.

Still, key risks remain. A sustained decline in US interest rates would compress reserve income and reduce the attractiveness of fully backed and yield-bearing models alike, forcing issuers to compete more aggressively on efficiency, scale and distribution rather than on yield alone. At the same time, regulatory fragmentation across jurisdictions, uneven access to banking rails and concentration risk among custodians and issuers remain structural constraints.

Taken together, the trajectory is clear. Stablecoins are evolving from a crypto-native asset into a universal liquidity and settlement layer that connects consumer finance, institutional infrastructure and global payments.

Capital And Revenue Map: Who Earned, Who Faded

2025 marked a decisive shift in how value is generated and captured across the crypto economy. Revenue expanded across nearly all major sectors, but the distribution of that growth revealed a clear structural pattern: a small group of protocols continues to dominate fee capture while a new wave of entrants reshapes competition within key verticals.

At the same time, falling infrastructure costs allowed applications to scale far beyond previous cycles, reinforcing the shift from base-layer value capture to application-layer economics. The result is a DeFi landscape where revenue is rising, concentration remains high, and competitive dynamics are accelerating.

Where the Money Was Made: Sectors and Protocol Concentration

A DeFi Landscape Still Concentrated

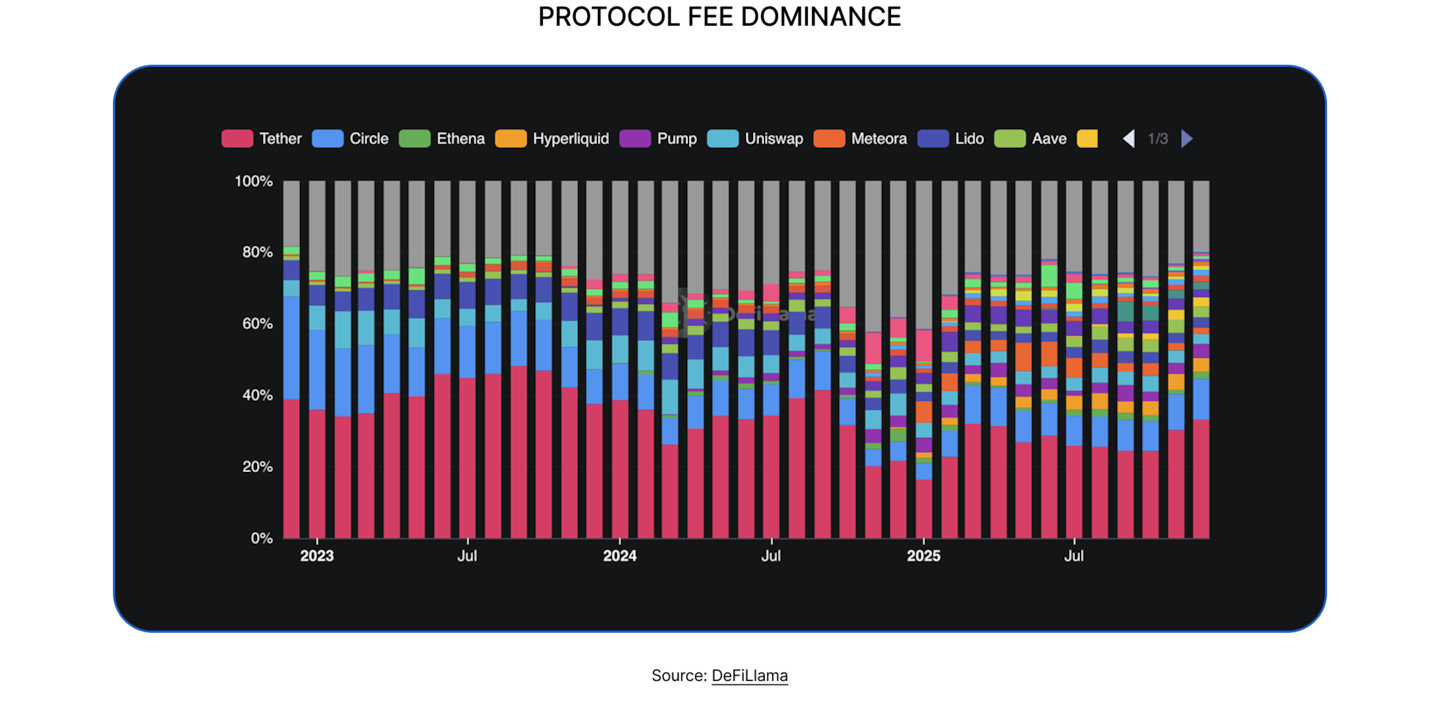

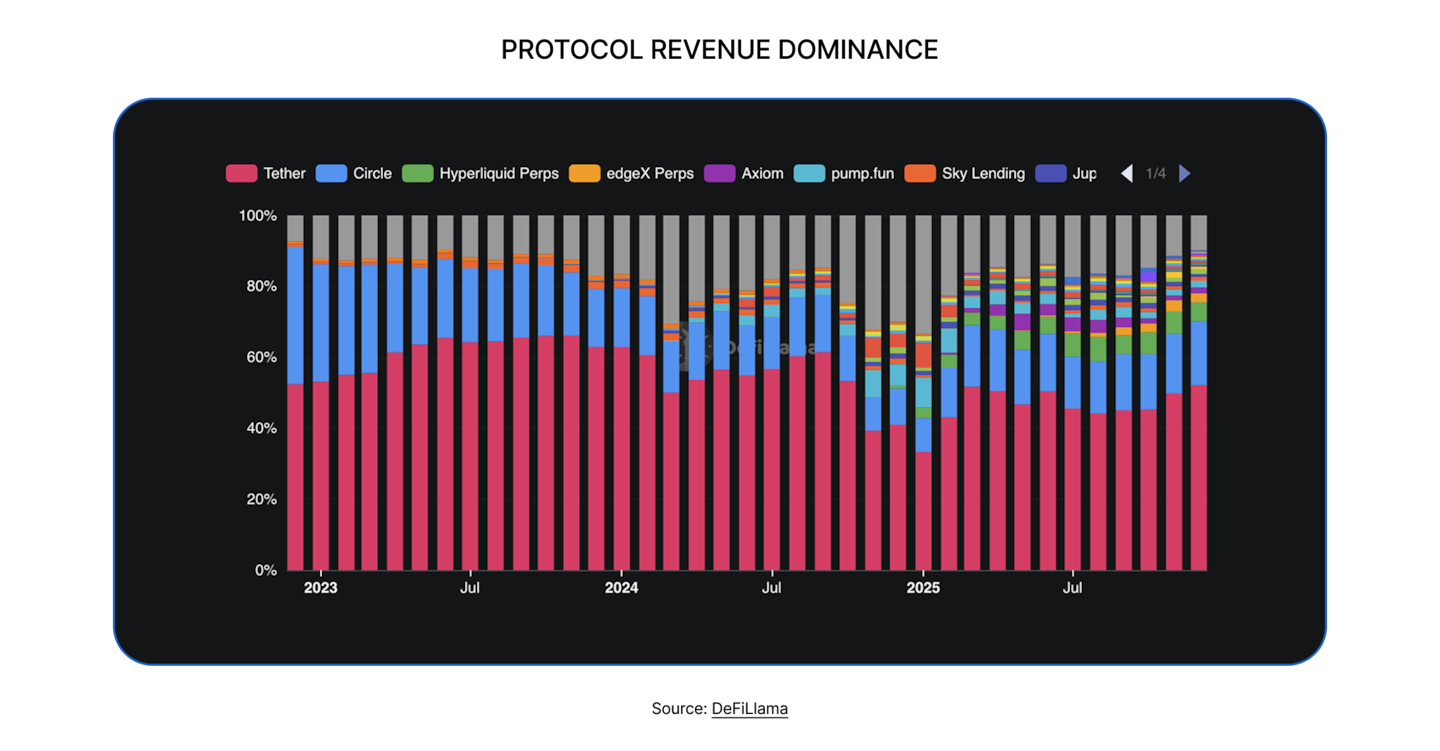

Despite the growth and diversification of activity in 2025, value capture within DeFi remained heavily concentrated. Across the year, the top ten protocols generated around 60% of all fees, while the top twenty consistently captured close to 80%. This pattern shows that users continue to gravitate toward a narrow cluster of platforms offering reliable execution, deep liquidity and proven operational performance.

One category sits far above the rest: stablecoin issuers. The dominance of Tether and Circle reinforces the conclusion drawn in the stablecoin section: digital dollars have become a foundational financial layer.

Below them, leading platforms such as Pump.fun, Uniswap, Lido, Aave, Sky and Hyperliquid show the same clustering effect. Activity does not spread evenly across the ecosystem but remains concentrated around a limited number of robust, established players operating across very different verticals. Yet the picture is more diversified than in early 2024, when Tether, Circle, Uniswap, Lido, Aave and Jupiter alone accounted for approximately 70% of total revenue. The emergence of new entrants signals a gradual broadening of competitive dynamics.

The revenue distribution makes this even clearer. Tether alone captured around 54% of all revenue, enabled by a reserve-based model where income scales with assets and marginal costs remain low. Circle followed with roughly 18%, reflecting a similar structure. Together, the two issuers represent nearly 75% of the revenue generated across DeFi, leaving the remaining 25% to be shared among a wide range of protocols.

Within that remaining share, perpetual exchanges stood out. Hyperliquid, EdgeX, Lighter and Axiom together generated around 7.5% of industry revenue, suggesting that perps may be capable of rivalling the revenue generated by stablecoin issuers.

Sector and Protocol Level

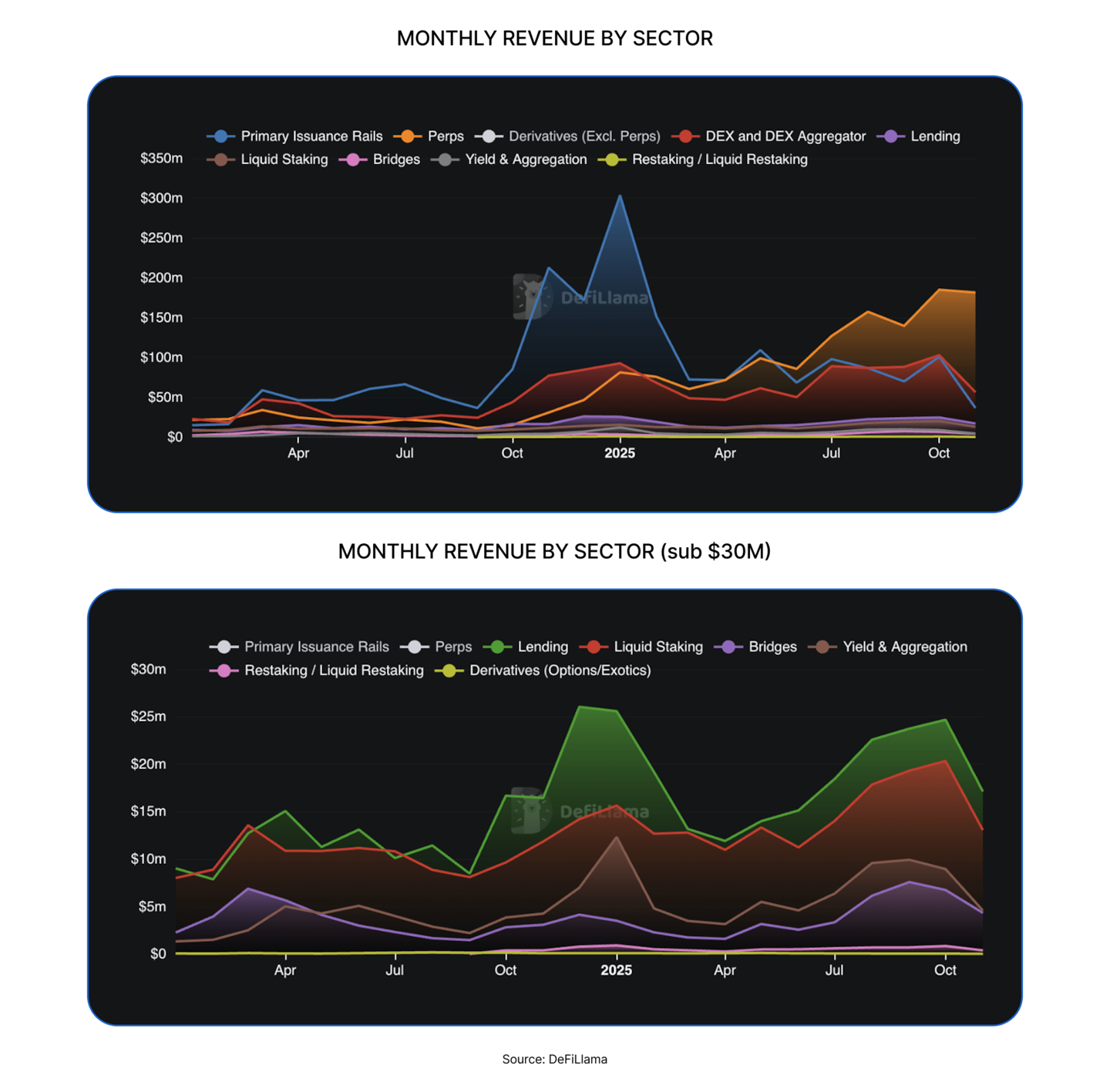

The charts below serve as the reference point for this analysis as they map revenue across the main DeFi verticals.

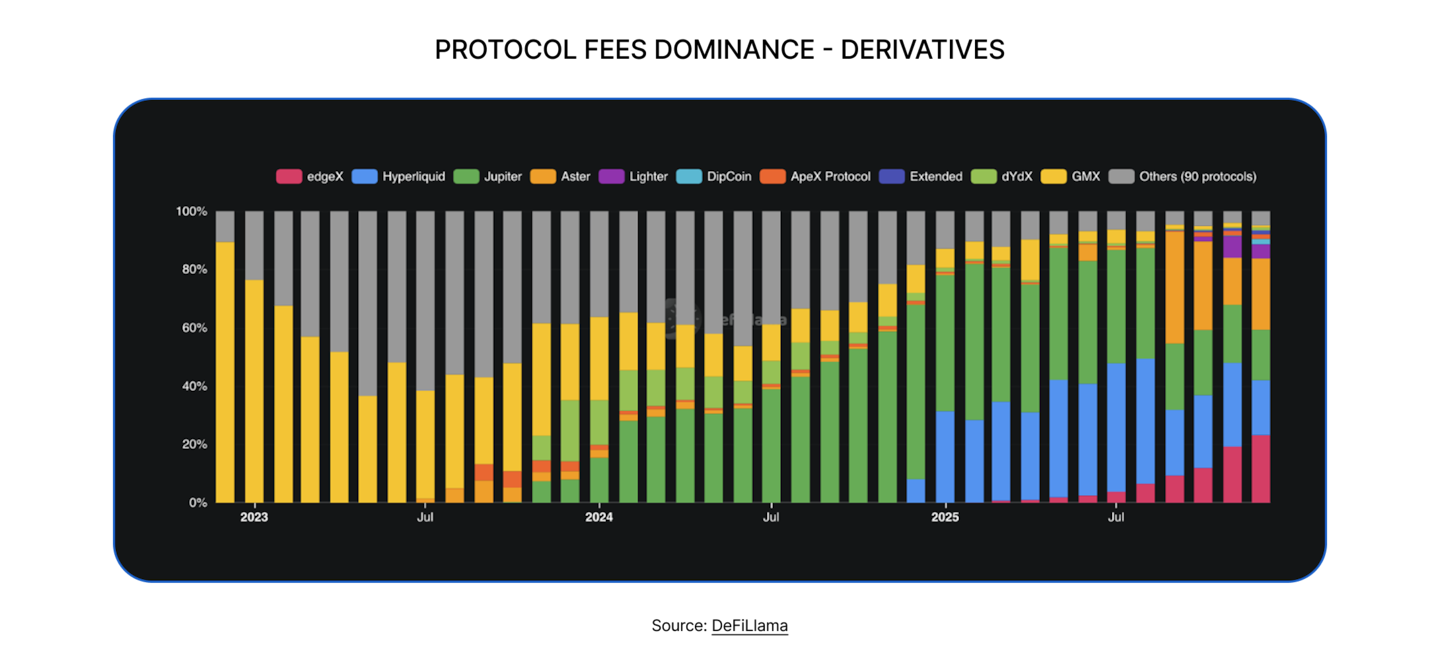

Perpetual Exchanges: The Dominant Engine

Perpetuals were one of the strongest revenue engines of the year. Monthly sector revenue doubled from roughly $100 million to more than $200 million, driven by renewed trading activity and major improvements in execution environments. After years of lagging behind centralised exchanges due to high fees, latency and uneven UX, onchain perps finally reached full competitiveness in 2025. Notably, perps revenue has become largely uncorrelated with market direction, confirming that onchain derivatives have matured from a cyclical product into a structural financial primitive.

Hyperliquid led this shift, rapidly absorbing the market share previously held by Jupiter Perps and establishing itself as the sector’s anchor. New entrants such as Aster, EdgeX and Lighter intensified competition and pushed execution quality higher. Within a single year, the market became highly consolidated, with roughly five protocols capturing nearly 90% of fees. This competition is ultimately beneficial: it drives fees down, improves execution and accelerates the migration of perps from centralised exchanges to onchain venues.

Primary Issuance Rails: A New Category Takes Shape

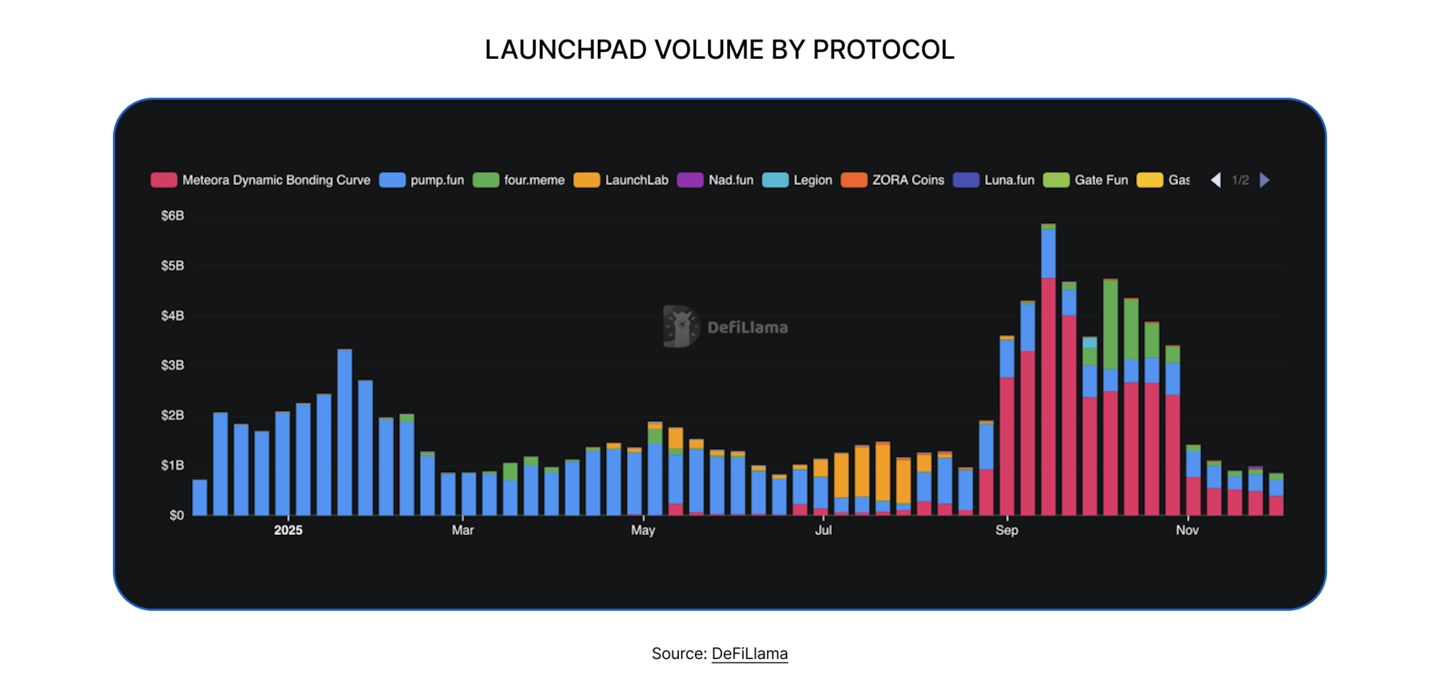

Primary issuance rails emerged as one of the major winners of 2025. The momentum began in 2024 with Pump.fun, which gamified token creation and tapped deeply into retail participation. The sector peaked in late 2024, coinciding with the U.S. elections and the launch of the TRUMP token, a moment that fuelled a surge in speculative activity. From that point onward, issuance rails consistently generated around $100 million in monthly revenue throughout 2025.

