- Changpeng Zhao was sentenced to four months for breaking US banking law.

- Prison term is a fraction of Sam Bankman-Fried's 25-year sentence.

- A number of former crypto luminaries have run afoul of the law.

They were billionaires. They were megastars. One is just a dev.

They were the very best their generation had to offer, and they vowed to revolutionise the world of finance and money itself.

But crypto can be slippery and when the boom of 2021 gave way to the hard reality of a bear market, some of the industry’s icons were swept up in criminal cases.

The latest is Changpeng Zhao, the 47-year-old co-founder of Binance, the world’s biggest crypto exchange.

On Tuesday, a federal judge sentenced CZ, as he’s known, to a four month term for violating US banking law.

Here’s a roll call of other crypto figures who are suspected or convicted of breaking the law.

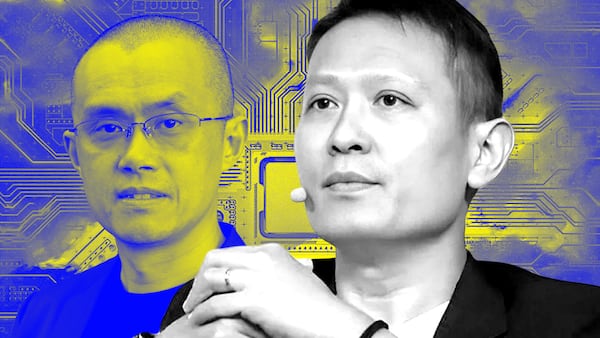

Changpeng Zhao, aka CZ

Co-founder and former CEO of Binance

Status: Pleaded guilty to violating US banking law and was sentenced to four months April 30.

Whereabouts: Waiting to learn which correctional facility he must report to.

Case File: It took a short time for Binance to become the top trading post in crypto after its launch in 2017.

That’s largely due to the organisational prowess of Zhao, a onetime Bloomberg Tradebook software developer who built a bourse handling $10 billion in transactions a day without having a designated headquarters.

FTX co-founder Sam Bankman-Fried may have been the face of crypto, but Zhao was arguably the most influential figure in the space.

Then, about three weeks after Bankman-Fried was convicted, Binance pleaded guilty to “willful failures” of US banking law by permitting criminals and terrorists to use its services, and paid a $4.3 billion penalty.

The company agreed to build proper anti-money laundering and anti-terrorist financing practices, and to appoint an independent monitor to oversee such efforts for the next five years.

Zhao also pleaded guilty and resigned as CEO of the global exchange he founded six years ago.

Sam Bankman-Fried, aka SBF

Co-founder and former CEO of FTX, and co-founder Alameda Research

Status: Convicted of wire fraud and conspiracy to commit securities fraud, commodities fraud, and money laundering and sentenced to a 25-year prison term.

Whereabouts: Serving time in a medium-security prison in California.

Case file: Rubbing shoulders with celebrities and buying Super Bowl spots, Bankman-Fried personified the giddy ambitions of crypto. He didn’t mind being compared with banking giant JPMorgan, and sported a can’t-care-less vibe with his uniform of cargo shorts and T-shirts.

Bankman-Fried vowed to change the world through crypto riches and “effective altruism.” Following his conviction on a raft of felonies in November, he leaves behind a bankrupt crypto exchange once valued at $32 billion and a spectacular tale of hubris.

At trial, he was eviscerated by former colleagues and friends, and his amnesiac performance on the stand did not sway the jury. The 12-member panel took only a few hours to convict him, and denied bail, he sits in a federal holding facility facing a lengthy prison sentence.

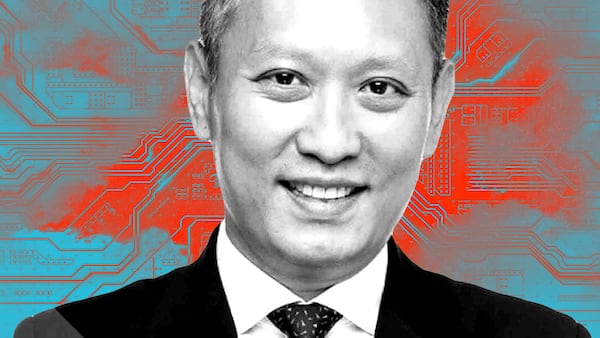

Do Kwon

Co-founder and former CEO of Terraform Labs

Status: Convicted in Montenegro of using a false passport; charged by US and South Korean authorities with fraud. He has denied the charges.

Whereabouts: Jailed in Montenegro pending extradition to South Korea.

