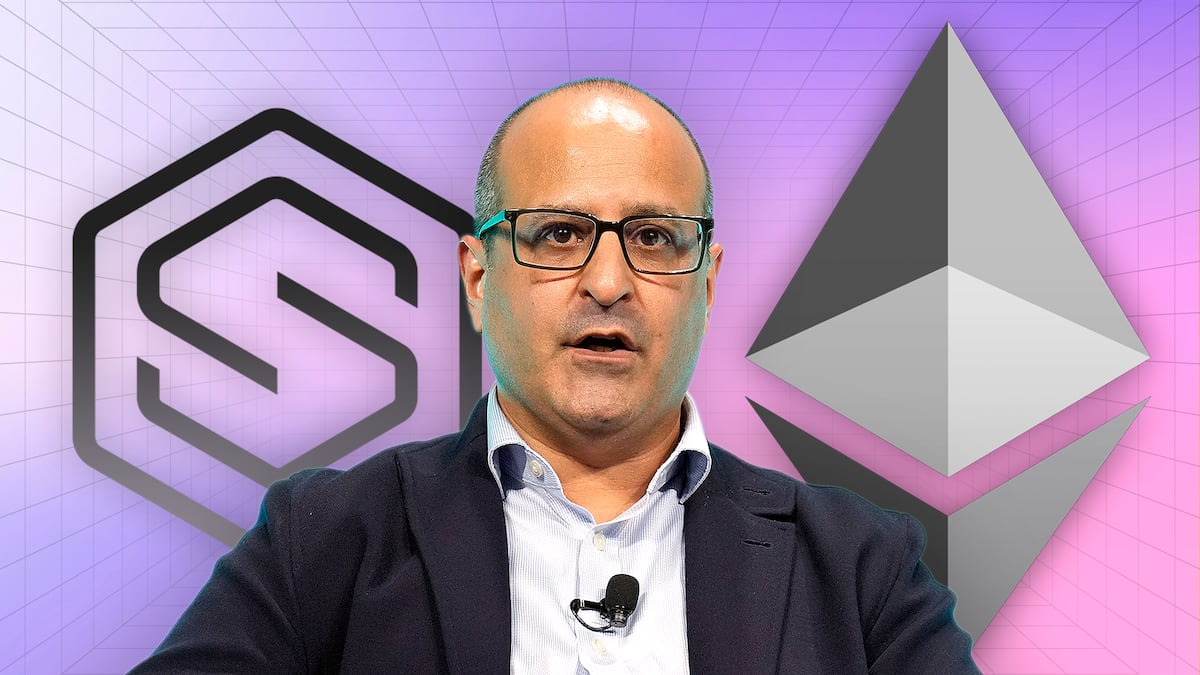

- BlackRock's crypto chief joins SharpLink Gaming.

- It's the second-biggest Ethereum treasury company.

BlackRock’s head of digital assets announced Friday that he’s leaving the Wall Street giant and joining the second-biggest Ethereum treasury company, SharpLink Gaming, as co-CEO.

Rob Phythian, SharpLink’s current CEO, will transition to the role of president over the next quarter and remain a member of the firm’s Board of Directors.

Joseph Chalom led BlackRock’s crypto push, which included the launch of Bitcoin and Ethereum exchange-traded funds, as well as the firm’s $2.4 billion Ethereum-based tokenised fund.

“Ethereum is becoming the foundation of global finance,” Chalom said in an X post announcing the move. “That’s where the future is being built.”

The development comes as Ethereum excites a furore among institutional investors.

Investors have piled $3.3 billion into Ethereum ETFs over the past two weeks, the highest rate of inflows since the SEC greenlit the investment products last year.

Ethereum treasury companies, including SharpLink, have so far snapped up $5.3 billion worth of Ethereum and added it to their books.

The top institutional holder of Ethereum is Bitmine Immersion Technologies, a converted Bitcoin mining company, chaired by Fundstrat co-founder Tom Lee.

Ethereum treasury companies aim to gobble up as much of the asset as possible, the same approach pioneered by Michael Saylor’s Strategy for Bitcoin.

Those running such schemes say Ethereum is well-positioned to grow over the coming years as the primary network for issuing and transferring stablecoins and other tokenised assets.

20 years

Before joining SharpLink, Chalom spent 20 years at BlackRock, serving in several senior roles and ultimately leading the firm’s digital assets strategy.

He forged many of the firm’s crypto partnerships, including those with Coinbase, Anchorage Digital Bank, BNY Mellon, and Circle.

He also served on the board of tokenisation firm Securitize, which acts as the transfer agent for the BlackRock USD Institutional Digital Liquidity Fund, often shortened to BUIDL.

SharpLink Gaming is a Minneapolis-based online casino company that recently pivoted to pursuing an Ethereum treasury strategy. It is chaired by Joe Lubin, one of Ethereum’s co-founders and the CEO of blockchain software firm Consensys.

So far, the firm has acquired over 360,000 Ethereum, worth approximately $1.34 billion, resulting in a $354 million profit.

On June 2, SharpLink raised $425 million through a private investment in public equity — or PIPE — funding round, as well as an additional $64 million in at-the-market sales.

Later that month, shares of the firm, which trade under the ticker SBET, fell some 75% as investors in the PIPE sale filed to give themselves the ability to sell shares.

SharpLink shares have since partially rebounded, thanks in part to Ethereum’s 52% surge over the past month.

Shares are down 4.5% on the day.

Tim Craig is DL News’ Edinburgh-based DeFi Correspondent. Reach out with tips at tim@dlnews.com.