- Bitcoin ETFs have generated new demand for the cryptocurrency.

- It’s more than just a rally in price, according to Chainalysis.

- Comparisons to gold, a boom in onchain activity, and whale-sized purchases are among notable developments.

Bitcoin ETFs have done more than stir investors to scoop up even more crypto — they have also provided the sector with a rebrand.

“It’s clear that we’re experiencing a seismic shift in both perception and usage of crypto,” Chainalysis said in a report.

Exchange-traded funds offer investors a way to buy Bitcoin through their brokerage accounts like they would Google or Apple stock.

The ETFs are issued by finance giants, including Fidelity, BlackRock, and VanEck.

Bitcoin demand heats up

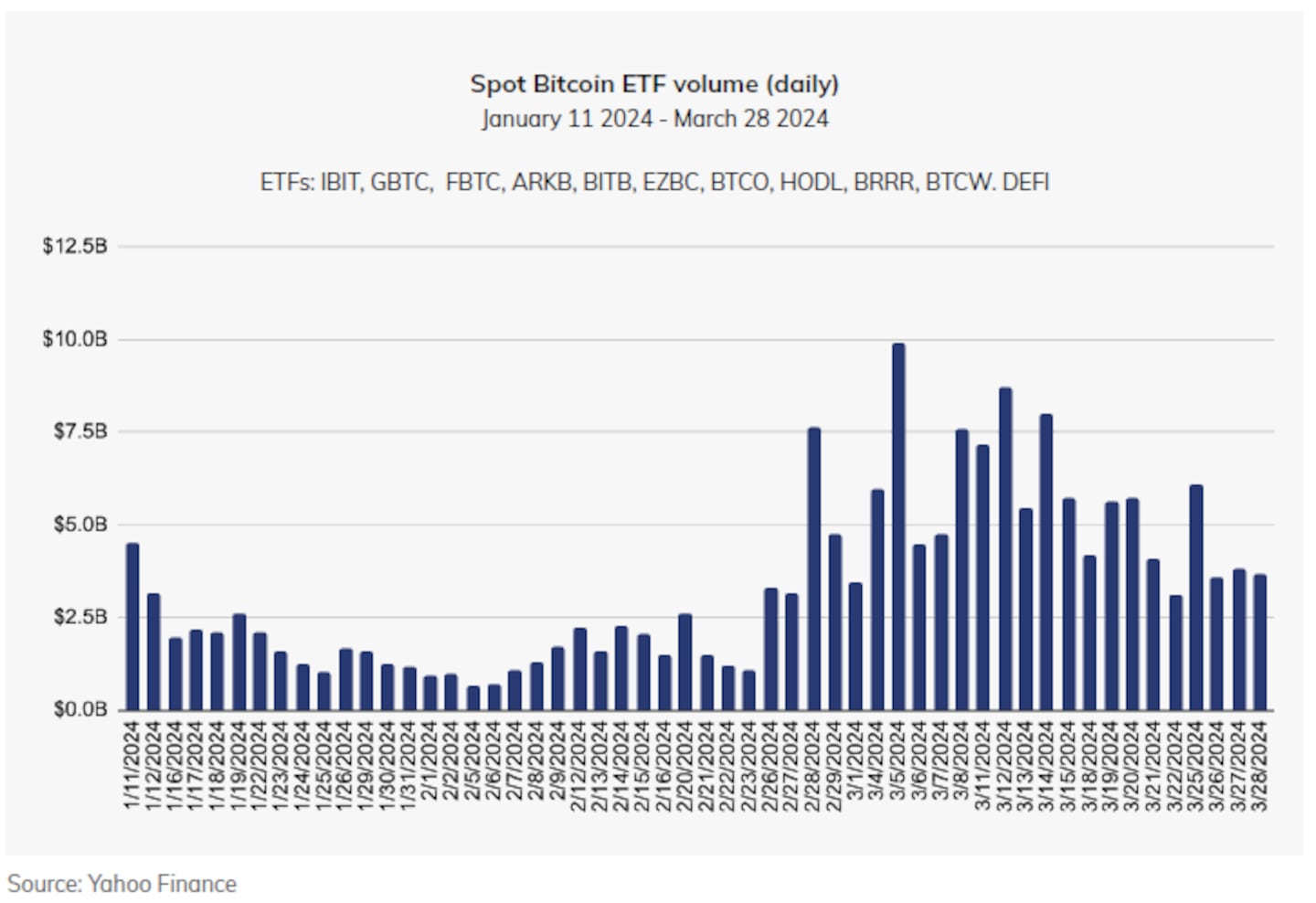

Since the SEC approved the slew of ETFs in January, demand has been high. Spot Bitcoin ETF volume gained serious momentum at the end of February.