Pump’s dominance began to soften as new platforms entered the market, including Four.Meme, Binance Alpha and LetsBonk.fun. Although the category remains heavily led by Pump, the arrival of competitors has pushed the sector toward a more competitive structure.

The key takeaway is that issuance rails represent a new business model, one that monetises attention, distribution and entertainment, rather than traditional liquidity or trading activity.

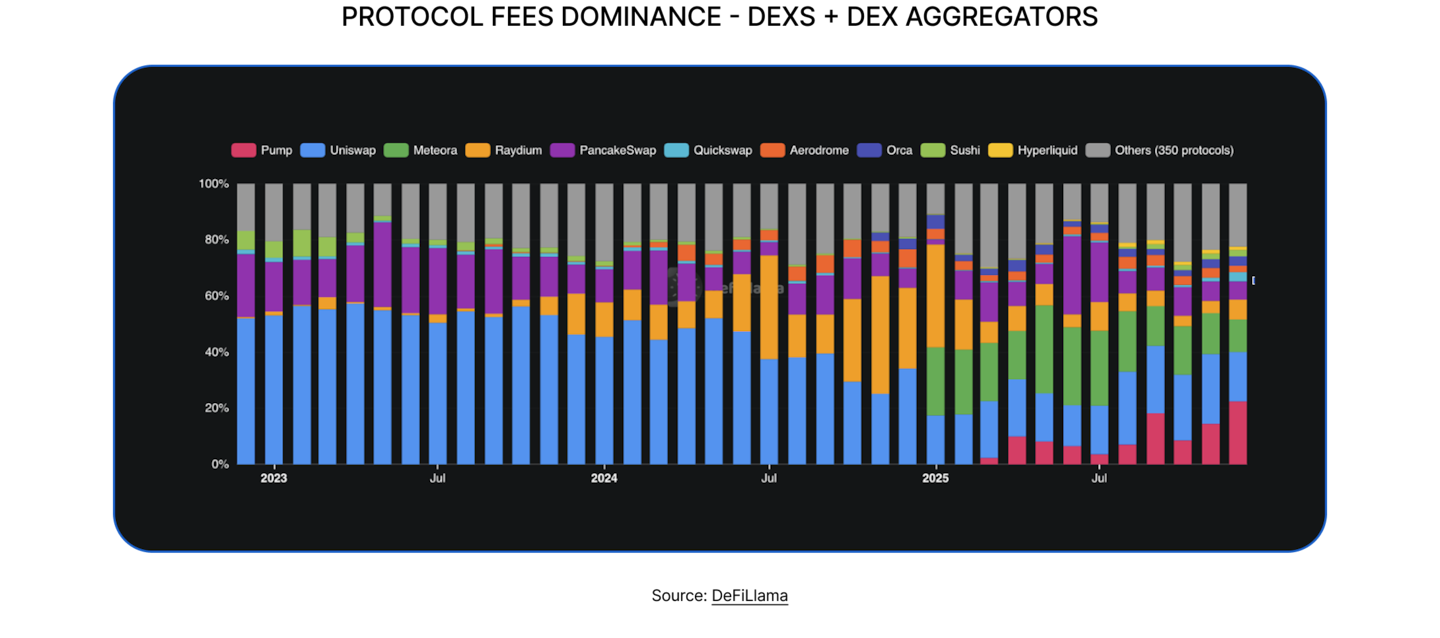

DEXs and Aggregators: Strong Growth but Market-Linked

DEXs and aggregators also recorded meaningful revenue growth. After generating around $25 million per month in 2024, the sector approached the $100 million range in 2025. Unlike perps, however, DEX activity remains closely tied to market conditions. Revenue fluctuates with trader sentiment, expanding during periods of volatility or risk-on behaviour and contracting when activity slows.

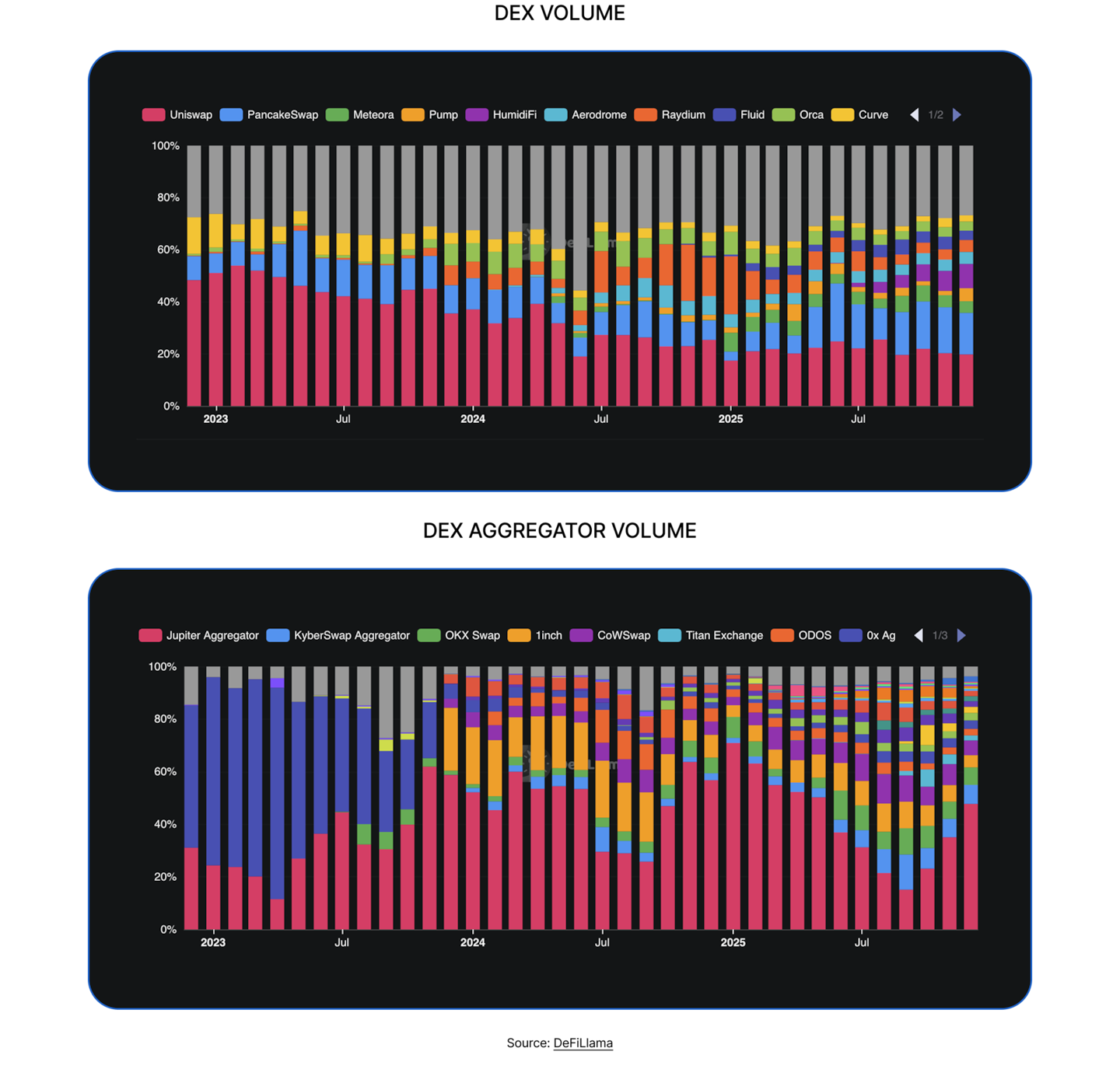

What stands out in 2025 is the sharp rise in competition. A market once dominated by two or three platforms capturing nearly 80% of fees is now far more balanced: today, ten protocols collectively account for that same 80%. Uniswap’s decline illustrates this shift clearly, with its dominance falling from roughly 50% to around 18% in a year. PancakeSwap and Raydium experienced similar contractions, each losing roughly half of their market share over the past few years.

The driver behind this redistribution is the emergence of more innovative, efficient and often cheaper alternatives. Platforms such as Meteora, PumpSwap, Aerodrome and Hyperliquid Spot have reshaped routing dynamics and fee structures, forcing incumbents to compete on execution quality, cost efficiency and overall user experience.

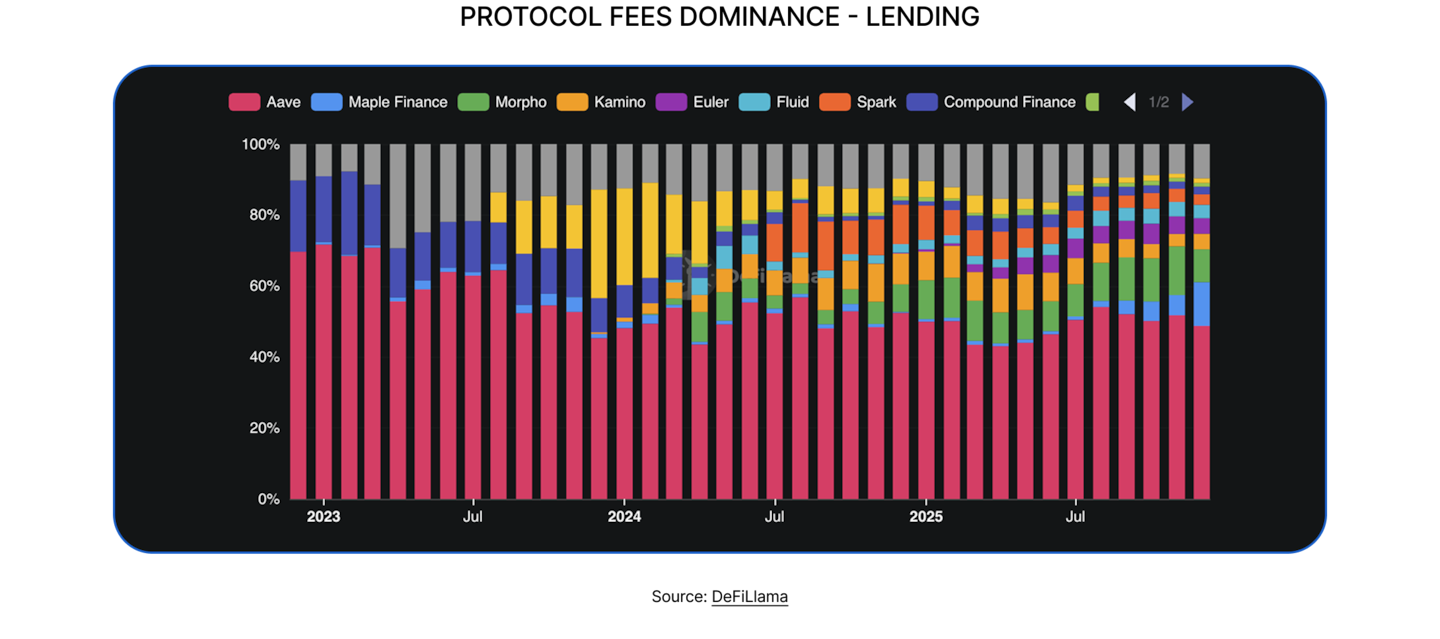

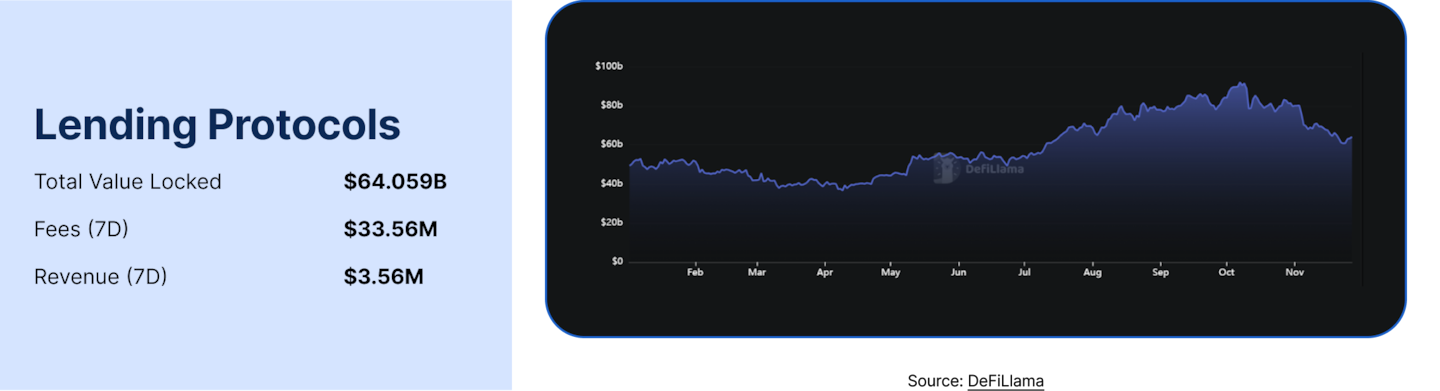

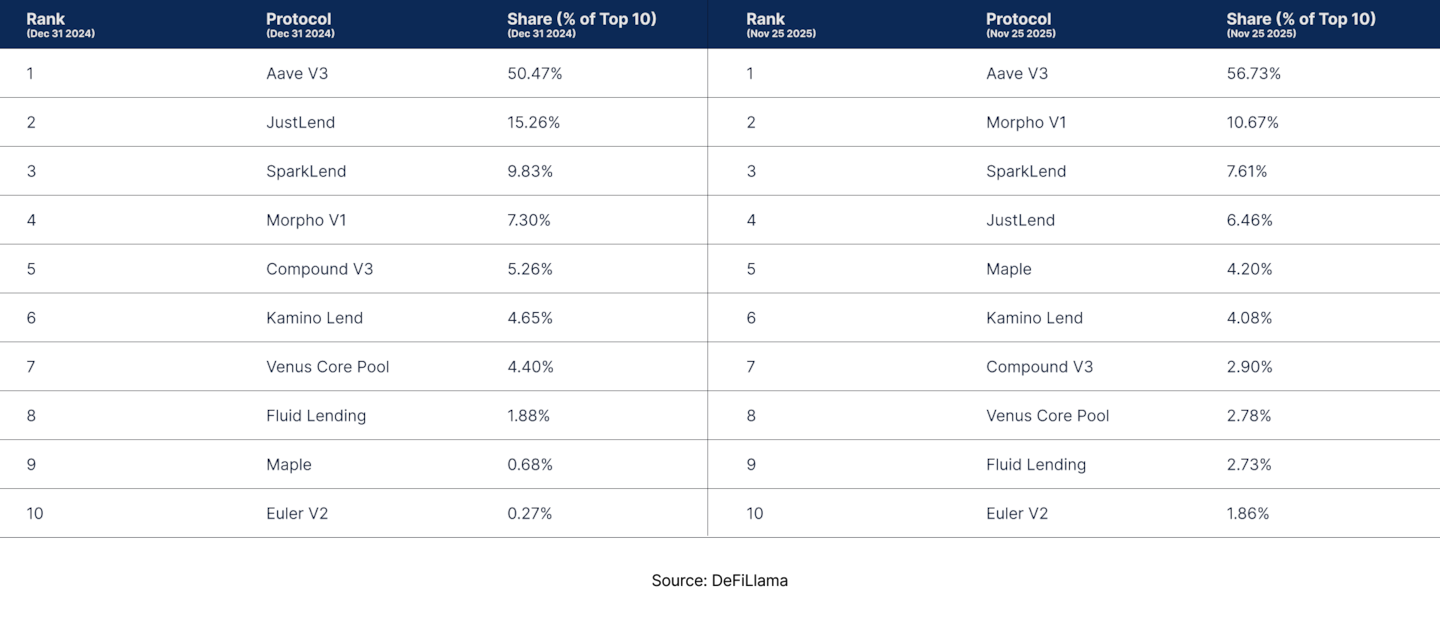

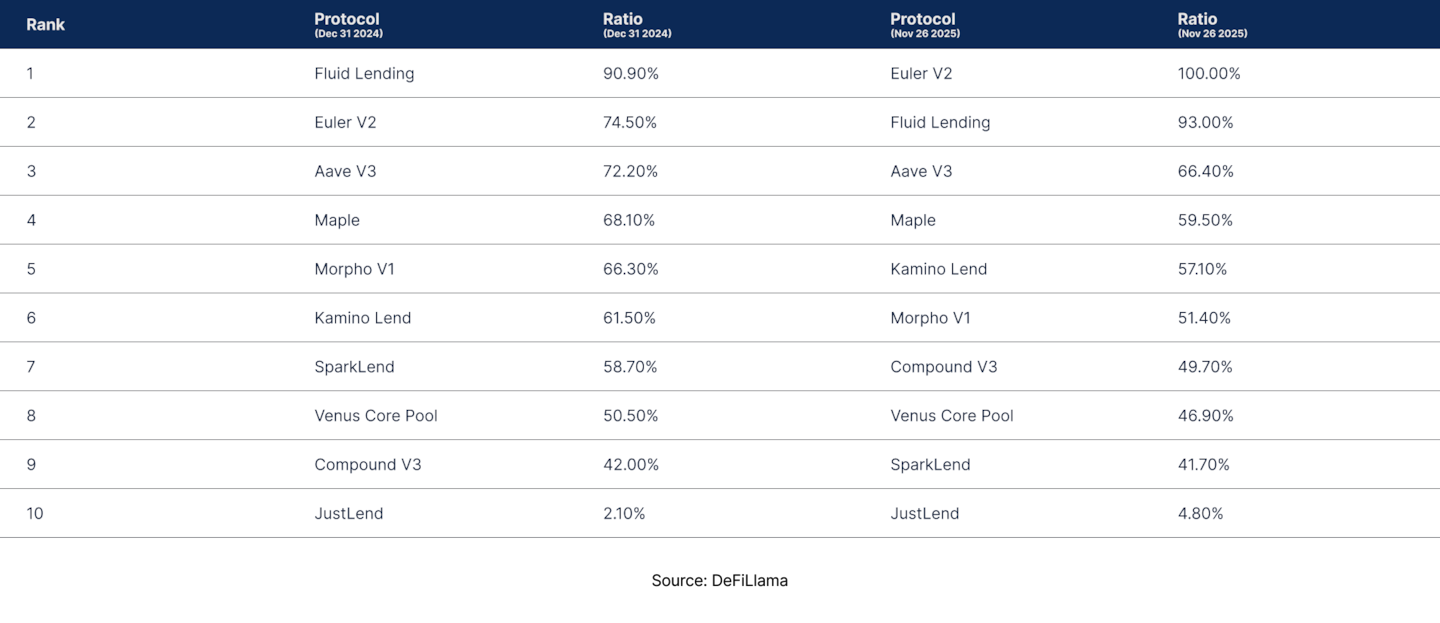

Lending, Curation As The Engine of Growth

Lending revenue increased from around $10 million per month in 2024 to between $15-25 million per month in 2025, although volumes continued to fluctuate with market sentiment. The sector’s overall size did not transform dramatically, but its internal structure shifted.

