- Crypto advocates remain wary EU regulators may follow SEC playbook

- More US firms may swap chaotic enforcement climate for stable regulatory regime.

- Gensler just getting started as he assails crypto model as built on ‘non-compliance.’

The European Union just became even more attractive to US crypto firms.

At least that’s the hope as the digital assets industry absorbs Securities and Exchange Commission Chair Gary Gensler’s legal action this week against Coinbase and Binance.

‘Desperate for clarity’

Thanks to the recent passage of MiCA, a sweeping set of crypto regulations, the 27-nation EU offers a haven of stability compared to the US.

And European crypto advocates are looking to make the most of the opportunity, though they remain wary regulators may follow the same path as their American counterparts.

“If we want to capitalise on the good work that’s been done so far we should avoid borrowing from the SEC’s playbook [of] calling everything a transferable security by default,” Erwin Voloder, senior policy fellow at the European Blockchain Association, told DL News.

“Or we will find ourselves in a similar situation and companies will go further East.”

NOW READ: How Coinbase’s SEC woes clobber its earnings outlook

Some EU policymakers are leaning toward the American approach. In April, the European Parliament’s Economic and Monetary Affairs Committee published a paper deeming all crypto assets should be treated as securities, and that decentralised finance platforms should be treated as legal entities.

Voloder said the propositions in the paper are “pretty bold and arguably unworkable solutions.” The study, while sparking heated debate, has no practical influence on the EU’s policy course.

‘We should avoid borrowing from the SEC’s playbook.’

— Erwin Voloder

Building a vibrant new crypto hub is easier said than done. The UK, which fostered fintech over the last decade, is now struggling to deliver.

Revolut, the London-based payments and crypto unicorn, is weighing whether to decamp to France as it struggles to obtain a UK banking licence.

When it comes to frustration in the US, European crypto boosters do have a lot to work with.

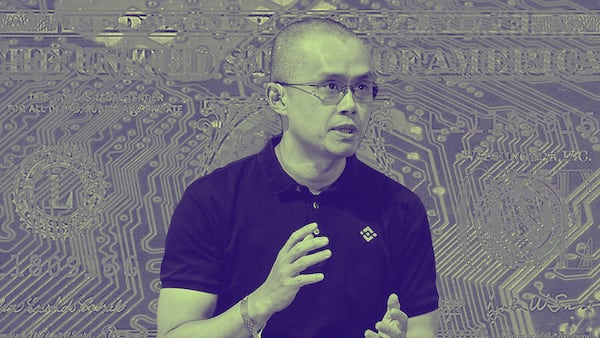

By accusing Binance of fraud on Monday and Coinbase of running an illegal exchange and broker-dealer on Tuesday, the SEC made its broadest move yet to drag the industry into the traditional regime that governs Wall Street.

No path

That is anathema to crypto leaders. Coinbase CEO Brian Armstrong denied the SEC allegations the company was operating unlawfully without proper licences.

On Tuesday, he echoed his longstanding argument crypto needs its own special laws by tweeting that the agency offered no path to register its businesses. “We tried, repeatedly,” he said.

Like stocks and bonds

Gensler, the SEC’s chair, promised more to come. On Tuesday he said that crypto is built on a business model that is “non-compliance with securities laws.”

And the SEC suggested in its lawsuits that more than a dozen altcoins — tokens used by Solana, Cardano, Near, among others — are supposed to be registered with the Feds like stocks and bonds.

If the SEC wins its enforcement suits against Binance and Coinbase, it could halt the giants’ operations in the US, and, some fear, cripple the US crypto market.

Late yesterday, the agency asked a court to immediately freeze the assets of Binance.US, the exchange’s American business.

‘There are a lot of players looking to Europe now because they are desperate for regulatory clarity.’

— Erwin Voloder

Meanwhile, the EU is celebrating its new crypto rulebook, known as MiCA, marking the first major comprehensive regulatory framework for the industry.

“There are a lot of players looking to Europe now because they are desperate for regulatory clarity and to know where they stand,” Voloder said. “The longer this drags on stateside the more momentum shifts.”

New rules

Since 2020, EU policymakers have rallied to get the Markets in Crypto-Assets regulation through the door. Now, regulators are preparing to implement the rules covering stablecoin issuance, company licensing, and consumer protection over the coming months.

In the US, industry representatives have long sought a new law or rules that recognise cryptocurrencies are different from stocks, bonds, and other securities.

In an emailed statement Tuesday, Paul Grewal, Coinbase’s top lawyer, called for legislation that “allows fair rules” that apply equally across the market, rather than litigation.

NOW READ: Coinbase short sellers set to rake in $307m on stock crash

“The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness,” Grewal said.

The Biden Administration doesn’t buy that argument. Binance and Coinbase are only the latest in a longer string of US regulators’ lawsuits against firms, including Kraken, Bittrex, Ripple and others.

New draft bill

The US Congress is now taking steps to address concerns for the industry — lawmakers tabled a new draft bill for discussion last Friday.

The framework would define whether crypto assets would be regulated under securities or commodities laws depending on their level of decentralisation.

NOW READ: Retail feared that insiders would dump Optimism’s $500m token unlock — so they mass dumped it first

As the US is working to regulate the sector, the EU is moving at pace. Regulators in Europe are already calling for a second round of legislation to cover the gaps in MiCA — especially decentralised finance.

“While events in the US are usually noted in the EU, the bloc is moving forward with implementation of its MiCA regulatory model and starting work on the next batch of proposals,” Mark Foster, EU policy lead at the Crypto Council for Innovation, told DL News.