Bernstein raised its target prices on a slew of Bitcoin mining companies as investors pile into trades tracking this year’s 154% Bitcoin rally.

The firm’s analysts say Bitcoin mining companies “offer attractive entries to participate in the new Bitcoin renaissance, led by rapid institutionalisation.”

According to Bernstein, Bitcoin-based tokens and NFTs have driven up transaction fees, leading to “break out high revenues” at miners including Riot Platforms, CleanSpark, and Marathon Digital Holdings.

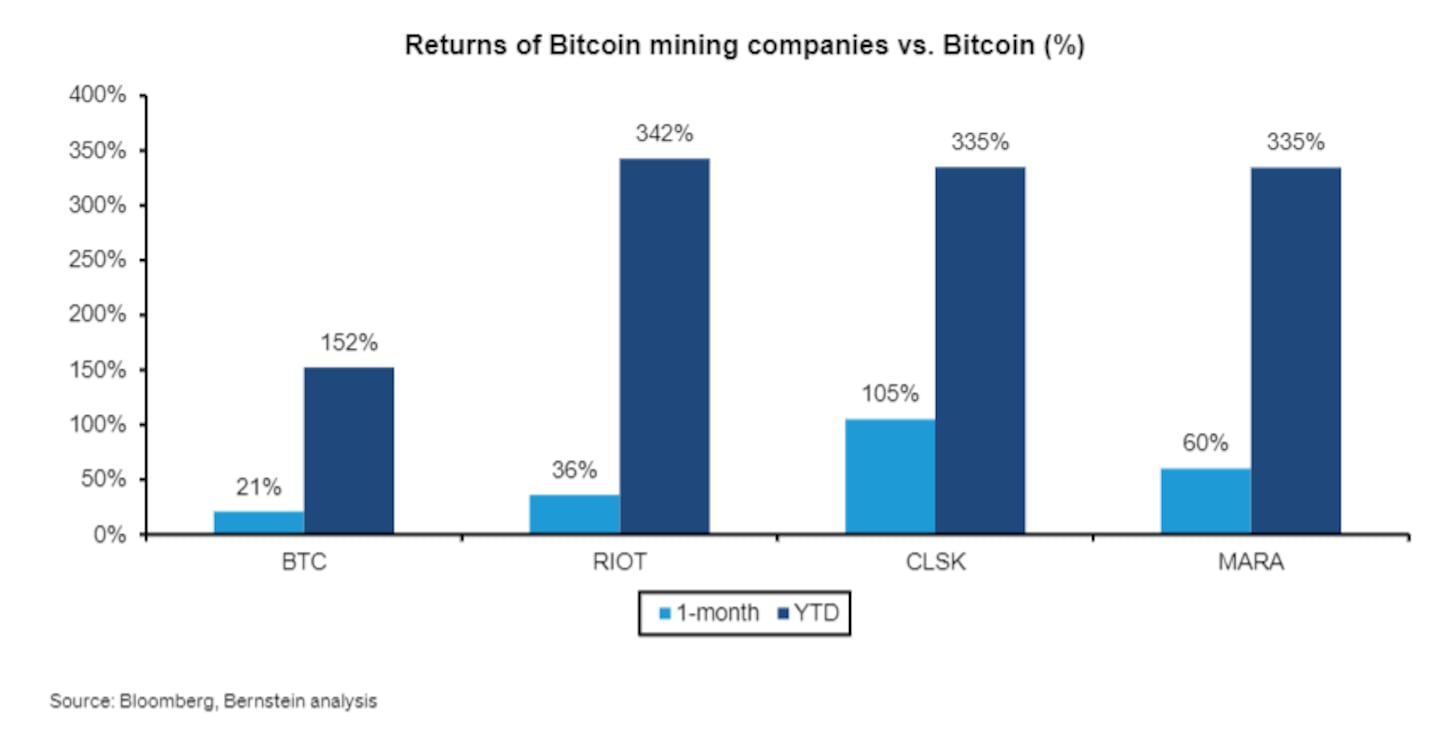

This month alone, the stocks are up 36%, 105%, and 60%, respectively, Bernstein noted.

“Mining stocks are in discovery mode — moving from highly liquid retail stocks to early discovery by institutional investors.”

The report points to mining stocks’ tendency to move in tandem with Bitcoin’s price, as well as high liquidity in mining stocks and strong on-chain revenues in 2023. Coinbase is another stock that has acted as a proxy for crypto sentiment, with a surge this year of almost 340%.

This year, CleanSpark’s stock has rocketed about 370%, while both Riot Platforms and Marathon Digital Holdings have gained 358%.

Analyst Gautam Chhugani points to Riot and CleanSpark as potential leaders due to higher access to capital than their smaller competitors.

“Given improved BTC prices,” Chhugani writes, using the currency and stock ticker abbreviations, “we assume a greater miner realisation for both RIOT and CLSK, as miners are incentivised for higher uptime.”

Bernstein projects Bitcoin will reach $150,000 by mid-2025.

“Bitcoin miners remain high-beta Bitcoin stocks.”