Report by DL Research based on content provided by RedStone

Key Takeaways

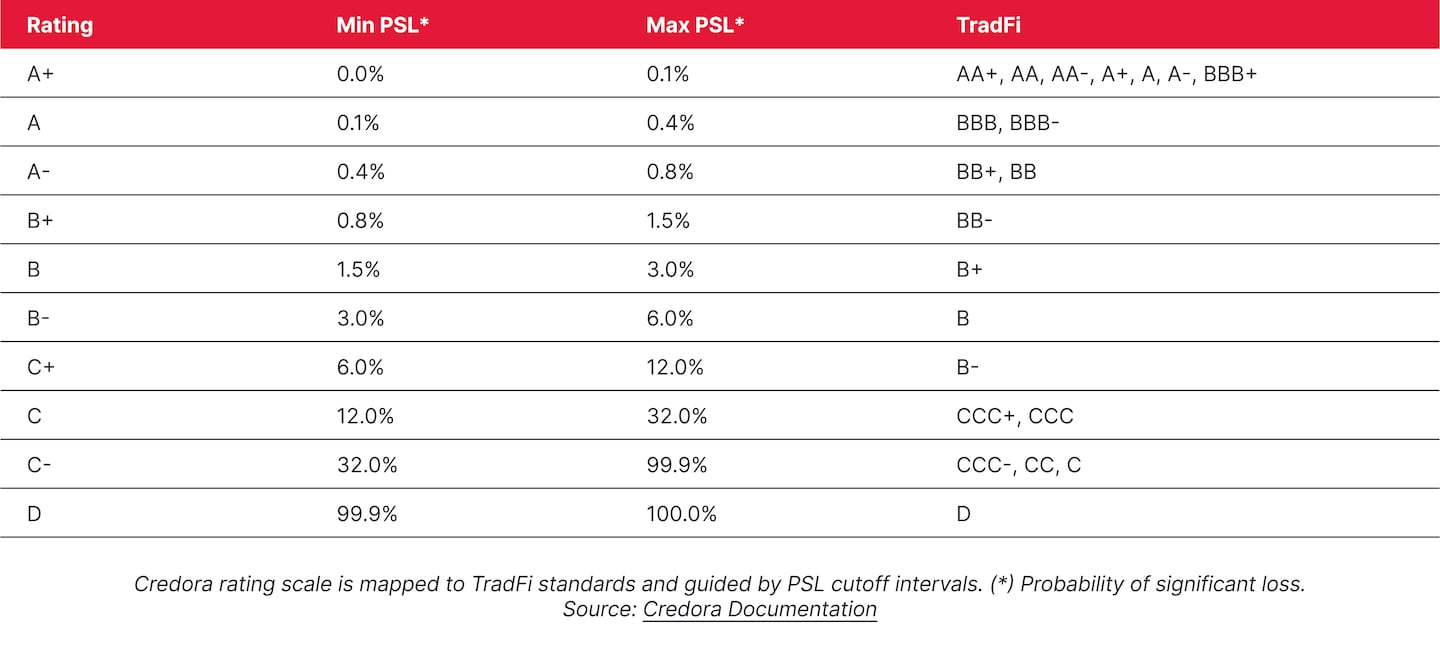

- Credora introduces DeFi-native risk ratings that translate complex protocol risks into an A–D scale based on Probability of Significant Loss (PSL), making downside risk comparable across assets, markets, and vault strategies for the first time.

- Following RedStone’s acquisition, Credora ratings can now flow through oracle infrastructure alongside price data, enabling protocols to dynamically adjust parameters and present risk intelligence transparently at the point of allocation.