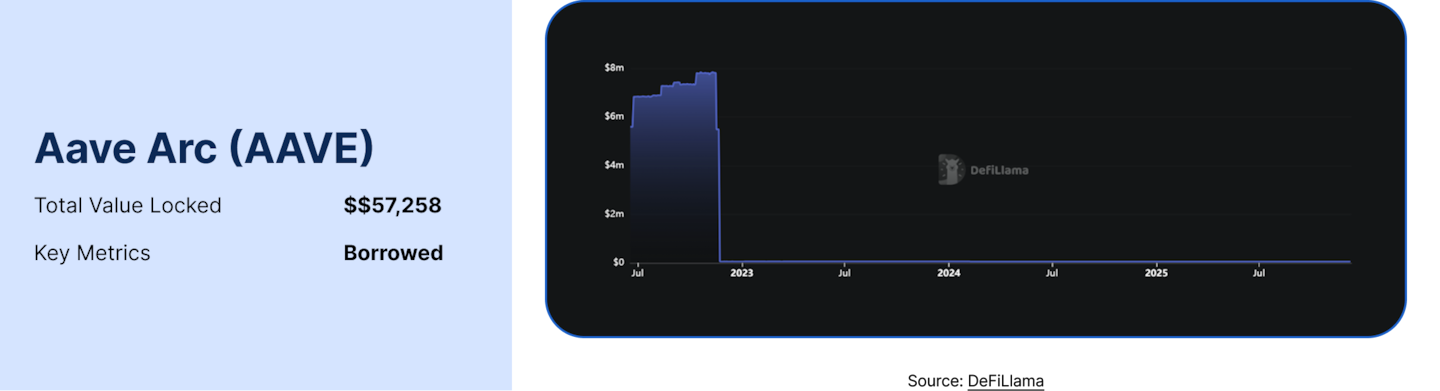

Aave remained the anchor, capturing close to half of all fees and strengthening its position through a clearer institutional and RWA-focused roadmap.

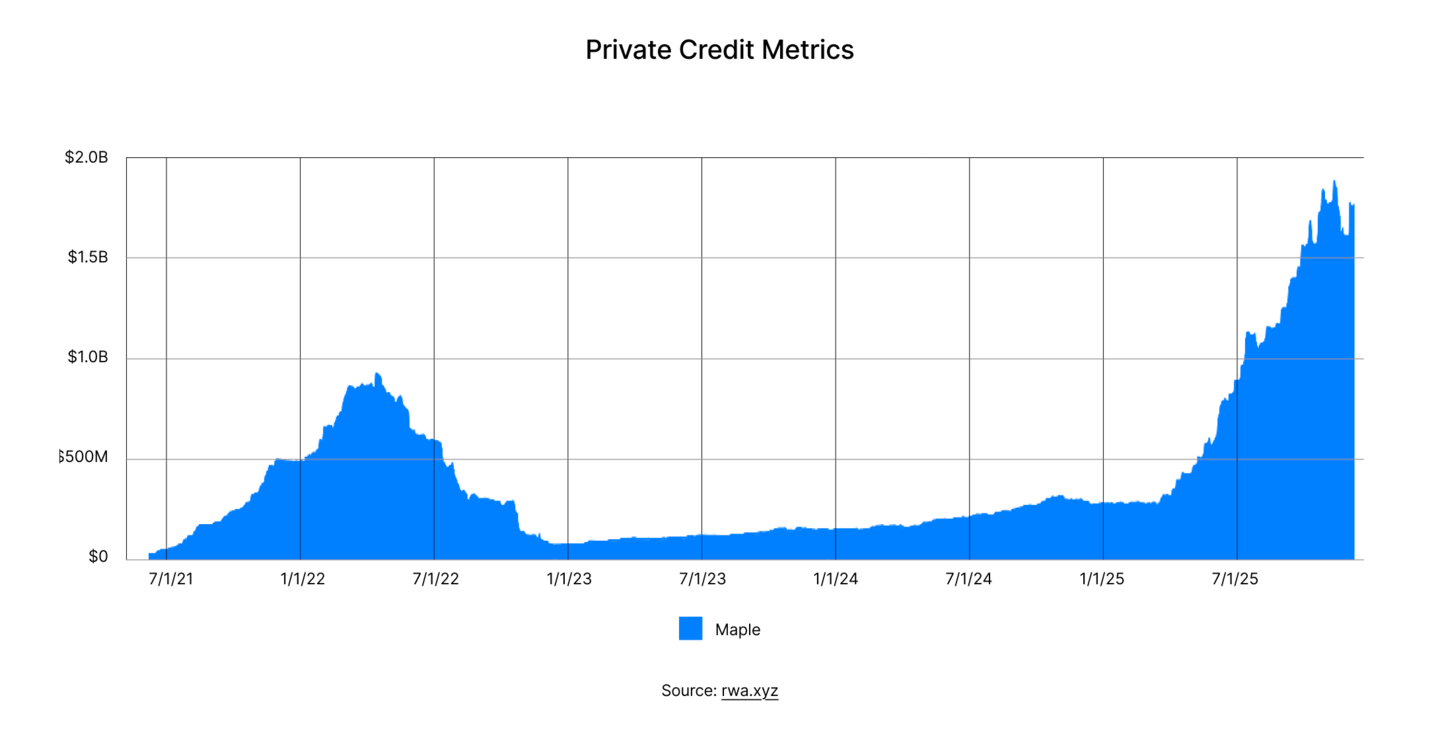

At the same time, growth increasingly came from curated credit markets. Morpho, Maple Finance and Euler expanded by offering controlled, risk-segmented lending environments aimed at institutions seeking predictable exposure. This marks a gradual divergence within the sector: open, retail-oriented platforms like Kamino or SparkLend play a smaller role in fee generation, while regulated, curated liquidity channels steadily gain relevance.

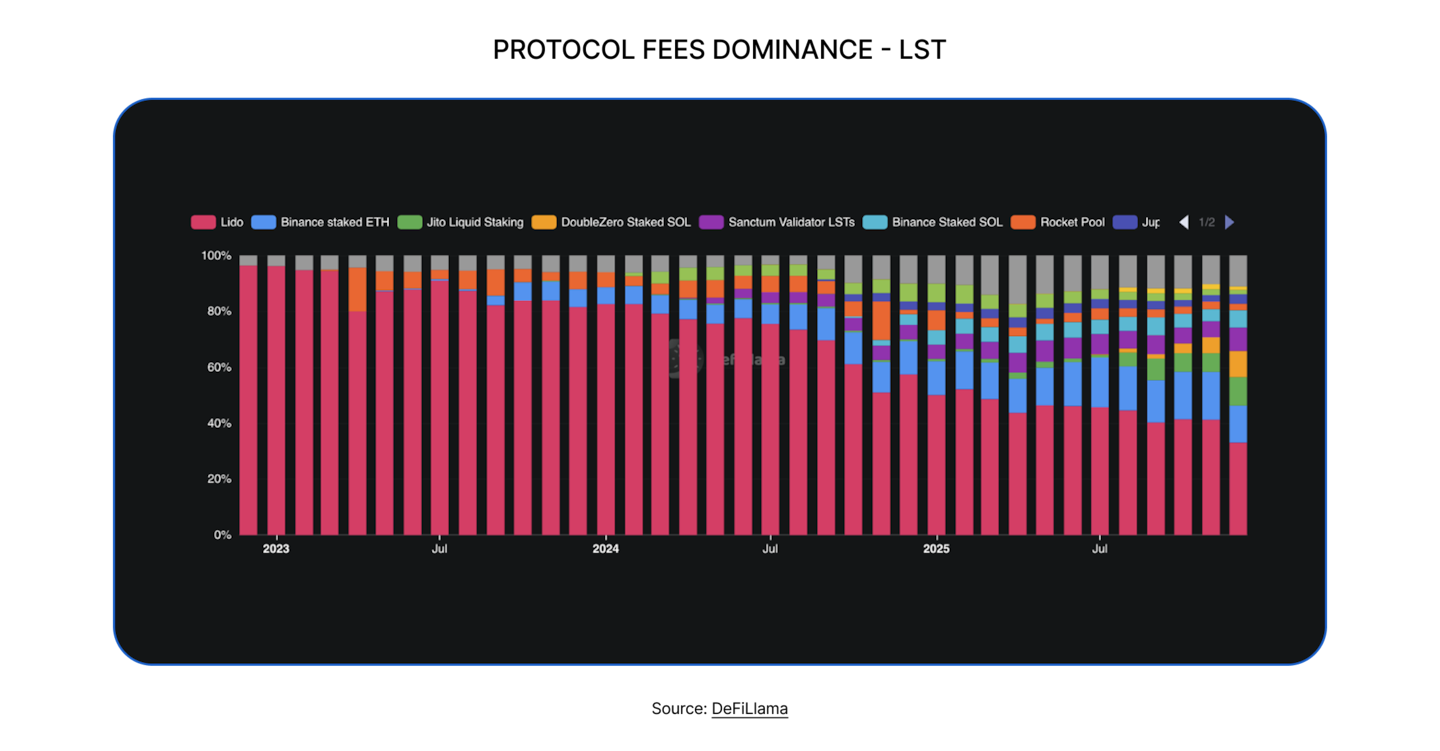

Liquid Staking, CEXs competing with Lido

Liquid staking recorded steadier progress, with monthly revenue rising from around $10 million to roughly $15 million. This growth was primarily structural, supported by declining global interest rates that pushed market participants to seek yield alternatives, as well as increasing regulatory acceptance of staking, which encouraged institutional participation.

At the protocol level, the competitive landscape shifted meaningfully. Lido, which captured nearly 80% of market share in 2024, saw its dominance erode as new LST ecosystems expanded, particularly on Solana, and as major competitors such as Binance Staked ETH, Staked SOL, Jito and Sanctum strengthened their positions. The result is a market that is becoming increasingly competitive, a dynamic that ultimately benefits stakers through greater choice, improved services and broader diversification.

Contrasting Results Across Other Sectors

Zooming into three sectors generating less than $50 million per month, most categories saw year-on-year growth, although with different levels of consistency:

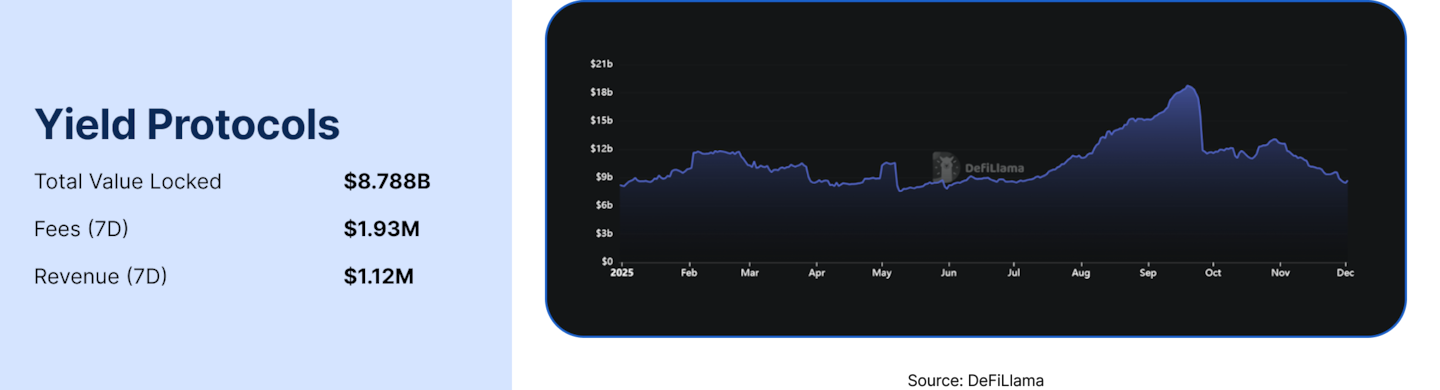

- Yield markets, primarily led by Pendle, grew but remained volatile. Inflows accelerated during liquidity-rich and incentive-heavy periods but contracted quickly during risk-off phases, reflecting the segment’s sensitivity to broader macro and crypto market conditions.

- Bridges maintained stable revenue between $3-5 million per month. Despite healthy usage, fierce fee competition pushed operators to constantly lower pricing, limiting revenue expansion even as volumes remained strong.

- Restaking, liquid restaking and derivatives (excl. perps) continued to lag. Fee generation remained flat, signalling limited adoption and a lack of established product-market fit. These sectors may require further innovation before gaining meaningful traction.

RWA and Stablecoin Issuers, Opaque Fee Capture

RWA platforms and stablecoin issuers were two of the most important themes of 2025, yet both remain difficult to analyse through a pure onchain lens. Much of their fee generation occurs offchain or within centralised structures, making transparent revenue assessment challenging.

For stablecoins, the example of Tether and Circle shows how lucrative the model can be. Reserve-based income scales with supply, and favourable regulatory developments suggest that both revenue and the number of compliant issuers will continue to grow. As new entrants arrive under clearer regulatory frameworks, the market is likely to become more balanced, reducing the extreme concentration seen today.

As for RWA, TVL increased significantly throughout the year, but actual fee capture remains difficult to quantify. Most issuers operate as traditional financial entities, where management fees, treasury yield spreads and servicing costs are not disclosed onchain.

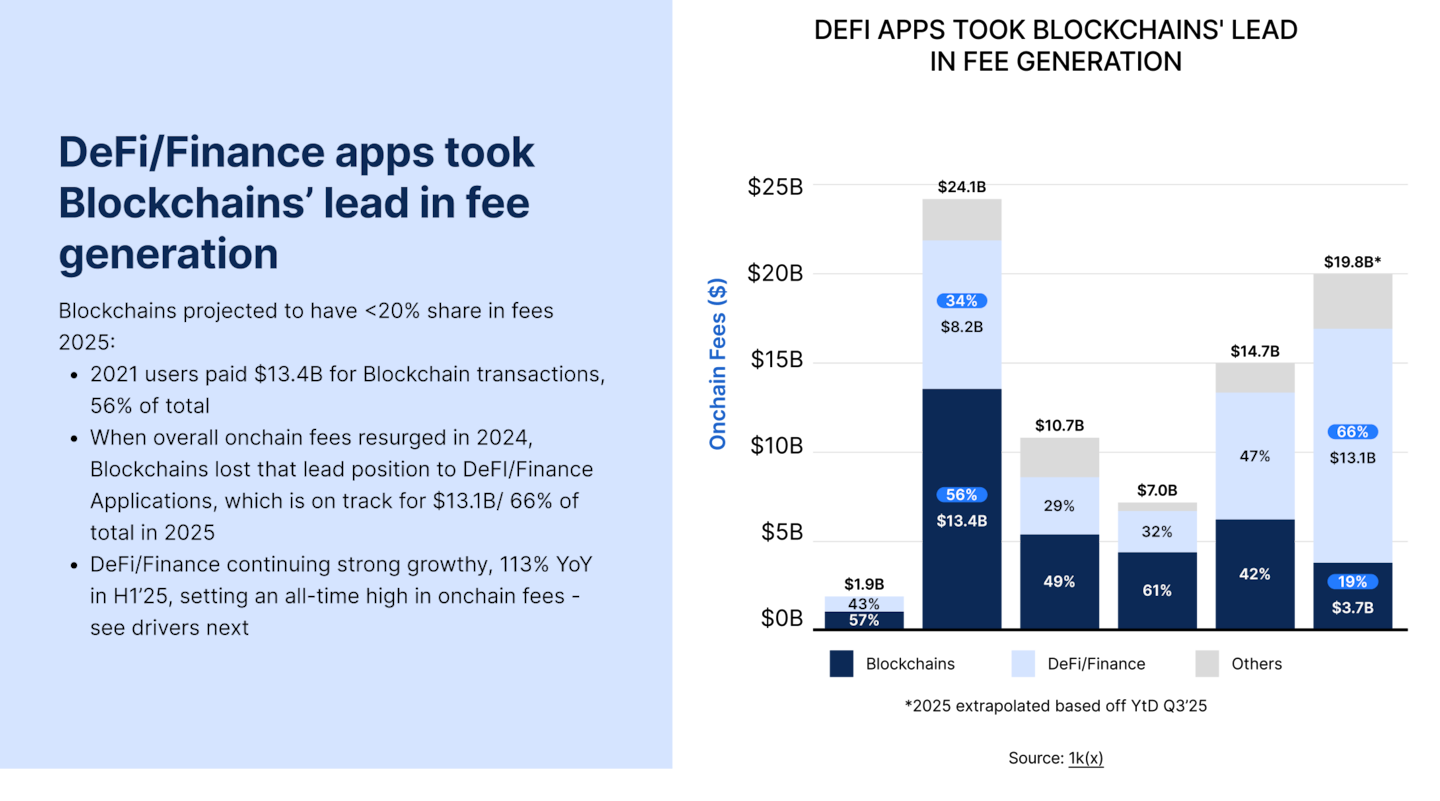

Infrastructure Costs Collapsing, DeFi Thriving

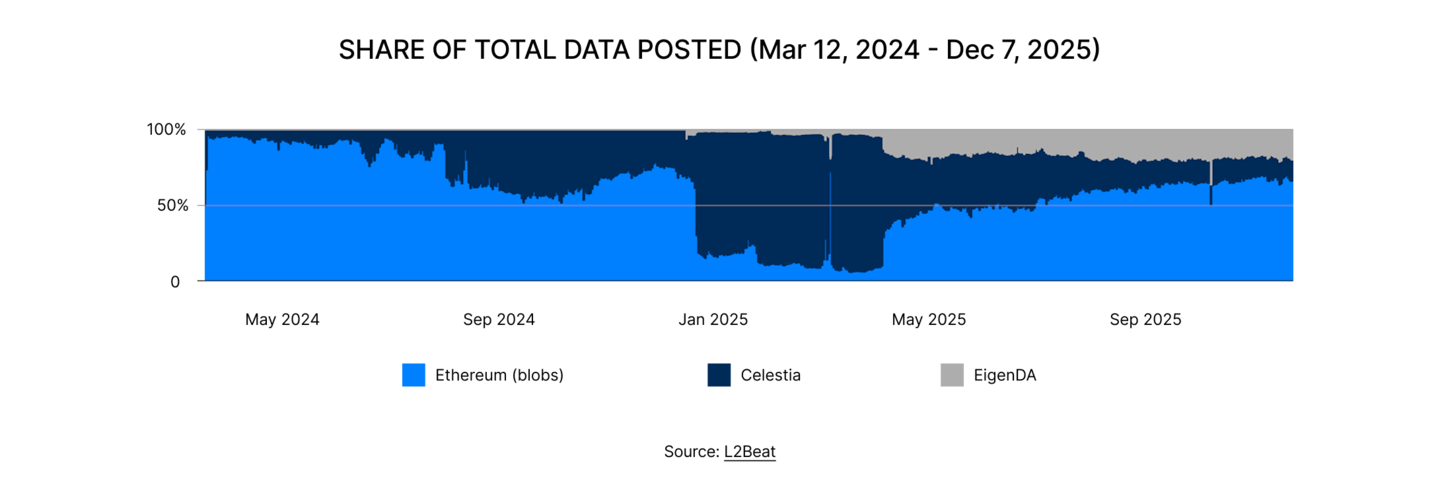

A clear shift took place in 2025: DeFi applications began generating more fees than the underlying blockchains they operate on. This marks a decisive moment in the maturation of the industry. Infrastructure has become cheaper, faster and more efficient, creating conditions where applications, not base layers, capture most of the economic activity.

