Sam Benyakoub's blockchain journey began in 2017 with the founding of Journal du Coin, which has since grown into the leading French-language blockchain news outlet, serving millions of readers worldwide. In 2021, he launched Node Guardians, a well-established SaaS provider supporting major industry protocols, as well as a staking platform securing over $100M in assets. As a seasoned entrepreneur, Sam's main strength lies in his strategic judgment and ability to develop practical, innovative approaches to growing businesses. Having been a DeFi user since the early days of DeFi Summer, he has explored protocols across multiple market cycles, gaining firsthand experience with their liquidity and efficiency limitations. This background, along with his interest in how yield-bearing stablecoins can facilitate more effective market bootstrapping, ultimately inspired him to create Terminal Finance.

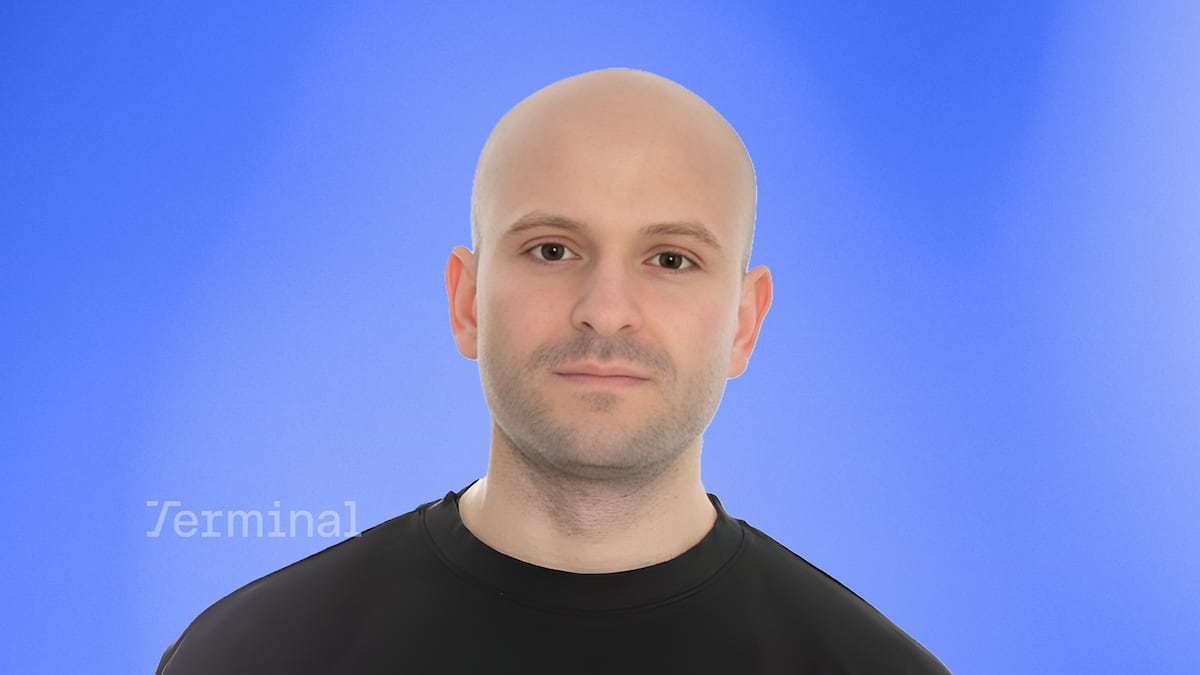

We recently spoke with Sam Benyakoub, founder of Terminal Finance, about the limitations of current DEXs and how he is building a new liquidity hub for yield-bearing assets like Ethena’s USDe.

Sam Benyakoub began his career in the blockchain industry in 2017, founding Journal du Coin, which remains the leading French-language blockchain news outlet. In 2021, he launched Node Guardians, a SaaS provider and staking platform that has secured over $100 million in assets. A DeFi user since “DeFi Summer,” he has explored protocols across multiple market cycles, gaining firsthand experience with their limitations.

His interest in Ethena and yield-bearing stablecoins inspired him to build Terminal Finance, a next-generation DEX. The platform is designed to be the liquidity hub for Ethena, built around yield-bearing assets to capture and reinject their native yield back into the DEX economy, benefiting both liquidity providers and traders.

Read more about Terminal’s strategy to create deep, sustainable liquidity for a new class of assets in the interview below.

You have a long history across crypto media, staking infrastructure, and now DeFi markets. What insight convinced you that yield-bearing assets needed a new kind of DEX?

I noticed a few untapped opportunities early on and decided to pursue them. Back in 2017, France didn’t have a dedicated media outlet focused on blockchain, so we built one (Journal du Coin), which has been quite successful.

