- Ethereum is up 90% in the last 60 days.

- It has outperformed all other major cryptocurrencies.

- The cryptocurrency is still trading below its all-time high.

Ethereum is ripping after Federal Reserve Chair Jerome Powell signalled a possible interest rate cut during his Jackson Hole speech.

It up 8% over the past 24 hours to trade at $4,630, but some analysts say it’s just the beginning.

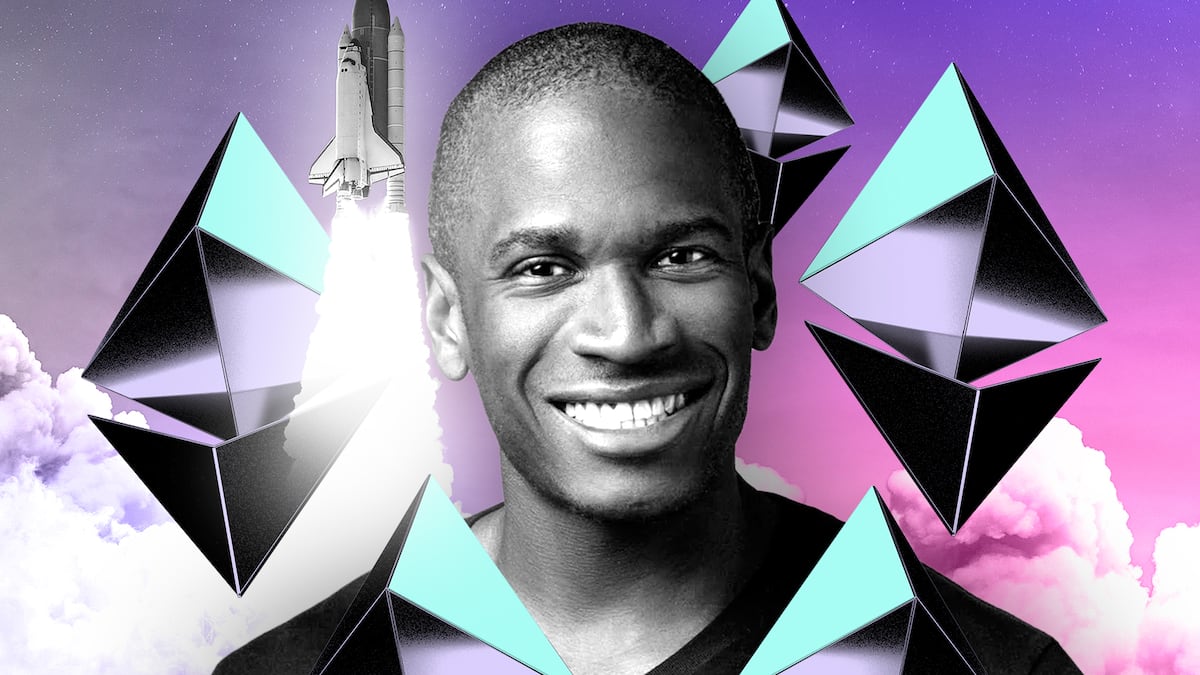

Perennial crypto bull Arthur Hayes, chief investment officer at Maelstrom, now says Ethereum’s momentum is slated for a fivefold move

“The chart says it’s going higher, you can’t fight the market,” Hayes said in a recent interview on Crypto Banter, a crypto media channel run by industry promoter Ran Neuner. “I think [Ethereum] goes to $10,000, $20,000, before the end of the cycle.”

Hayes didn’t say when the cycle would end, but Ethereum has already outperformed Bitcoin and other major cryptocurrencies, like Solana and XRP, over the last two months. Despite almost doubling in price this quarter, it’s still below its all-time high price of $4,878.

But market analysts, including Geoffrey Kendrick, Standard Chartered’s head of digital assets, predict Ethereum will reach and surpass its all-time high.

Kendrick has forecasted that Ethereum could reach $7,500 before the end of the year and go as high as $25,000 by 2028.

Hayes’ hopium

In July, Hayes said the price could go as high as $10,000 in 2025 on the back of massive credit expansion in the US.

Institutional demand for Ethereum, especially via spot exchange-traded funds, also surged earlier in August, with Ethereum ETFs amassing almost $3 billion in net flows, more than five times the $562 million recorded for Bitcoin ETFs.

The broader market experienced a significant pullback this week, with massive outflows from both Ethereum and Bitcoin ETFs.

Yet, following Powell’s remarks seems to have shifted the narrative.

Ethereum surged 8% above $4,600, following Powell’s remarks.

While ETF flows might ebb and flow, Ethereum treasury buying by corporations continues to surge. Ethereum treasury companies have increased their stash of the cryptocurrency on their balance sheets by more than 4% in the last 24 hours, CoinGecko data shows.

Publicly-traded firms gobbling up Ethereum have now captured about 2.3% of the cryptocurrency’s total supply.

Osato Avan-Nomayo is our Nigeria-based DeFi correspondent. He covers DeFi and tech. Got a tip? Please contact him at osato@dlnews.com.