Competition has played a central role in driving costs down. Solana’s rise in 2021 set a clear precedent by demonstrating that high throughput and low fees were achievable, pushing Ethereum and other ecosystems to accelerate their scaling roadmaps. The same dynamic still exists across all major chains: execution is increasingly commoditised, and networks compete to deliver the cheapest and most reliable blockspace. The result is an environment where blockspace is no longer scarce, allowing applications to operate profitably at scale for the first time.

Ethereum illustrates this evolution perfectly. Two major upgrades, Dencun and Pectra, sharply reduced fees while increasing usable throughput. Transacting on Ethereum now costs less than $1 even as daily activity exceeds levels seen during the 2021 bull market. A report by 01kX, using DeFiLlama, Dune and TokenTerminal data, estimates that the average transaction cost has fallen by 86% while the number of transactions has grown by 2.7 times compared with the peak of 2021.

This mirrors the trajectory of early internet infrastructure: as connectivity became cheaper, entire categories of applications,websites, ecommerce, digital services, emerged on top of it. DeFi is now following the same pattern.

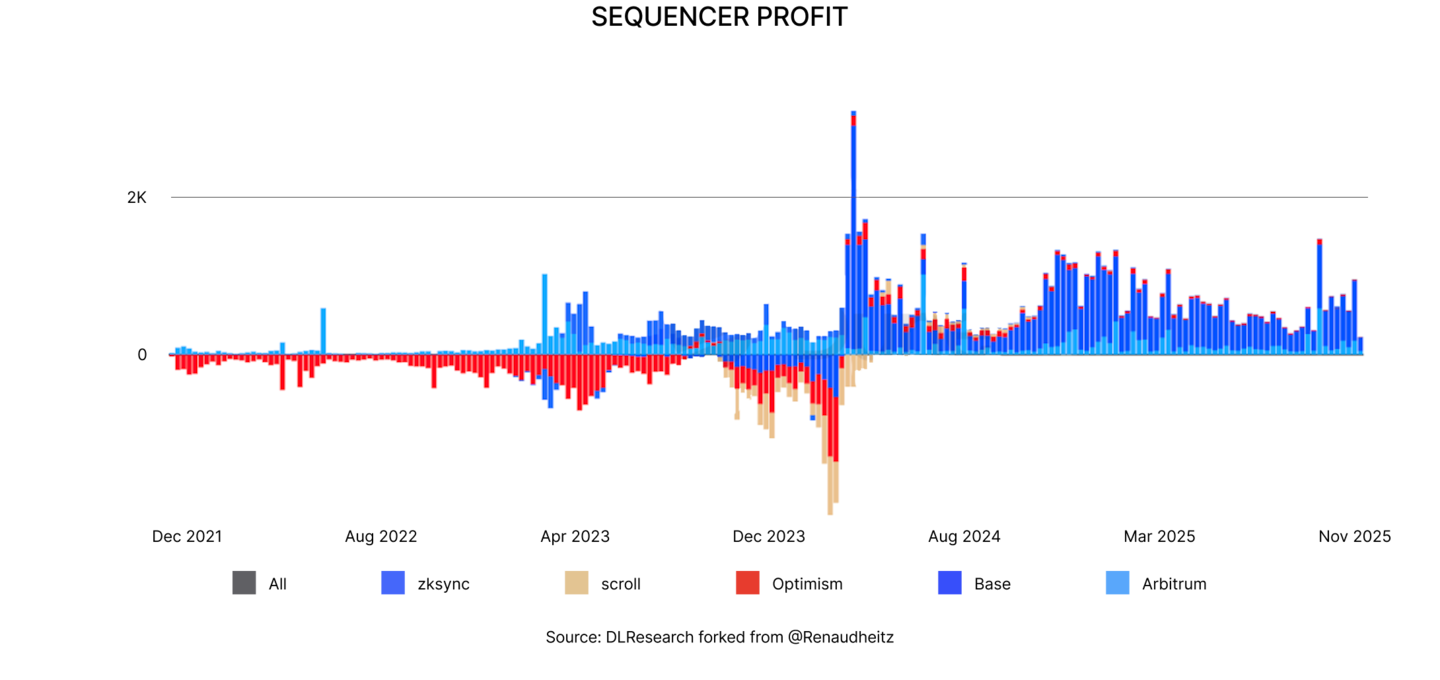

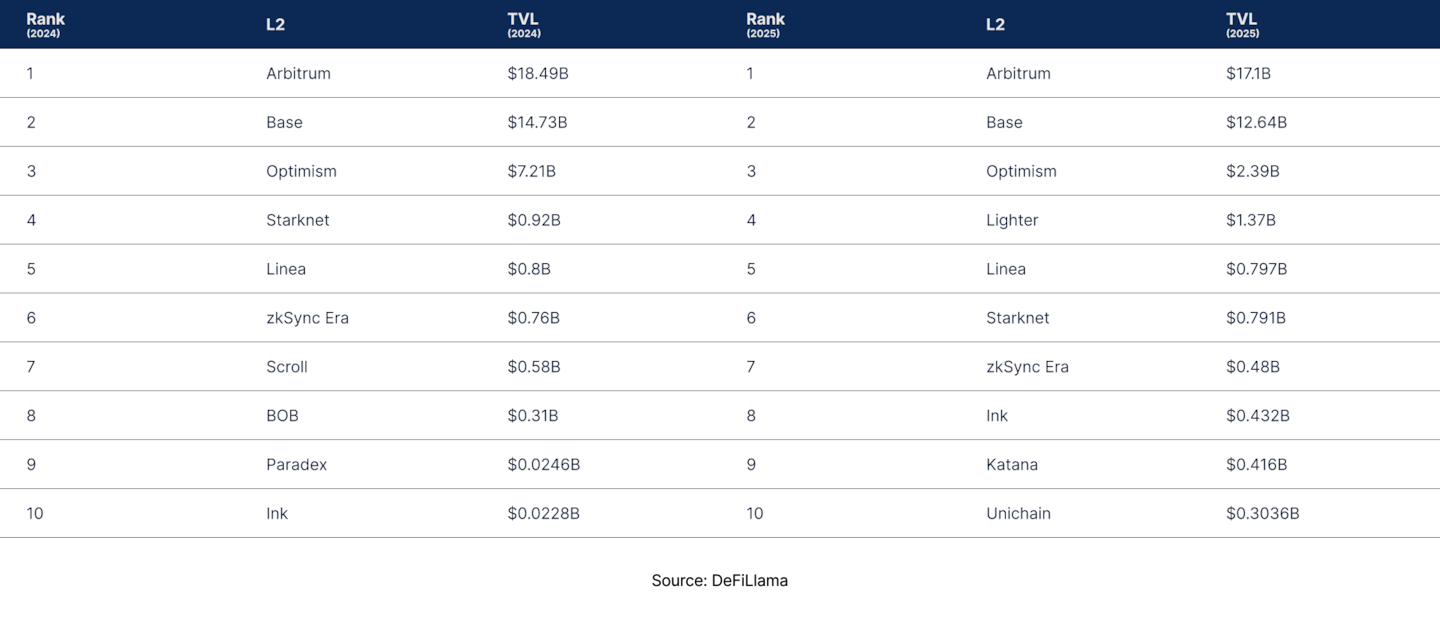

Consequence #1 : Layer 2 Networks Become Cash-Flow Positive

As infrastructure costs decline, the benefits are most visible on Layer 2s. Dencun’s introduction of cheaper blobspace in March 2024 dramatically lowered settlement costs for Layer 2s and moved many of them into positive revenue territory. Optimism and Base both shifted from structural losses to sustained profitability.

With lower operating expenses and rising activity on the application layer, Layer 2s now have both the margin and the incentive to reinvest aggressively into growth.

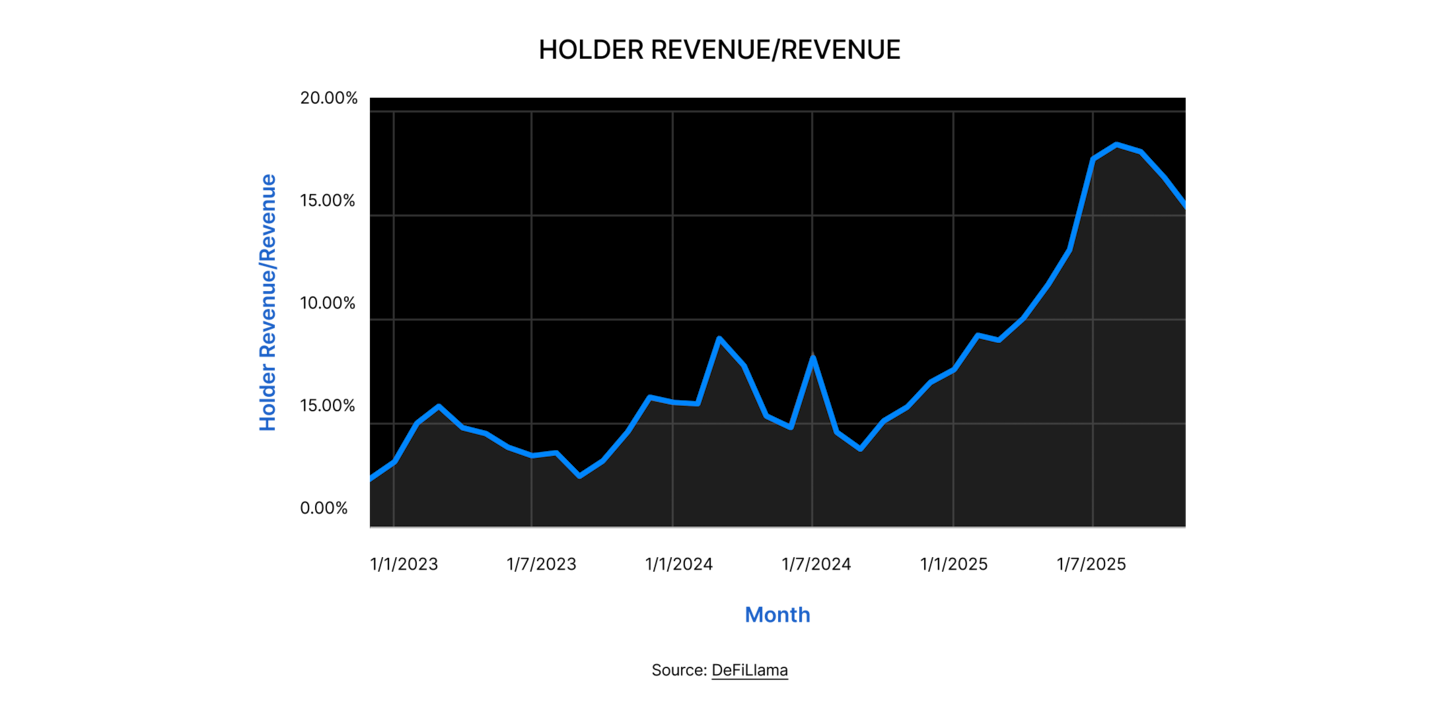

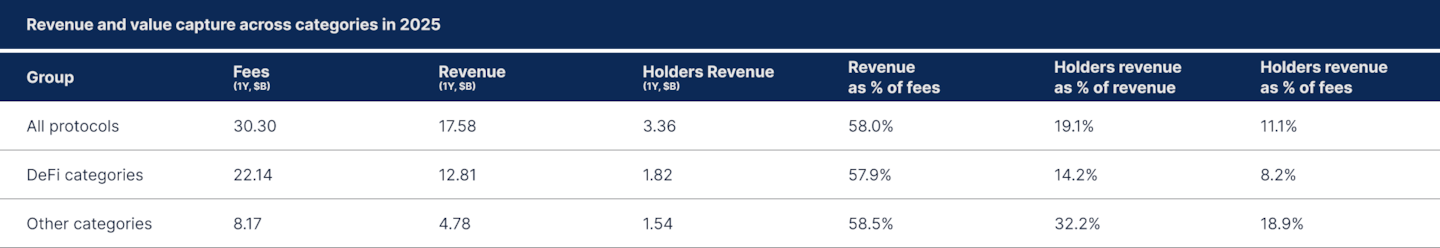

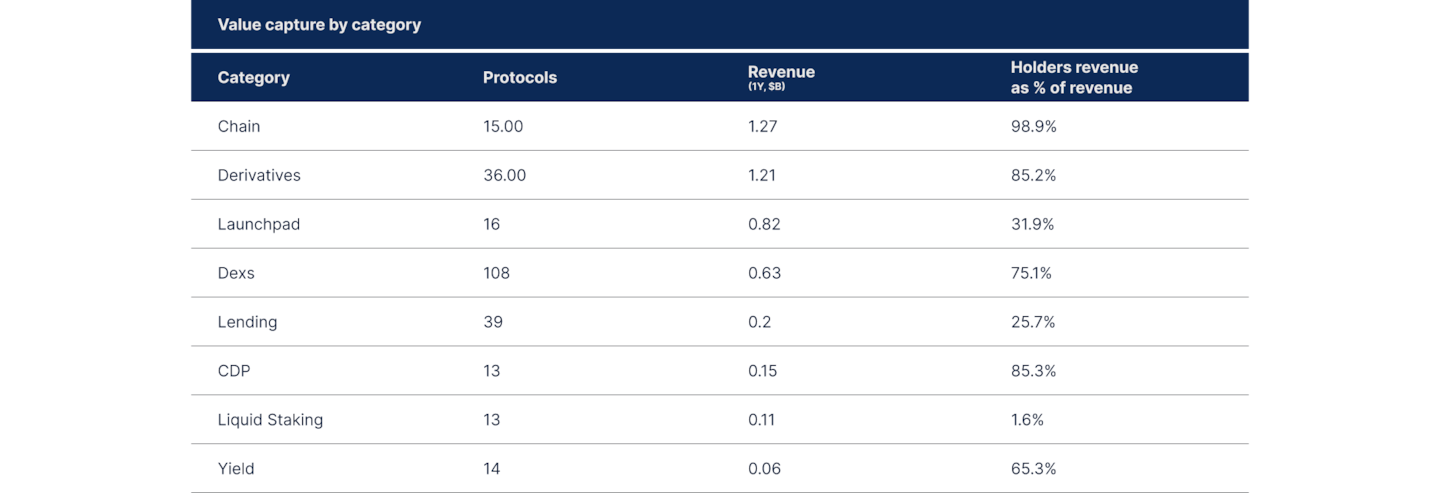

Consequence #2: Protocol Value Is Increasingly Returned to Holders

A growing share of industry revenue is now flowing back to tokenholders. As protocols become more profitable, sustainable and less dependent on inflationary rewards, value distribution has become a core feature of the market. The shift in regulatory tone, from hostile to constructive, has reinforced this trend, giving teams clearer frameworks for revenue sharing, treasury yield distribution or buyback-and-burn strategies.

While only around 5% of protocol revenue was redistributed to holders before 2025, this number has tripled to roughly 15%. Major protocols such as Aave and Uniswap, which historically avoided explicit value distribution, are now moving in this direction.

As competition intensifies and tokens increasingly resemble traditional financial assets, more protocols are expected to adopt similar approaches.

Consequence #3: Emergence of New Business Models

The reduction in infrastructure costs did far more than improve efficiency, it opened the door to entirely new business models. When blockspace becomes cheap, protocols can experiment freely with how they launch, monetise and distribute products.

Token issuance is the clearest example. What was expensive and limiting in 2021, such as minting an NFT or issuing a token, is now trivial. In a few clicks, anyone can launch a token on platforms like Pump, which has effectively democratised the launchpad. Monetisation no longer comes from the token itself but from attention and distribution.

The same dynamic applies to trading. Perps and DEXs now operate in an environment where onchain execution is fast, cheap and reliable enough to compete with CEXs. Fee capture in these markets now reflects execution quality rather than network limitations, making the model sustainably profitable for the first time.

A performance-fee model is also emerging as a viable path to profitability, mirroring traditional finance. Lido demonstrated this early by charging a fee on staking rewards, but for smaller protocols high infrastructure costs once made this approach difficult to sustain. With today’s efficiency, any protocol that generates yield, from stablecoins to RWAs to Pendle-style products, can capture a small fraction of that yield and operate profitably.

In short, cheaper blockspace removed friction. It unlocked experimentation not only technically but economically, allowing protocols to explore new models and reach product-market fit with far more freedom than in previous cycles.

Consequence #4: Competition Compresses Prices and Improves User Experience

As the charts in the previous sections showed, competition has intensified across every major DeFi vertical. Falling infrastructure costs and a wave of new entrants in 2025 reshaped markets such as perps, DEXs, liquid staking and issuance rails. Sectors once dominated by two or three protocols now display a broader and healthier distribution of activity.

This competitive pressure forces protocols to optimise execution, reduce fees, improve routing and expand features. Perps demonstrated this most clearly: a single year of new entrants compressed fees, raised execution quality and redistributed market share. The same dynamic is now unfolding across DEXs, lending and staking.

The result is a steadily improving user experience where competition has become a structural driver of progress, ensuring that efficiency and user alignment continue to accelerate as the ecosystem matures.

Closing Thoughts and Outlook

At the end of 2025, the structure of the industry looks very different from the cycle that preceded it. Infrastructure has become cheaper, more efficient and more secure, creating an environment where applications can scale without being constrained by execution costs. This shift has allowed DeFi to capture a growing share of the value generated onchain. With regulatory clarity improving across major jurisdictions, the conditions for sustainable growth are clearer than at any point since the sector emerged.

Yet not all verticals have found their footing. Segments such as restaking, liquid staking, options and exotic derivatives remain in an exploratory phase. Their long-term relevance depends largely on whether they can demonstrate real demand beyond incentives.

Competition and product sophistication are rising across the leading sectors, from perps to DEXs and lending. Perps provided the clearest preview in 2025: a wave of new entrants reshaped a previously concentrated market, pushing incumbents to innovate, sharpen execution and compress fees. The same dynamic is emerging across other verticals, where protocols are increasingly forced toward greater efficiency and more user-aligned models.

As costs continue to fall and innovation spreads, end users will benefit the most through better pricing, improved execution and higher reliability.

Trading Stack: Perps, Spot, And Primary Issuance Rails

As spot DEXs, perps DEXs, and issuance platforms converge into one trading stack, how do you expect the role of oracles in execution quality and risk management to change over the next cycle?