Later, I explored the staking industry. The core idea was to create a high-quality, free tool to help developers improve their skills, supported by our staking infrastructure. As we delivered real value, foundations and ecosystem players began delegating to our infrastructure. Those delegations funded further upgrades, creating a virtuous cycle in which increased usage led to better resources and a continually evolving public good.

More recently, I got deeply involved in Ethena, started holding and staking USDe, and recognized its potential. However, one challenge stood out: the lack of a strong secondary market. The question was how to design a model that could maintain deep, lasting liquidity. That’s when the idea came to mind: a DEX that could efficiently capture and redistribute yield from yield-bearing assets. It was a logical step forward, so we built it.

In your own words, what exactly is Terminal, and how does it differ from a normal AMM or centralized exchange?

Terminal is a next-generation DEX powered by USDe. The key difference is that Terminal focuses on yield-bearing assets. It captures the yield they generate and reinvests it into the DEX ecosystem. This approach benefits liquidity providers, traders, and token holders by improving the protocol’s efficiency and economic model.

Terminal is described as the liquidity hub for Ethena. How deeply is Terminal integrated with Ethena’s infrastructure, and how does it help stabilize sUSDe markets?

Ethena has been supporting us closely since the beginning, and we’re incredibly thankful to be working with them. We are moving ahead with launching our DEX on the mainnet first. Given the traction we’ve seen, we believe mainnet is the perfect ground for this new model.

For example, in March 2024, the market could absorb only about $6 million in USDe before experiencing a 4% price impact, forcing Aave to hard-peg USDe to USDT to mitigate risk. Terminal aims to address this gap by serving as the liquidity hub of the Ethena ecosystem, creating deep, efficient markets for USDe and sUSDe pairs to execute large trades with minimal slippage.

One of Terminal’s core features is yield extraction via the rUSDe wrapper. Could you walk us through how that works and where the yield accrues?

A yield-bearing token, such as sUSDe, is wrapped into a redeemable token (rUSDe) that’s linked to a redemption rate oracle, in this case, the sUSDe/USDe rate. When the oracle submits a price update showing an increase in the underlying’s value, the redemption rate of rUSDe to sUSDe decreases so that the accrued yield isn’t reflected in rUSDe’s price. The accumulated yield remains stored within the redeemable contract and can be claimed at any time by redeeming rUSDe back to sUSDe.

Importantly, rUSDe is entirely abstracted from users; they only interact directly with sUSDe. This setup allows the protocol to handle redemption mechanics and yield accounting transparently in the background, providing a seamless user experience while keeping yield isolated.

Terminal introduces a ‘t-tax’ on unstaked LPs to favor long-term liquidity. Who sets the tax, and how dynamic is it?

The protocol governor determines the tax. At first, this role is held by the team, but it will later be transferred to the governance. It can be adjusted at any time by the current governor. The goal is specifically to penalize unstaked assets and encourage long-term liquidity provision.

USDe is currently the third-largest stablecoin. Do you believe it will overtake USDC by the end of the decade? How do you respond to critics who point to the de-pegging and basis risks?

Yes, I do. It really comes down to each person’s risk tolerance. As T-bill yields cool off and funding rates go up, I think Ethena will stand out even more. It held up through some seriously volatile events without major failures or losses for users. That gives me even more confidence that it will eventually surpass USDC.

If you’re long-term bullish on (1) BTC and (2) perpetual futures, it makes sense to include USDe in that conviction. As long as the market continues to express BTC exposure through the most efficient instrument, i.e., perpetuals, then Ethena’s core business model remains fundamentally sound.

Recently, USDe briefly traded at $0.65 on Binance during a liquidation event. Is there a mechanism you’ve built to handle such events?

There is no liquidation mechanism on Terminal as the pool’s liquidity determines the price. Oracles are used only for yield-bearing assets expected to generate positive yields; the protocol rejects updates for assets with negative yields.

It is important to note that the protocol’s use of price oracles is solely for redemption rate feeds, not for price feeds. Therefore, if USDe de-pegs again, it will have no effect on the sUSDe/USDe redemption rate, which is determined by a smart contract. Hence, it does not affect the yield-bearing asset.

As a DeFi user since DeFi Summer, what is the single biggest mistake protocols from that era made regarding liquidity incentives or token design that you are determined to avoid?

Nothing complicated, we keep things simple. We avoid year-long points programs, 60% insider token allocations, very short vesting periods, and onboarding risky projects with non-backed POL on our DEX. By following these basic principles, we genuinely believe you can achieve good results, as long as your protocol is solid.

Looking at your roadmap, what is the key feature you believe is critical for achieving product-market fit and proving Terminal’s necessity in the market?

Yield skimming is the first feature, and it directly addresses a structural disincentive that has historically limited liquidity for yield-bearing assets on DEXs.

By allowing LPs to retain and monetize that yield, we’re fundamentally improving the economics of liquidity provision for this asset class. We’re particularly bullish on stableswap/CL pools combined with yield skimming.