- EigenLayer relies on a pooled security model that makes it cheaper to launch certain protocols.

- Still, that model may encourage risk-taking.

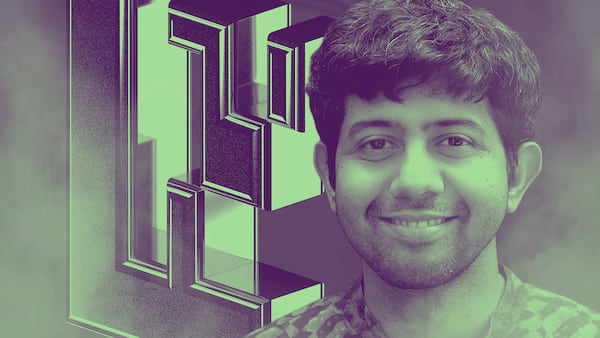

- Over the past two months, founder Sreeram Kannan has revealed a change that may minimise collateral damage.

A forthcoming version of the billion-dollar EigenLayer protocol will let some users buy “insurance,” a change that may quell sceptics’ fears that the protocol could destabilise Ethereum.

EigenLabs co-founder Sreeram Kannan detailed the change earlier this month in a series of posts on X.

The change, which Kannan had outlined during a presentation at a November conference in Istanbul, is highly technical.

In short, it is intended to reduce collateral damage suffered by EigenLayer’s users in the event some of them fail or are successfully hacked.

Kannan did not return requests for comment.

Restaking

Ethereum’s security model requires that users lock up, or “stake” their Ether. The more Ether staked, the more an attacker would need to gain control of the network. Still, retail investors often find the process too technical or the capital requirement too high to stake Ether themselves.

EigenLayer matches investors who hold Ether or staked Ether with individuals and companies known as node operators, who manage the capital and hardware necessary to run the Ethereum blockchain.

EigenLayer then matches node operators with protocols that would otherwise require bespoke blockchains. EigenLayer calls these protocols actively validated services, or AVSs.

This process, restaking, makes it possible to use the same capital to simultaneously secure Ethereum and a variety of other protocols.

Proponents have called it one of the most exciting developments on Ethereum, something that could make it safer, cheaper, and easier to launch new protocols.

The eight-month-old protocol has adopted a phased rollout, and its first AVSs have yet to launch. Nevertheless, it has already attracted more than $1.7 billion in user deposits.

Sceptics, however, have questioned the protocol’s potential impact on Ethereum as money pours in and its full launch approaches.

Pooled and attributable security

That is, in part, because EigenLayer currently uses a “pooled” security model, in which AVSs rely on the same pool of capital.

Sharing the cost to access that security across every AVS makes it more affordable and ensures that attacking any single AVS would require a massive amount of capital.

At the conference in Istanbul, Kannan likened pooled security to a military alliance.

“Cities don’t have armies, nations have armies. Sometimes even many nation states coordinate to create alliances that actually work together,” he said. “It’s exactly the same phenomenon. Shared security is strictly better.”

It may also introduce some unproductive incentives.

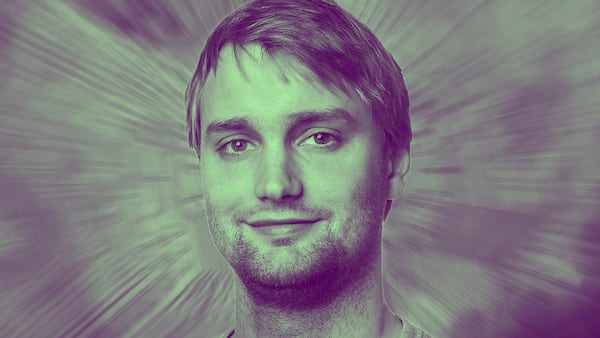

“You’re incentivizing people to basically take on more risk with security that’s being subsidised by other people,” Chunda McCain, founder of Ion Protocol, told DL News.

“If you assume now that everyone’s hand-in-hand, you know, all working together for the betterment of Ethereum, only building the most robust and resilient systems, then it’s great, right?” McCain continued.

“As soon as you say, ‘OK, no, this is a permissionless protocol that anyone can build on top of,’ then you’re like, ‘Wait a second, this system doesn’t make sense’.”

A future version of EigenLayer will still feature pooled security, but it will also give AVSs the option to purchase “attributable security,” a feature that Kannan has likened to insurance.

Attributable security gives an AVS a claim on a certain amount of restaked capital that it can seize and redistribute in the event something goes wrong.

That allows them to enjoy the benefits of pooled security while limiting collateral damage to node operators, restakers, and other AVSs in the event one fails.

AVSs will likely pay a premium for that, according to Kratik Lodha, a founder contributor at Renzo, a liquid restaking protocol.

“As an AVS, when you are attracting attributable security you will ideally incentivise that capital more, as it’s solely dedicated to securing you and not any other AVS,” he said.

“We see a hybrid model developing between the two wherein AVSs can have both [of] the security models and differently incentivise each.”

Given concern over the leverage that restaking could introduce to the Ethereum ecosystem, adding attributable security may address some of the criticism.

“It definitely is less rehypothecation than pooled security,” said Meir Bank, co-founder of Anzen, a protocol under development that will attempt to automate AVS’s payments to node operators.

“If the concern is just about the amount of rehypothecation, attributable security is less rehypothecated by definition.”

Slow and steady

McCain said that some AVSs will form coalitions in order to save money on insurance — those that trust one another may opt to split the cost rather than purchasing it individually.

While making the EigenLayer ecosystem safer, this could effectively raise the cost to launch AVSs using the protocol.

“You decrease the cost of capital to some extent, but it’s not like the orders-of-magnitude decrease that you would get by pooling security across thousands of applications,” McCain said. “Because technically now the attributable security is a couple applications, or maybe a dozen at a time.”

EigenLayer has not given a timeline for introducing attributable security. Node operators and an EigenLabs-built AVS are expected to launch in the first half of 2024, with third-party AVSs to follow.

“The EigenLayer team, they’re not going at the fastest speed because they actually want to get these things right,” Bank said, “because it’s important for the long-term security of Ethereum.”