- Lighter airdropped 250 million LIT tokens on Tuesday.

- The decentralised perpetual futures exchange now has a $2.5 billion valuation.

Lighter, the largest decentralised perpetual futures exchange over the past month, airdropped its highly anticipated token on Tuesday with half of the supply set aside for employees and investors.

Early users were also airdropped a quarter of the token’s supply.

The token, LIT, opened above $3.30 but fell to around $2.50 on Wednesday.

With a supply of 1 billion tokens, that places the protocol’s value at just above $2.5 billion — about 66% higher than the $1.5 billion valuation investors reportedly gave the company when it raised $68 million in exchange for tokens and equity in November.

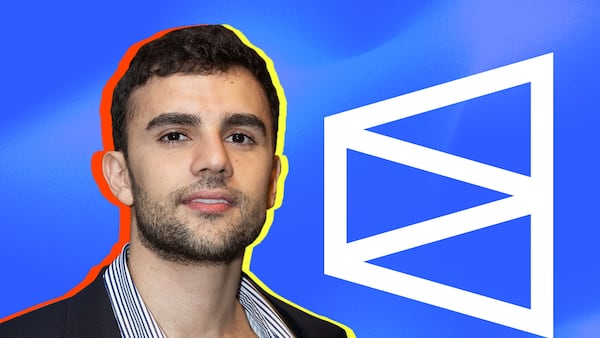

“The token is where the value will accrue,” founder and CEO Vladimir Novakovski said in a X Spaces on Saturday.

“All the investors knew that, they invested with that in mind.”

Perpetual exchanges have been a standout crypto success story in 2025. Several protocols, chief among them Hyperliquid, burst onto the scene this year with meteoric growth.

Developed by Florida-based Elliot Technologies, Lighter is both a layer 2 blockchain on Ethereum and a decentralised exchange for spot and perpetual futures trading.

It launched in January and has since become a top player in the highly competitive perpetual futures category, with more than $201 billion in volume over the past 30 days, according to DefiLlama data.

Inspired by fintech stalwart Robinhood, Lighter doesn’t charge a fee for most of its users. It only began charging a fee for market markets and high-frequency traders in September, and Novakovski has referred to it as “essentially a Robinhood model onchain.”

“If you can make life easy for retail, that’ll grow the pie much higher,” he said on another livestream earlier this month, explaining the company’s business model.

For months, Lighter users accrued points — a reward system that has typically been used by crypto startups to allocate yet-to-be-released tokens and lure users.

Lighter distributed a quarter of its tokens to users who had earned points since the protocol’s January launch. Another quarter has been set aside for future points programmes and other growth initiatives.

Employees and investors received half of the one billion tokens with a one-year lockup and a three-year vesting period.

In a thread on X, Lighter gave a brief summary of the token’s utility.

“Financial data providers and subscribers will use LIT as the fee token and staking will incentivise verifiable data for trading and risk management,” the company said.

Protocol revenue will be split between growth initiatives and token buybacks, it added.

“The value created by all Lighter products and services will fully accrue to LIT holders,” the company said. “We are building in the USA and the token is issued directly from our C-Corp, which will continue to operate the protocol at cost.”

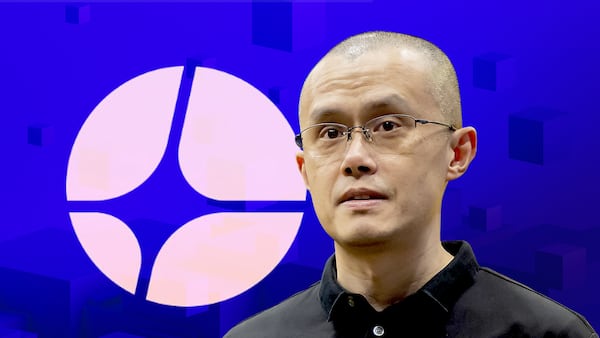

In November, Lighter raised $68 million in a round led by Founders Fund. Other investors included Ribbit Capital, Haun Ventures, and Robinhood, Fortune reported.

That round valued Lighter at $1.5 billion, according to the report, and followed a 2024 round that raised $21 million.

While the protocol just offers spot and perpetual futures trading at the moment, it can support other financial products, including lending, according to the company’s website.

Novakovski has said the company plans to integrate options and fixed income trading in the coming year.

Aleks Gilbert is DL News’ New York-based DeFi reporter. You can reach him at aleks@dlnews.com.