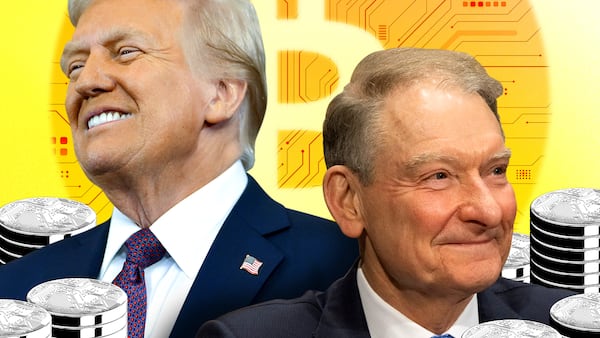

- Galaxy CEO says altcoins inject fresh energy and capital.

- SEC Chair Paul Atkins’ pro-onchain pivot a “radical departure.”

Bitcoin may be the biggest crypto, but you should look elsewhere for the real fireworks.

That’s according to Galaxy Digital CEO Mike Novogratz, who says the $4 trillion digital assets market is entering a new phase: one led by altcoins and alternative asset treasuries.

“Bitcoin’s in consolidation right now,” he told CNBC. “You’re seeing a lot of these treasury companies in other coins take their shot. It’s bringing energy and money into the space.”

Novogratz pointed to Forward Industries’ $1.6 billion raise as an example. The Solana-focused corporate treasury firm is backed by Galaxy, Jump Crypto, and Multicoin Capital.

“That’s new dollars into crypto,” Novogratz said. “It’s just getting started.”

The comments come as crypto and financial industries are rapidly becoming more mixed.

For instance, Nasdaq has filed to allow tokenised versions of stocks and exchange-traded funds to trade onchain, potentially transforming market infrastructure.

Yet, crypto’s $4 trillion market capitalisation has a “long way to go” compared to the $400 trillion of global wealth, he stressed.

Regulators are shifting gears too.

US Securities and Exchange Commission Chair Paul Atkins recently vowed to “move all markets onchain.” Novogratz hailed the stance as “a radical departure” that’s “pushing things in the right direction.”

Under former Chair Gary Gensler, the agency cracked down on crypto companies by firing off a barrage of lawsuits against those firms.

The regulatory pivot is “a signal that Wall Street adoption is finally gathering pace,” Novogratz said.

Combined with faster, more secure blockchains, Novogratz said, the plumbing is finally in place for Wall Street adoption.

“What held us back was blockchains being fast enough, safe enough … and a regulatory framework that allowed people to experiment. And now we have both.”

Altcoin action doesn’t mean Bitcoin is out of the picture. “It’s digital gold, going nowhere but up over time,” Novogratz said.

But he stressed altcoins are carving their own lanes. “It’s not like we’re going to have one blockchain to rule them all … this is healthy competition to rebuild the financial architecture the world runs on.”

Looking ahead, he expects the possibility of the Federal Reserve cutting interest rate to light a fire under Bitcoin.

We probably “have another big surge up towards the end of the year,” Novogratz said.

He isn’t alone in making that prediction. Arthur Hayes, founder of BitMEX, has predicted $250,000 Bitcoin this year. Analysts at Bitwise, Bernstein, and Standard Chartered have predicted $200,000.

“The crypto idea just keeps gaining momentum,” he said.

Lance Datskoluo is DL News’ Europe-based markets correspondent. Got a tip? Email at lance@dlnews.com.