While platforms will increasingly verticalize their offerings through either prime brokerage-style unified UX or full vertical integration like Euler or Fluid on EVM networks, the underlying technical stack will remain specialized. We’re seeing more acquisitions and consolidations, but the teams building each component continue to operate as specialized units focused on their domain. Oracle infrastructure follows this same pattern: the end-user experience becomes seamless and abstracted away, but the role of dedicated data providers in execution quality, risk management, and security remains critical. As an analogy, you can add as many electronic gadgets and additional features to a car to make it more useful - but if the engine (the oracle) malfunctions, the whole system can get a hit or crash fully.

Most DeFi users won’t directly interact with or even notice oracle infrastructure, yet specialized teams will continue innovating on these complex, multi-layered systems. The convergence is happening at the product and brand level, not at the technological expertise side. One can observe that with specific oracle offerings, i.e., in the case of RedStone oracles offering Low-latency (Bolt), Efficiency (Atom), Risk (Credora) or RWA feeds.

How do you think oracle infrastructure should adapt to a world where much of the order flow is driven by intents, RFQ systems, and routing algorithms rather than direct user swaps?

At its core, an oracle aggregates different inputs from data providers, i.e. Market Makers, or direct sources, i.e. a DEX or aggregator, and calculates the most objective price as a function of those inputs. RedStone’s modular approach has proven our technology can ingest data in various formats from different providers, making it adaptable to evolving market structures. The design choices we made in 2022 allow us to adapt to the ever-evolving data sourcing vertical.

Whether prices come from traditional order books, RFQ systems, intent-based protocols, off-chain TrafFi systems, or proprietary routing algorithms, they ultimately represent yet another input format for price discovery. If there’s demand for incorporating these new trading schemas into oracle feeds, we’re positioned to develop the necessary infrastructure to capture that volume and maintain the most secure and specialised onchain price feeds available.

What are the most important oracle design trade offs that high throughput perps venues and order book DEXs are wrestling with today, and how do you see those trade offs evolving as latency and volume increase?

High-throughput oracles present unique design trade-offs that RedStone has been addressing extensively with RedStone Bolt, which delivers onchain oracle data in a Push model with previously unprecedented sub-20 millisecond latency for chains like MegaETH and Monad. The fundamental challenge starts with a chicken-and-egg problem: building technology capable of sub-20ms delivery is meaningless without actual demand from decentralized applications. Traditional blockchain network constraints made this level of granularity impossible, but new high-performance chains are finally creating the infrastructure where demand can materialize, enabling builders to experiment with what’s possible in such a high-velocity data environment. Euphoria, powered by Bolt, can be a good example.

A critical design choice involves the aggregation algorithm used to produce the final onchain price from multiple data inputs. With real-time delivery, every incremental trade on underlying exchanges affects sequential prices significantly, making the choice between median, weighted median, or other mathematical functions far more consequential than in traditional oracle designs. Additionally, technical factors like geographical proximity to data sources become dramatically more important at this frequency level, as even minor latency differences compound when delivering prices dozens of times per second.

These high-frequency oracles represent one of the most technologically advanced oracle categories in blockchain infrastructure, requiring specialized expertise across aggregation mathematics, network architecture, and real-time data processing that most teams simply cannot replicate. Our team has always followed a builders, for builders motto, hence we enjoy such technical challenges.

As oracle extractable value becomes more visible, what is the right way for the ecosystem to handle it so that perps venues, money markets, and traders all see it as a feature rather than a hidden tax?

Oracle Extractable Value is an inherent part of DeFi infrastructure that can be managed effectively with adequate design. As the onchain market grows and DeFi volume scales, OEV solutions will play the key role to redistribute this value to the appropriate participants. RedStone Atom, developed in partnership with FastLane, represents a fundamental reimagining of how oracles handle OEV by capturing it through atomic liquidation auctions and routing it back to the protocols that generated it in the first place.

What makes Atom distinctive is that it doesn’t just redistribute value, it actively improves protocol performance. By introducing zero-latency oracle updates that trigger exactly when liquidations become possible, Atom allows lending protocols to offer higher LTV ratios and deliver better risk-adjusted returns than competitors using legacy push feeds. The atomic auction mechanism bundles price updates, liquidations, and OEV payouts into a single transaction under 300 milliseconds, eliminating front-running while capturing over 90% of liquidation value that would otherwise leak to MEV bots. Conservative estimates suggest legacy oracles have lost over $500 million to OEV.

Rather than viewing OEV as a hidden tax, Atom transforms it into a revenue stream that protocols can use to boost user yields, reduce borrow fees, or fund development, turning what was previously value extraction into a competitive advantage for protocols that adopt it.

In a future where perps, spot, and issuance all lean on the same data backbone, what kind of failures or feedback loops worry you most at the oracle layer, and how can the industry preempt them?

Derivative products typically leverage spot prices as their underlying reference, which creates natural spillover risks. A vulnerability in the spot token’s smart contract or an issue with exotic spot asset pricing could cascade into derivative markets built on top of that data. However, with rigorous due diligence when evaluating and constructing oracle price feeds, placing data intelligence at the front of the process, these risks become manageable. A good example of potential risks was visible on the 10th of October crash, where a flash depeg report by the internal CEX oracle of margin assets like USDe caused an even bigger liquidation cascade.

The key is maintaining that disciplined approach as the ecosystem scales. At RedStone, we haven’t experienced a single mispricing event, and our operational focus is on continuing that track record.

Perps venues increasingly list long tail assets and structured products; what kind of market structure or liquidity conditions do you believe should exist before an oracle feed for a new market considered safe?

There’s a strong need for quantified and objective oracle requirements when deciding to support new market feeds. At RedStone, we maintain clear thresholds based on liquidity metrics across both onchain venues and centralized exchanges that asset issuers must meet before we’ll consider developing a price feed. Having clear-cut rules around market depth, trading volume, and liquidity distribution is essential for determining when an asset has sufficient market structure to support a safe oracle feed. Our proprietary framework protects both the oracle infrastructure and the protocols relying on it from manipulation risks inherent in thin or fragmented markets.

A great example is markets powered by HyperStone, a bespoke Hyperliquid HIP-3 oracle. Our team, together with the deploying party, like Felix, carefully selects assets supported and helps to navigate new market parameters like max leverage or open interest. We see a great opportunity in commodities like Gold or stocks like TSLA.

Trading Stack: Perps, Spot, And Primary Issuance Rails

The structure of onchain markets changed fundamentally in 2025. What once existed as separate layers of activity, from swapping on AMMs to trading perpetuals or issuing tokens on new rails, has started to behave like a unified trading system.

Liquidity now moves more fluidly across issuance, spot markets, derivatives venues and speculative funnels, and user behaviour responds rapidly to catalysts that propagate across the entire stack. Behind this consolidation is a shift in architecture. Execution has become more abstract, collateral more mobile and information more immediately priced.

The result is a market in which DEXs, perps, issuance platforms and prediction markets no longer operate as isolated primitives but as linked components within a continuous trading environment.

DEXs: From AMMs to Intent-Based Execution

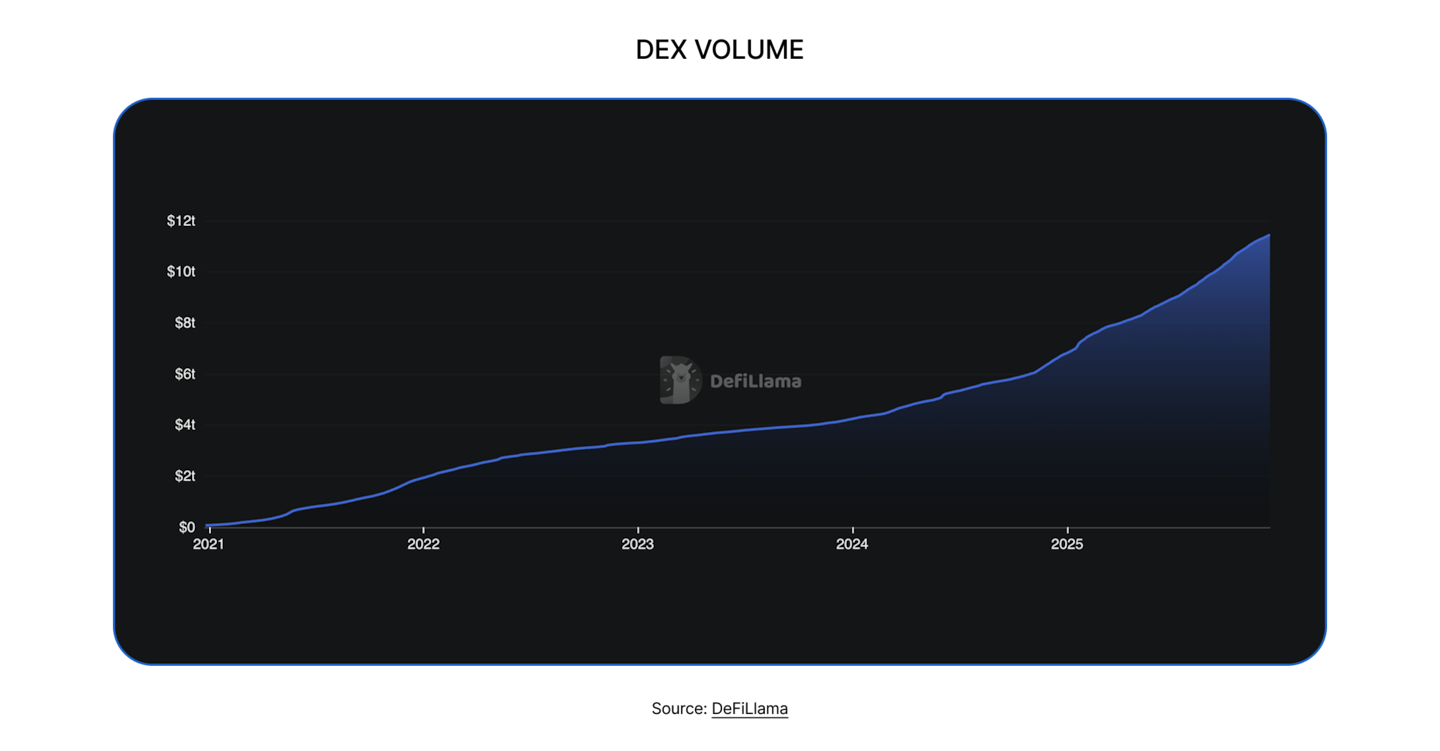

Decentralised exchange activity continued to expand materially in 2025. Cumulative DEX TVL rose from 4.2 trillion dollars at the start of 2024 to 6.8 trillion by year-end, before climbing further to 11.4 trillion in 2025. At the same time, DEXs increased their share of global spot trading, rising from roughly 4% to around 20% of combined CEX and DEX spot volume. This sustained uptrend confirms that onchain trading is not merely keeping pace with centralised venues, but steadily gaining market share. Yet behind this expansion lies a market undergoing a structural transformation. Rising competition, new execution models and the abstraction of user choice are reshaping how swaps happen and who captures the resulting value.

The most visible change is the decline of unilateral dominance. In 2023, three protocols (Uniswap, Curve and PancakeSwap) accounted for roughly 75% of all DEX volume. By 2025, that same share is split across around ten protocols. Aggregators experienced the same shift. What was once an 80% duopoly between Jupiter and 0x has now fragmented into more than ten meaningful participants. This redistribution mirrors patterns seen across the broader DeFi landscape: as infrastructure becomes cheaper and cross-chain liquidity easier to access, competition increases and fee capture becomes more widely distributed.

This shift is not only competitive but architectural. The DEX experience has progressively abstracted away user decisions. The first generation of AMMs required traders to choose a specific pool. Aggregators, the second layer, removed this step by routing across venues. A third wave is now emerging: intent-based execution. Users express the outcome they want, not the path to achieve it, and solver networks determine how to fulfil that intent, often spanning chains, liquidity layers and bridging systems in a single action.

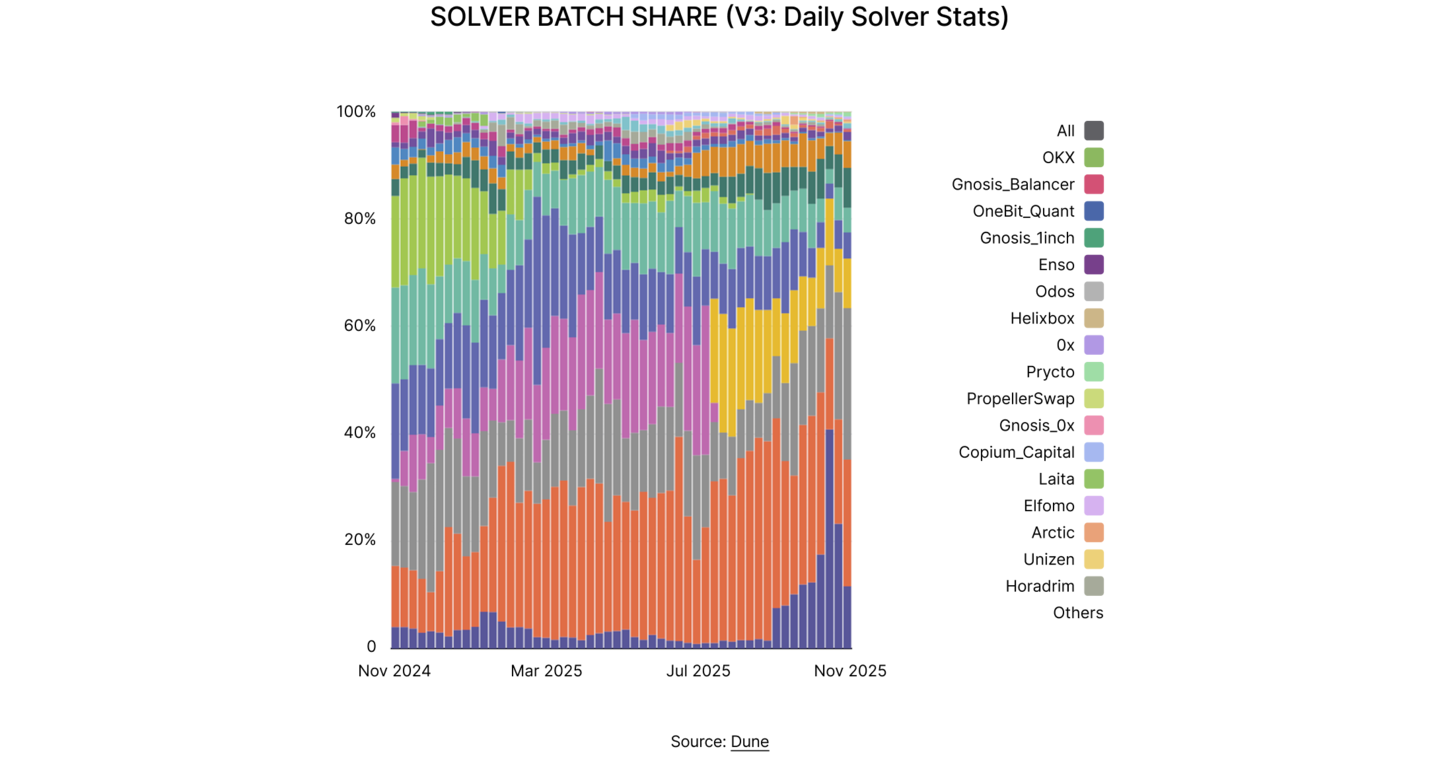

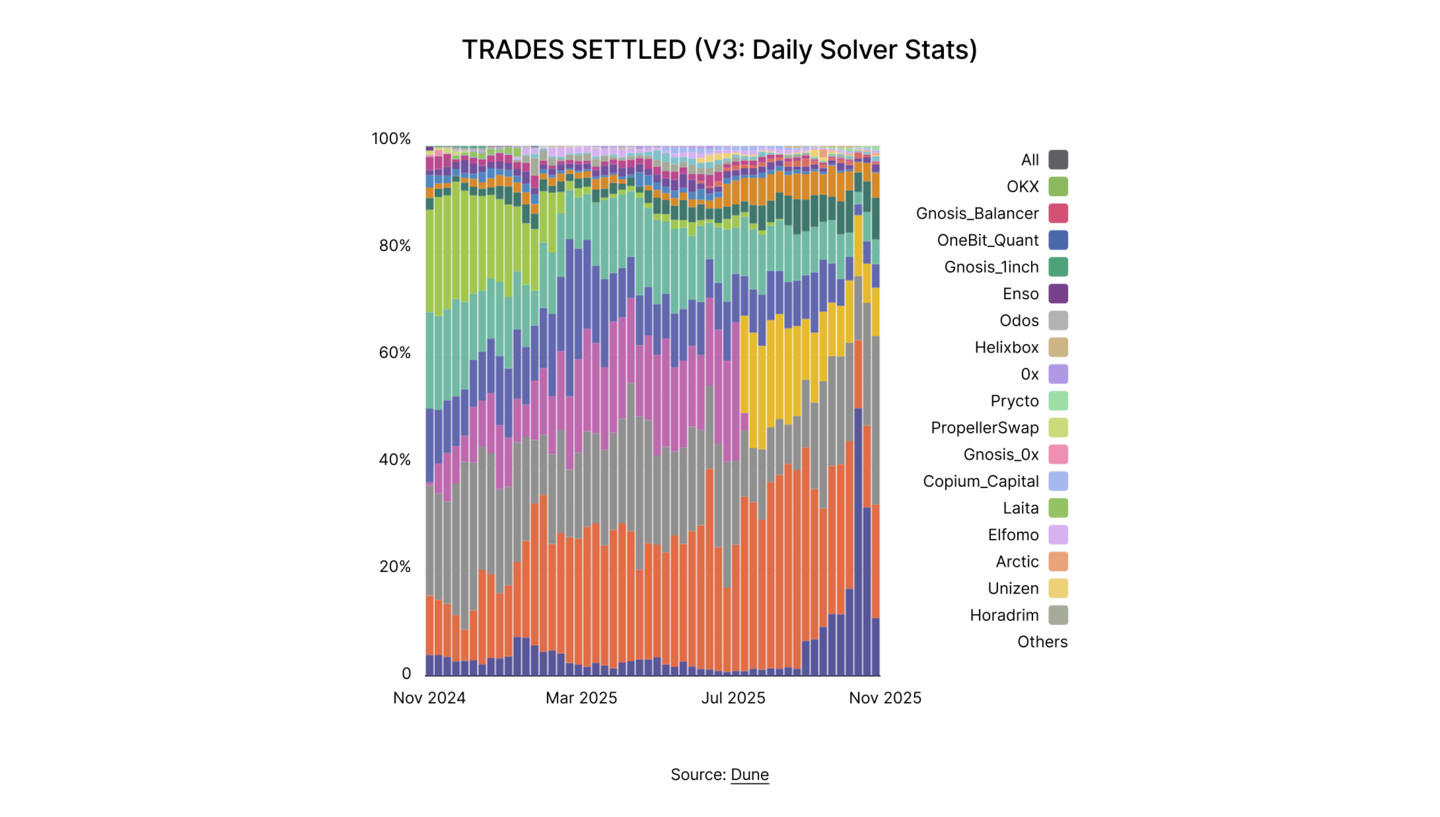

Within this wave, several execution models are competing or complementing one another: RFQ systems, solver-based batch optimisation, CLOB-style matching and professional market-maker involvement. Together, these designs point toward a future in which routing, bridging, matching and settlement become invisible to the user. Execution is determined not by where liquidity resides but by which mechanism can deliver the best possible final price.

