- A software developer accused Binance of demanding millions in exchange for listing new tokens.

- Binance called some of his claims “defamatory” and threatened to sue.

- It later walked back the post, calling it “excessive.”

Binance, the world’s largest crypto exchange, is backing down after threatening to sue the founder of a prediction market over claims the exchange demanded an enormous sum to list a token.

“While we stand by our position, the way we communicated was excessive and we sincerely apologize to our users, partners, and the wider industry,” it said on X.

CJ Hetherington, founder of the prediction market Limitless, alleged in a viral social media post that Binance demanded 8% of a new token’s supply and over $2 million in additional payments in exchange for listing the token.

In a series of subsequent posts, he accused Binance of then “dumping” tokens on retail investors.

Hetherington’s posts set off a heated debate over listing standards at Binance and other centralised crypto exchanges.

Several crypto investors and DeFi founders criticised the company’s listing standards, either directly or indirectly. At the same time, scores of other entrepreneurs rushed to Binance’s defence.

Nicolas Vaiman, CEO at crypto data firm Bubblemaps, said Binance was clear about what it required before listing the company’s token, BMT. Since the listing, Binance has run several campaigns to promote BMT.

“Binance brings us new opportunities almost weekly,” Vaiman said. “Hard to ask more from a listing.”

As for the company itself, it threatened to sue Hetherington in a since-deleted post.

In the deleted statement, the company said Hetherington’s posts “contain allegations” that are “false and defamatory.”

At the same time, however, Binance appeared to confirm some of the details in those posts.

“We are also surprised by CJ’s illegal and unauthorised disclosure of confidential communications with Binance,” the company wrote.

“Given the egregiousness and inexcusability of CJ’s actions, we expressly reserve all of our rights, including taking legal action to protect our interests.”

Binance and Hetherington did not immediately respond to DL News’ request for comment on Wednesday.

Pay to play

The battle over crypto listings occasionally makes headlines. Last December, Hong Kong-based firm BiT Global sued crypto exchange Coinbase for delisting a token called wBTC.

BiT Global alleged Coinbase was attempting to monopolise the market for wrapped Bitcoin products in the US. Coinbase, in turn, said it was simply protecting users from BiT Global’s newest business partner, controversial crypto mogul Justin Sun.

Moreover, Hetherington’s post wasn’t the first to accuse Binance of demanding outsize payment in exchange for listing new tokens.

On October 10, Jeffy Yu, an entrepreneur who infamously faked his own death earlier this year, alleged Binance had requested $1 million to list a token affiliated with his now-defunct project, Zerebro.

Kraken and Bybit requested at least $100,000 and $250,000, respectively, according to Yu.

Yu did not immediately return DL News’ request for comment.

‘Short-term exploitation’

According to Hetherington, Binance demanded 1% of the supply of the LMTS token upfront, another 3% within six months, another 1% “for ‘marketing,’” 3% for its HODLer Airdrops programme, a $2 million security deposit, and more.

In a series of subsequent posts, he appeared to bask in the attention and to take additional shots at Binance.

“Today is the start of a new chapter of onchain capital & community formation that prioritise fairness and long-term sustainability,” Hetherington wrote. “Not short-term list and dump.”

In the now-deleted post and another, more conciliatory post published on Wednesday, Binance denied that the company or its founders are dumping tokens and that it profits from its listing process.

“All project token allocations go 100% to users through marketing campaigns,” the company said.

And the security deposit is refundable, according to Binance.

“It acts as a safeguard against short term exploitation and ensures the project team stays committed post listing,” the company said. “Once a project meets its commitments, the full deposit is returned.”

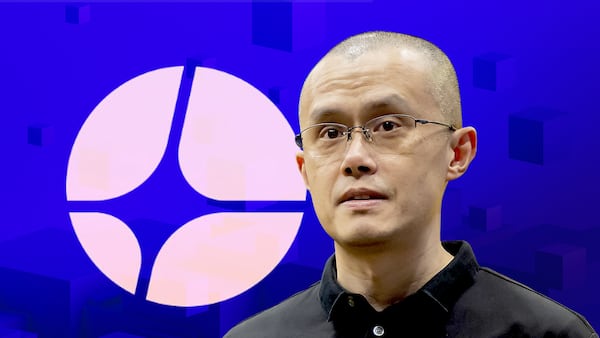

Even former Binance CEO Changpeng Zhao weighed in on the discussion, saying issuers unhappy with Binance’s terms should attempt to list their tokens elsewhere.

“If you have to beg an exchange to list, then you need to ask yourself why, and who is providing value to whom,” he said.

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can reach him at aleks@dlnews.com.