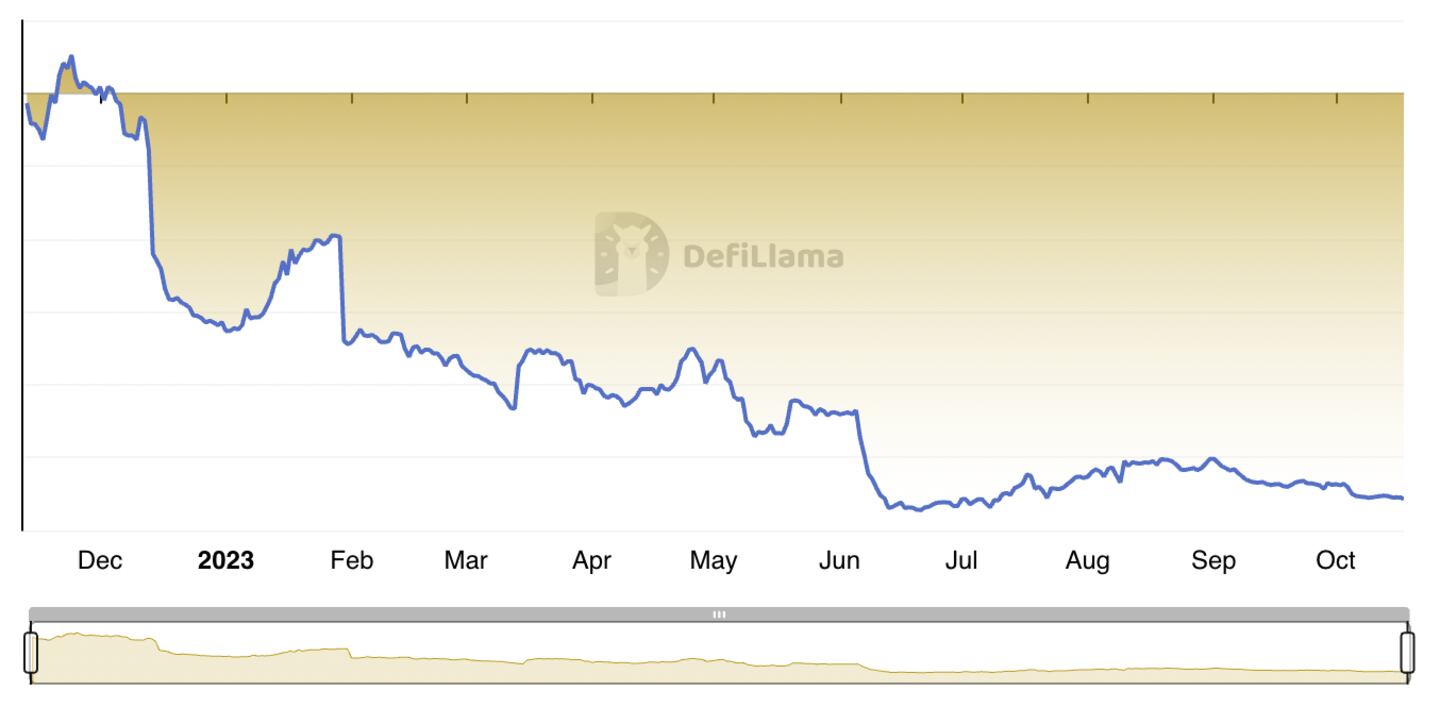

- Binance has seen more than $500 million in net outflows in October so far.

- The movement follows more than $840 million in net outflows in September. The decline in September was linked, in part, to Binance ending a zero-free trading promotion.

- Crypto spot trading volumes elsewhere have improved as prices move higher.

Users have withdrawn hundreds of millions from Binance this month despite an uptick in crypto prices and positive news around exchange-traded funds.

One market trader told DL News he is seeing regulatory risks spook investors and attributed the outflows to this. Another trader told DL News one of his clients told him they’re pulling funds out of Binance. The trader declined to be named speaking negatively about Binance.

Binance has seen around $525 million in net outflows this month, according to DefiLlama data. The withdrawals come as crypto prices move higher amid seasonal influences and positive developments in the effort to launch a spot Bitcoin ETF in the US.

The $525 million so far this month follows over $840 million pulled in September and nearly $4 billion in June. The decline in September was linked, in part, to Binance ending a zero-free trading promotion.

Regulatory woes

US regulators have been on red alert since the collapse of crypto exchange FTX last November, with Binance, the world’s largest crypto exchange, the focal point of legal action.

Binance displayed a “blatant disregard for federal securities laws,” the US Securities and Exchange Commission said in a June lawsuit.

The exchange “unlawfully solicited US investors to buy, sell, and trade crypto asset securities,” the regulator noted. Binance also lied to investors, mishandled funds, and manipulated markets, the SEC’s lawsuit claims.

The exchange has said that the charges were “unjustified” and “respectfully disagree with the SEC’s allegations that Binance operated as an unregistered securities exchange or illegally offered and sold securities.”

One overarching question remains behind the steady drip of legal developments: Will the exchange, and its founder, be criminally indicted in the US?

While the US Justice Department has yet to charge Binance and its CEO, Changpeng “CZ” Zhao, legal experts and media reports have said it may file criminal charges.

The firm looks to be preparing for an elongated legal battle.

Binance hired a slew of former officials from the US Treasury Department, the Internal Revenue Service, and other agencies to beef up its legal compliance operations.

ETFs have sent crypto abuzz

Against this background, there are signs of a thawing of sorts in the crypto winter.

Digital asset manager Grayscale won its case to overturn the SEC’s rejection of its proposal to convert its Bitcoin trust into a spot ETF in August. The regulator decided against appealing the decision last week and GBTC shares soared as a result.

GBTC is up 10% since Friday and it’s trading above $22 for the first time since May 2022 — before the collapse of the Terra ecosystem and the subsequent string of high-profile crypto bankruptcies which included Celsius, Voyager, and the crypto hedge fund Three Arrows Capital.

Bitcoin has outperformed recently as traders position for news around a potential spot bitcoin ETF, Coinbase’s head of institutional research, David Duong, said in a report on Friday. Proponents of a Bitcoin fund now include multi-trillion-dollar asset manager BlackRock’s CEO Larry Fink. BlackRock’s iShares Bitcoin ETP application is currently under review by the SEC.

However, Binance users continue to pull funds off the platform, despite improved sentiment. On the other hand, rival exchange OKX has seen $560 million in net inflows this month alone.

Binance did not return requests for comment for this story.

Adam Morgan McCarthy is DL News’ London-based Markets Correspondent. Got a tip? Reach out at adam@dlnews.com.