- The Fed’s first meeting of the year will take place Tuesday and Wednesday.

- The central bank is expected to hold interest rates steady.

- But traders will pay attention to what Chair Jerome Powell says.

The Federal Reserve is expected to hold interest rates steady in the US central bank’s first decision of the year this week.

The decision has likely been priced in by Bitcoin traders, who usually want a low interest rate environment. The odds of the Fed keeping rates as they are was 97% on Tuesday, per the CME’s FedWatch tool.

Instead, all eyes will be on Chair Jerome Powell, whose comments after the two-day meeting could give traders a hint as to where interest rates may go next.

Politics is playing an unusual role this time around. The central bank chief is fighting allegations that he misled lawmakers about the cost of renovations to Federal Reserve buildings — allegations he pinned on President Donald Trump, who has long wanted interest rates slashed.

Why this time it’s different

The Federal Reserve is supposed to be free from political influence, which can lead to decisions that boost politicians in the short term while endangering long-term economic stability.

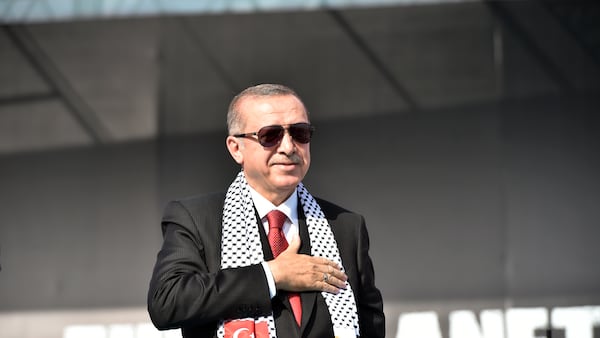

Since last year, however, Trump has tried to sway the central bank. He has publicly demanded that Powell lower interest rates and even threatened to fire the chair.

Earlier this month, the Justice Department opened an investigation into testimony Powell gave to a Senate committee about renovations to Federal Reserve buildings.

Powell has since alleged Donald Trump was using the Department of Justice to pressure the central bank and influence monetary policy.

Experts previously told DL News that increased pressure from the Trump Administration on the Fed could influence the price of Bitcoin, given the inflationary impact that a similar campaign had in Turkey.

Bitcoin has typically done well in a low interest rate environment; when the Fed Chair has signalled rates will drop, crypto markets have generally popped on the news.

But markets overwhelmingly believe the Fed will continue to hold rates steady at its March meeting as well, according to CME’s FedWatch tool. If Powell suggests the central bank is, in fact, strongly considering a rate cut, the surprise could redound to Bitcoin.

What Powell hints following the central bank’s two-day meeting will influence where the price of the leading cryptocurrency goes next.

Other things to watch this week

There are other things to keep an eye on this week, according to experts. Apple, Meta Platforms, Microsoft, and Tesla report earnings this week — which could have an impact on Bitcoin.

“Strong results could lift risk assets across the board, including Bitcoin, while disappointment would likely reinforce the current bid for established safe havens,” Matt Howells-Barby, VP at Kraken, told DL News.

He added that credit spreads have tightened since November, meaning investors are looking for more risk — a potential boon for the world’s largest cryptocurrency.

Mathew Di Salvo is a news correspondent with DL News. Got a tip? Email at mdisalvo@dlnews.com.