- One crypto firm says a fifth of its staff wants to leave Israel after approval of a law reining in the power of the Supreme Court.

- Experts fret venture capital investment is not rebounding in Israel amid giant street protests.

- Other crypto players support Netanyahu and discount the impact of political strife on the sector.

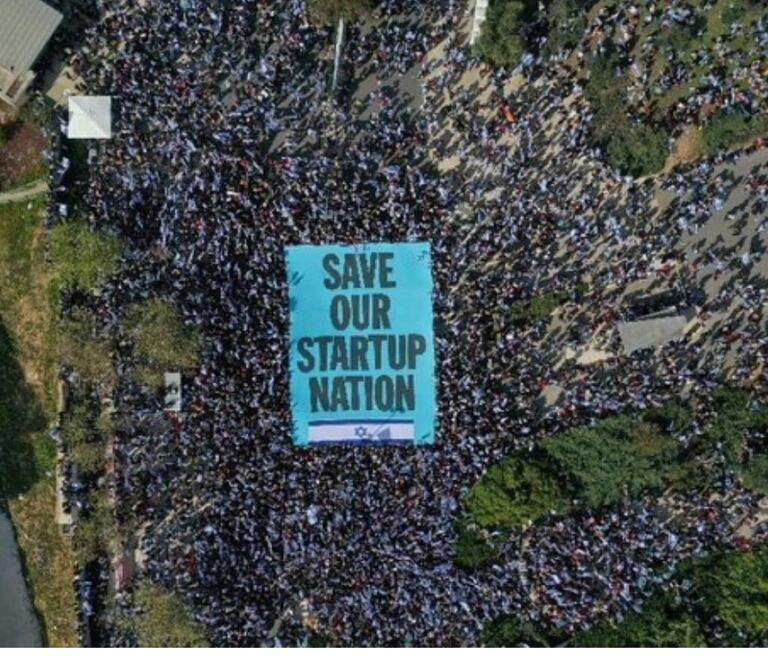

On a hot Saturday evening this month, thousands of protesters assembled beneath the palm trees and skyscrapers in central Tel Aviv for the 33rd week in a row.

They were demonstrating against a judicial revision law pushed by Prime Minister Benjamin Netanyahu. The measure, which passed a final parliament vote on July 24, means that Israel’s Supreme Court no longer has the power to halt government actions it deems unreasonable.

‘No democracy, no high-tech’

Opponents decry the law as a blow against democracy. At one stall close to the bridge over the Ayalon highway, activists sold light blue tank tops and T-shirts with the words: “Save our startup nation” and “No democracy, no high-tech.”

“The whole world is recognising the anti-democratic slide dragging Israel down,” said a protest organiser in Hebrew, who works in the tech industry and asked not to be identified.

Not every Israeli in the tech space sees it that way. Some support Netanyahu’s judicial law, and others, such as Mati Greenspan, CEO and founder of fintech analysis firm Quantum Economics, say the protests are “causing a lot more problems than the actual reforms ever could.”

Even so there are many who fear that laws like Netanyahu’s judicial overhaul will undermine a flourishing tech sector. Since the bill was introduced in January, many involved in high tech have come off the fence and picked a side, which is unusual in an industry that strives to be apolitical.

NOW READ: Why Lebanon just can’t quit Justin Sun’s Tron — it’s ‘100% mixed up’ with Tether

On July 25, the morning following the passage of the controversial bill, the tech protest movement bought and blacked out the front page of Israel’s biggest newspapers. It was captioned, “A black day for Israeli democracy.”

Now worries are mounting that the political situation in Israel may spur many in the tech industry to decamp to other nations.

“A brain drain might turn into a big problem,” said Inbal Orpaz, an innovation consultant and one of the organisers behind the high-tech protest. She said inquiries about leaving Israel are flooding social media, and some are already “quiet-leaving.”

‘A brain drain might turn into a big problem.’

— Inbal Orpaz

Israel is a startup dynamo that has long generated world-beating cybersecurity firms and gifted software engineers. The information technology sector accounted for almost a fifth of the Middle Eastern nation’s gross domestic product in 2022, and about half of its exports, according to the Israel Innovation Authority.

Crypto has deep roots in Israel. Vitalik Buterin developed the prototype for Ethereum while visiting Israel in 2013. And eToro, one of the first online retail brokerages to embrace cryptocurrencies, was founded in Tel Aviv.