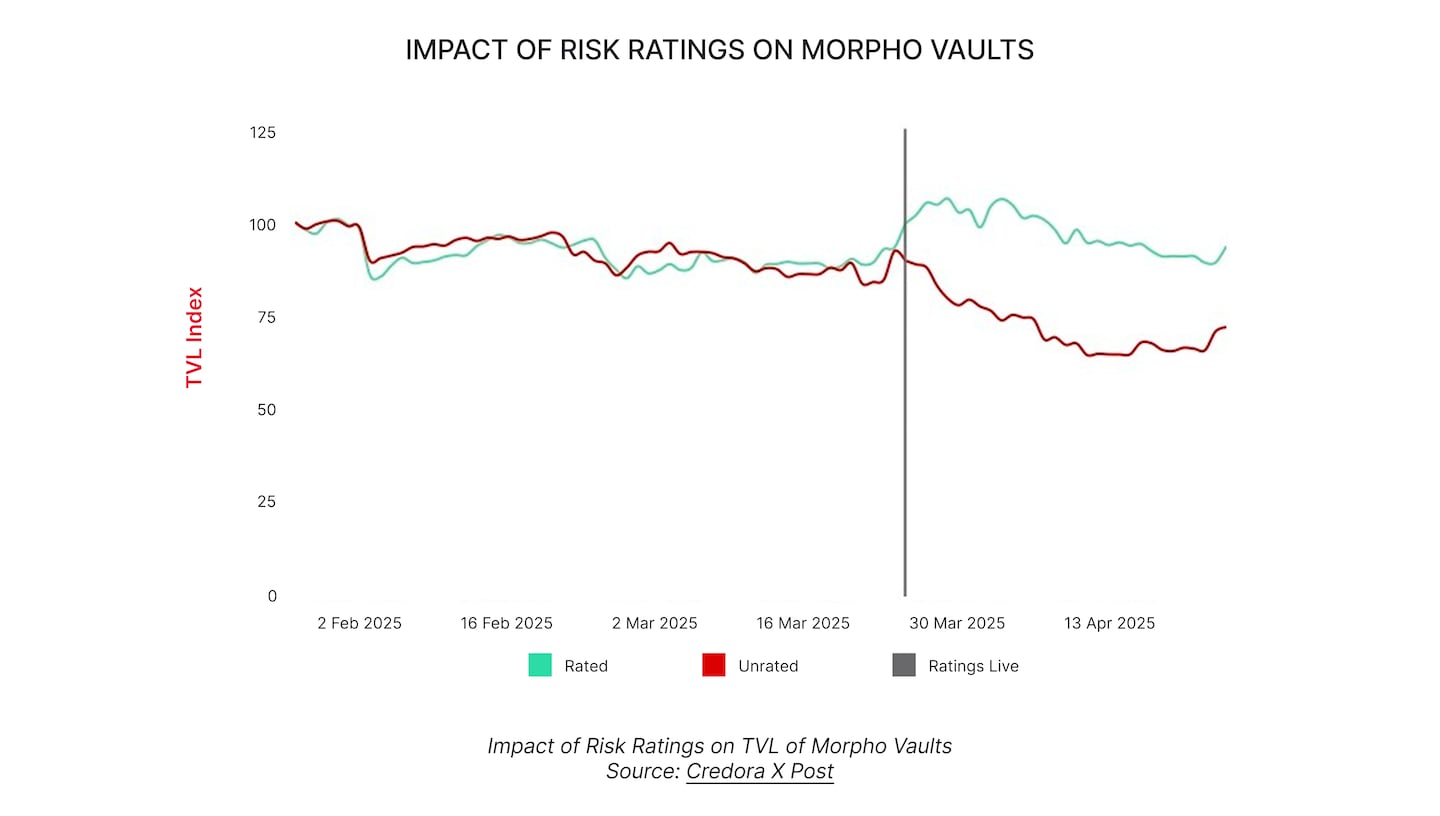

- Early integrations demonstrate measurable impact: rated vaults on Morpho show faster TVL growth and higher capital retention than unrated peers, while Spark’s integration surfaces both real-time ratings and risk profiles directly in user interfaces.

- By anchoring on historical default data and updating continuously, Credora transforms risk from static disclosure into a live signal, preventing information asymmetry and enabling risk-adjusted capital allocation at scale.

