- Bitcoin’s 30-day average volume is at its highest point since 2021.

- High volume points to increasing institutional presence and capital flows, Glassnode said.

- An explosion of interest following the launch of US spot Bitcoin ETFs is having an outsized effect on market behaviour.

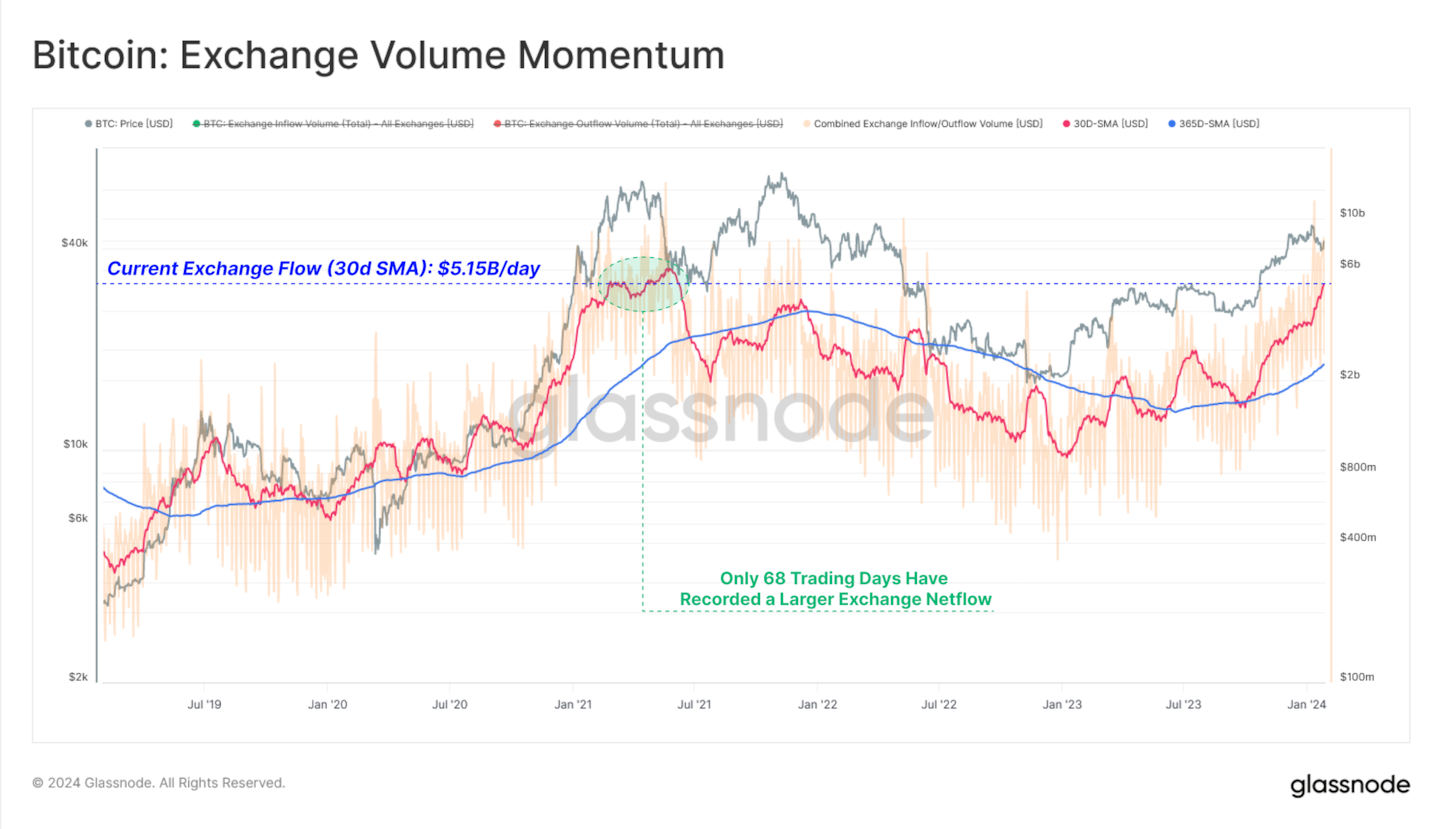

Exchange flows for Bitcoin are at levels not seen since the height of the previous bull cycle, as the impact of exchange-traded funds on market activity continues to churn.

Exploding daily volumes can be attributed to “a growing presence of institutional investors and capital flows,” according to a recent analysis by blockchain data analytics platform Glassnode.

Bitcoin net flows on exchanges reached around $5.15 billion when viewed over a 30-day average.

That’s the highest since mid-2021, according to Glassnode.

Throughout Bitcoin’s history, only 68 days have recorded higher figures, Glassnode said.

A surge in Bitcoin volume this month coincides with the launch of 10 US spot Bitcoin ETFs, which continue to gobble up the asset as previously risk-averse investors jump aboard.

The significant trading activity that occurred both before and after the ETF approvals was largely driven by market makers, Sam Holman, derivatives analyst at Australian trading firm Zerocap, told DL News.

These entities played a critical role in purchasing Bitcoin for ETF issuers like BlackRock and Fidelity.

“Combined with Grayscale redemptions, the futures basis trading at attractive levels again, and the general speculation surrounding the ETF, I am not surprised to see volumes trade at two-year highs,” Holman said, adding he expects “it to normalise somewhat in the coming months.”

High volume typically increases liquidity, making it easier for traders to buy and sell without significantly impacting price.

This benefits traders who want to enter or exit the market quickly.

It’s worth noting while Bitcoin’s liquidity has recovered in recent months, it is still below levels seen before the collapse of FTX in November 2022.

“Mature and well-established investment entities appreciate better liquidity, more stable returns, and lower volatility for diversification purposes,” Le Shi, head of trading at market maker Auros, told DL News.

Active hedge funds, on the other hand, thrive on increased volatility and market inefficiencies as those factors align with their core business model, Shi added.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.