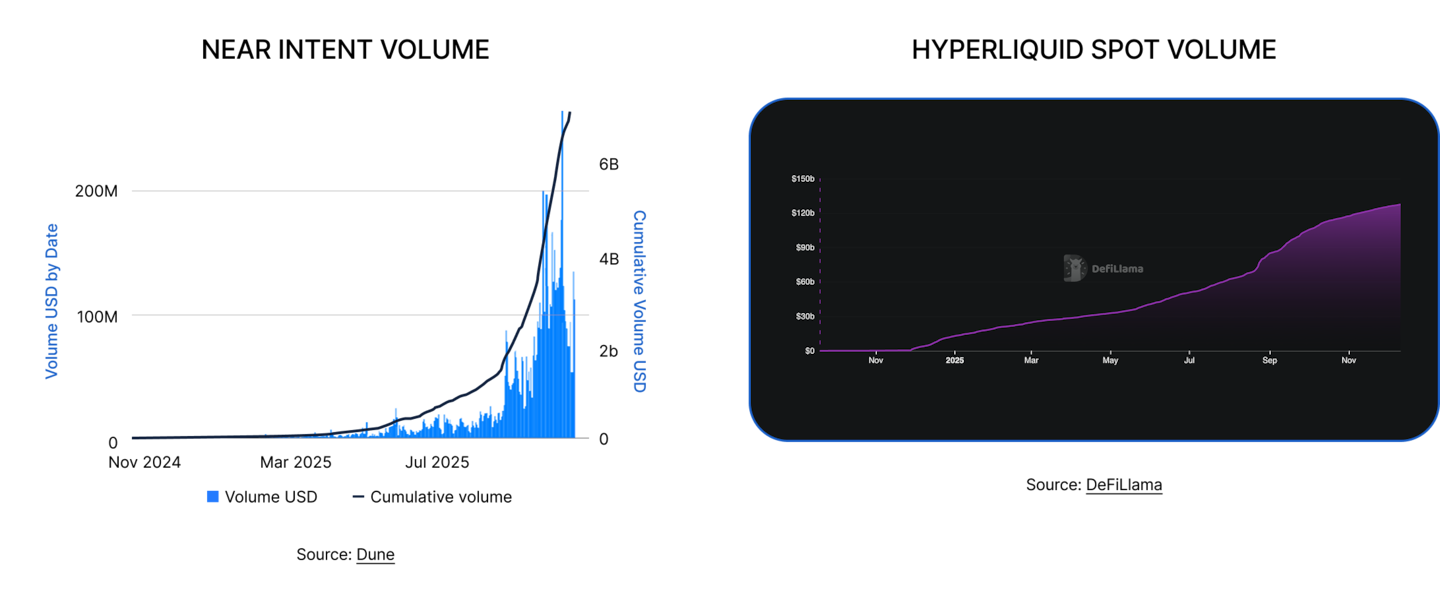

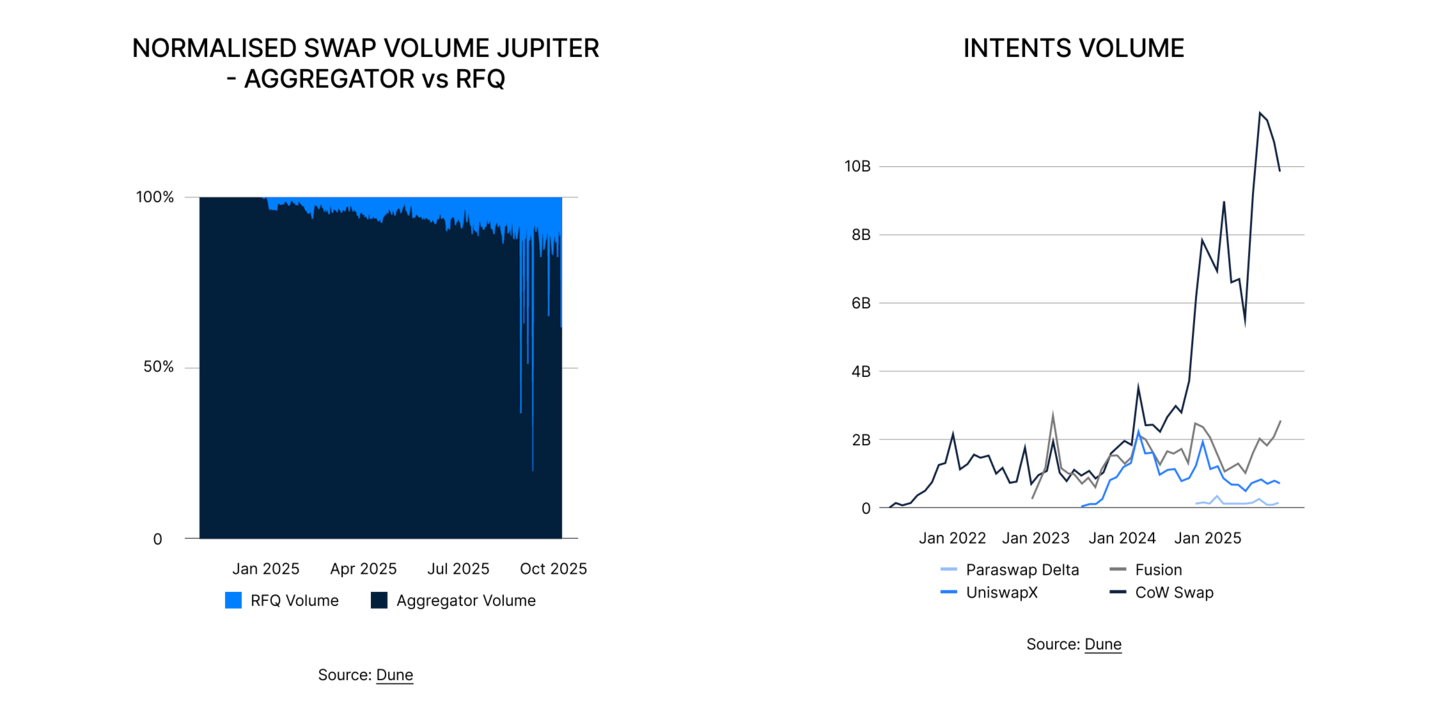

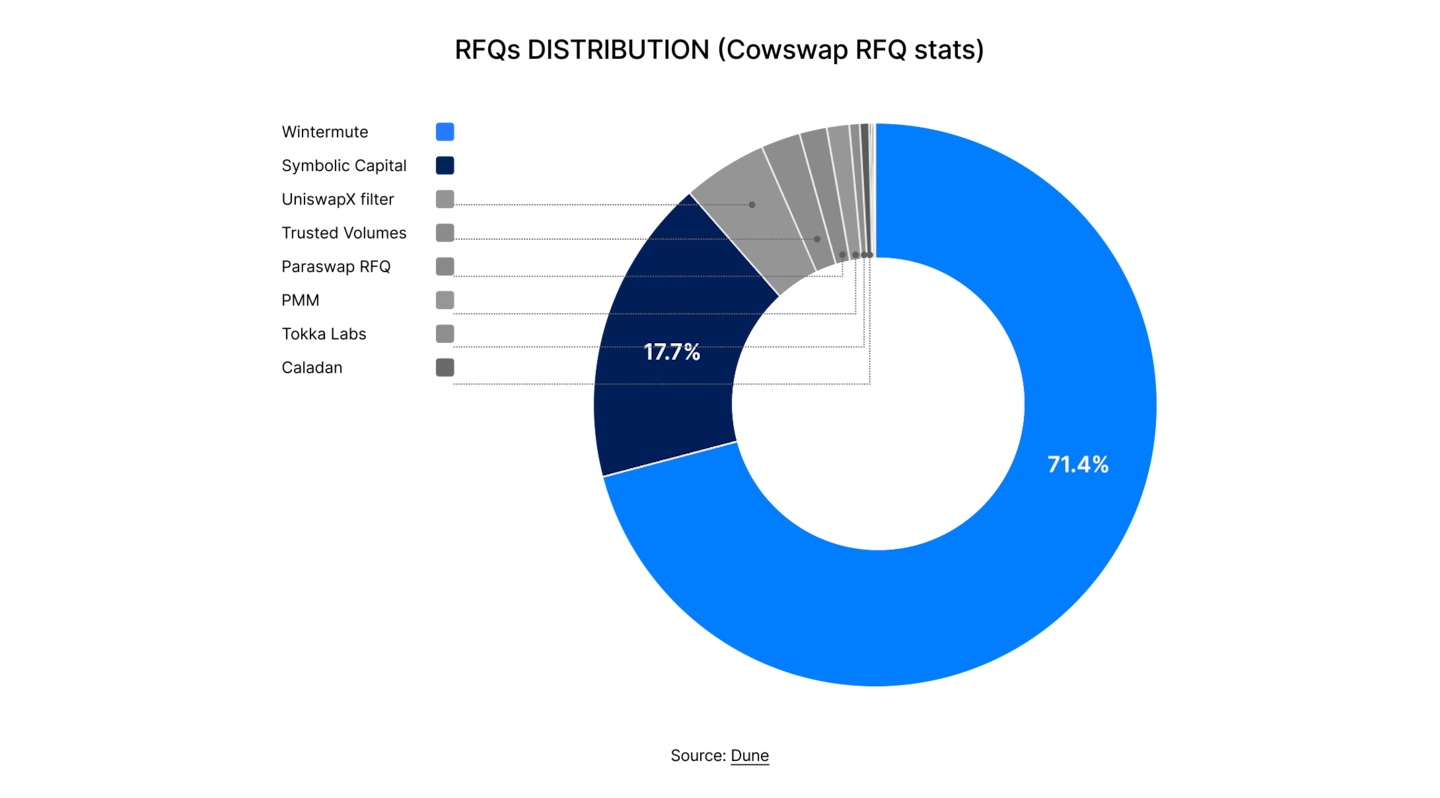

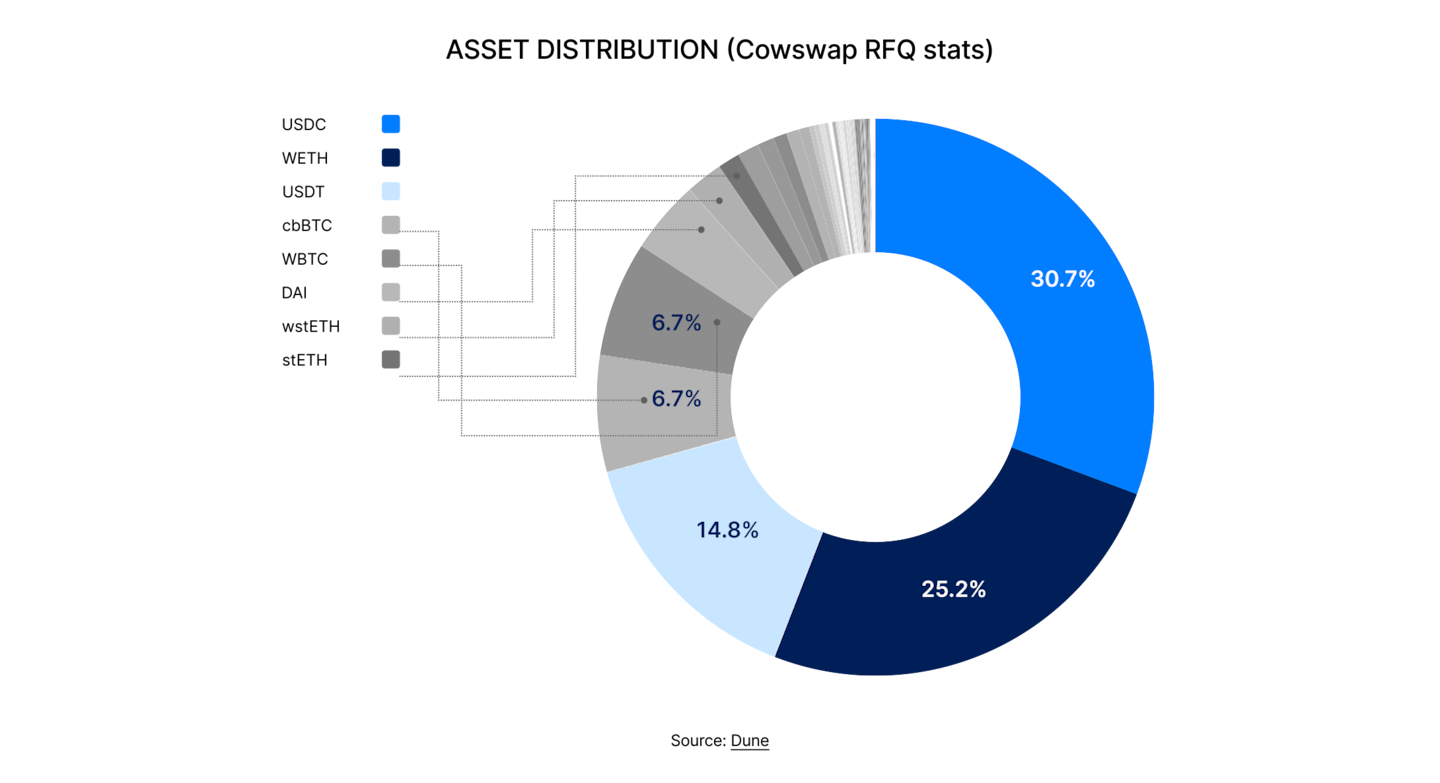

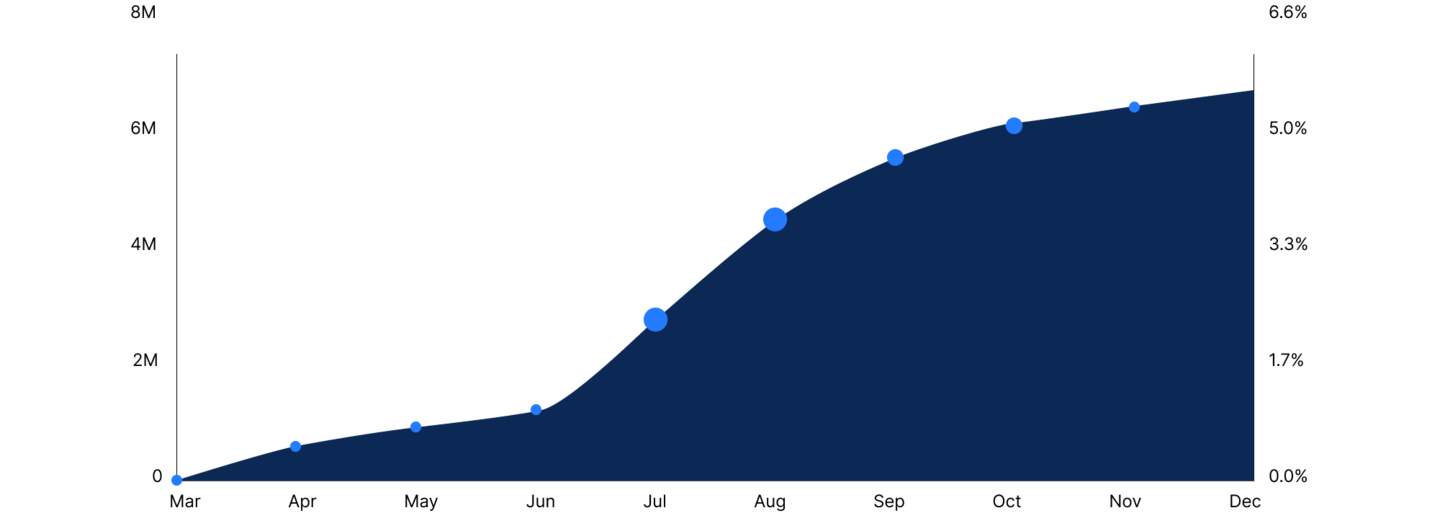

The data shows how quickly this shift is taking hold. NEAR Intents grew from roughly 3 million dollars in cumulative volume at the start of 2025 to more than 6 billion by year-end, an increase of more than 200,000%. CoW Swap’s monthly volume increased fivefold compared with late 2024, reaching 10 billion dollars per month. Jupiter’s RFQ system is steadily eating into the market share of its classic aggregator, while Hyperliquid’s spot orderbook grew from 12 billion to 125 billion dollars in 2025, a tenfold increase. Across these examples, the pattern is the same: users are moving away from direct pool interaction and toward systems that guarantee best execution regardless of where liquidity sits.

This raises the question of long-term direction. As markets mature, the architecture increasingly resembles centralised exchange infrastructure: orderbooks, deep liquidity, unified routing layers and seamless chain abstraction. Whether this infrastructure will ultimately be powered by fully decentralised systems, hybrid CeDeFi designs or a blend of solver-driven networks remains uncertain. CeDeFi currently appears ahead in performance, but the possibility of a high-performance, permissionless alternative cannot be dismissed.

What is clear is that DEXs are entering a new competitive phase. As more entrants emerge, execution models surface and user expectations rise, protocols are being pushed to deliver better routing, lower costs and more reliable execution. The result is a trading environment that is richer, more diverse and increasingly shaped by abstraction. Swapping is no longer about choosing a venue, it is about expressing an intent and letting the network decide the rest.