- As DeFi converges with RWAs and institutional capital, unified risk ratings become foundational infrastructure that supports user protection and enables protocols to meet the standards required by professional capital allocators.

- 2026 is the year of Risk-Aware DeFi and industry maturation by leveraging data-driven risk ratings. In the coming months, we can expect wallets, FinTech platforms and AI agents to integrate Credora outputs for more informative capital allocations.

1. Risk Ratings: What They Are and Why They Matter

DeFi generates continuous data but lacks a unified way to express downside risk at the point of capital allocation. The upside is visible—APYs are displayed prominently, returns are easily benchmarked. The downside remains fragmented across protocol parameters, liquidity assumptions, oracle design, and collateral dependencies, rarely aggregated into a common signal. This mismatch has contributed to repeated DeFi failures, where loss events emerge from interactions between leverage, collateral reuse, and liquidity constraints that evolve systemically while remaining invisible to users.

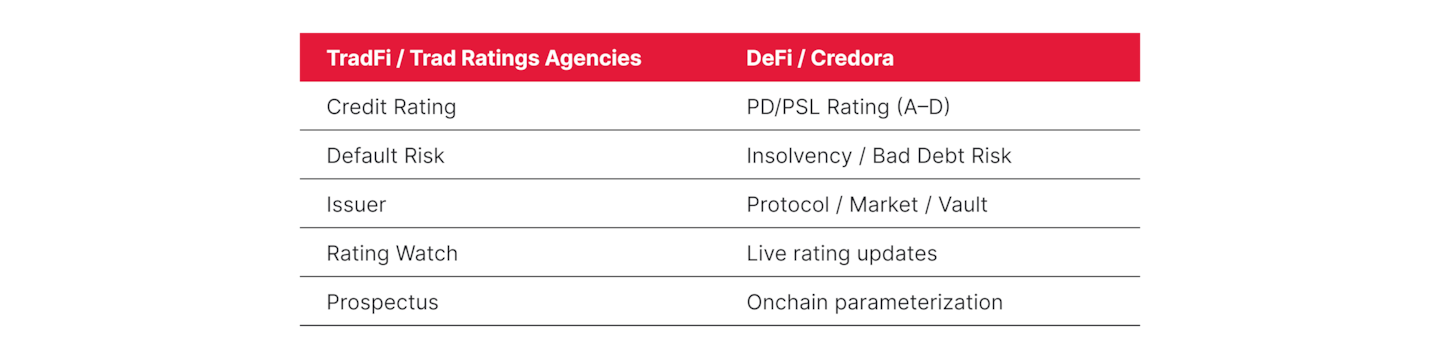

Traditional credit markets solve this through uniform risk classifications. A corporate bond yielding 8% means something fundamentally different at BB versus AAA. DeFi lacks this abstraction layer: APY is often treated as a standalone metric, flattening fundamentally different risk profiles into superficially comparable opportunities.

