- Crypto titans are split over the Senate’s decision to delay a planned vote on the Clarity Act.

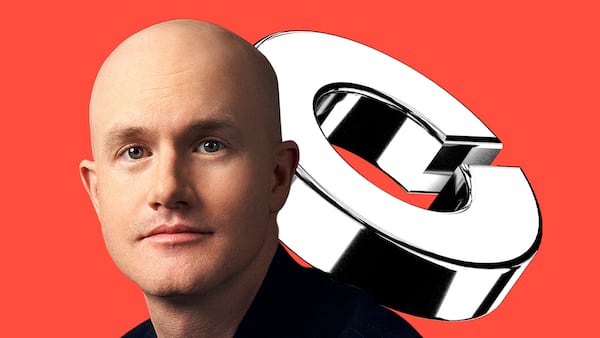

- The delay came after Coinbase CEO Brian Armstrong pulled his support for the bill.

- Onerous disclosure provisions would “create a massive incentive to decentralise,” an industry attorney told DL News.

Some of the most prominent names in crypto are split over a last-minute decision to delay Thursday’s scheduled vote on landmark crypto legislation.

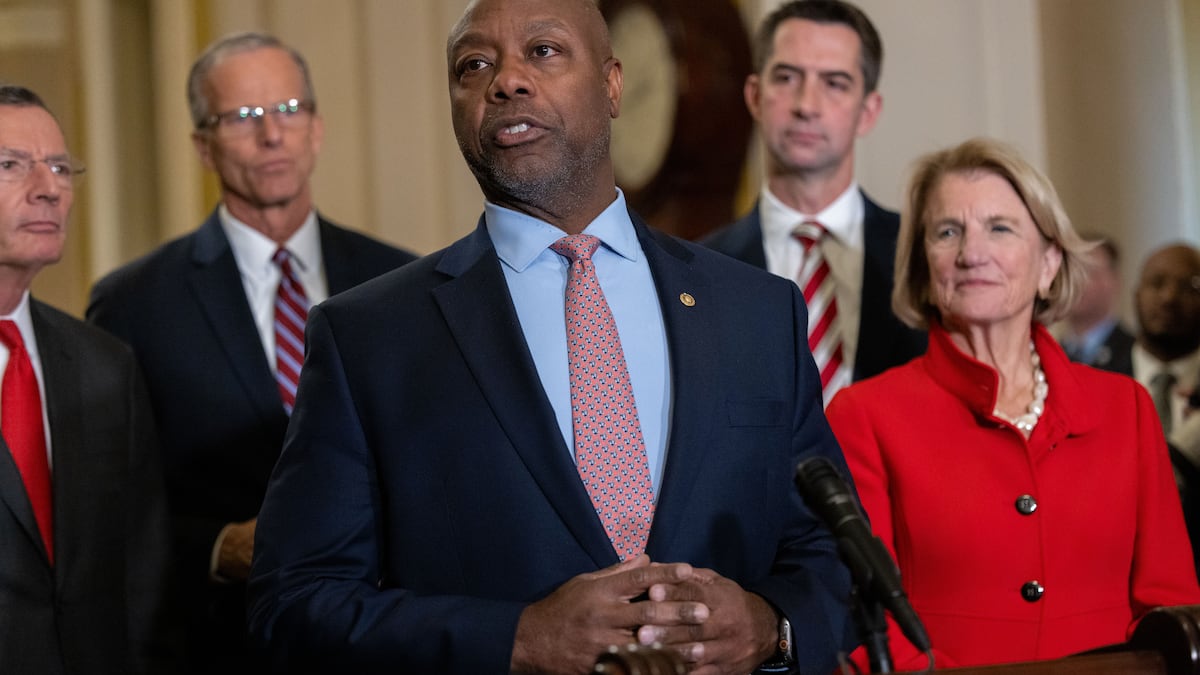

The delay, announced late Wednesday by Senator Tim Scott, came after Coinbase CEO Brian Armstrong said his exchange would not support the Clarity Act, a nearly 300-page bill that promises to dramatically reshape the US crypto industry.

“We’d rather have no bill than a bad bill,” Armstrong said in a social media post on Wednesday.

Other crypto bigwigs quickly issued their own, duelling statements.

Ripple CEO Brad Garlinghouse called the Clarity Act “a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers.”

While long-overdue, this move by @SenatorTimScott and @BankingGOP on market structure is a massive step forward in providing workable frameworks for crypto, while continuing to protect consumers. Ripple (and I) know firsthand that clarity beats chaos, and this bill’s success is… https://t.co/EWcml1NpBE

— Brad Garlinghouse (@bgarlinghouse) January 14, 2026

And top executives at venture capital firm Andreessen Horowitz said the industry was on the cusp of squandering a massive opportunity.

“Nothing like it exists today and we must seize this opportunity,” Mike Jennings, head of policy at the firm’s crypto arm, said on X. “Freedoms are not easily won, but they are easily lost.”

The split is notable because all three firms were among the largest spenders in the 2024 election cycle through their contributions to Fairshake.

“I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith,” Scott said in a statement announcing the delay.

“This bill reflects months of serious bipartisan negotiations and real input from innovators, investors, and law enforcement. The goal is to deliver clear rules of the road that protect consumers, strengthen our national security, and ensure the future of finance is built in the United States.”

‘More friction’

The bill would, first and foremost, divvy up regulation of the crypto industry between the Securities and Exchange Commission, and the Commodity Futures Trading Commission.

