- Bitcoin is down 8% but treasury stocks have been hit harder.

- Strategy drops to five-month low amid fading premium

- Metaplanet shares down 60% from June peak after $5.4 billion raise.

Investors who piled into Bitcoin treasury stocks earlier this year to beat the crypto itself are now finding the trade has flipped, with Bitcoin holding up better than its proxies.

This is especially true for the two top proponents, Strategy and Tokyo-listed Metaplanet, whose shares have sunk to multi-month lows this week.

The discrepancy isn’t due to a booming Bitcoin revival either. The top crypto has slipped about 8% from a record above $124,000 last month to roughly $114,000 today.

“I’ve been trying to convince myself to buy some of these digital asset treasuries,” Travis Kling, chief investment officer at Ikigai Asset Management told Bloomberg. “But the whole setup feels like the last gasp of a cycle that couldn’t come up with anything better than this silliness.”

The concern runs deeper than just two companies. Recent reports suggest as many as one in three Bitcoin treasuries now trade below the value of their holdings, raising fears of a wider spiral if companies are forced to sell coins to cover debt.

Strategy slump

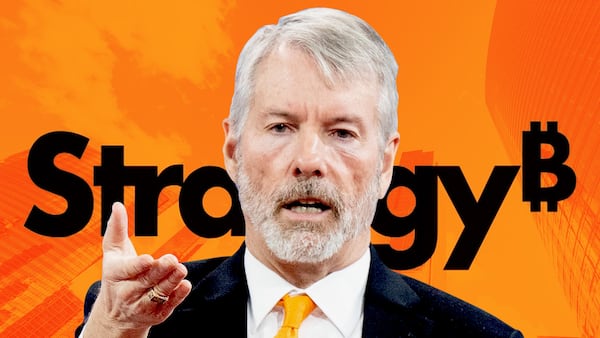

The Bitcoin treasury play began with Strategy, the company built by Michael Saylor into the flagship corporate holder of the token.

By turning a stash of Bitcoin into a stock that traded at a premium, Strategy showed other firms how to transform balance sheets into leveraged bets on Bitcoin.

Now its shares have slid to about $323, their lowest in nearly five months and well below July’s $500-plus levels.

The slump shows a growing divergence between Bitcoin and the stocks tied to it.

“We’re starting to see digital asset company stock prices diverge from the underlying crypto prices, which is making investors question whether they are a worthwhile investment,” said Dom Kwok, a former Goldman Sachs analyst.

That divergence poses a risk to Strategy’s flywheel model of selling equity at a premium to buy more Bitcoin. The trade only works if shareholders value the stock above its holdings.

With peers like Sequans Communications already resorting to reverse splits to avoid delisting, analysts warn the strain on the sector is spreading.

Metaplanet markdown

Metaplanet, once a small hotel management firm in Tokyo, has rebranded itself into Asia’s answer to Strategy with an aggressive Bitcoin-first strategy that it began in April 2024.

This past June, it announced Asia’s largest-ever equity raise for Bitcoin: $5.4 billion to help fund a target of 210,000 Bitcoin, equal to one percent of its maximum supply, by 2027.

Its stock jumped from roughly $9.30 to nearly $12.90 after the news.

That momentum has since evaporated. Shares now trade near $4.40, their lowest in four months and more than 60% below the June peak.

The slump highlights how aggressive share issuance risks tipping from accretive to extractive.

“Once you are trading at net asset value, shareholder dilution is no longer strategic,” Matthew Sigel, VanEck’s head of digital assets, warned in June. “It’s erosion.”

Kyle Baird is DL News’ Weekend Editor. Got a tip? Email at kbaird@dlnews.com.