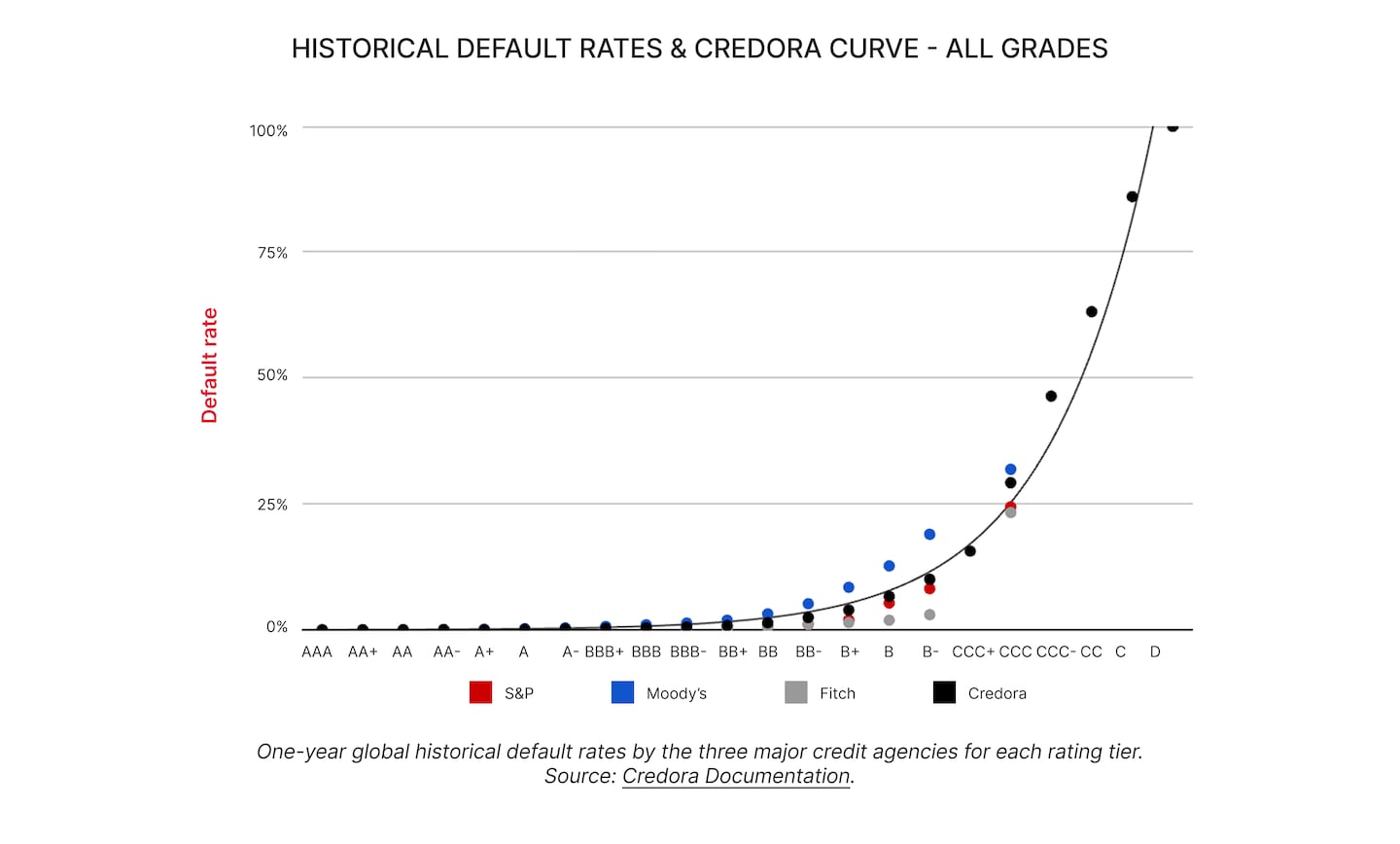

This report lightly introduces Credora’s DeFi-native risk framework built around Probability of Significant Loss (PSL): an annualized measure of the likelihood that an exposure experiences material principal impairment due to insolvency or bad debt. By mapping PSL to a consistent A–D rating scale, complex risk dynamics become a comparable, continuously updated signal. Credora’s ratings update daily, making downside legible before capital is deployed.

The above table mirrors the role credit ratings play in traditional finance. Agencies like Moody’s, S&P, and Fitch provide standardized views on default risk, allowing investors to compare instruments on a common scale. Until recently, DeFi lacked an equivalent. Risk was inferred from APYs, TVL, or via ad-hoc heuristics.

Credora fills that gap by introducing a unified and easily-mappable risk language native to on-chain systems.

Following RedStone’s acquisition of Credora, the integration creates the first oracle to deliver price data and risk intelligence together. RedStone now answers not only “What is the price?” but also “How risky is this exposure?”. Protocols can auto-adjust collateral ratios based on live credit scores, optimize lending parameters dynamically, and transparently present risk alongside price. This convergence solves a critical distribution bottleneck: risk data previously lacked the native delivery infrastructure that oracles provide for price feeds, limiting adoption despite clear demand.

