- Curve Finance's CRV edges closer to the $0.4 price where investors purchased 158 million tokens from founder Michael Egorov.

- The fear is that some buyers may sell their CRV to avoid losses.

- “I’m not particularly worried,” Egorov told DL News.

CRV tokens sold by Curve founder Michael Egorov in over-the-counter deals earlier this month edges closer to the purchase price as the wider crypto market continues to decline.

On August 1, Egorov started offering his CRV stash to repay the shaky loans he had taken out on several DeFi lending protocols. To attract buyers, he sold tokens at a discount for $0.4 each — over 30% below the $0.61 market rate — but with the stipulation that buyers shouldn’t sell them for between six and 12 months after the purchase.

However, less than a month after selling over 158 million CRV tokens for $63 million, that 30% discount has almost evaporated.

“I do keep contact with all who bought over-the-counter, and I’m not particularly worried here,” Egorov told DL News.

CRV traded as low as $0.44 on Wednesday. It has since recovered slightly and now swaps hands for $0.46.

The fear now is that some buyers may sell the CRV they bought from Egorov to avoid losses if the price drops below $0.4. Egorov’s over-the-counter deals were based on handshake agreements, meaning there’s no formal mechanism to enforce the lockup period.

Egorov said it was “especially good” to see some of the counterparties he sold to voluntarily lock their tokens in the Curve protocol.

Locking CRV converts the token into vote escrowed CRV, or veCRV for short. veCRV cannot be traded and affords holders voting rights in the Curve protocol — the longer holders lock their tokens, the more voting power the protocol grants them.

That voting power allows veCRV holders to direct the Curve protocol’s CRV tokens rewards to specific trading pools, incentivising users to provide liquidity.

Those who have an interest in attracting liquidity to certain Curve pools, such as stablecoin issuers, compete to lock up Curve tokens to make sure their trading pools receive the most rewards — an ongoing competition known as the Curve Wars.

On-chain records show that several counterparties, including Jeffrey Huang, known online as MachiBigBrother, and Tron founder Justin Sun, have locked up their CRV tokens. However many buyers — some of whom aren’t publicly known — have not.

NOW READ: Why Croatia is the latest European Union state to craft crypto rules ahead of landmark MiCA law

All it might take is for one of these unknown entities to get cold feet to cause a cascade of selling as other buyers rush for the door.

“We are generally not concerned with short-term price action,” Evgeny Gaevoy, CEO of trading firm Wintermute, told DL News. Wintermute is one of Egorov’s biggest counterparties, having bought a total of 25 million CRV tokens.

Gaevoy said that the firm’s decision to buy CRV was motivated by the desire to take a long-term strategic stake in Curve, and to lower the probability of bad debt at DeFi protocols, such as those Egorov took out loans from.

“We have already achieved the latter, and as for the former, we’ll reevaluate our Curve thesis in 12 months once the lock-up expires,” Gaevoy said.

Wintermute is currently in talks with Yearn Finance to stake a portion of its CRV purchase with the protocol.

Other counterparties also say they’re optimistic despite the CRV price slump.

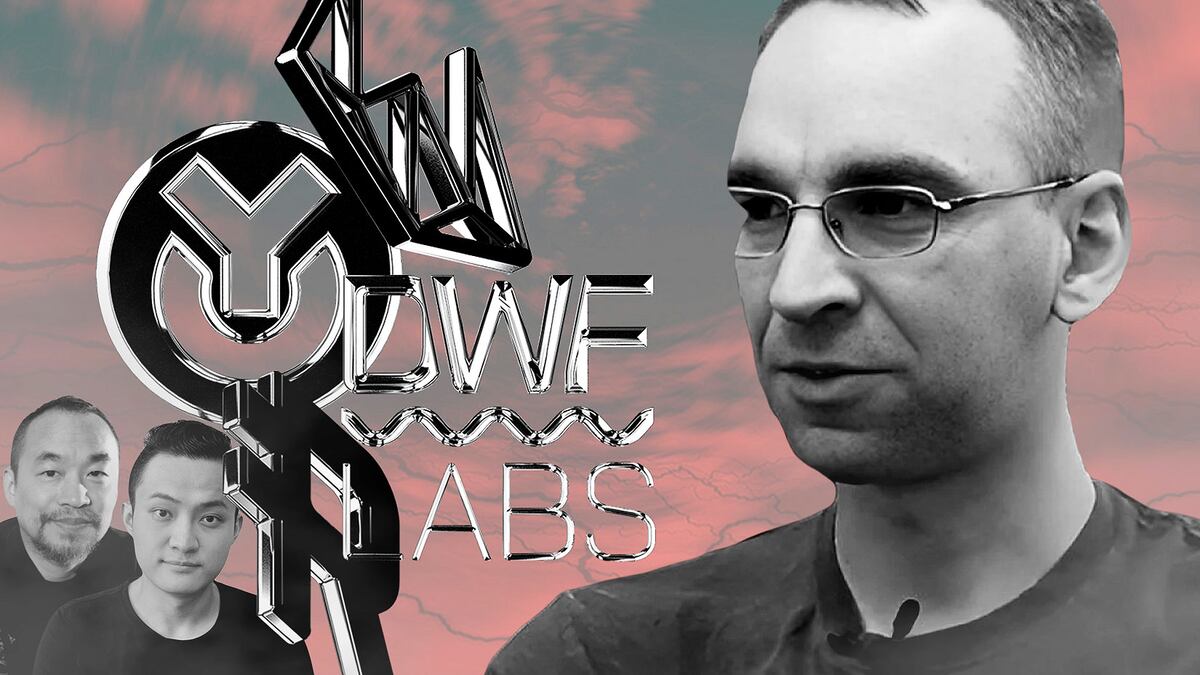

“I don’t think that the over-the-counter buyers will renege the deal,” Andrei Grachev, co-founder of DWF Labs told DL News. DWF Labs bought 12.5 million CRV from Egorov earlier this month.

“We are all professionals and have identified and hedged our risks after the deals were settled,” he said.

Grachev said he respects the handshake deals and had notified Egorov that his firm would need to deposit CRV on centralised exchange Binance.

He added that sending CRV to Binance was necessary for the firm’s financial operations and that it would withdraw the tokens back on chain at a later date.

NOW READ: Maple Finance returns to Solana after weathering $36m loan default linked to FTX blowup

Spiral DAO, a smaller counterparty that bought 1.75 million CRV from Egorov, is also unperturbed by the price drop.

“Those who wanted to de-risk could have already done it through multiple hedging strategies other than selling CRV,” a representative from the DAO told DL News. “The potential reputational losses are greater than the benefits in our opinion.”

Disclaimer: The two co-founders of DL News were previously core contributors to the Curve protocol.