We are disappointed that @BankingGOP has decided to postpone their markup on crypto market structure tomorrow, but are optimistic for a swift rescheduling after further bipartisan discussion.

— Alexander Grieve (@AlexanderGrieve) January 15, 2026

There are significant edits still needed with this bill, and we do not agree with any…

But it would also establish rules for the websites and crypto wallets that provide easy access to decentralised financial protocols; shield software developers from certain criminal charges tied to the operation of those protocols; establish rules for the tokenisation of equities; and much more.

Salman Banaei, general counsel at Plume, the real-world assets blockchain, said the delay could make it harder to pass a bill that satisfies everyone involved in the negotiations.

“Now that there’s more time, everybody’s going to expand their wish list,” he told DL News, “which just creates more friction.”

Andreessen Horowitz and Ripple weren’t the only firms to express their dismay that the vote had been delayed. Leaders at industry trade association Digital Chamber and crypto venture firm Paradigm were among those who expressed dismay the bill was not advanced on Thursday.

“Coinbase seems to be on an island right now,” said one source familiar with the negotiations, who spoke to DL News on the condition of anonymity.

“Coinbase is negotiating in public to get the rewards language they want. My sense is they were told something definitive yesterday they did not like and did not see a way forward through markup.”

Armstrong’s issues

Armstrong said he had four issues with the bill: a “de facto ban on tokenised equities,” “DeFi prohibitions” that would give the government “unlimited access to your financial records,” a limited role for the CFTC, and restrictions on the kind of rewards that companies could pay customers who hold and use stablecoins.

‘We can’t really have banks come in and try to kill their competition at the expense of the American consumer;

— Brian Armstrong, CEO at Coinbase

For months, banks and the crypto industry have been locked in a very public battle over stablecoin interest. Banks say it could severely limit their ability to lend to businesses and would-be homebuyers. Crypto proponents say banks are fear mongering in an attempt to limit competition.

The Clarity Act forbids companies from paying customers interest or rewards for simply holding a stablecoin. Instead, it allows companies to offer such incentives on activities such as making payments or transfers, sending remittances, and providing liquidity in DeFi protocols.

“We can’t really have banks come in and try to kill their competition at the expense of the American consumer,” Armstrong said in an appearance on CNBC on Thursday. “People should be able to earn more money on their money.”

Decentralisation boost?

The Clarity Act would have the SEC regulate so-called ancillary assets, with the CFTC given jurisdiction of most other crypto assets.

Critically, however, the SEC would have the responsibility of deciding whether a given token or cryptocurrency meets the definition of an ancillary asset.

At the outset, that definition would likely capture most cryptocurrencies, according to Banaei.

“This bill is going to create a massive incentive to decentralise, and it’s going to lead to a big change in the economics of how crypto works,” he said. “The disclosure requirements are quite burdensome.”

Companies or people that issue an ancillary asset would be required to regularly disclose the asset’s tokenomics, its distribution, their crypto experience, their finances, their identities, their project’s roadmap, a “plain-English” description of the project, the project’s fees, its code, and much more.

That could prompt some developers to attempt to launch immutable protocols — protocols whose code cannot be changed after the fact, under any circumstances. Most developers today retain some control or cede it to a community of tokenholders, to allow for updates or emergency patches in the event a bug is discovered.

DeFi ambiguity

While truly decentralised protocols appear to have few, if any, obligations under the bill, centrally-controlled interfaces that make it easy to access those protocols would have to comply with several requirements meant to combat cybercrime.

Websites that offer access to DeFi protocols will have to block sanctioned addresses and monitor transactions for signs of money laundering or other criminal behaviour, for example.

Echoing Armstrong, prominent crypto attorney Jake Chervinsky said those provisions were unacceptable.

“The last draft leaves ambiguity about whether all sorts of developers and infrastructure providers could be forced to KYC users, register with SEC, or comply with other rules that don’t fit DeFi,” he wrote on X on Thursday.

KYC, or know-your-customers, checks are essentially background and identity checks companies must have in place to avoid their services being used for money laundering and other financial crimes. It is also a hotly debated issue in crypto circles.

But Chervinsky’s view wasn’t shared by all self-proclaimed defenders of DeFi.

“Coin Center’s mission is to protect software developers and non-custodial, decentralised tools,” the nonprofit’s executive director, Peter Van Valkenburgh, wrote on X. “Judged by that standard, we’re optimistic about where the current market structure draft stands.”

Banaei said it was unlikely that some of these provisions would be revisited.

“I don’t know if there’s much more to be done there,” he said. “There was kind of a very delicate balancing act that was done.”

As for Armstrong’s claim the bill would ban tokenisation of equities, Banaei said it was “overstated.”

It wasn’t a ban on tokenised equities, but on alternative products marketing themselves as such, according to the attorney.

Before joining Plume in 2025, Banaei held roles at Uniswap, the SEC, and the CFTC. He was at the latter when lawmakers were negotiating the Dodd-Frank Act in the wake of the Great Recession.

Although the Clarity Act’s passage is far from certain, he has taken solace in the circuitous route that Dodd-Frank took before it was signed into law.

“That was declared dead a number of times,” he recalled. “I’ve seen this happen before, and I think the cliche is, every major piece of financial services legislation dies a dozen times before it passes.”

Aleks Gilbert is DL News’ New York-based DeFi correspondent. You can contact him at aleks@dlnews.com.