The result is a shift from reputation-based decision-making to risk-adjusted allocation. Protocols can benchmark markets, vault curators can signal robustness, and users can compare opportunities beyond headline returns—with consistent risk classifications becoming particularly essential for institutional participants who require auditable frameworks for capital allocation.

Over time, standardized risk ratings raise the bar across DeFi, rewarding better design and discouraging fragile, disingenuous, or short-term yield engineering. The objective is not to eliminate risk, but to make downside legible before capital is deployed.

2. Credora: The DeFi Risk Ratings Standard

Credora is a DeFi-native risk ratings platform designed to bring standardized, comparable risk signals to onchain markets. Following the acquisition, Credora now sits directly alongside arguably one of the most technologically advanced and secure blockchain oracle layers, allowing protocols and users to consume comprehensive market data and risk intelligence together.

Credora produces ratings for three types of DeFi exposures: individual assets, lending markets, and vault strategies that combine multiple positions. The system translates complex financial data and risk dynamics into simple, actionable signals while maintaining methodological clarity for those who want to understand how ratings are constructed. Rather than static, descriptive analytics alone, ratings are designed to support real allocation decisions: lending, strategy construction, and capital deployment under uncertainty.

Why Credora Matters

DeFi historically lacked a common risk language. Capital flowed based on APY, TVL, or narrative strength, with little ability to compare downside risk across products. The collapse of Terra/Luna exemplifies this gap: allocators poured billions into Anchor Protocol’s 20% APY on what appeared to be a USD-denominated stablecoin strategy, yet the underlying insolvency risk remained invisible to 99% of participants until it materialized. Credora prevents events like this, by introducing a crypto-native equivalent of credit ratings, calibrated to real default behavior and designed to make such tail risks legible before deployment.

The result is:

- Clear, comparable risk signals across DeFi assets and strategies

- Improved risk-reward decision-making for users and protocols

- Earlier detection of deteriorating risk profiles

- Stronger incentives for protocols to improve design and resilience

Empirically, markets and vaults with Credora ratings have shown faster and more durable growth than unrated counterparts, reflecting reduced information asymmetry. Post-acquisition, the initial integration relaunched on Morpho and soon on Spark, with coverage expanding to additional protocols, vaults, and aggregators over time.

From Probability to Rating: The Credora Scale

Credora ratings are derived from:

- Probability of Default (PD) defines the likelihood that a borrower or asset issuer will be unable to meet its debt or redemption obligations within a specified period (12 months). The PD forms the basis of Credora’s rating framework: an anchor PD is calculated from historical default data and adjusted using modifiers to map the risk to an implied rating.

- Probability of Significant Loss (PSL) measures the probability that a lending market incurs bad debt exceeding 1% of principal, arising when liquidations fail to fully cover borrower debt and lenders take a loss.

These probabilities are mapped onto a familiar A–D letter scale, enabling direct comparison with traditional credit instruments.

All methodologies anchor to a single PD Curve, calibrated using historical default data from major credit rating agencies across multiple credit cycles (1990–2023). This ensures that:

- A given letter grade corresponds to a comparable long-run default probability

- Risk can be compared consistently across asset types (tokens, markets, vaults)

- Onchain ratings are interpretable by institutional allocators

The curve is fitted using exponential interpolation and mapped into rating bands to maximize differentiation where most DeFi risk currently sits.

How Ratings Are Built

At a high-level, Credora assesses risk across three core layers: the asset layer (collateral quality, issuer risk, and default behavior), the market layer (liquidity, volatility, liquidation mechanics, oracle design), and the vault layer (strategy aggregation, curator incentives, governance, and operational control). Each layer is modeled using simulation tools like Monte Carlo simulations and stress testing and contributes to a single, unified rating. These ratings are updated in real time and mapped to a letter-grade scale (A+ to D) calibrated against traditional credit benchmarks.