Perps: A Market Becoming Institutional-Grade

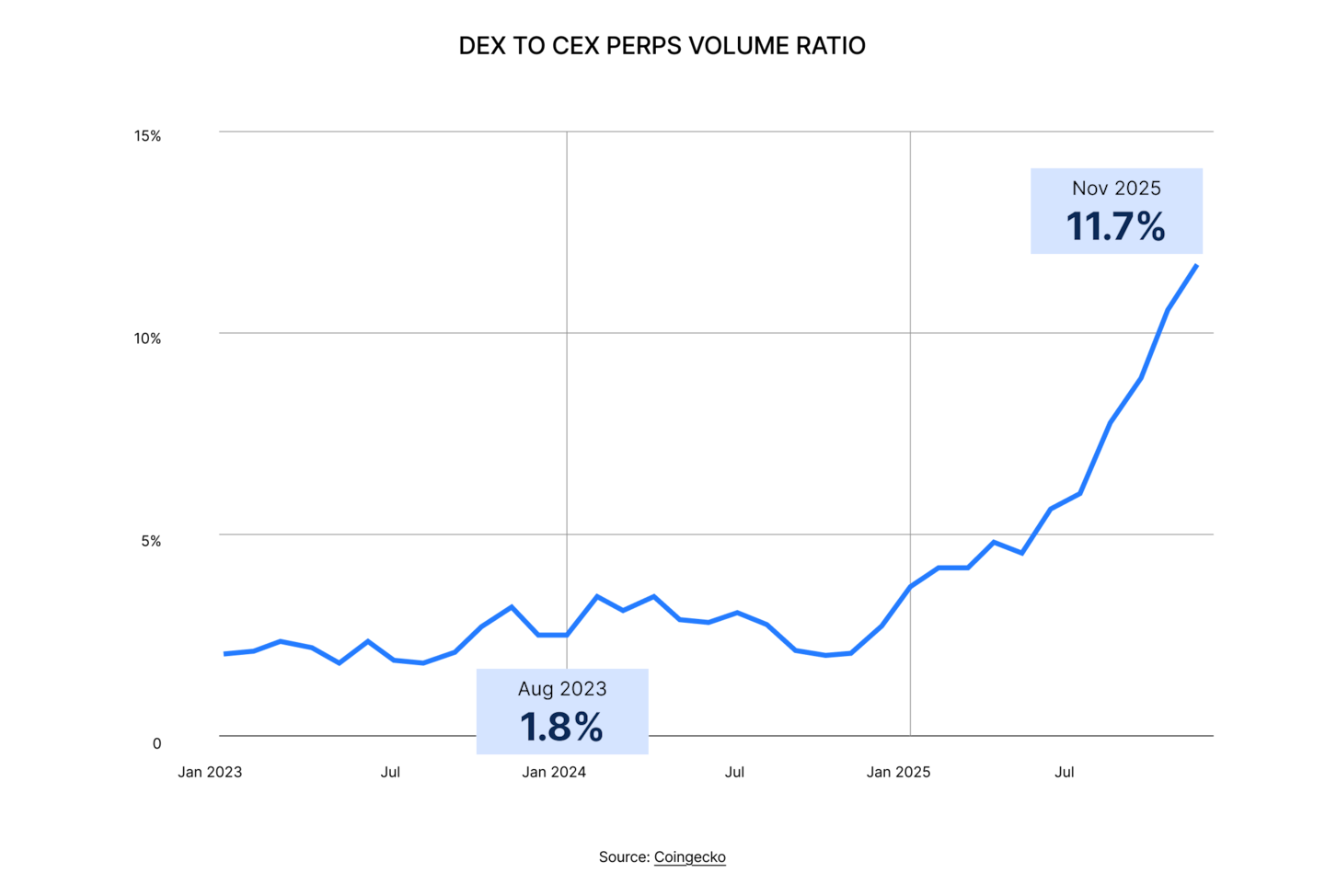

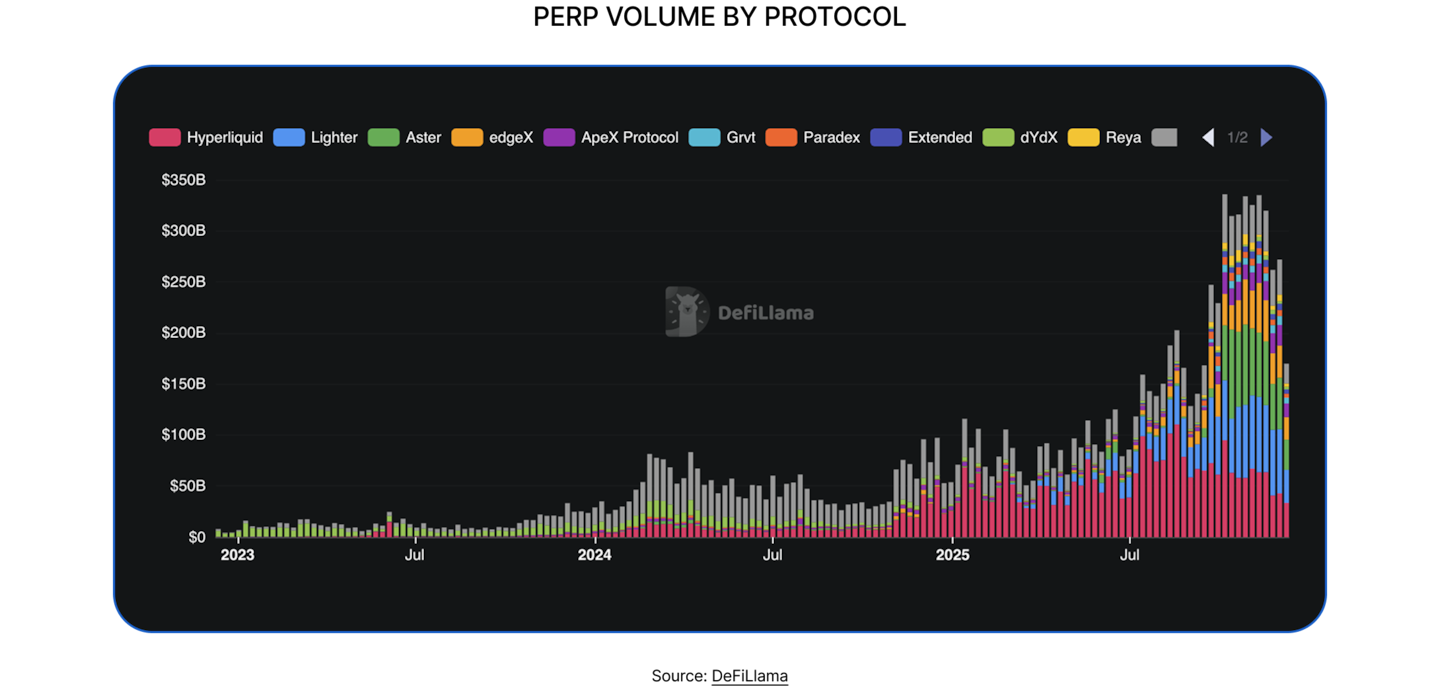

Onchain perpetuals entered 2025 as one of the fastest-growing pillars of DeFi. Weekly trading volume expanded from roughly 50 billion dollars in 2024 to more than 250-300 billion in 2025, pushing cumulative volume from around 4 trillion in January to more than 12 trillion by year-end. Their share of global derivatives activity rose sharply as well, increasing from roughly 2.5% of CEX perpetual volume in early 2024 to around 12% in 2025.

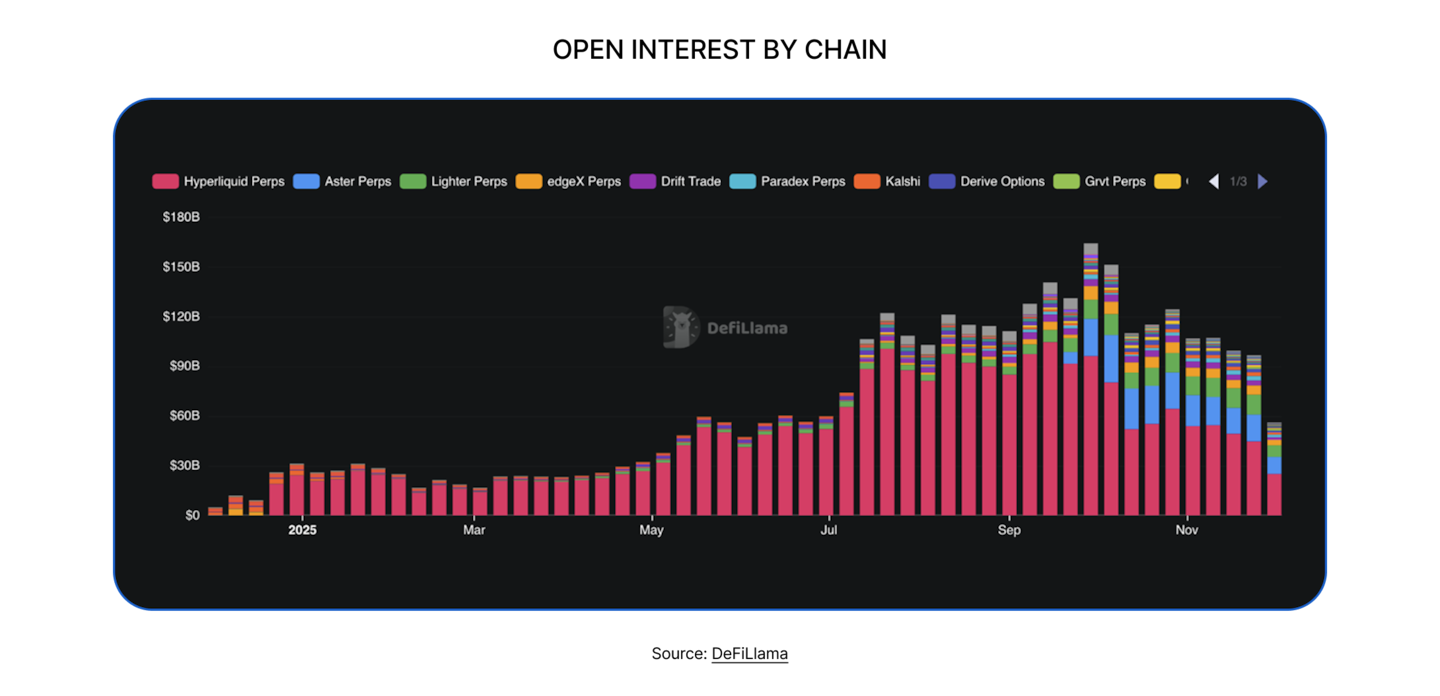

Open interest tripled from around 30 billion to nearly 90 billion in 2025, signalling deeper liquidity and stronger capital commitment onchain. Higher OI reflects traders keeping positions open longer and greater confidence in the stability of these venues. At the same time, liquidity became more distributed: Hyperliquid’s share fell from roughly 75% to about 44% as competitors scaled. This broader spread of OI marks a healthier sector structure, reduced concentration risk and a derivatives landscape that is maturing beyond a single dominant venue.

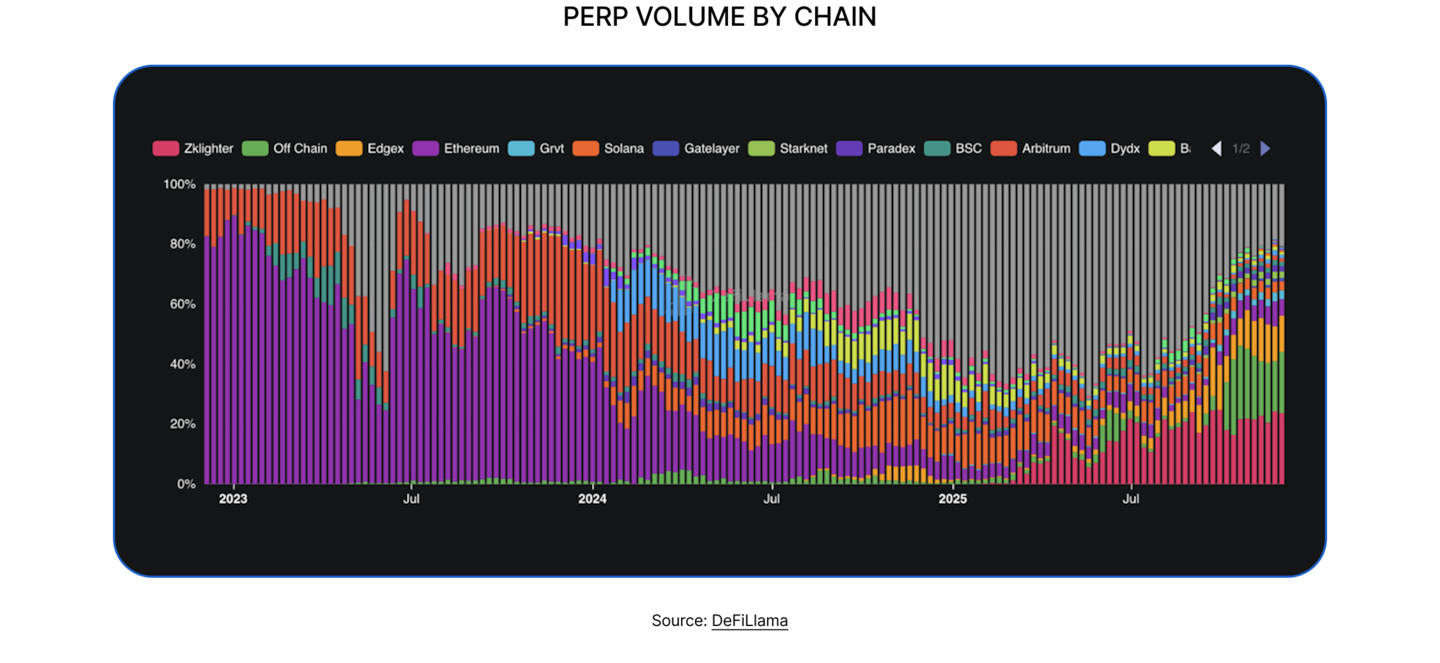

The competitive map transformed just as quickly. At the start of 2025, Hyperliquid and Jupiter Perps captured more than 60% of market share. By year-end, Hyperliquid, Aster, Lighter and EdgeX each controlled roughly 15-20% of trading volume, while Jupiter held closer to 10%. Five protocols now account for almost 70% of all onchain perps volume. This is no longer a market shaped by one or two incumbents but a genuinely competitive derivatives ecosystem.

The rise of chain-specific perps environments further reinforces this shift. While Ethereum and Arbitrum together represented nearly 70% of perps volume in 2024, the centre of gravity has now moved to purpose-built execution layers. dYdX’s earlier migration to Cosmos was the first signal. Today platforms such as Hyperliquid, EdgeX and Lighter dominate volume on their own chains, and a parallel wave of offchain engines with onchain settlement is emerging. This reallocation of liquidity shows that perps are no longer tied to general-purpose Layer 1s or Layer 2s. They gravitate instead toward environments offering high throughput and predictable execution.

Behind this shift lies an even deeper transformation: the architecture of onchain perps has fundamentally changed. The early generation of platforms, including GMX and vAMM-based protocols, relied on vault models where LPs absorbed directional risk and execution quality was limited by AMM curves, oracle cadence and block-level latency. These systems were easy to bootstrap but structurally unable to support professional flow. Spreads widened sharply in volatile markets, LP inventories destabilised during liquidations and capital efficiency lagged meaningfully behind CeFi.

The 2025 entrants inverted this equation. Hyperliquid, Aster and Lighter operate with exchange-grade matching engines and orderbook-based execution, delivering near-instant matching, predictable queueing and tight spreads. Vertex and Drift use hybrid designs, combining offchain or semi-offchain orderbooks with onchain risk and settlement, achieving much lower latency than traditional EVM-native AMM architectures. Together, these models enable what early AMMs could not: a trading environment in which market makers can quote efficiently, hedge exposure, provide deep liquidity and manage inventory using tooling similar to what they use on centralised exchanges.

Margin and collateral systems have advanced in parallel. GMX-style isolated collateral constrained leverage and prevented risk from being netted across markets. The newer cohort converges on cross-margin and unified collateral, allowing unrealised PnL to offset losses and improving capital efficiency significantly. Hyperliquid’s portfolio margining, Vertex’s sub-account structure and Aster’s multi-collateral model all reflect the same idea: a risk engine that behaves much closer to institutional-grade exchange infrastructure.

Liquidation logic also improved. More robust price feeds, batch and auction-style execution and slippage-aware mechanisms reduce tail risk and create healthier leverage profiles at the system level. These changes allow platforms to support larger positions and more professional liquidity provision with more predictable liquidation pathways.

Taken together, these architectural upgrades have reshaped liquidity behaviour. For the first time, professional market makers and funds can participate meaningfully onchain at scale. Deterministic matching, deeper orderbooks, unified collateral and chain-specialised execution environments reduce operational risk to levels acceptable for institutional strategies. RFQ layers, filler incentives and more competitive execution flows, visible across Aster, Drift and Jupiter’s RFQ system, reinforce this by turning execution itself into a competitive marketplace rather than a single fixed pathway.

In short, the trading environment has become the key differentiator. The question is no longer whether onchain perpetuals can function, but whether their microstructure is comparable to CeFi. In 2025, the answer is increasingly yes.

This maturation positions onchain perps to attract institutional participation in a way that was not realistic in 2021–2023. Deeper liquidity, more robust risk engines, chain-specific throughput, lower fees and more predictable execution collectively remove many of the historical barriers for funds, market makers and structured-product desks. Onchain derivatives are evolving into a credible, operationally reliable market that competes directly with centralised exchanges.

Looking ahead, the next stage of evolution is likely to centre on collateral mobility, cross-chain margining and the unification of liquidity across execution environments. As the market fragments across specialised chains, the winners will be those that can deliver seamless collateral portability, low-latency settlement and deep liquidity without sacrificing trust minimisation.

If 2025 was the year CLOB- and cross-margin-based perp DEXs proved they could scale, 2026 will be the year they begin to converge toward fully institutional-grade trading infrastructure while offering unique products such as RWA-Perps.

Primary issuance rails and the new speculative economy

Primary Issuance

Primary issuance rails became one of the defining narratives of 2025. What began as a Solana-native experiment matured into a global issuance layer operating at a speed and scale unmatched in previous cycles. Pump.fun, Echo, Four.meme and comparable systems have effectively rebuilt the ICO funnel onchain, but with far greater transparency, higher cadence and a user base substantially larger than anything seen in 2017.

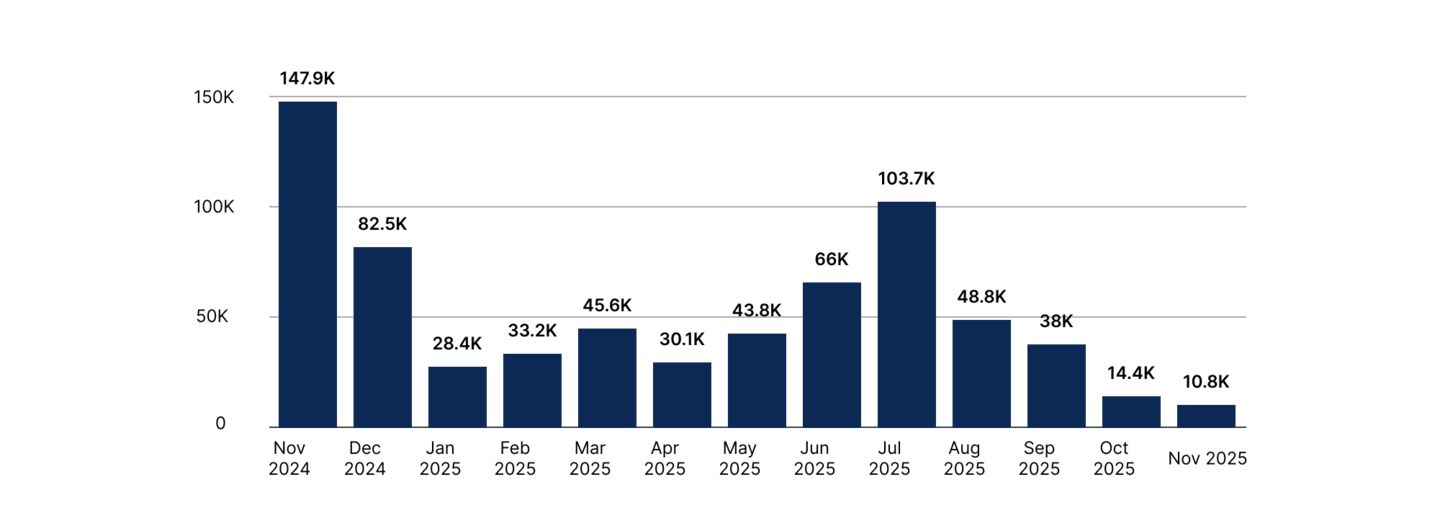

The scale of activity shows how foundational this category has become. Pump.fun alone saw between 40,000 and 60,000 new tokens minted per day at the start of 2025, stabilising to 15,000 to 20,000 by year-end. Daily active users remained above 100,000 for most of the year and reached nearly 300,000 during the early-year memecoin mania triggered by the TRUMP token. Revenue followed the same trajectory. Cumulative fees increased from $285 million at the start of the year to $920 million, which is remarkable for a platform less than two years old.

Graduation into deeper liquidity venues followed a consistent pattern. Out of the roughly 14 million tokens created on Pump.fun, only about 150,000 (1.07%) progressed to Raydium or PumpSwap, where liquidity becomes meaningful and early price discovery develops. Four.meme displayed a similar trend: around 764,000 tokens were issued, with approximately 10,000 ultimately listed on PancakeSwap.