Digital gold takes flight

Comparisons between gold and Bitcoin — for better or worse — have also hit a fever pitch.

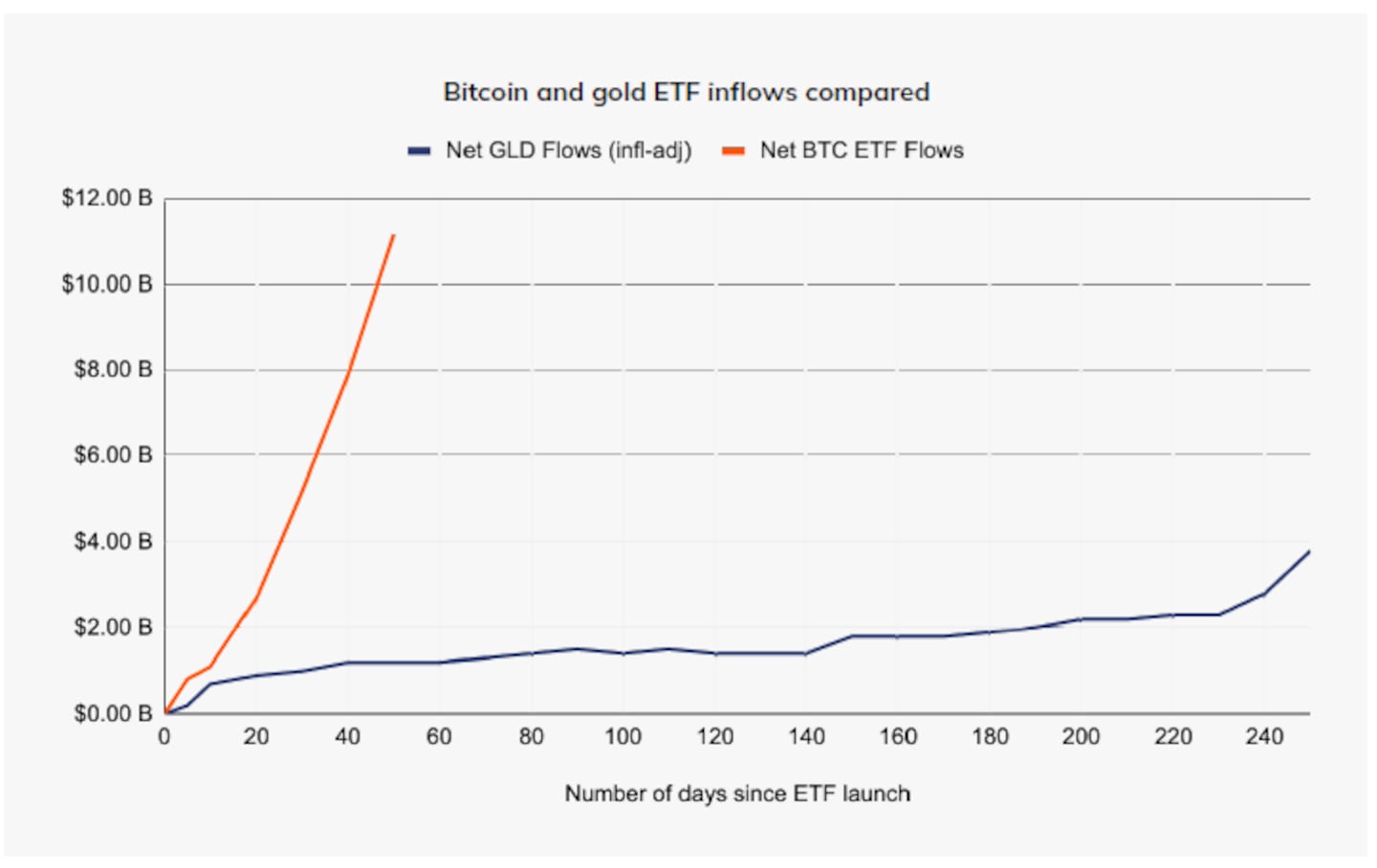

Still, in terms of inflows, the first days of the Bitcoin ETF launch far outpaced the first days of the first gold ETF in 2005.

According to Chainalysis, in less than 50 days, net flows into Bitcoin ETFs have soared past $10 billion. Gold flows didn’t cross the $2 billion mark until about 190 days of trading.

Demand from buyers has created demand among issuers — which in turn has led to some unusual outcomes in crypto markets.

One of the industry’s largest publicly traded Bitcoin miners, Hut8, told DL News that it has received offers to buy its Bitcoin.