Each rating begins with a quantitative anchor PD, estimated using models appropriate to the asset’s structure. Depending on the instrument, this may include:

- Smart contract and custodian risk

- Stress simulations of collateral and liquidity behavior

- Structural credit-style models for strategy-driven stablecoins

- Tail-risk analysis focused on reserve insolvency and redemption capacity

This risk basis is then adjusted using a structured set of risk modifiers that capture real-world considerations, including:

- Smart contract risk: audit coverage, maturity, and exploit history

- Legal and regulatory structure: licensing, enforceability, bankruptcy remoteness

- Collateral quality: over-collateralization, reserve transparency, loss buffers

- Governance and user protections: upgrade controls, timelocks, concentration

- Liquidity and adoption: depth, usage history, and resilience under stress

These adjustments produce final PD and PSL estimates, which are mapped to a letter grade.

Token Coverage and Methodological Scope

Credora applies a unified scoring framework, adapted per token type, thereby allowing risk to be assessed at the correct abstraction layer. Currently, coverage includes (with exemplary assets):

- Derivative Tokens: Wrapped Tokens (wETH), Liquid Staking Tokens (stETH), Liquid Restaking Tokens (eETH)

- Stablecoins: RWA/Fiat-backed (USDT), Alternative-asset backed (USDS), Active strategy (USDe)

A Live Risk Oracle

Unlike traditional rating agencies, Credora operates as a continuous, automated system. Over 90% of the pipeline is machine-driven, enabling ratings to update as conditions change. Governance actions, liquidity shocks, or parameter changes can be reflected without delay.

In this sense, Credora functions as an "intelligent oracle”: transforming raw market, protocol, and unstructured data into actionable intelligence. As RedStone integrates this directly into its robust oracle stack, DeFi gains the ability to price not just assets, but risk itself.

The objective is straightforward: help capital avoid the next black-swan systemic failure by making the downsides visible before it materializes.

