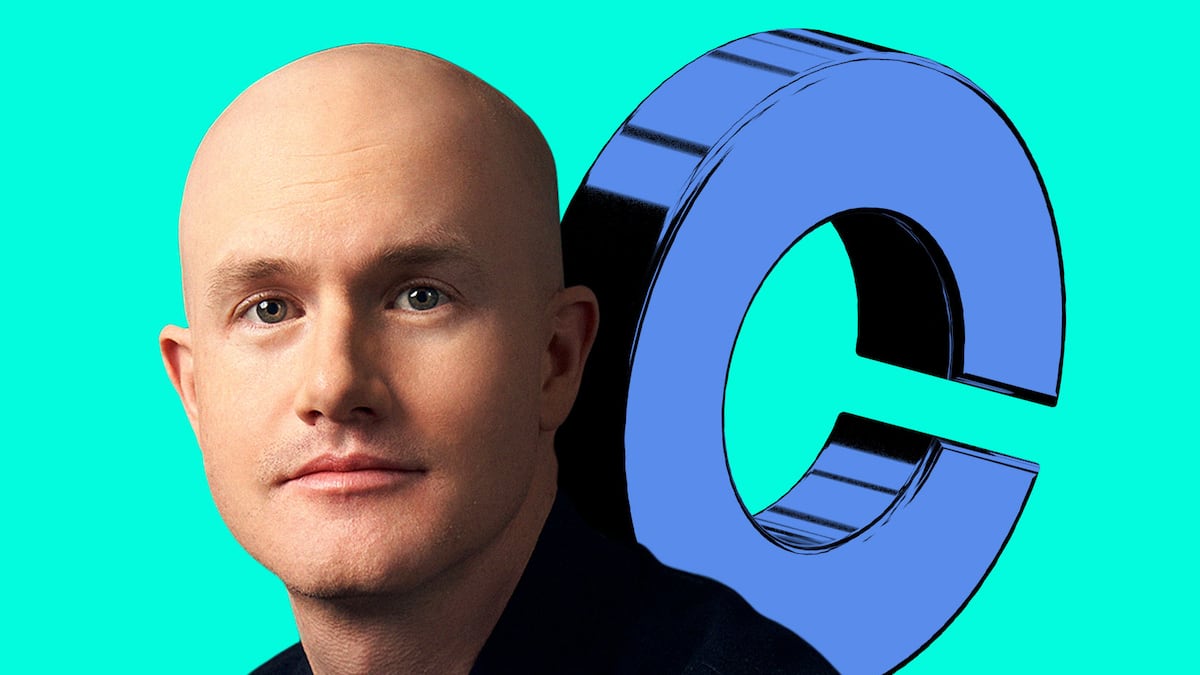

- Coinbase makes a major move in options trading.

- Deribit handles 85% of Bitcoin and Etherem options market.

In a huge boost for crypto derivatives, Coinbase just agreed to a $2.9 billion acquisition of Deribit, a crypto options exchange.

The cash and stock deal, which Coinbase disclosed in a blog post, is Coinbase’s biggest to date.

It demonstrates how the US listed exchange anticipates a surge in sophisticated investors comfortable with betting on future price action in Bitcoin and other digital assets.

“Most won’t realise how smart this is,” Nick Forster, CEO of Ethereum-based options platform Derive said on X.

“If you understand how options markets work, it’s clear: they just locked in the most defensible position in crypto derivatives.”

Stock spike

Coinbase’s shares spiked more than 6% on a day when Bitcoin was up about 5%.

This is Coinbase’s fifth strategic purchase since 2019 for the largest crypto exchange in the US.

Options are financial contracts that give traders the right — but not the obligation — to buy or sell assets at predetermined prices. Those traders can then hedge their risk, or speculate on whether the asset will go up or down.

Acquiring an options giant like Deribit — it accounts for more than 85% of the Bitcoin and Ethereum options market and processed $1.5 billion in the past 24 hours — signals that the crypto market is maturing well beyond simple coin ownership.

Traders, hedge funds but increasingly retail investors, too, are increasingly turning to options, perpetual futures, and leveraged ETFs to magnify gains and hedge volatility.

“We believe crypto options are on the cusp of significant expansion, similar to the equities boom of the 1990s,” said Greg Tusar, the head of institutional products at Coinbase in the post.

Notoriously difficult

But the risks of using such instruments are considerable.

Unlike spot and perpetual futures markets, options trading requires complex quoting systems and deep institutional relationships that are notoriously difficult to build from scratch.

Owning the underlying infrastructure has the potential to be financially huge for Coinbase.

“The flows are sticky, capital-heavy, and hard to replicate,” said Forster on X.

All of this comes just as policymakers in Washington are labouring to develop a regulatory framework for crypto.

New rules are expected to kick open the door to Wall Street players who have been wary of entering the digital assets market without clear rules of the road.

Forster, for one, said Coinbase is trying to steal a march on potential rivals.

“This is Coinbase betting that derivatives will define the next phase of exchange competition,” said Forster. “They’re right.”

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.