“We’ve had banks reach out to us to try to buy our Bitcoin because of the supply shortages on these different exchanges,” said Asher Genoot, CEO of Hut 8.

Bitcoin lures bigger whales

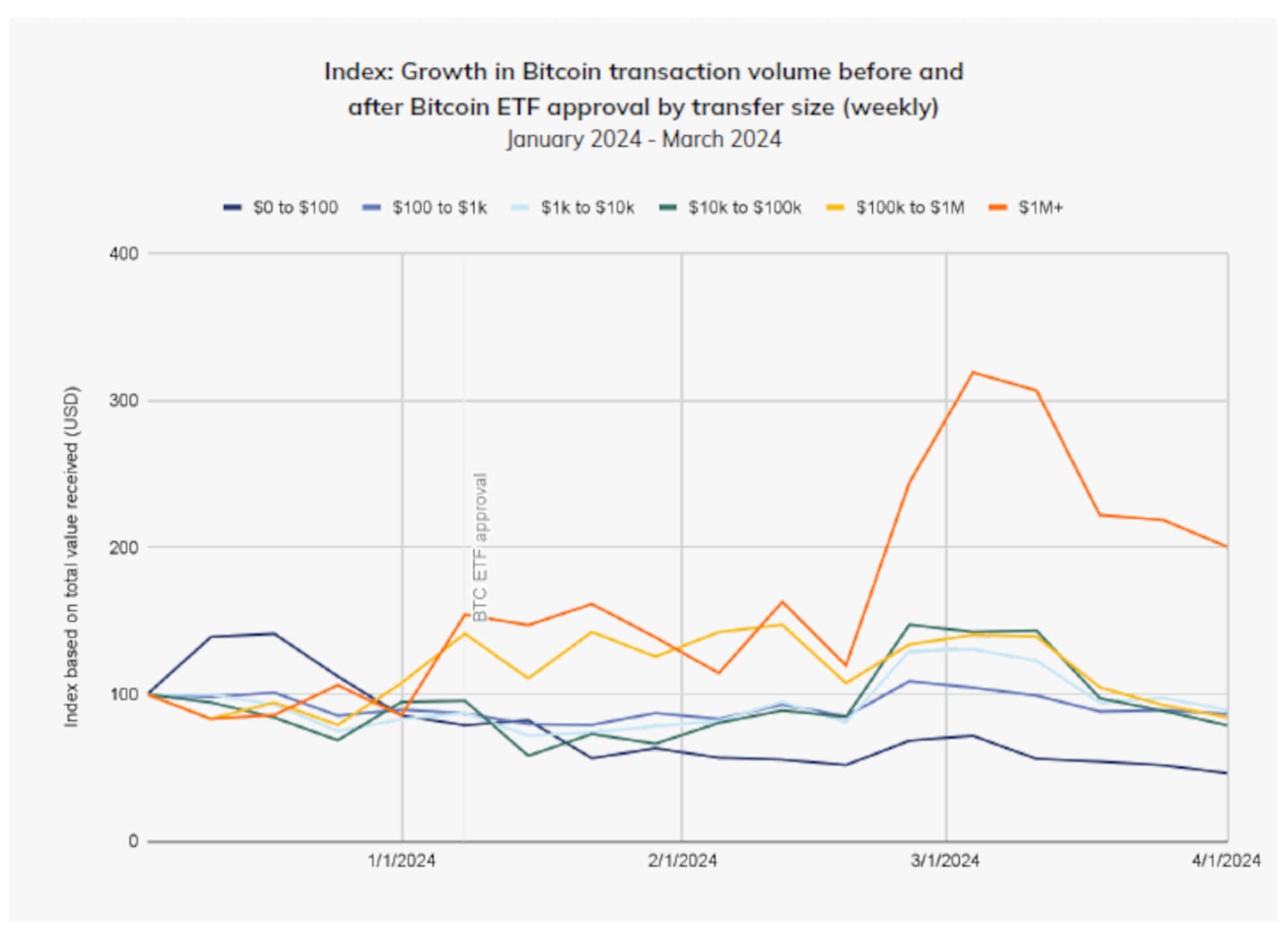

Institutions have dominated Bitcoin buying. The amount of transfers worth $1 million or more skyrocketed shortly after the ETF approvals. The next demographic to show similar demand were investors buying between $100,000 and $1 million in Bitcoin.