Case File: After Terra’s blockchain network collapsed and wiped out $60 billion in market capitalisation in 2022, Do Kwon went on the run.

Interpol issued a red notice on behalf of South Korean prosecutors, and then the US Justice Department filed their own charges against the entrepreneur, who surfaced online every now and then claiming his innocence.

In March, Kwon was picked up on the tarmac at Montenegro’s international airport as he was attempting to fly to Dubai on a fake Costa Rican passport.

He is now incarcerated in the Spuž prison complex in the Balkan nation while South Korea and the US seek his extradition. After months of back and forth, a Montenegrin court decided to extradite Kwon to South Korea in March.

There appears to be little doubt he will eventually be extradited from Montenegro. The question is where will he be sent to face justice.

Heather Morgan, aka Razzlekhan, and Ilya Lichtenstein

Entrepreneur and amateur rapper; Tech entrepreneur and investor

Status: Morgan pleaded guilty to money laundering conspiracy and conspiracy to defraud the US in August 2023; Lichtenstein pleaded guilty to conspiracy to commit money laundering at the same time.

Whereabouts: Morgan is under house arrest in New York while awaiting sentencing. Lichtenstein is detained.

Case file: When the US Justice Department arrested the married couple and seized Bitcoin worth $3.5 billion in 2022, the case immediately went viral thanks to Morgan’s alter ego, Razzlekhan, a self-described “surrealist and shameless rapper” who was all over YouTube.

Yet the big news may be the sheer scale of the heist. The Bitcoin fortune was the missing loot from the legendary hack of Bitfinex back in 2016.

According to prosecutors, Lichtenstein used “advanced hacking tools and techniques” to fraudulently authorise more than 2,000 transfers of Bitcoin from Bitfinex to a wallet he controlled. He then erased his digital footprints and enlisted Morgan in laundering the stolen coins.

The couple used fictitious identities, accounts on darknet markets and exchanges, and chain-hopping to anonymise and conceal the stolen Bitcoin, prosecutors said.

They even converted some Bitcoin into actual gold. But their machinations weren’t enough to prevent FBI cybersleuths from tracking the stolen coins to the New York couple.

While they have yet to be sentenced, their misadventures have inspired Amazon MGM Studios to start development of a film about them.