3. Case Studies: Morpho and Spark

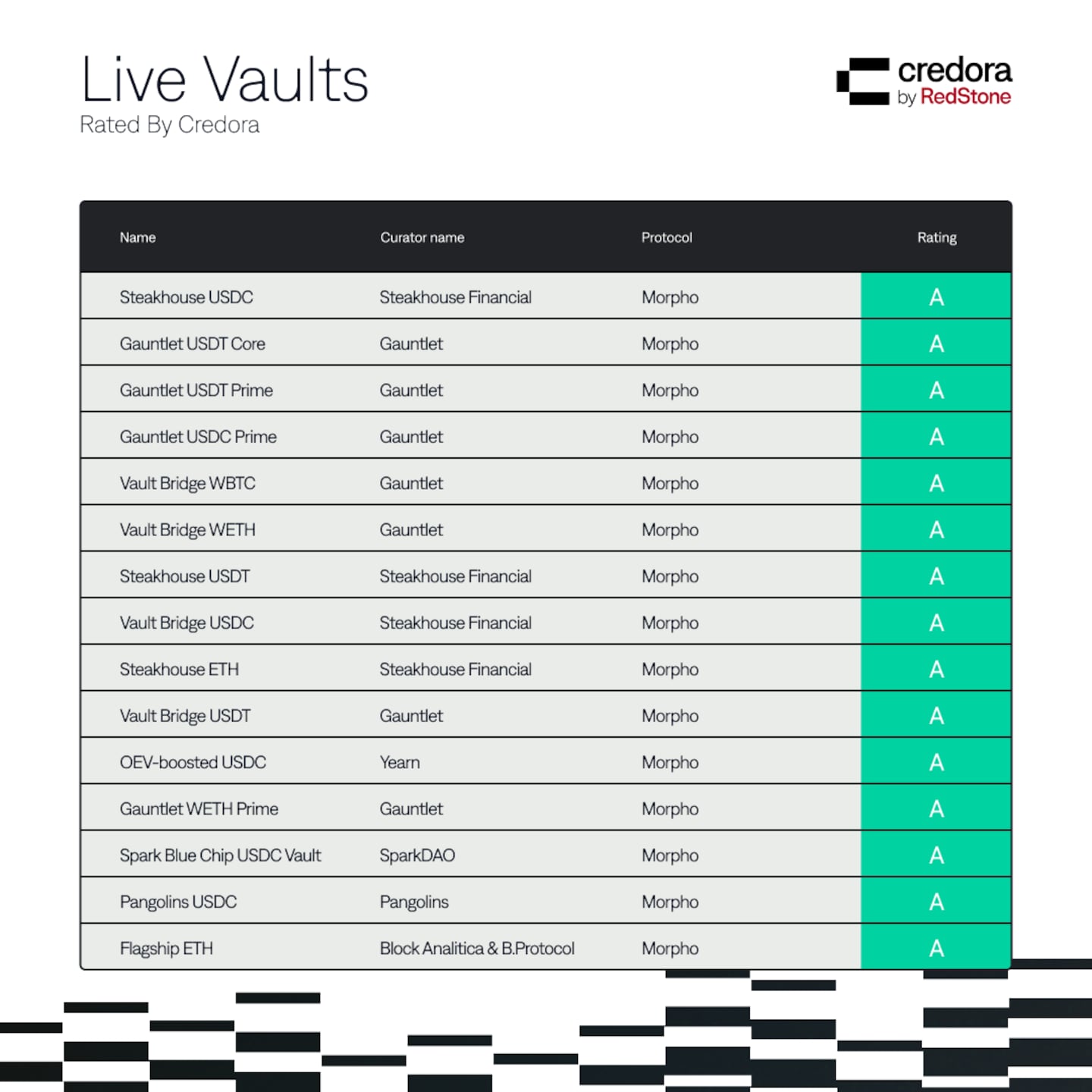

Morpho and Spark are the first lending protocols to adopt Credora’s risk ratings as a native interface primitive. Both recognized that scale in DeFi lending requires more than yield discovery–it requires uniform, legible risk disclosure at the point of allocation.

Morpho: Risk at the Vault Level

Morpho is a peer-to-peer lending optimizer that introduced Morpho Vaults in early 2024–curated strategies managed by independent vault curators. With the launch of Morpho V2, customization and strategy differentiation expanded significantly at the curator level, making it harder for users to assess risk based on APY alone. As vault count and complexity increased, a new layer of visibility became necessary.

To solve this, Morpho integrated Credora as an opt-in rating layer for curators. Credora evaluates vault strategies individually, and approved vaults now display a letter-grade risk rating alongside APY in the Morpho interface. Each vault is treated as a portfolio: Credora estimates its Probability of Significant Loss (PSL) and maps it to the appropriate scale.

From a practical angle, let’s take a brief look at the Morpho WETH/USDT market and, at a high level, understand the basics of how Credora works. We start by analyzing the core market characteristics such as LLTV, liquidation incentives, and oracle configuration. On top of that, we look at how borrowers are actually positioned relative to the liquidation threshold (are they clustered near max LLTV or more conservative?), how likely they are to rebalance when they get close to that limit, the standalone risk of WETH as collateral, and the historical return and tail-risk profile of the WETH/USDT pair.

All these inputs feed into our simulations to estimate how often this Morpho market hits liquidations. When that happens, we stress test whether liquidations clear cleanly or create bad debt by simulating the liquidation triggers against stressed on-chain liquidity conditions, factoring in collateral utilization across multiple lending protocols that may be competing for the same liquidity.

Since launch, the rated Morpho vaults exhibited:

- Faster deposit growth than unrated peers

- Higher capital retention (“stickier” TVL)

- Greater curator credibility and fee stability

Morpho is currently on track to exceed 100 Credora-rated vaults, reinforcing ratings as a default.

Spark: Risk at the Asset and Market Levels

Spark is a decentralized lending protocol built around USDS-denominated markets and integrated within the broader Sky ecosystem (formerly MakerDAO). Spark powers borrowing and savings across a suite of stablecoin and ETH-based products, including sUSDS, spUSDC, spETH, and stUSDS.