Crypto activity spikes

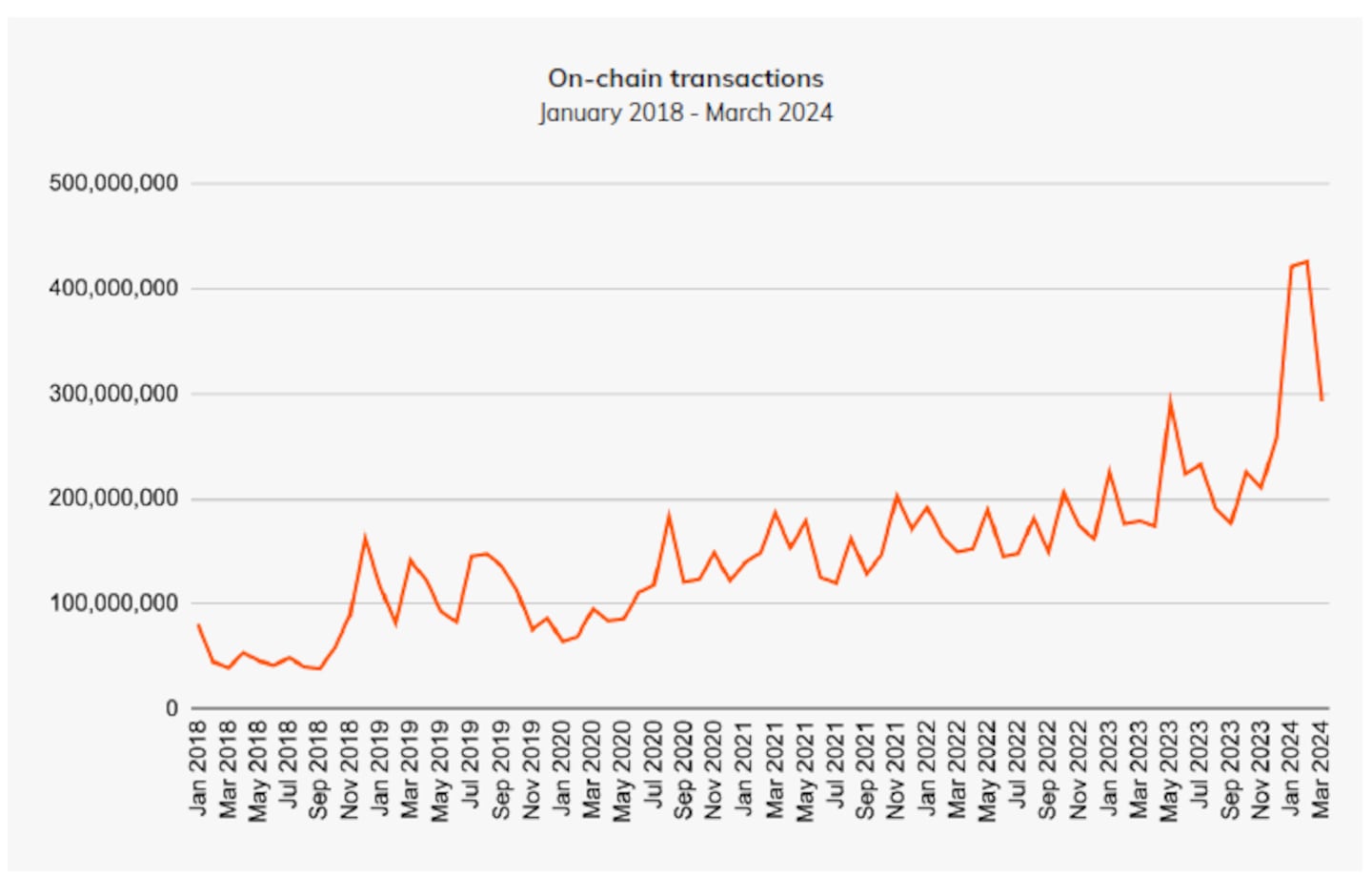

It’s not just Bitcoin that’s enjoying this new demand, Chainalysis said. Onchain transactions — crypto activity between wallets and apps — have also enjoyed a heady rise amid the ETF approvals.

Over the past six years, the 2024 increase in the number of onchain transactions is far more pronounced than in previous years. This underscores the wider impact ETFs have had on the crypto market.

