A version of this story appeared in our The Guidance newsletter on April 1. Sign up here.

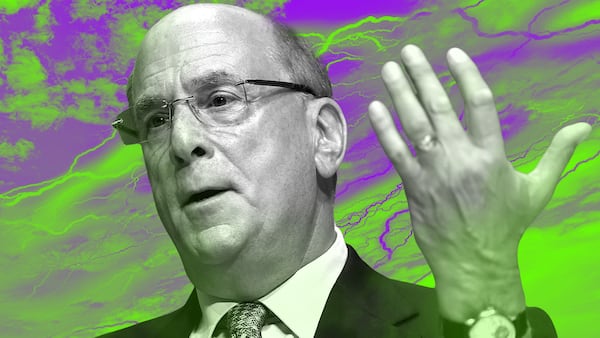

BlackRock’s Larry Fink says the future of finance is the full digitisation of assets like stocks and bonds.

His firm is putting its money where its CEO’s mouth is.

Adam Morgan McCarthy has some analysis here on BUIDL, BlackRock’s foray into tokenised funds on Ethereum. The fund has drawn about $275 million since its launch last week.

This is not the first time an investment firm has tokenised a fund — Franklin Templeton is way ahead — but BlackRock is a $10 trillion behemoth, and its fund “will likely be the biggest,” Adam writes.

Still, though, tokenisation is a long way from the holy grail of fully native digital assets, originated, traded, and custodied onchain for soup-to-nuts automation.

Tokenisation projects must still replicate traditional market structure while regulators and compliance teams get comfortable with the concept.

Take BUIDL, which, while it leverages crypto-native custody from Coinbase and Fireblocks, also partners with ultra-traditional BNY Mellon.

That would “comfort more traditional institutional customers to adopt onchain funds without major friction points,” Bernstein analysts said.

A $5 trillion opportunity

That’s not to say Wall Street’s excitement in tokenisation is any less sharp.

UK Finance has estimated that digital assets could represent 10% of the global securities market by 2030 — about $5 trillion.

That’s because, even if the entire lifecycle of a fund or bond isn’t automated, there are still trillions of dollars worth of efficiency gains to be had.

Investment banks provide what is known as “post trade” services to clients like BlackRock.

Post-trade processes include so-called “settlement” — the part where recordkeepers make sure the two “legs” of a securities transaction are completed.

The buyer has their asset, the seller has their cash, and everyone’s records match up with everyone else’s.

Much of this work is still done by humans with spreadsheets, so if it can be automated, that’s a competitive edge for these banks.

Tokenised securities can be settled atomically — that is, both legs of the transaction happen at the same time, and in a few minutes, as opposed to several days.

In a similar way, tokenised bonds can be swapped with other assets as collateral during lending that investment banks do to fund their trading activities

‘Trapped’ trillions

Since that lending often happens in transactions that occur literally overnight, automating the process and codifying the terms of the debt in underlying smart contracts could make more bonds available for use in this way.

The efficiencies to be realised here aren’t trivial, according to one 2023 report from the Global Financial Markets Association that evaluated blockchain’s potential impact on the financial markets.

The report found that $19 trillion worth of collateral is “trapped” in these short-term loans.

That’s capital that banks could be investing, but instead it’s “just sitting there, not used,” Peter Kerstens, an advisor at the European Commission, told Inbar Preiss at an event in Brussels hosted by DL News.