- Moves toward $60,000 ‘cannot be ruled out,’ says expert.

- South Korean professor says there won’t be a ‘Bitcoin recession’ in 2026.

- ‘No cause for concern,’ academic claims.

Bitcoin rebounds have weakened, and the coin’s price may drop as low as $60,000 in the short term, market watcher warns.

Georgii Verbitskii, founder of the crypto investment platform TYMIO, told DL News that an extended period of consolidation or correction is a “likely scenario” for Bitcoin prices in the short term.

“Despite the recent pullback into the $80,000 to $90,000 range, a deeper downside — including moves toward $70,000 or even $60,000 — cannot be ruled out,” he said.

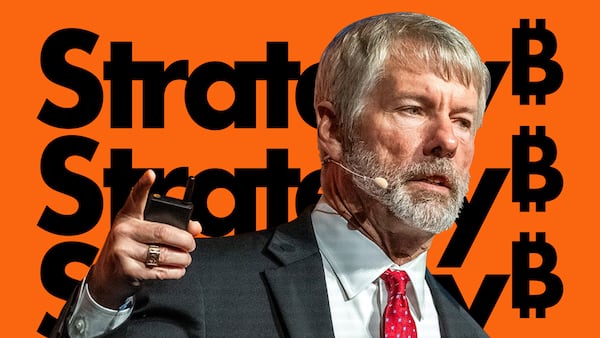

His comments come in the wake of a warning from Mike McGlone, senior commodity strategist at Bloomberg Intelligence, who this month said Bitcoin prices could spiral as low as $10,000 in 2026.

Experts appear divided on the matter of whether or not 2026 will mark the start of a new crypto winter. But many say long-term investors need not worry about the security of Bitcoin investments.

Bitcoin rally has ‘stalled’

“The market previously looked positioned for an accelerated move toward much higher levels,” Verbitskii said. “However, the rally stalled and rolled over into a correction. That behaviour points to exhaustion rather than [...] a strong expansion phase.”

“Bitcoin is now trading in a broad sideways range,” Verbitskii said. And, he added, until it decisively holds above the $100,000 mark, “the risk of further consolidation remains high.”

However, Oh Tae-min, an adjunct professor at Hanyang University Graduate School’s Department of Bitcoin Currency Philosophy, rejected the idea of a “Bitcoin recession” in 2026, the South Korean newspaper Maeil Kyungjae reported.

“This is not a time to be concerned,” said Oh. “Bitcoin is expected to continue its upward trend in the mid- to long-term. And the wider cryptocurrency market is excited by tokenisation trends, as it moves beyond dollar-denominated stablecoins.”

Oh said that Bitcoin is moving away from models of a four-year price cycle, which centres around Bitcoin halving events.

He’s not alone. Changpeng Zhao, co-founder of crypto exchange Binance; Cathie Wood of investment firm Ark Invest; and Standard Chartered’s top crypto researcher Geoffrey Kendrick have also rejected the four-year cycle.

Oh added that Bitcoin now behaves much more like traditional assets, such as the stock market. If this continues to be the case, 2026 is also likely to prove the four-year cycle model no longer applies to Bitcoin.

“This means typical recession periods may disappear,” the professor said.

And Oh said that while Bitcoin is not “directly linked” to real-world asset adoption and tokenisation drives, “the acceleration of these structural changes could strengthen Bitcoin’s position as a core digital asset within the global financial system.”

In the crypto world, the term real-world assets refers to tangible or traditional financial assets whose ownership is traded using tokens on blockchain networks. These allow traders to buy and sell small stakes in private property holdings, bonds, precious metals, and works of art.

“Now is not the time to be swayed by temporary Bitcoin price fluctuations,” said Oh. “We need to look at the bigger picture.”

On this point, Verbitskii concurred. “In [the current] environment, patience and disciplined risk management are far more important than chasing short-term upside,” he said.

Tim Alper is a news correspondent at DL News. Got a tip? Email at tdalper@dlnews.com.