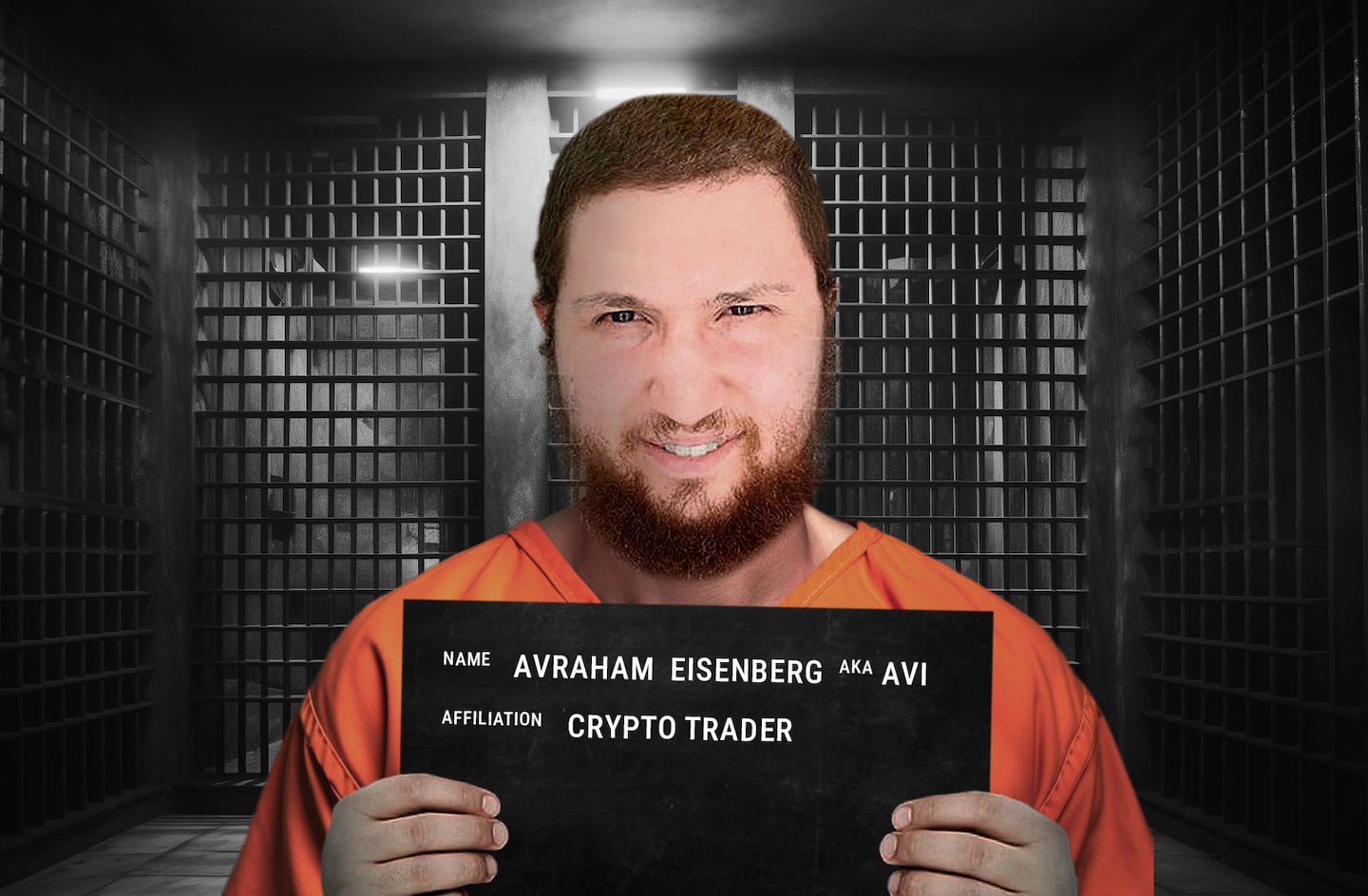

Avraham Eisenberg, aka Avi

Crypto trader

Status: Convicted of wire fraud, and commodities manipulation in April.

Whereabouts: Detained in a federal jail pending sentencing.

Case file: In October 2022, Eisenberg took credit for syphoning $110 million from Mango Markets, a Solana protocol, an operation which he called a “highly profitable trading strategy.” US authorities arrested Eisenberg two months later in Puerto Rico.

In February 2023, prosecutors in Manhattan charged Eisenberg with a scheme to fraudulently obtain $110 million worth of crypto from Mango Markets by manipulating the price of futures contracts. He was convicted by a New York jury on April 18.

The Eisenberg Mango case was one of the first in a spate of DeFi hacks where attackers appeared to be as interested in showing off their skills as they were in looting protocols.

Alex Mashinsky

Co-founder of Celsius Network

Status: US prosecutors charged Mashinsky with several counts of fraud, conspiracy to commit fraud, and market manipulation. Mashinsky has pleaded not guilty.

Whereabouts: Released on a $40 million bond in New York pending trial in September.

Case File: Celsius, a crypto lending platform with $25 billion in assets at its peak, claimed it was the “safest place for your crypto.” Yet following the collapse of Kwon’s Terra network in May 2022, Celsius froze customer withdrawals, then went bankrupt and disclosed a $1.2 billion hole in its balance sheet.

Celsius was one of the first crypto companies to default on its obligations — but by no means the last.

Prosecutors allege Mashinsky and other Celsius executives used customer funds to prop up the value of the company’s CEL token while dumping their own personal CEL holdings.

Alexey Pertsev

Tornado Cash developer

Status: Stood trial in March in the Netherlands on charges he facilitated $1.2 billion in money laundering for illicit actors, including North Korea’s hacking syndicate Lazarus Group.

Pertsev has pleaded not guilty and is awaiting a judicial verdict in May.

Whereabouts: Living in Amsterdam, Pertsev is restricted to the Netherlands and is monitored with a GPS device.

Case File: Two days after the US Treasury sanctioned Tornado Cash in August 2022, a decentralised protocol that conceals transaction history, Dutch police detained Pertsev and held him without charge for months.

The case marked the first time sanctions were placed on a piece of software and showed how developers can be held liable for the code they write even if they don’t own it.

It caused a “chilling effect” in open source communities as devs worried about their liabilities.

Pertsev became a cause célèbre in crypto as supporters argued he was being unfairly persecuted for writing software. At trial, this was a central argument in his defence.

Coinbase and the Blockchain Association filed briefs supporting a lawsuit filed by developers against the US government arguing the sanctions on Tornado Cash should be lifted.

With reporting by Inbar Preiss, Liam Kelly, Aleks Gilbert, and Ana Ćurić.

This is an updated version of a story that ran on December 25, 2023.

Tom Carreras is DL News’ reporter in Latin America. Got a tip? Reach him at tcarreras@dlnews.com. Edward Robinson is the story editor at DL News. Contact him at ed@dlnews.com.