Sky is now integrating Credora risk ratings to surface real-time, on-chain risk profiles for USDS and its adjacent markets. Each rating combines asset-level fundamentals (such as the default probability of USDS and its supported collateral) with market-level dynamics like liquidity depth and price volatility. This enables more precise differentiation between exposures, such as ETH-backed vs. BTC-backed pools.

Once live, Spark users will be able to view a clear, Credora-generated risk grade for USDS on an embedded risk dashboard, directly into the Spark Savings interface–giving users a transparent, side-by-side view of yield and risk.

For Spark, the core value proposition is transparency and visibility. Risk signals that were previously scattered across dashboards, documents, or buried in assumptions are now consolidated into a single, interpretable score. This is especially relevant for conservative or institutionally minded capital, where clear assessments of downside risk are a prerequisite for participation.

4. The Future of Risk Ratings in RWA–DeFi Convergence

Real-world assets (RWAs) represent DeFi’s convergence with traditional finance, combining onchain execution with offchain legal, regulatory, and financial infrastructure. This layered complexity makes RWAs uniquely dependent on structured, transparent risk assessment.

As RWAs scale, they are becoming the primary gateway for institutional participation in crypto. Banks, asset managers, and fintechs operate under strict fiduciary mandates that require explicit, auditable risk frameworks. These institutions cannot justify allocations based on yield alone—they need documented risk grades to satisfy compliance requirements, size exposures, and defend decisions to risk committees.

Credora extends its methodology to capture RWA-specific factors: regulatory licensing, custodian quality, legal entity structure, bankruptcy remoteness, and jurisdictional exposure. These are evaluated through dynamic tiering systems, with risk-weighted adjustments applied to each rated asset or strategy.

By bringing credit rating language onchain, Credora enables institutions to evaluate DeFi exposures using the same framework they apply to traditional bonds. An A– rated lending pool becomes directly comparable to an A– corporate bond, removing the translation barrier that has kept sophisticated allocators on the sidelines.

As the market matures, risk ratings evolve from optional disclosure to competitive necessity. Protocols that integrate transparent and independent risk assessment attract higher-quality capital; those that rely on opacity risk exclusion from institutional allocations. A Credora rating may become as fundamental as a security audit: baseline infrastructure for capital to deploy with confidence.

Beyond protocol-level adoption, Credora’s framework has gained recognition from broader ecosystem stakeholders. The Ethereum Foundation has publicly acknowledged the critical role that standardized risk ratings play in advancing DeFi maturity and institutional readiness.

The Credora team recently participated on a webinar with the Ethereum Foundation exploring these themes in depth, examining how risk ratings development and standardization can accelerate institutional participation while maintaining DeFi’s core principles of permissionless innovation.

Summary

Credora solves DeFi’s core coordination problem: making downside risk legible, comparable, and actionable. By translating complex protocol dynamics into uniform ratings anchored to historical default probabilities, Credora transforms risk from implicit narrative into explicit signal. Following RedStone’s acquisition, risk ratings now flow through oracle infrastructure alongside price data, solving a critical distribution bottleneck and enabling protocols to adjust parameters dynamically based on live risk scores.

Early integrations validate the model. Rated vaults on Morpho are poised to demonstrate faster growth and higher capital retention than unrated peers, proving that transparent risk disclosure from users’ side improves capital quality and curator accountability. As DeFi converges with real-world assets and institutional capital, ratings become essential infrastructure—not just for user protection, but as a prerequisite for protocols to access sophisticated capital sources.

The result is risk-aligned DeFi: protocols compete on design quality rather than opacity, users allocate with clear understanding of trade-offs, and institutions gain the common language necessary to participate responsibly. In a maturing ecosystem where capital demands both yield and clarity, Credora establishes transparent, continuously monitored risk disclosure as a market primitive rather than an afterthought.

Download the report

Download the “The Year of Risk-Aware DeFi: Credora ratings as the $1T Unlock Primitive” report (PDF)