Many of the country’s biggest firms in web3 are blockchain solution developers, such as Starkware, which provides zero-knowledge proof scaling solutions for Ethereum. The nation also hosts leading custody and security providers such as Fireblocks.

The burgeoning web3 sector in Israel employs about 3,800 workers, according to a report produced by KPMG for the Israeli Crypto, Blockchain and Web3 Companies Forum (ICBW3), a trade association.

Now the question is, how many are going to stick around?

An executive at a Tel Aviv-based crypto firm told DL News that 10% to 20% of the local staff have recently inquired whether they could keep their jobs if they decided to move abroad.

From aircon-blasted offices to trendy cafés where plants spill from the patio walls, sources in Tel Aviv’s crypto scene have told DL News that relocating has become a regular topic of conversation in their circles.

If the people in the tech sector who talk about leaving end up doing so, “there won’t be a state left,” Orpaz said. “It’s a small sector, we’re talking about 40,000 people. You don’t need a lot of people to leave for things to change.”

Some have already made the leap. A high-level staffer at an Israeli blockchain firm is settling into a new home in Europe. “The future is looking worse and worse. I didn’t want to stick around to find out,” they said on a video call.

“I am afraid that Israel’s leadership is bringing the country to very bad places,” they told DL News on condition of anonymity, not wishing to associate political views with the company. “I am afraid these bad places will quickly translate to social and economic damage, and to the quality of life. I just want to raise my children in peace.”

‘The future is looking worse and worse. I didn’t want to stick around to find out.’

— Israeli crypto staffer

The judicial power grab episode is only the latest to rock the confidence of Israel’s crypto scene. For years, the young industry has been enduring government instability, regulatory neglect, discrimination from the tax authorities, and a hostile banking sector, industry experts say.

Startup funding is also dropping. Venture capital investments in Israel fell by 24% in the first half of 2023 compared to the same period in 2022, according to IVC Research Center.

While this drop is consistent with the broader trend in VC investing, there is concern that Israel may not rebound like other regions. In July, PitchBook reported that venture capital flows are stabilising after the bear market late last year. European VC investment soared 37% in the second quarter, to $18.3 billion, from the first quarter.

NOW READ: Wall Street’s Bitcoin land grab may push crypto firms ‘by the wayside,’ say finance veterans

Before the political trouble, Israel was already coping with fallout from the collapse of the giant crypto lender Celsius Network in 2022. One of its Israeli founders, Alex Mashinsky, was arrested and charged with fraud by US authorities last month.

While uncertainty is something Israelis are accustomed to living with, it does not land well with outside investors, said Lior Zaks, legal counsel at Stake Capital Group.

“There is a crack in Israel’s image as a startup nation,” he said. “For crypto funders, Israel is often not on the radar. It’s a small market, now with a scam alerts following the Celsius case. And in meetings with foreign investors, Israel’s uncertainty easily comes up.”

Quantum Economics’ Greenspan agrees. “As long as that uncertainty continues, there will be some investors and entrepreneurs who feel that they could get the same thing done elsewhere with less risk. Our competitors, like Dubai, don’t have these issues,” he said.

It isn’t just the political climate that’s in play. Banks have given crypto a hard time in Israel. Their policies to mitigate risk often block the acceptance of funds with origins in crypto.

“The banking supervisor already instructed them to develop new policies and to soften their approach,” Nir Hirshman, CEO of trade association ICBW3 said. But work still needs to be done.

Against the tide

Still, there is some policy movement toward the industry recently. Last month, a bill extending tax benefits for crypto companies passed a preliminary reading in the Knesset, or parliament. The Ministry of Finance has also set up a team to examine the regulation of decentralised autonomous organisations.

“We are working hard against the tide,” Hirshman said. “We are working to bring people to be able to say: I want to open my next big crypto firm in Israel.”

Greenspan is hopeful once the protests subside, “We can pick up where we left off,” he said. “The talent and the brain power is still here.”

But the heavy, humid air carries more weight than on an average August day in Tel Aviv. For so many tech developers, the dilemma is looming: whether to stay and fight for the future of their country, or bail and follow their passion overseas.

Got any tips for stories on blockchain and crypto in Israel? Contact the author: inbar@dlnews.com.