Bitcoin’s soaring price

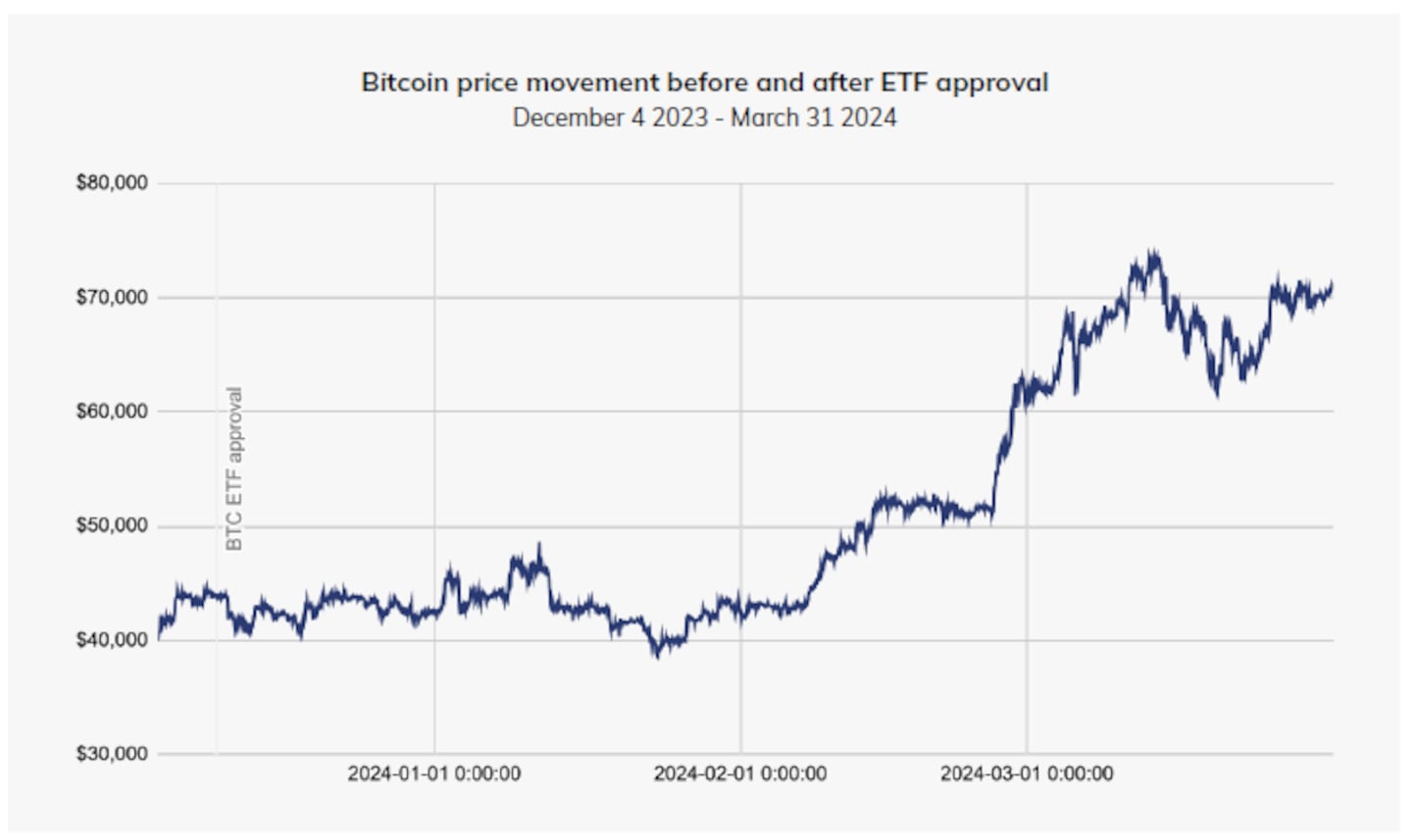

All of this activity culminated in Bitcoin striking all-time highs well in advance of its halving event.

The halving refers to a baked-in change to the Bitcoin network in which every four years it cuts the rewards miners receive by half — reducing supply and, in theory at least, shoring up its price.

Bitcoin has soared in the months after such events, but this year, thanks in large part to the ETF approval, the rally had already kicked off.

Since the ETFs were approved on January 11, Bitcoin has risen more than 37%.

According to data tracker CoinGecko, Bitcoin reached an all-time high of just over $73,000 in March.

Crypto market movers

- Bitcoin’s price hasn’t changed much overnight, trading at about $64,400.

- Ethereum rose 0.8% in the last day to $3,130

What we’re reading

- How Binance head Richard Teng is struggling to impose order as CZ’s sentencing looms — DL News

- Why many ‘zombie blockchains’ still have market caps in the billions of dollars — Unchained

- Binance founder Changpeng Zhao should face 3-year prison sentence — Milk Road

- Crypto industry groups sue SEC over expanded ‘dealer’ definition — Milk Road

- Polygon Labs COO Michael Blank to step down as the company axes the exec role — DL News

Liam Kelly is a Berlin-based DL News’ correspondent. Contact him at liam@dlnews.com.