Despite the short-lived nature of most issued tokens, this activity does not cannibalise DeFi. Instead, it creates temporary shifts in attention that coincide with periods of heightened speculation, such as early 2025. Surges in Pump.fun usage correlate with spikes in Solana DEX volume, rising funding rates on perpetuals and increased noise trading across platforms. Far from draining liquidity, these platforms onboard new users at scale. Many enter through memecoin issuance and eventually remain in the ecosystem, migrating toward other primitives such as DEXs, perps and yield products.

Beyond memecoin-driven issuance, more curated platforms targeting early-stage investment have also emerged, such as Echo. Since its launch in March 2024, it has facilitated more than $150 million in primary issuance, peaking in January 2025 before stabilising at 10 to 20 deals per month and $5 to $15 million in monthly funding.

Compared to 2017, the contrast is stark. The ICO wave was defined by opacity, slow cadence and fragmented access. The 2025 issuance cycle is the opposite. It is transparent, constant and directly integrated into efficient liquidity tools. Issuance rails have become the attention layer of DeFi, a set of markets where distribution, virality and speed often matter more than underlying fundamentals. Economically, they behave closer to social platforms than traditional exchanges.

Prediction Markets

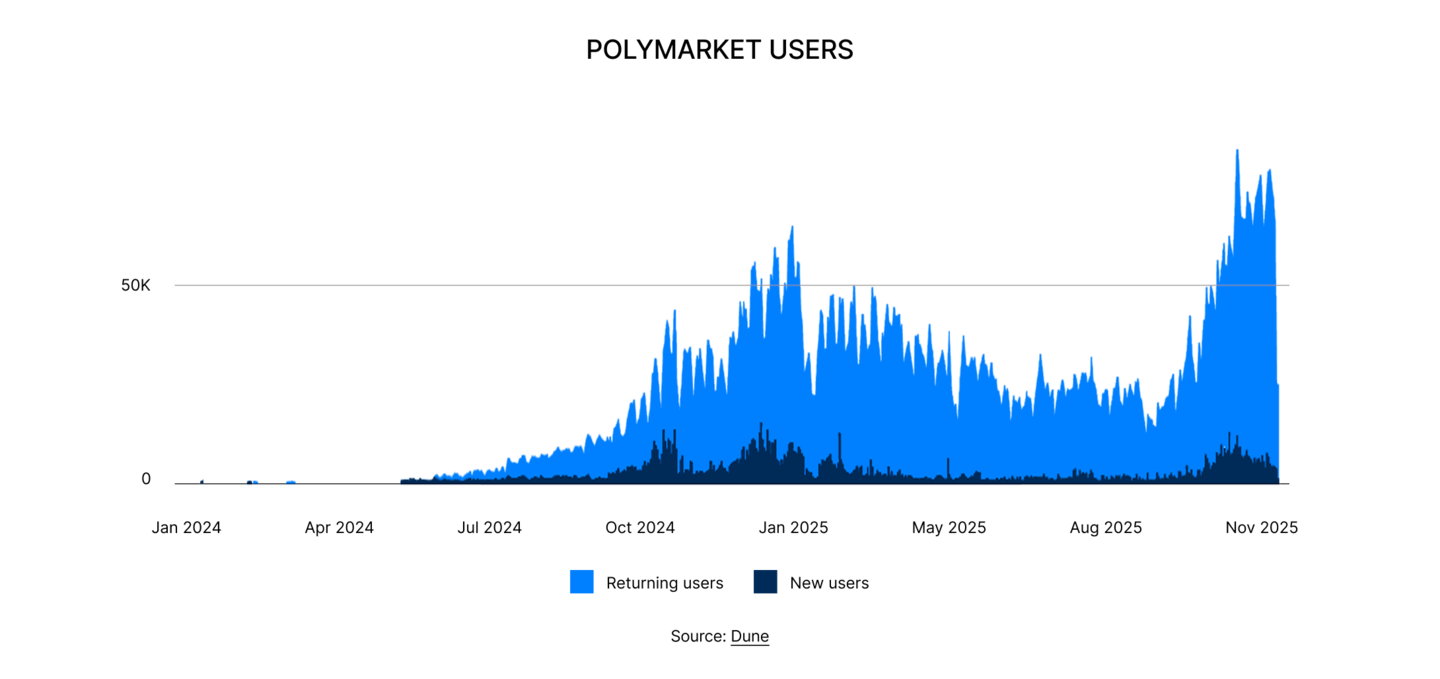

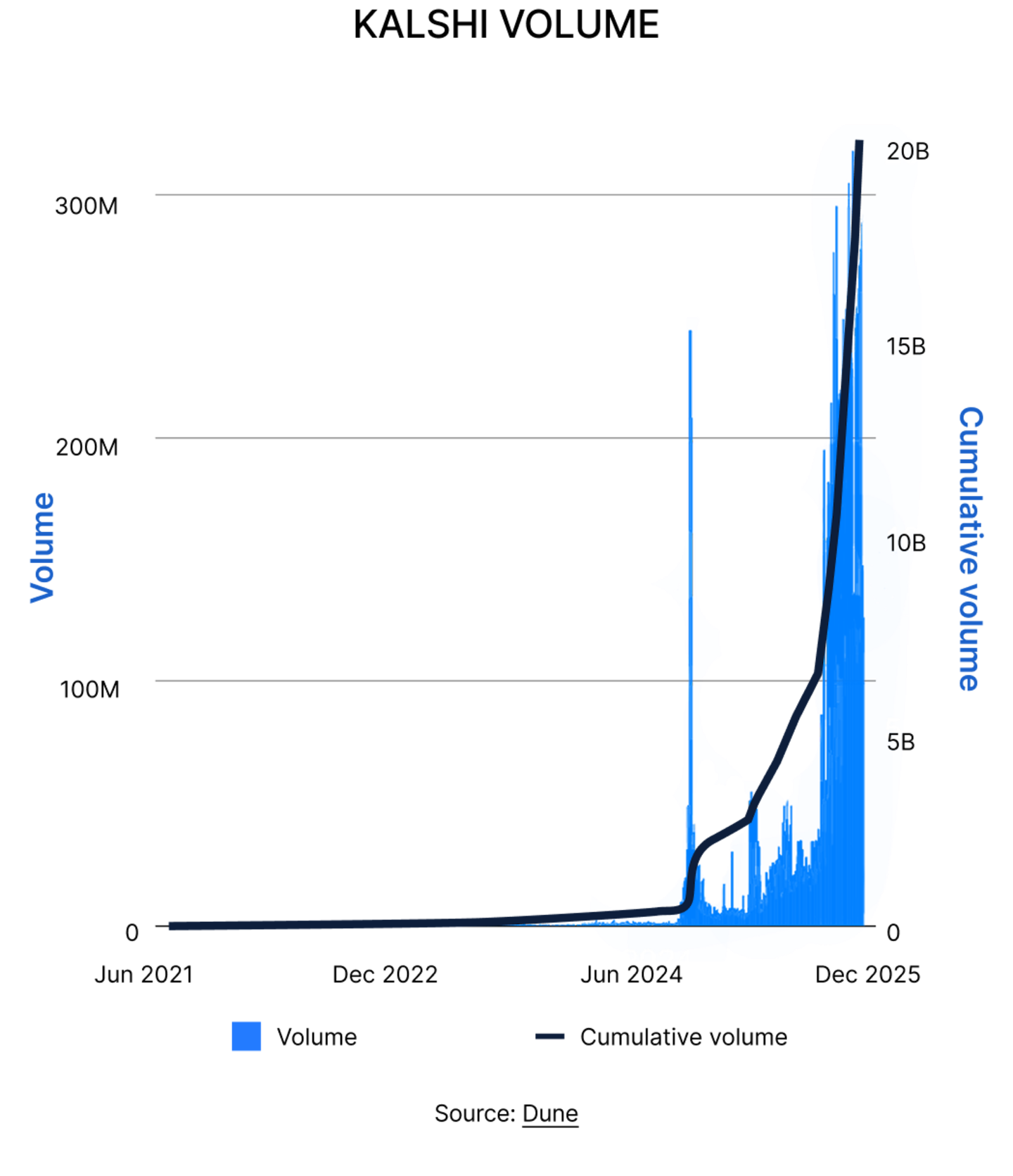

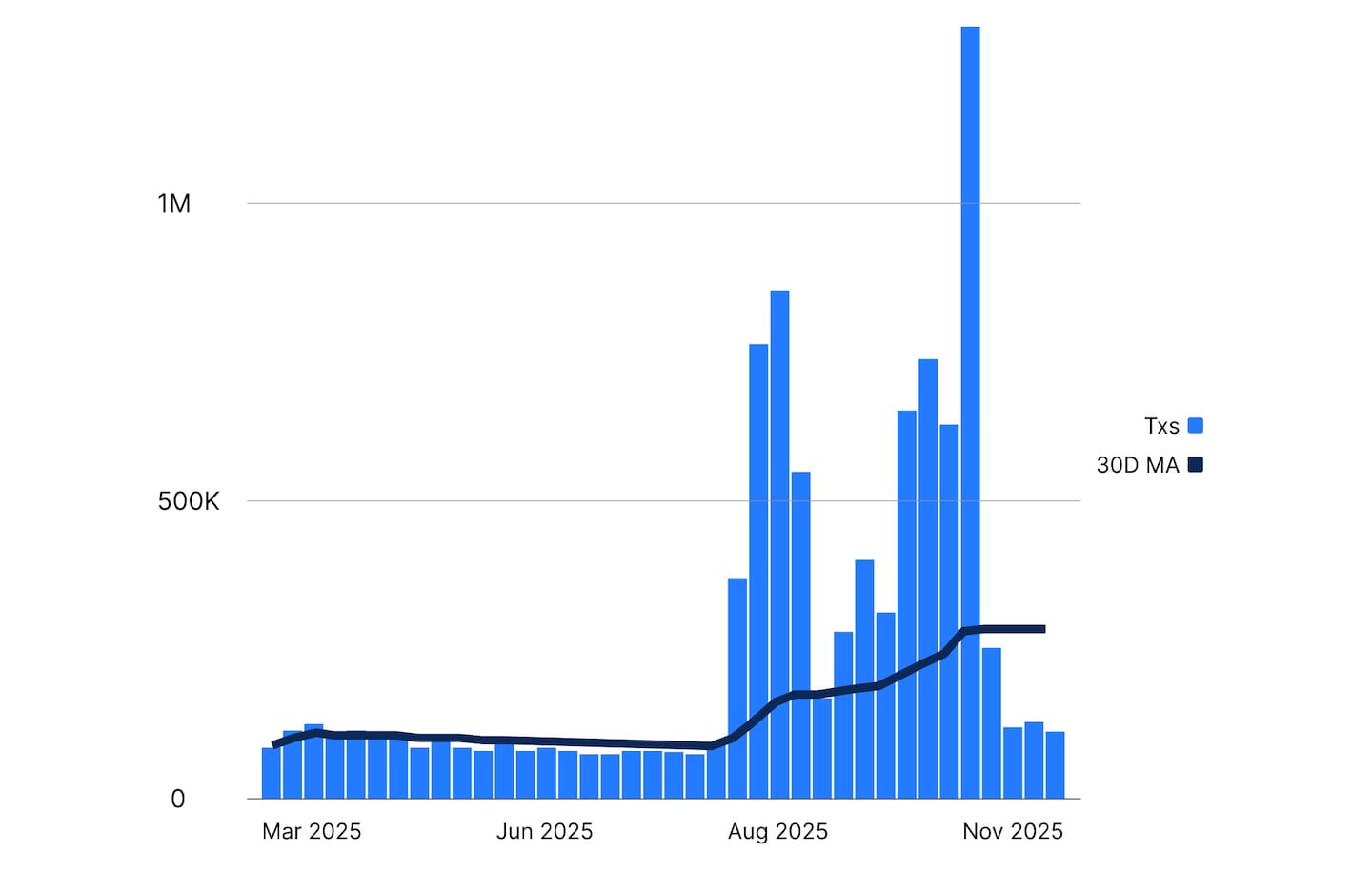

Prediction markets have emerged as another important component of this speculative layer. Platforms such as Polymarket and Kashi have moved from niche to mainstream. Polymarket reached a peak of 130,000 daily users, compared with roughly 50,000 at the start of the year. Daily transactions rose from around 400,000 to more than 1.3 million, and daily volume now ranges between $70 million and $100 million. Cumulative volume has exceeded $26 billion.

Kashi has followed a similar trajectory, with daily volume between $150 million and $200 million and cumulative volume of around $16 billion. These markets function like micro-perpetuals on real-world events, and their pricing often influences assets that proxy similar political or macro outcomes. For the first time, event-driven flow is becoming a measurable contributor to the DeFi liquidity stack.

Three developments in 2025 demonstrated why prediction markets are no longer a curiosity but a structural information engine. First, they consistently repriced political and macro outcomes faster than traditional sources. During the US presidential debates, for example, Polymarket odds moved within seconds of key moments, long before polling aggregators or news desks updated their models. Second, these markets now bleed directly into DeFi behaviour. Election-linked positions on Polymarket were followed by shifts in funding rates on ETH and SOL perpetuals, as traders hedged or amplified directional bets based on changing probabilities. Third, prediction markets unlocked a new form of event-driven user behaviour. During major catalysts such as CPI releases, court rulings or sports finals, liquidity rotated visibly between meme platforms, perps and prediction markets. Users moved where narratives moved, turning these events into short-cycle sources of flow for the broader ecosystem.

Interconnected and Outlook

What initially seemed like separate trends are converging toward a single structural outcome. The crypto trading stack is evolving into a more complete, interconnected and continuous system than at any point in its development.

At the top of the stack, issuance platforms supply an unprecedented flow of new assets, attention and users. Whether through mass-market rails like Pump.fun or more curated venues like Echo, issuance now acts as the ignition point of speculative cycles. These flows do not stay siloed. They feed directly into DEX routing and perps products.

In the middle of the stack, DEXs and perps transform that flow into deeper trading activity. Sophisticated matching engines, unified collateral models and exchange-grade execution have allowed Perp venues to absorb institutional-scale liquidity while DEX infrastructure increasingly acts as the universal router of onchain value. Activity rotates rapidly between issuance, spot markets and derivatives, but it does so within a coherent execution environment that is far more efficient than in previous cycles.

Prediction markets complete the stack by acting as an information and catalyst layer. Their probability signals influence positioning across perps, funding dynamics and short-term sentiment. They turn real-world events into tradeable markets, providing a live input into the broader price discovery system.

These layers now operate in a self-reinforcing loop. Issuance captures attention, attention fuels trading, trading expands derivatives demand, and derivatives positioning shifts with event probabilities. Crypto has moved beyond fragmented speculation into a circular liquidity system where each layer accelerates the others.

Credit, Yield, Staking, Restaking, And RWA Collateral

Vaults and yield aggregators are now a major entry point into DeFi; what distinguishes a mature vault and curation ecosystem from the earlier “chase the highest APY” phase of the market?

A mature vault ecosystem starts with a risk-first approach where yields are decomposed, position limits are explicit, and strategies operate within a consistent and transparent mandate rather than simply hunting for spikes.

Governance becomes process-driven rather than reactive, enforced through automatic execution pipelines, and users are given visibility into asset allocation. In that sense, the distinction is not the sophistication of the strategies, but rather the presence of an actual investment process behind them, one that looks more like portfolio management and less like yield farming.

As collateral types expand from ETH and stablecoins into LSTs, LRTs, and RWAs, what principles do you think should govern which assets are considered suitable for conservative yield strategies?

Conservative strategies should have explainable, observable, and controllable risk exposure, at least to a high degree of certainty. LSTs, LRTs, and RWAs introduce very different forms of technical, operational, and legal risk, so suitability depends on how transparent and predictable those risks are, especially under stress.

A critical criterion is the degree to which risk assessment relies on off-chain information. The more an asset depends on private agreements, unverifiable legal claims, or discretionary operator behavior, the harder it becomes to accurately price its risk inside an onchain strategy. Conservative vaults therefore favor assets whose essential mechanics e.g. validator performance; slashing exposure; redemption conditions; NAV calculation; duration mismatch; can be monitored and validated directly onchain. When off-chain components exist, they should be minimized, standardized, and backed by strong, transparent reporting, so that risk is not dependent on information asymmetries or trust gaps.

Many treasuries and funds now face a menu of restaking, credit, and RWA products; how do you expect their approach to portfolio construction to change as curated vaults become more common?

Many funds make allocation decisions on a per-position basis, often stretching themselves to understand a wide range of investment opportunities. As curated vaults mature, hybrid portfolio allocation frameworks are emerging, where funds retain direct control over certain high-conviction exposures but delegate a portion of assets to simpler, more constrained mandates that are executed by reputable counterparties.

These mandates have clearly defined investment universes, liquidity parameters, and risk limits, and they operate with quasi-automatic execution, which makes them cheaper to operate. This balance enables funds to maintain strategic discretion while offloading the operational burden of continuous monitoring, rebalancing, and risk assessment for the more predictable components of their portfolios.

We’re seeing this happening already in our curated vaults, where most of their supply/borrow liquidity is coming from yield aggregator vaults and liquid funds.

RWA and tokenized credit products now sit side by side with permissionless DeFi strategies; what kind of curation or rating framework do you consider necessary before these assets can be mixed in the same vaults at scale?

We can already see meaningful dispersion in onchain credit yields. Permissionless lending markets like Aave and Morpho typically price senior stablecoin credit around the 4–7% range depending on utilization. Tokenized private credit platforms e.g. Goldfinch; Maple often offer 9–13% yields for diversified senior or senior-secured pools, with higher rates for mezzanine or emerging-market exposure. Meanwhile, short-duration RWA Treasury products have recently been yielding 3–5% on fully collateralized U.S. T-bill exposure. These differences reflect not just market conditions but the underlying risk stack, and highlight exactly why a consistent rating framework is necessary before mixing these assets at scale.

Credible frameworks should assess both onchain and offchain risks as first-class, measurable attributes: smart-contract audits, protocol governance, oracle design, liquidity behavior, NAV accounting, legal enforceability, counterparty trust, collateral quality, etc.

These metrics can’t be measured on a one-time underwriting exercise. They should also include ongoing, automated monitoring, so that risk is not merely evaluated at inception but continuously supervised throughout the life of the asset.

Automation and agent based systems are increasingly used for monitoring and execution; what new categories of risk or misconfiguration do you think the industry underestimates when it delegates day to day management to agents?

Automations create reflexivity. If many of them react similarly to market signals, they can amplify volatility by triggering similar execution patterns. A way to prevent these events is to implement change-control processes, circuit breakers, and a clear separation between monitoring and execution to prevent automation from becoming a systemic risk.

Another underappreciated risk is configuration drift: small, unnoticed changes to agent parameters or external data sources that meaningfully affect behavior. At kpk, we maintain a simple scope and deterministic approach to agent parameterization, so we keep control of the outcomes at any point in time.

Instant exit liquidity is becoming an expectation for onchain products; how do you see this shaping the way protocols manage duration, rehypothecation, and liquidity buffers in yield markets?

The expectation of instant exit liquidity forces protocols to reconcile user convenience with the reality that many yield sources are inherently term-based. If redemptions need to be available at all times, then strategies must preserve liquidity buffers, limit how much capital is locked into long-duration positions, and reduce reliance on heavy rehypothecation.

Instant liquidity isn’t free, it shows up as lower deployment ratios, lower yields, stricter risk controls, and more active management of cash or liquid collateral. Over time, I expect protocols to explicitly segregate exposures into distinct risk classes, where liquidity becomes recognized as just another core dimension alongside duration, counterparty exposure, and strategy complexity.